The Reality of International Private Banking

Expanding your wealth across borders is a strategic necessity. However, it should not be an administrative burden. Unfortunately, the current landscape for opening a foreign bank account is defensive.

In fact, most non-resident applicants get stuck. They face a process designed to filter people out rather than welcome them. Consequently, without the right preparation, you risk losing months to a system that defaults to “no.”

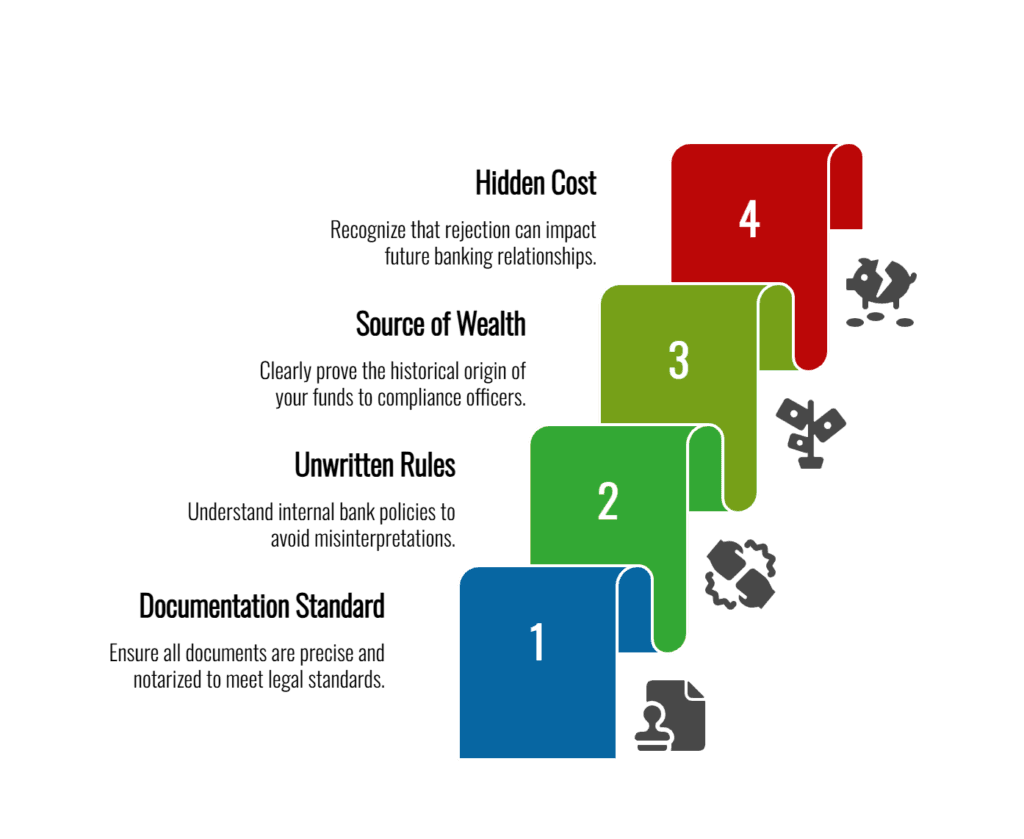

The Four Key Barriers You Will Face

You will likely encounter specific hurdles when approaching Swiss Private Banks or Singaporean institutions.

First, The Documentation Standard. Top-tier banks do not just ask for forms. Instead, they demand precise, notarized documentation that meets strict legal standards. A single missing signature can restart your entire bank account opening timeline.

Second, The “Unwritten Rules.” Every financial hub has internal policies that are never published online. Therefore, misinterpreting a bank’s specific risk appetite often leads to rejection. This is especially true if you apply to the wrong institution for your asset protection profile.

Third, The Source of Wealth Requirement. Modern compliance is rigorous. As a result, it is no longer enough to simply show your passport. You must actively prove the historical origin of your funds. If your Source of Wealth (SoW) narrative is unclear, compliance officers will decline the file. They do this to protect the bank from regulatory risk.

Finally, The Hidden Cost of Rejection. A denied application is not just a nuisance. On the contrary, it leaves a mark on your internal compliance record. This can make future attempts to secure a private banking relationship significantly harder.

Ultimately, these obstacles make international banking feel daunting. But they are not insurmountable. They simply require a professional architect to navigate them.

The Philosophy Behind Our Name

We are often asked why we chose the name “Easy Global Banking.” In the exclusive world of private wealth management, true simplicity is a luxury. Yet, it is also the hardest thing to achieve. Specifically, it requires deep regulatory knowledge to make a complex Swiss compliance process look simple.

We chose this name as a deliberate promise to you. In short, we take on the heavy lifting. We handle the due diligence, the legal structuring, and the complex paperwork entirely. By absorbing this complexity, we ensure your experience remains frictionless. We transform a frustrating struggle into a clear journey. This allows you to secure your international assets with confidence.

How We Deliver Results

Global Access, Tailored to Your Strategy

We do not believe in generic solutions. Instead, we align your specific goals with the top financial institution that actually wants your profile. Whether you need wealth preservation, portfolio diversification, or an offshore corporate account, we have the solution. Thus, we secure your access to Swiss security and Singaporean growth markets. Best of all, you never need to leave your home.

The “Compliance Dossier” Advantage

We go far beyond standard applications. For instance, our team uses advanced data structuring to organize your financial history. Then, it is refined by seasoned compliance officers. This creates a professional “Compliance Dossier” that bankers trust. Because the bank understands your profile immediately, your probability of a successful remote account opening increases dramatically.

Sovereign Swiss Expertise

We operate as BMA Business Solutions GmbH. Therefore, we live the reality of international finance every day. We provide you with precise, country-specific insights into current regulations. Consequently, you enter the banking relationship fully prepared, compliant, and protected.

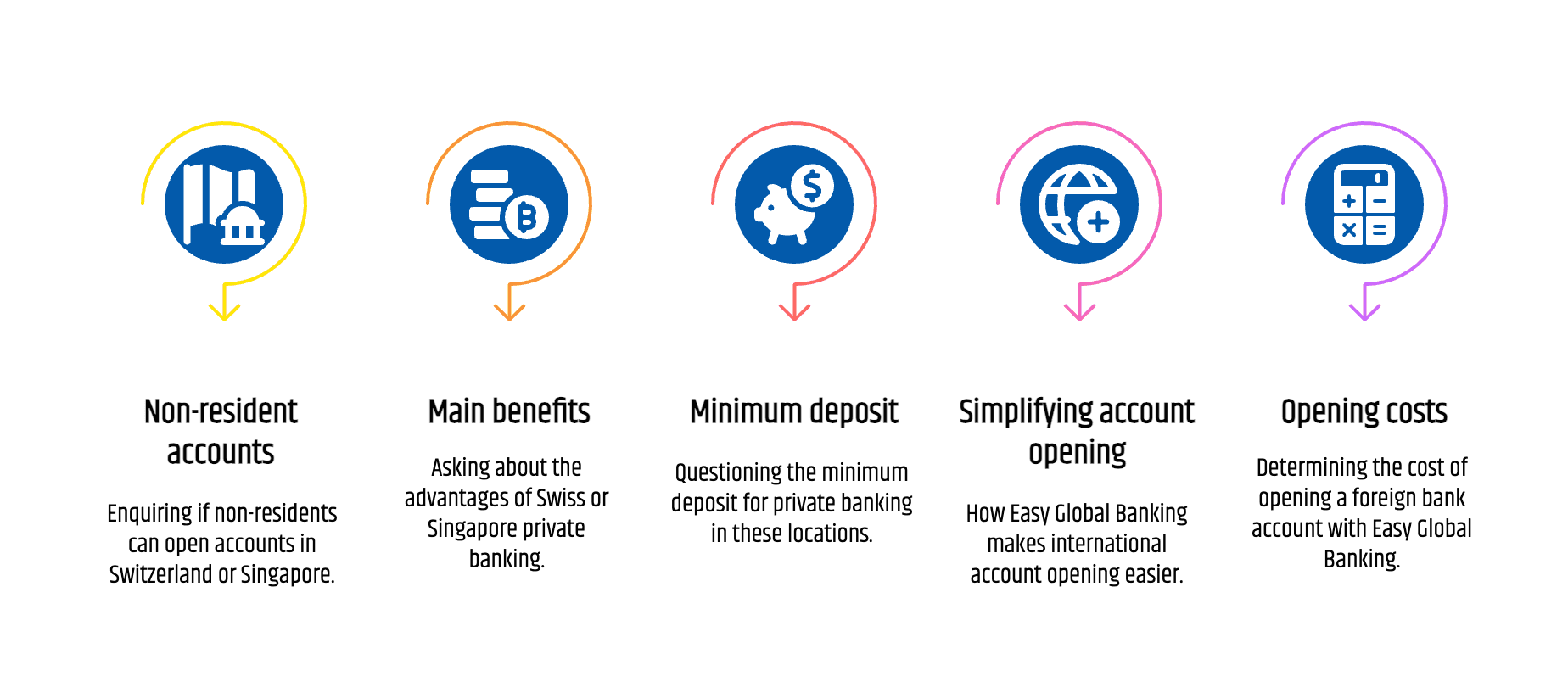

Stop wasting weeks on rejected applications. We guarantee successful account opening in Switzerland and Singapore—so you can access global markets with confidence. Non-residents, family offices & complex structures welcome. Choose from personal banking, corporate structures, or family office solutions. Whether you need multi-currency accounts, investment access, or regulatory positioning expertise—we handle the complexity so you focus on opportunity.

Swiss Banking

Secure and private account opening in Switzerland

Singapore Banking

Access to Singapore banking for individuals and businesses

Investment Opportunities

Diverse investment options including stocks, bonds, and cryptocurrencies

High-Interest Savings

High-interest savings accounts in major currencies

Swiss Banking

Secure and private account opening in Switzerland

Singapore Banking

Access to Singapore banking for individuals and businesses

Investment Opportunities

Diverse investment options including stocks, bonds, and cryptocurrencies

High-Interest Savings

High-interest savings accounts in major currencies

Expert guidance on your specific situation**

We’ll clarify your exact qualification threshold during your consultation**

**Minimums vary by nationality, residency, and bank. During your consultation, we’ll clarify your specific requirements and position you for approval.

If we accept your case, your account is guaranteed. Our track record is 98% success for all completed processes.

*Our introductory fee is determined by several factors to ensure fairness and transparency. These include the type of account, the citizenship and nationality of the client or beneficiary, and the complexity of the case. This personalized approach allows us to provide optimal solutions tailored to your unique needs while maintaining the highest standards of service.

Trust is the foundation of our business. We are proud to share the stories of clients who have partnered with us to overcome the complexities of international finance .

“I was frustrated with the overwhelming bureaucracy of my previous bank. Easy Global Banking cut through the red tape and made the process of diversifying my investments simple and transparent. They truly gave me peace of mind.” – J.R., Entrepreneur & Global Investor

“Opening a corporate account for our business was a complex and time-consuming process. Easy Global Banking’s expertise made all the difference, providing a seamless solution that respected our time and helped us achieve our goals without international travel.” – S.P., CEO of a Multinational Corporation

Offshore Banking: Your Top Questions Answered

Our banking industry related Publications

Can You Still Open a Swiss Account as a Non-Resident? (2026 Update)

Quick Answer: Yes — it is possible to open a Swiss bank account as non-resident…

How to Document Crypto Income for a Bank Application: The 2026 Compliance Guide

If you get your crypto income documentation bank application wrong in 2026, your bank can freeze or…

How to Open a Bank Account in Dubai as a Non-Resident: Step-by-Step 2026 Guide

Introduction: Dubai Wants Your Money — But Not Without a Fight Every week, I speak…

How to Open a Bank Account in Georgia (Country): The 2026 Guide for Non-Residents & Nomads

Introduction: Why Georgia Is Still on My Radar My name is Asel Mamytova. Before I…

The 2026 Strategic Crossroads: Will Bank Frick Sell or Scale in the New Digital Economy?

The European banking sector is currently navigating an era of profound structural transformation. Driven by…

Lombard Odier 2025: How Its Record Year and New Geneva HQ Redefine Swiss Private Banking

Lombard Odier closed 2025 with record client assets, rising profitability and a landmark headquarters in…