Opening a bank account is a straightforward process for most people—but not for Politically Exposed Persons (PEPs). If you hold or have held a prominent public position, you face significantly stricter scrutiny from financial institutions worldwide. The good news? With proper preparation, transparency, and the right strategy, opening a bank account as a PEP is absolutely achievable. This comprehensive guide reveals everything you need to know about navigating the complex world of PEP banking, from understanding why banks treat you differently to proven strategies for successful account opening.

Understanding Politically Exposed Persons (PEPs): Who Qualifies?

A Politically Exposed Person (PEP) is an individual who has been entrusted with a prominent public function, either currently or in the recent past. According to the Financial Action Task Force (FATF), the international standard-setting body for anti-money laundering regulations, PEPs are recognized as presenting higher risks due to their position and influence, which could potentially be abused for money laundering, corruption, bribery, or terrorist financing activities.

The Three Main Categories of PEPs

Foreign PEPs include heads of state or government, senior politicians, high-ranking government officials, judicial or military officers, senior executives of state-owned companies, and important political party officials in foreign countries.

Domestic PEPs hold prominent public positions within their own country of residence. This category encompasses presidents, prime ministers, parliament members, senior civil servants, and high-level judicial officials.

International Organization PEPs occupy top-tier roles in global bodies such as the United Nations, World Bank, International Monetary Fund, NATO, European Union, or international sports organizations recognized by the International Olympic Committee.

Family Members and Close Associates Are Also Considered PEPs

The PEP designation extends beyond the individual holding the public office. Immediate family members—including spouses or equivalent partners, children and their spouses, and parents—are also classified as PEPs. Additionally, close associates who have joint beneficial ownership with a PEP or maintain close business relations are subject to the same enhanced scrutiny.

Why Banks Apply Enhanced Scrutiny to PEPs

Banks don’t treat PEPs differently because they assume criminal activity—rather, it’s a preventive measure required by international regulations. Due to their prominent positions, PEPs have potential access to large public funds, control over government contracts, and opportunities to create structures that could facilitate corruption or money laundering.

The Financial Action Task Force explicitly requires financial institutions to identify PEPs and apply enhanced due diligence measures to manage the inherent risks associated with these relationships. These requirements are preventive in nature and should not stigmatize PEPs as being involved in criminal activity. However, non-compliance with PEP regulations can result in severe consequences for banks, including hefty regulatory fines, reputational damage, and loss of business.

Common reasons PEP bank applications get rejected, with documentation and verification issues being the leading causes

The Major Challenges PEPs Face When Opening Bank Accounts

High Rejection Rates and “Debanking”

Recent data reveals a troubling trend: UK banks alone close over 1,000 accounts daily, with many PEPs facing outright rejections or unexpected account closures. In the UK, approximately 90,000 individuals have been classified as politically exposed persons, leading to widespread banking access issues. High-profile cases, such as former UKIP leader Nigel Farage and UK Chancellor Jeremy Hunt, have brought public attention to the systemic challenges PEPs encounter when trying to access basic banking services.

Banks’ Risk-Averse Approach

The vast majority of banks simply won’t accept PEPs as clients. Of the banks that do accept PEPs, they typically impose significant restrictions based on the specific nature of the political exposure. There’s a substantial difference in how banks assess an honorary consul versus a high-ranking military general, or the child of a former president compared to the child of a former bureaucrat.

Enhanced Due Diligence Requirements Create Barriers

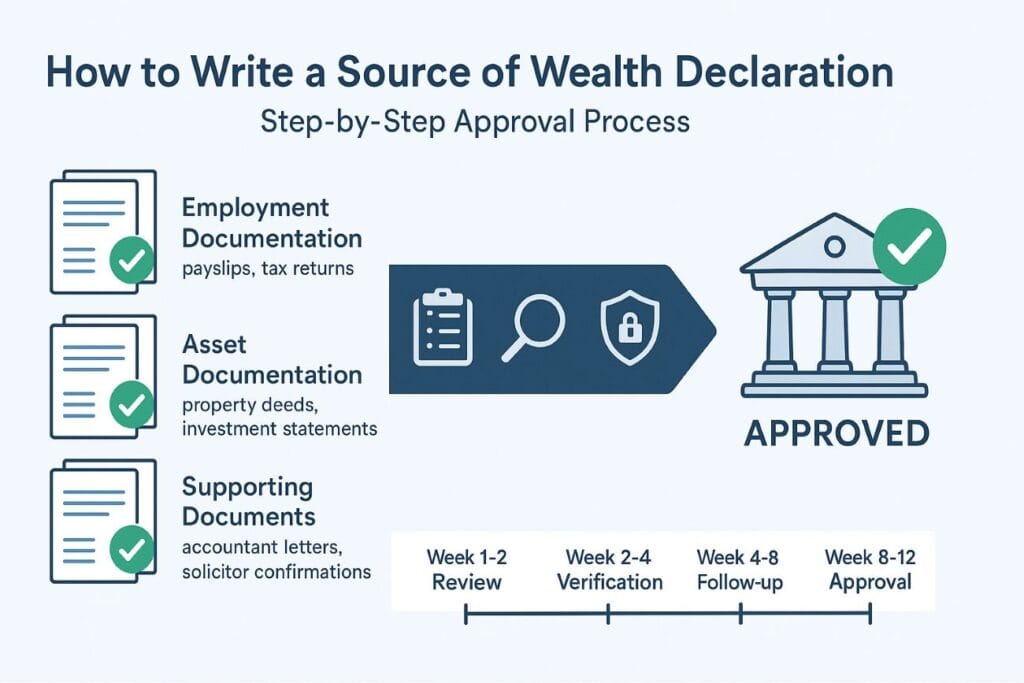

When banks do consider PEP applications, they require significantly more documentation and scrutiny compared to standard customers. Enhanced due diligence (EDD) measures include comprehensive identity verification from multiple independent sources, detailed collection and verification of source of funds and wealth documentation, mandatory senior management approval before establishing the banking relationship, and continuous enhanced transaction monitoring throughout the relationship.

Geographic Considerations Matter Significantly

The challenges vary dramatically based on nationality and region. African PEPs face different obstacles than Asian PEPs, while Latin American and Caribbean PEPs encounter their own unique barriers. American PEPs are considered among the most challenging categories for international account opening.

Essential Documentation: What You Must Prepare

Core Identity Documents

Valid passport with current certification or notarization, comprehensive proof of address (utility bills, bank statements less than three months old), and tax documentation including tax returns, Tax Identification Number (TIN), and FATCA declarations (especially important for U.S. persons).

Source of Wealth (SoW) Documentation

Banks must understand how you accumulated your total wealth over time. This requires detailed career history showing positions held, salaries earned, and progression over time, investment statements demonstrating long-term wealth accumulation, inheritance records including estate accounts and legal documentation, business ownership documentation showing dividends, sale proceeds, and company valuations, and property sale agreements with corresponding transfer records.

The key distinction: Source of Wealth refers to the origin of your total accumulated wealth, while Source of Funds refers to the specific money being used for particular transactions.

Source of Funds (SoF) Verification

For each transaction or relationship, banks need to see bank statements showing the movement and origin of specific funds, payslips or invoices confirming current income sources, sale agreements for assets being converted to cash, and documents confirming the legitimacy of the specific funds being deposited or transferred.

Business Relationship Documentation

Detailed written explanation of why you need the specific account, supporting business contracts, invoices, or corporate formation documents demonstrating legitimate business needs, evidence of international business operations, foreign property management, or currency requirements, and clear description of anticipated transaction volumes and patterns.

Enhanced Due Diligence Comparison Table

| Requirement Category | Standard Customer | PEP Customer |

|---|---|---|

| Identity Verification | Basic ID verification | Enhanced ID from multiple sources |

| Source of Wealth Documentation | Not required | Comprehensive wealth history required |

| Source of Funds Verification | Basic only | Detailed fund origin with evidence |

| Business Relationship Purpose | Brief explanation | Detailed written justification |

| Senior Management Approval | Not required | Mandatory senior sign-off |

| Ongoing Monitoring Frequency | Annual or less | Quarterly or monthly |

| Transaction Monitoring | Standard | Enhanced with lower thresholds |

| Beneficial Ownership | If applicable | Mandatory verification |

The Three-Step Strategy for Successfully Opening a PEP Bank Account

Step 1: Select the Right Banks and Jurisdictions

The most critical decision you’ll make is choosing banks that actively accept PEP clients. Premier and private banking hubs offer greater flexibility and experience handling complex client profiles like PEPs. Look for jurisdictions with a history of supporting clients from your home country, as they’ll already be comfortable with baseline risks and have established procedures for verifying identity documents from your nationality.

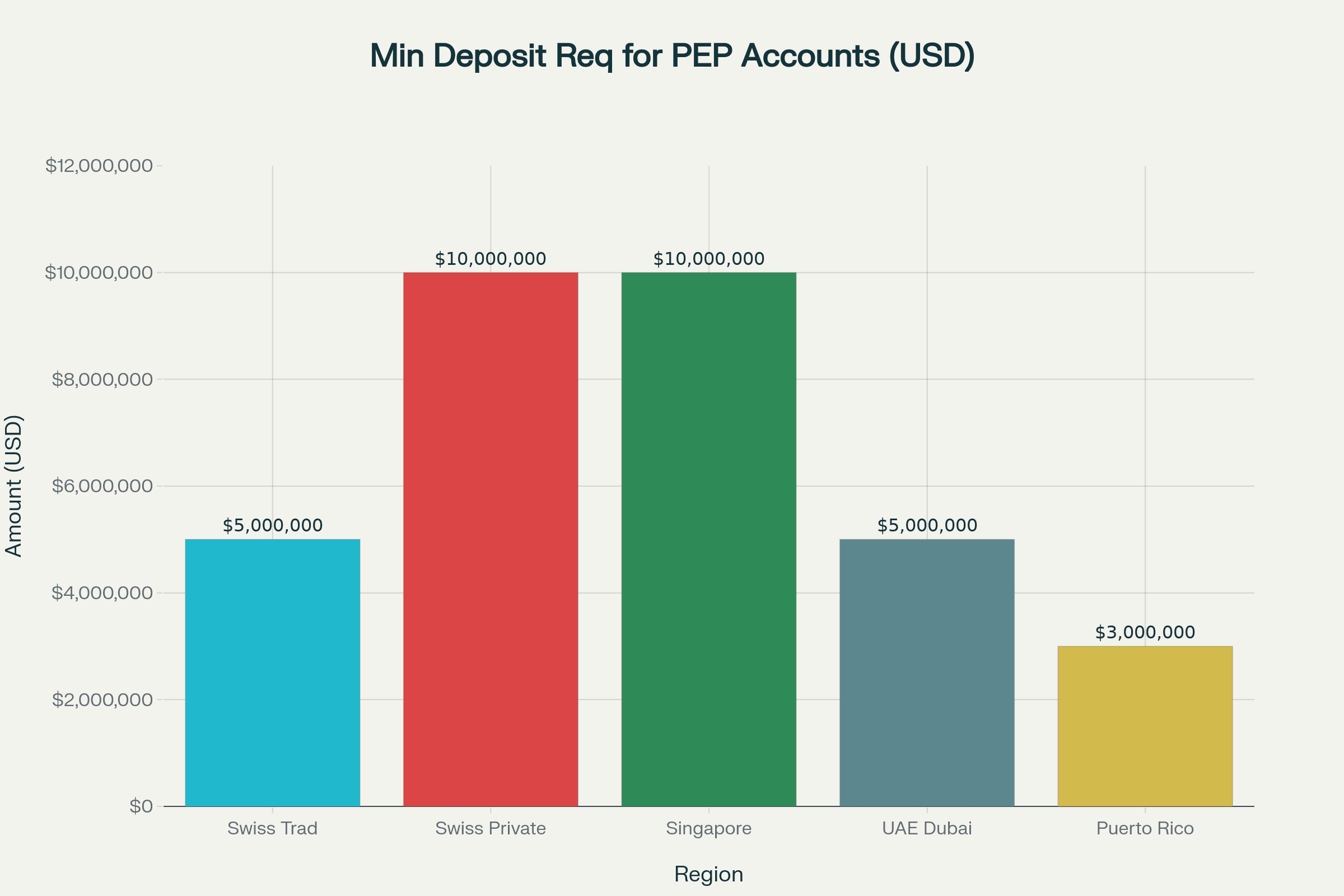

Top jurisdictions for PEP banking include Switzerland, which remains the benchmark for private banking with specialized PEP compliance expertise. Traditional Swiss banks require CHF 5 million (USD 5 million) minimum deposits, while private banks impose CHF 10 million (USD 10 million). Singapore consistently ranks among the safest banking jurisdictions, requiring SGD 10 million (USD 10 million) for PEP accounts. The UAE, particularly Dubai, offers modern financial centers with PEP account minimums at USD 5 million. Puerto Rico provides an alternative with USD 3 million minimums for PEPs seeking international banking services. Luxembourg provides EU access combined with favorable banking regulations

Minimum deposit requirements for PEP accounts vary significantly by region, with Swiss traditional banks requiring the highest initial deposits

Step 2: Provide a Clear and Compelling Business Rationale

Banks need to understand your legitimate reason for opening the account. Vague explanations like “I want international diversification” or “better banking services” won’t satisfy compliance teams. Instead, provide specific justifications such as: living or working outside your home country with genuine need for international banking, conducting business with international partners requiring multi-currency transactions, managing foreign property investments or rental income, facilitating staff payroll for international operations, or managing currency risk for legitimate business purposes.

Support your explanation with concrete documentation: business contracts showing international relationships, invoices demonstrating cross-border trade, property ownership documents for foreign real estate, or employment contracts showing international assignments.

Step 3: Maintain Realistic Expectations and Full Cooperation

Opening international bank accounts as a PEP is inherently more challenging and time-consuming than standard applications. Banks will charge additional fees for processing PEP applications to cover enhanced compliance costs. You should expect to provide significantly more paperwork than non-PEP applicants, anticipate multiple rounds of questions and clarifications from compliance teams, and prepare for potential video calls or in-person interviews even for remote applications.

Delays, partial answers, or reluctance to provide additional documentation will likely result in immediate rejection, as banks interpret non-cooperation as a major red flag.

Bonus Strategy: Demonstrate Investment Commitment

If you’re planning to maintain substantial balances, committing a portion to investment products through the bank can significantly increase your chances of approval. Banks gain clear visibility into how they’ll profit from the relationship, which motivates relationship managers to advocate for your application through the compliance process.

This strategy typically works best when bringing mid-six-figure or seven-figure deposits, though such large amounts may trigger additional scrutiny and documentation requirements given your PEP status.

Critical Red Flags That Will Get Your Application Denied

Weak or Missing Documentation

Vague explanations like “inheritance,” “business profits,” or “crypto gains” without supporting documentation will result in immediate rejection. Banks require employment contracts, detailed sale agreements, tax filings, and transfer statements proving the legal origin and movement of funds.

Complex or Opaque Ownership Structures

Ownership structures using multiple layers—offshore companies, trusts, or nominee shareholders—raise instant suspicion if the ultimate beneficial owner (UBO) is unclear. Prepare clear organigrams, notarized company documents, and step-by-step UBO explanations.

Sanctioned Country Connections or High-Risk Jurisdictions

If you’re a national or resident of comprehensively sanctioned countries (Russia, Iran, North Korea, Syria), most banks will reject your application outright regardless of documentation quality. The 2025 EU sanctions package bars banks from onboarding Russian nationals even if they reside elsewhere, and UAE residency does not allow Russian clients to open accounts in the EU or UK.

Inconsistent or Contradictory Information

Banks algorithmically cross-check every detail—names, addresses, dates, income, company records, and transaction histories. Mismatches, outdated identification, or even small spelling variations between documents result in instant denial.

Evasiveness About PEP Status

Attempting to hide or downplay your PEP status is the fastest path to rejection. Always disclose your political exposure immediately, provide clear documentation separating personal wealth from public office, and anticipate additional questioning.

Lack of Cooperation During Due Diligence

Banks increasingly require live interviews, video verification, and sometimes in-person document review. Delaying responses, providing vague answers, refusing additional checks, or missing scheduled compliance calls signals avoidance and typically results in application closure.

Ongoing Compliance Requirements After Account Opening

Opening the account is just the beginning. Banks must conduct enhanced ongoing monitoring of PEP relationships throughout the entire duration of the business relationship. This includes regular review and updating of client identification information, beneficial ownership details, and the purpose and nature of the relationship.

Transaction monitoring intensity is significantly higher for PEPs. Banks review transactions more frequently against suspicious transaction indicators, develop enhanced reports with management sign-off, flag activities that deviate from expected patterns, and set business limits or parameters triggering mandatory reviews.

Periodic reassessment schedules for PEPs typically occur quarterly or even monthly, compared to annual reviews for standard customers. Banks must promptly identify if existing customers become PEPs or if PEP status changes, triggering immediate enhanced due diligence measures.

How Long Does PEP Status Last?

An important consideration: PEP status doesn’t necessarily end when you leave office. Many jurisdictions require enhanced scrutiny to continue for a period after the individual has left their prominent public position. However, recent regulatory updates in some countries, particularly the UK, have introduced more proportionate approaches allowing for prompt declassification once individuals genuinely no longer meet PEP criteria.

Family members and close associates typically lose PEP classification immediately when the relationship ends (such as through divorce or annulment) or when the primary PEP leaves office, though policies vary by jurisdiction.

Specialized Solutions: Working with Banking Consultants

Given the complexity and high rejection rates, many PEPs successfully open accounts by working with specialized banking consultants who understand the nuances of PEP compliance. These professionals offer expertise in selecting appropriate banks with PEP experience, pre-screening applications to identify potential issues before submission, preparing comprehensive documentation packages that satisfy enhanced due diligence requirements, and negotiating better terms and conditions on behalf of clients.

For PEP accounts in Switzerland, specialized consultants can introduce clients to the top banks and asset managers specializing in PEP compliance, significantly increasing approval chances.

Take Control of Your International Banking Future

Being classified as a Politically Exposed Person undeniably makes opening a bank account more challenging—but it’s far from impossible. Success requires selecting the right banking partners, preparing comprehensive documentation demonstrating legitimate sources of wealth and funds, providing clear business rationales for why you need the account, maintaining full transparency and cooperation throughout the due diligence process, and having realistic expectations about timelines, fees, and scrutiny levels.

The landscape is evolving. Recent regulatory guidance in several jurisdictions recognizes the need for more proportionate, risk-based approaches to domestic PEPs. Banks are increasingly distinguishing between different risk levels of PEPs rather than applying blanket policies.

Open Your Foreign Bank Account with Expert Guidance

Navigating PEP banking requirements doesn’t have to be overwhelming. Easy Global Banking specializes in helping Politically Exposed Persons successfully open a foreign bank account in premier jurisdictions worldwide. Our team understands the intricate compliance requirements that create barriers for PEPs and has established relationships with banks that actively work with politically exposed individuals.

Whether you’re looking to open a Swiss bank account with its legendary stability and wealth management expertise, or open a bank account in Singapore to access Asia’s leading financial center, our AI-powered compliance system and expert guidance streamline the entire process. We prepare bulletproof documentation, conduct pre-screening to identify potential issues, and leverage our banking relationships to maximize your approval chances.

For additional insights into global anti-money laundering requirements and PEP regulations, the Financial Action Task Force provides authoritative guidance that shapes international banking standards.

Don’t let your PEP status prevent you from accessing world-class international banking services. Contact Easy Global Banking today for a free consultation and discover how our specialized expertise can help you successfully open the foreign bank account you need. With proper preparation, the right banking partners, and expert guidance, your political exposure becomes manageable rather than prohibitive. Start your international banking journey now and experience the security, stability, and sophisticated financial services you deserve.