Picture this: You’re sitting in a modern banking tower in Panama City. The Pacific Ocean stretches westward. The historic canal lies to your east. Your banker across the desk speaks perfect English. They understand exactly why you’re here—to build wealth across borders.

This isn’t a spy movie scene. It’s the real experience for thousands of wealthy individuals and smart business leaders discovering Panama’s banking advantage.

Here’s the key fact: Non-residents must deposit $250,000 to open Panama bank accounts. This large amount isn’t meant to exclude serious clients. Instead, it filters out casual inquiries. Banks need this threshold to manage compliance costs in today’s strict regulatory environment.

The Game-Changing Secret Most Advisors Don’t Share

But wait. There’s a crucial insight most advisors won’t tell you upfront: Panama residency changes everything dramatically. Suddenly, that $250,000 requirement drops to just $500-$5,000. Account opening becomes much smoother. Plus, you unlock a tax system that could save you hundreds of thousands yearly.

This transforms your entire banking strategy from difficult to achievable.

One Entrepreneur’s Real-World Discovery

Marcus Chen learned this lesson the hard way. He’s a successful tech entrepreneur from Singapore. In early 2024, he tried opening a Panama corporate account as a non-resident. After three months of paperwork, document requests, and enhanced due diligence, the bank rejected his application. He’d even offered to deposit $300,000.

Then his tax advisor suggested something different: Get Panama residency first, then approach banks as a resident. Six weeks later, Marcus had permanent residency through Panama’s Friendly Nations Visa. Two weeks after that? He walked into Multibank and opened both personal and corporate accounts. His total initial deposit? Just $8,000.

“The difference was night and day,” Marcus explains. “Banks treated me completely differently as a resident. No interrogations. No compliance concerns. Instead, they welcomed me as a valuable local client with global business operations.”

The Hidden Tax Advantage

Marcus discovered another powerful benefit. His software company’s overseas income—95% of his total revenue—became completely tax-free under Panama’s territorial tax system. Through smart structuring, he cut his global tax rate from 32% to just 7% on Panama-sourced income.

His annual tax savings? Over $400,000. That $6,500 residency fee suddenly looked like the deal of a lifetime.

Understanding Panama’s Friendly Nations Visa

Panama offers one of the world’s most accessible residency programs through the Friendly Nations Visa. This program welcomes citizens from 50 countries including the United States, Canada, Australia, most European nations, Singapore, Japan, South Korea, and several Latin American countries.

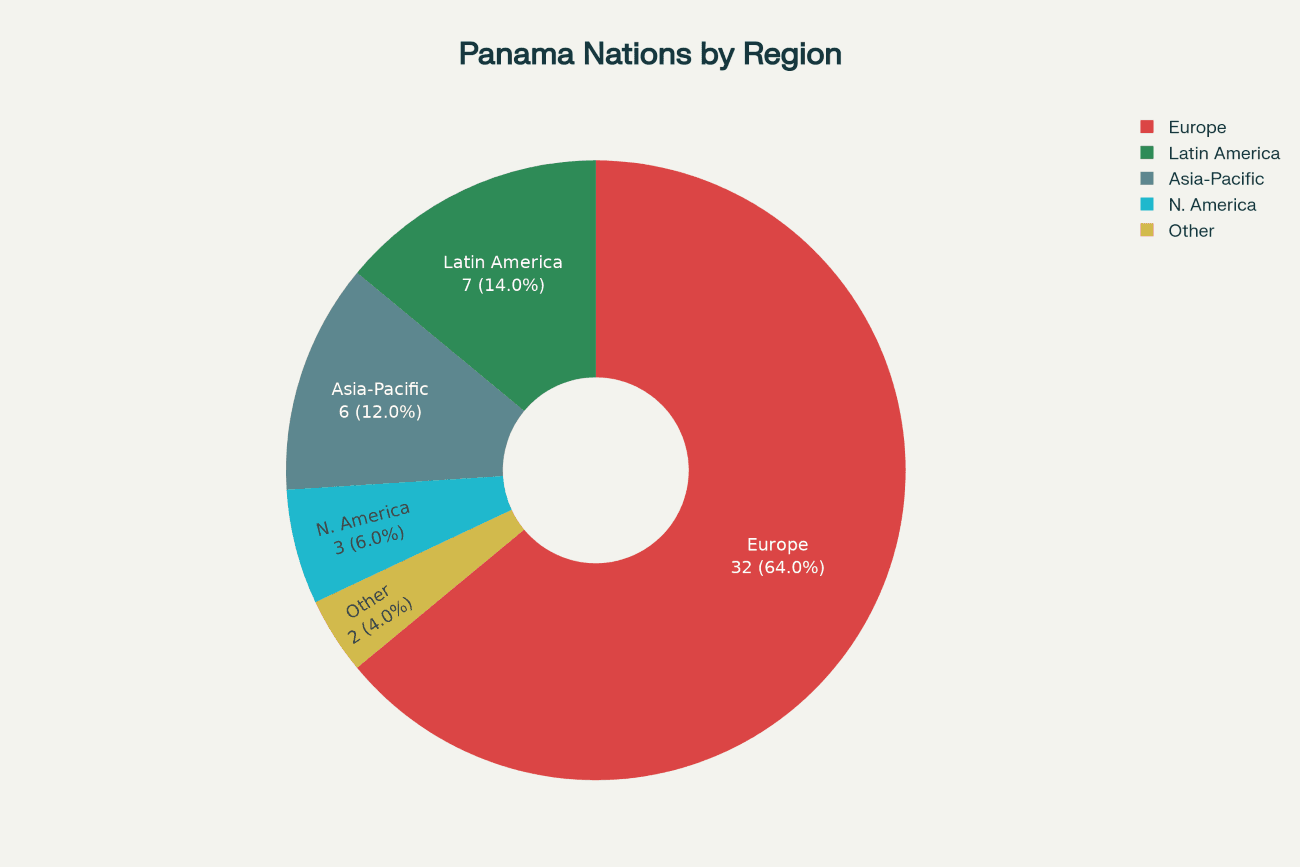

The Panama Friendly Nations Visa program encompasses 50 countries, with European nations representing the largest share at 64% of eligible countries

The Simple Requirements You Need to Know

Getting approved involves straightforward steps. First, establish economic ties to Panama through one of three simple options: start a Panama corporation ($1,500), buy any real estate (even a $50,000 condo works), or secure employment with a Panama company.

Second, show proof of economic solvency. This typically means a $5,000 fixed-term deposit in a Panama bank (which you control and can access later), recent bank statements, or an employment contract.

Third, provide a clean criminal record from your home country and anywhere you’ve lived over six months in the past five years. Importantly, get these documents apostilled.

Finally, you need a valid passport with at least six months remaining.

The Surprisingly Fast Timeline

Here’s where Panama’s program shines: Most people receive permanent residency in just 8-12 weeks. Compare this to most European programs requiring five years, or Caribbean citizenship programs costing $150,000+. Panama’s offer looks incredibly attractive.

Even better? You get permanent residency immediately—not temporary status you must renew yearly. Additionally, there are no minimum stay requirements for your first two years (though you can’t be absent for more than 24 consecutive months). After five years, you can apply for full citizenship if you wish, though most international clients keep their permanent residency indefinitely.

The Total Cost Is Remarkably Affordable

Overall investment? Around $5,000-$8,000 in legal fees plus your economic ties. That typically means less than $15,000 total to secure lifetime permanent residency in one of Latin America’s most stable countries.

Comparing Resident vs. Non-Resident Banking Access

The contrast between these two paths is stark and important. Understanding this difference is crucial for anyone serious about Panama banking.

Panama residents enjoy dramatically superior banking advantages compared to non-residents, with lower deposit requirements, better access to credit, and enhanced relationship banking benefits

What Non-Residents Face

Non-residents encounter substantial barriers: minimum deposits starting at $250,000, extensive due diligence requiring weeks of back-and-forth, approval timelines exceeding 8-12 weeks, limited credit access, higher monthly fees, and banks’ general hesitation about clients lacking Panama connections.

What Residents Enjoy

Residents experience a completely different picture: minimum deposits dropping to $500-$5,000, streamlined documentation, approval in just 2-4 weeks, easy access to credit, lower fees (many waived entirely), and banks actively competing for your business.

Extended Benefits Beyond Account Opening

The advantages extend far beyond the initial account setup. Isabel Fernández, a Spanish real estate investor, discovered this when she moved to Panama in 2023. “As a resident, I secured a mortgage at 5.8% interest for an investment property—something unavailable to non-residents,” she explains. “I also opened a securities trading account with Banco Aliado’s private banking division. Now I can access Latin American investments that weren’t possible from Madrid.”

Isabel’s experience reveals a critical truth: Residency transforms your banking from transactional to strategic. Banks view residents as valuable long-term clients worth investing in. They offer personalized service, competitive pricing, and access to their full product range.

The Tax Trinity Strategy: Three Strategic Jurisdictions

Here’s where sophisticated financial planning reaches new heights: Combine Panama residency with banking in both Switzerland and Singapore. Experienced advisors call this “the tax trinity”—a comprehensive structure offering superior asset protection, investment access, and tax optimization.

A Real-World Success Story

Consider Alexandra Morrison, heir to a substantial European manufacturing fortune. By age 35, she’d accumulated approximately €18 million in liquid assets. However, her native Netherlands imposed crushing wealth taxes and dividend taxes that steadily eroded her inheritance.

Her wealth advisor designed what initially seemed complex but proved brilliantly effective.

Phase One: Establishing Panama Tax Residency

In Phase One, Alexandra secured Panama residency through the Qualified Investor Visa. She deposited $750,000 in a fixed-term account at Banco General. This critical step immediately established her as a Panama tax resident. Consequently, her entire global investment income became completely tax-free under Panama’s territorial system.

Phase Two: Accessing Swiss Banking Excellence

Next, she opened a private banking relationship in Switzerland with Julius Baer, leveraging her Panama residency status rather than her Dutch citizenship. Swiss banks typically hesitate with direct applications from high-tax countries. However, they welcomed her enthusiastically as a Panama resident with legitimate wealth documentation. Her $1.2 million deposit opened doors to renowned Swiss wealth management, exclusive European investments, and legendary banking stability.

Phase Three: Building Asia-Pacific Presence

Finally, she established a complementary banking relationship in Singapore through DBS Private Bank. This Asian hub provided access to growing Asia-Pacific markets, sophisticated currency hedging, and emerging Asian equity opportunities that perfectly complemented her European holdings.

The Remarkable Financial Results

The result? A truly global financial infrastructure with legal tax benefits. Alexandra spends approximately 200 days yearly in Panama (easily meeting tax residency requirements). She travels freely for business and pleasure. Meanwhile, her integrated Swiss and Singapore platforms manage her global portfolio efficiently.

Her effective global tax rate dropped from 48% in the Netherlands to just 8%. That 8% only covers Panama-sourced real estate income.

Therefore, her annual tax savings total approximately €720,000. This isn’t tax evasion—it’s completely legal international tax planning available to anyone willing to establish genuine residency in a favorable territory.

Dispelling the Billionaire Myth

“People think this strategy only works for billionaires,” Alexandra notes. “However, anyone with $2-5 million in investable assets can implement this structure. Panama residency costs under $10,000. The Swiss bank required $1 million minimum (which I’d invest anyway). Singapore accepted $500,000. For someone paying 40-50% taxes currently, payback happens in months, not years.”

Why Swiss and Singapore Banks Welcome Panama Residents

This seems counterintuitive: Won’t prestigious Swiss and Singapore banks reject clients holding Panama residency?

The answer is no—and understanding why reveals important banking realities.

What Swiss Banks Actually Care About

Swiss banks focus on three key factors: legitimate wealth documentation, substantial assets under management, and international compliance. Panama residents presenting well-documented wealth and offering to deposit $250,000-$1,000,000 find Swiss banks remarkably receptive.

The key difference: Swiss banks view Panama residents as internationally mobile individuals engaged in sophisticated planning. They’re exactly the clients Swiss banks actively seek.

Marcus Chen experienced this firsthand opening his Pictet account after obtaining Panama residency. “The Swiss compliance officer told me something surprising,” he shares. “My Panama residency actually simplified their due diligence. They could verify I had legitimate tax status, wasn’t evading home country obligations, and operated genuine global business. If I’d applied as a Singapore resident, they’d have questioned why I needed Swiss banking at all.”

Singapore’s Similar Welcoming Approach

Singapore banks similarly welcome Panama residents, especially clients with Asian business operations or investment interests. The key is demonstrating authentic international activity. You’re not hiding from obligations. Instead, you’re operating a genuinely global financial life with strategic tax residency in a favorable location.

The Strategic Playbook Professional Advisors Recommend

Smart wealth advisors follow this proven sequence:

First, establish Panama residency as your foundation. This creates your base in a favorable territorial tax jurisdiction.

Second, open Panama banking relationships as a resident. Enjoy dramatic accessibility and cost advantages.

Third, approach Swiss banks for European asset management. Access their wealth preservation expertise and sophisticated investment products.

Fourth, establish Singapore banking for Asia-Pacific access. Gain currency diversification and fintech-forward services.

This approach creates genuine geographic diversification. You’re not putting all eggs in one basket. Instead, you protect against political risk, currency fluctuations, and regulatory changes in any single country.

The Reality of Non-Resident Account Opening

Some individuals must open Panama accounts as non-residents. Corporate entities with immediate business needs often fall into this category. Therefore, understanding current realities helps set appropriate expectations.

The Non-Negotiable Minimum Deposit

The $250,000 non-resident minimum isn’t negotiable at reputable institutions in 2025. This represents a dramatic increase from the $10,000-$50,000 minimums seen just 3-4 years ago. Several factors drive this shift.

First, compliance costs increased dramatically. Panama strengthened anti-money laundering frameworks after leaving the FATF grey list in 2023. Banks must now conduct enhanced due diligence on non-residents. They only accept this expense for substantial relationships.

Second, correspondent banking relationships with major U.S. and European banks require Panamanian institutions to demonstrate robust client vetting. Non-resident accounts trigger heightened scrutiny from these correspondent banks. Banks therefore accept this risk only for high-value relationships.

A Real Business Experience

Jonathan Weber runs a U.S.-based international trade company. In 2024, his growing firm needed a Panama account for Latin American supplier payments. “We came prepared to deposit $100,000. We thought that was plenty,” he recalls. “Three banks rejected us as non-residents. Finally, one agreed—but only with a $250,000 deposit and six months of U.S. banking history.”

Understanding Extensive Documentation Requirements

Non-residents face comprehensive documentation demands:

First, provide a clear business rationale for needing Panama banking. Include supplier contracts, customer agreements, and proof of Latin American business activities.

Second, submit a tax residency certificate from your home country proving compliant tax status.

Third, obtain bank reference letters from two existing institutions. Preferably choose internationally recognized banks.

Fourth, present complete source of wealth documentation including tax returns, business ownership records, and income sources.

Finally, for corporate accounts, provide apostilled corporate documents: certificates of good standing, shareholder registries, and director resolutions authorizing the account.

The Timeline Investment Reality

Approval typically takes 8-16 weeks from application to account activation—substantially longer than the 2-4 weeks residents experience.

Is It Worth the Effort?

For genuine business needs where Panama operations are central, absolutely yes. Companies engaged in Latin American trade, businesses in Colon Free Zones, and corporations with significant regional activities benefit substantially despite the high entry cost.

However, for individual investors seeking diversification or private banking? The residency-first approach makes far more sense.

The Account Opening Process for Residents: Week by Week

Assuming you’ve obtained Panama residency—the strategically optimal path for most individuals—account opening becomes straightforward and efficient.

Week 1-2: Strategic Bank Selection and Initial Contact

Your first decision involves choosing the right banking partner. Different institutions specialize in different client types:

Multibank excels in private banking for high-net-worth individuals. They offer comprehensive wealth management, trust services, and sophisticated investments. Resident minimums start around $3,000-$5,000, with private banking beginning at $50,000.

Banco General provides robust general banking with 60+ nationwide branches and 300+ ATMs. It’s ideal for residents maintaining significant Panama presence with frequent local transactions.

Banistmo (Grupo Bancolombia) offers superior international payments, making it perfect for businesses with regular cross-border transactions.

Banco Aliado specializes in private banking with boutique service and personalized attention. Resident minimums typically start around $10,000.

Global Bank Corporation focuses on multi-currency accounts, offering competitive exchange rates and flexible currency holdings.

During this phase, you schedule an initial meeting (in-person or video) with a relationship manager. You explain your banking needs, expected transaction volume, and desired services.

Week 2-3: Document Submission Phase

During this period, you gather and submit required documentation:

- Valid passport

- Official Panama residency permit (cédula)

- Proof of Panama address (utility bill, lease, or property deed)

- Bank reference letter from existing relationship

- Source of funds documentation (employment contract or investment statements)

- Initial deposit confirmation

For corporate accounts, additionally provide company formation documents, shareholder registry, and director authorizations.

Week 3-4: Compliance Interview and Due Diligence

The bank conducts a compliance interview lasting 30-45 minutes. They cover your background, income sources, intended account usage, and banking needs. As a resident, this conversation proceeds professionally without the suspicion often directed at non-residents.

The compliance department processes your application. They conduct background checks and verify all submitted documentation.

Week 4: Account Activation and Access

Upon approval, you make your initial deposit via wire transfer or in-person deposit. Within 1-3 business days, the bank activates your account. You receive:

- Complete account number and banking information

- Secure online banking credentials and mobile app access

- Physical debit card (typically issued within 2-3 weeks)

- Direct relationship manager contact information

- Checkbook if requested

Total timeline: 3-5 weeks from first contact to full account functionality. This is dramatically faster than the 8-16 weeks non-residents typically experience.

Panama’s Top Banks: A Detailed Comparison

Selecting the right banking partner requires understanding each institution’s strengths and ideal client profiles.

BAC International Bank – Panama’s Largest Institution

BAC commands total assets of $31.1 billion, making it Panama’s largest bank. The institution offers exceptional corporate banking and unparalleled regional presence throughout Central America.

Ideal for: Corporations requiring multi-country banking, regional trade companies, businesses needing substantial credit lines

Resident minimum deposit: $1,000-$2,500

English support: Comprehensive

Banco General – Strong Local Infrastructure

With $18.4 billion in total assets, Banco General is Panama’s second-largest bank. The institution operates 60+ nationwide branches and 300+ ATMs. Recently, it significantly enhanced digital banking and international services.

Ideal for: Expatriates with significant Panama presence, businesses with frequent local transactions, residents needing extensive branch access

Resident minimum deposit: $500-$1,000

English support: Limited (improving)

Multibank – Private Banking Specialist

Multibank manages $5.03 billion in total assets, specializing distinctly in private banking and wealth management. The bank serves high-net-worth individuals and affluent families. They offer personalized portfolio management, trust services, and sophisticated investment products.

Ideal for: HNWIs seeking wealth management, investors needing portfolio management, families requiring trust and estate planning

Resident minimum deposit: $3,000-$5,000 (private banking from $50,000)

English support: Comprehensive

Understanding True Banking Costs

While minimum deposits capture attention, understanding total cost of ownership matters more.

Monthly maintenance fees for residents vary by institution: $0-$10 at Banco General and Global Bank (with minimum balances maintained), $10-$25 at Multibank and BAC, and $15-$40 at premium private divisions.

Importantly, many banks waive maintenance fees entirely for residents maintaining $2,000-$5,000 minimum balances.

Calculating Your Annual Cost

Calculate your realistic annual cost based on your usage:

- Basic banking (minimum balances, limited wires): $100-$300 yearly

- Active international banking (frequent wires, multi-currency): $500-$1,200 yearly

- Premium private banking (full services, relationship perks): Often net-negative due to investment value-add

| Account Type | Minimum Deposit (Non-Resident) | Minimum Deposit (Resident) | Monthly Fee (Resident) | Annual Cost (Resident) |

|---|---|---|---|---|

| Basic Personal | $250,000 | $500-$1,000 | $0-$10 | $100-$300 |

| Corporate Account | $250,000 | $1,000-$5,000 | $20-$40 | $500-$800 |

| Private Banking | $250,000+ | $10,000-$50,000 | Often waived | $200-$500 |

| Multi-Currency | $250,000 | $2,000-$5,000 | $10-$25 | $300-$600 |

Hidden Advantages Experienced Clients Truly Value

Beyond obvious tax and privacy benefits, experienced Panama clients consistently identify underappreciated advantages that significantly enhance value.

Geographic Diversification Protection

Geographic diversification protects against single-country risks like political instability, banking system problems, or regulatory overreach in your home jurisdiction. Marcus Chen specifically values his Panama banking because it exists completely outside Singapore’s regulatory system. “If Singapore implements capital controls or faces banking crisis, my Panama accounts remain completely unaffected. That independence carries real value,” he explains.

Latin American Investment Access

Access to Latin American investments otherwise unavailable to foreigners represents another underappreciated advantage. Panama banks facilitate regional real estate, private placements, and securities markets throughout Central and South America. These often provide higher returns with lower correlation to North American and European markets.

Multi-Currency Flexibility Benefits

Multi-currency flexibility in a dollarized economy eliminates currency risk plaguing most offshore accounts. Your USD deposits face no conversion risk, currency devaluation concerns, or government-imposed exchange manipulations. Yet you maintain ability to hold EUR, GBP, CHF, and other currencies when strategically beneficial.

Common Pitfalls and How to Avoid Them

Even sophisticated clients make preventable mistakes when approaching Panama banking. Learning from others’ experiences saves time, money, and stress.

Mistake #1: Non-Resident Approach Without Exploring Residency

Approaching banks as a non-resident without exploring residency options represents the single most expensive mistake. That $250,000 requirement combined with lengthy timelines and potential rejection makes the non-resident path strategically poor for most individuals.

Instead, invest 3-4 months securing residency through Friendly Nations or Qualified Investor programs. Then approach banks with dramatically improved positioning and terms.

Mistake #2: Bank Selection Based on Name Alone

Selecting banks based solely on name recognition rather than service alignment leads to disappointment. The largest bank isn’t necessarily best for your needs. A boutique private bank might provide superior personalized service for HNWIs. A smaller specialized institution might offer better international payments for corporations.

Mistake #3: Underestimating Documentation Time

Underestimating documentation requirements and timelines creates unnecessary delays. Even as a resident, expect 2-3 weeks gathering properly formatted and apostilled documents.

Start this process before arriving in Panama to compress your overall timeline.

Your Strategic Banking Roadmap: The Six-Month Plan

Transforming from interested reader to successfully banked Panama resident requires structured execution. Here’s your proven six-month roadmap:

Month 1-2: Foundation Building

- Consult a qualified international tax advisor about Panama residency tax savings

- Hire a reputable Panama immigration attorney (budget $5,000-$8,000)

- Gather required documents: passport, birth certificate, marriage certificate, police certificates (all apostilled)

- Research and identify 2-3 target banks matching your needs

Month 3: Residency Application

- Travel to Panama for residency application (typically 3-5 days)

- Open temporary fixed-term deposit account

- Establish economic ties (incorporate company, sign employment contract, or purchase property)

- Submit residency application

Month 4-5: Banking Preparation

- Gather banking documentation while residency processes

- Obtain bank reference letters from existing institutions

- Prepare source of funds documentation and financial summary

- Schedule preliminary meetings with target bank relationship managers

Month 6: Banking Establishment

- Receive permanent residency permit

- Open your primary banking relationship

- Transfer initial deposits to activate account

- Set up online banking, mobile apps, and services

- If pursuing multi-jurisdiction strategy, begin Swiss and Singapore applications

Month 7+: Optimization

- Work with tax advisor on proper Panama tax residency documentation

- Establish systems for ongoing compliance

- Build regular communication with your banking team

- Explore investment opportunities and wealth management services

This structured approach compresses what could take years into a manageable six-month project with clear milestones.

Making Your Strategic Decision

Panama banking with strategic residency makes excellent sense for specific profiles:

High-net-worth individuals earning substantial foreign income while facing high home country taxation benefit most. If you’re paying 35-50% effective tax rates on investment income, consulting fees, or business profits earned outside your home country, Panama’s system could save hundreds of thousands annually.

International entrepreneurs building global businesses requiring sophisticated multi-country banking infrastructure find exceptional value. Panama uniquely combines U.S.-level banking sophistication with emerging market accessibility.

Expatriates and digital nomads seeking stable permanent residency without burdensome stay requirements discover ideal conditions. The Friendly Nations program’s flexibility provides significant benefits.

Families focused on multi-generational wealth benefit from Panama’s sophisticated planning tools. Combined with no inheritance taxes, these structures enable tax-efficient wealth transfer.

This strategy likely isn’t optimal for those requiring absolute banking anonymity, clients demanding ultra-sophisticated investment products only available elsewhere, or people unwilling to invest time in proper structuring and compliance.

Take Action: Your Next Steps

The wealth management landscape in 2025 rewards those thinking globally and acting strategically. Panama represents an accessible entry point into international banking. Ultimately, it can transform your tax position, protect your assets across jurisdictions, and secure your family’s financial future.

Remember: Secure residency first, then approach banks as an established resident. This simple reordering reduces minimums from $250,000 to $500-$5,000. It compresses timelines from months to weeks. It transforms you from a compliance burden to a valued client.

For those pursuing the sophisticated three-jurisdiction strategy—Panama residency combined with Swiss and Singapore banking—the rewards multiply significantly. You’re not just opening accounts. Instead, you’re building a comprehensive international financial infrastructure designed to preserve and grow wealth across generations while legally minimizing tax burdens.

Ready to Begin Your International Banking Journey?

Easy Global Banking specializes in guiding high-net-worth individuals and corporations through international banking complexities, including comprehensive Panama residency and account opening support.

Our expert team provides personalized guidance tailored to your specific financial situation. We ensure seamless execution from initial consultation through fully operational international banking relationships. We’ve helped hundreds of clients successfully establish banking in Panama, Switzerland, Singapore, and other premier jurisdictions. We navigate documentation requirements, compliance procedures, and strategic considerations that overwhelm those attempting this independently.

Whether you’re ready to open a foreign bank account positioning your wealth outside your home country, seeking the legendary security of Swiss banking by learning to open a Swiss bank account, or exploring Asia’s dynamic hub through preparing to open a bank account in Singapore, Easy Global Banking delivers expertise that transforms complex international banking from overwhelming to achievable.

Visit Easy Global Banking today to schedule your confidential consultation. Begin your journey toward true international financial freedom.

For additional perspectives on international tax strategies and offshore banking considerations, explore this comprehensive resource on offshore banking fundamentals from Investopedia, one of the world’s leading financial authorities.