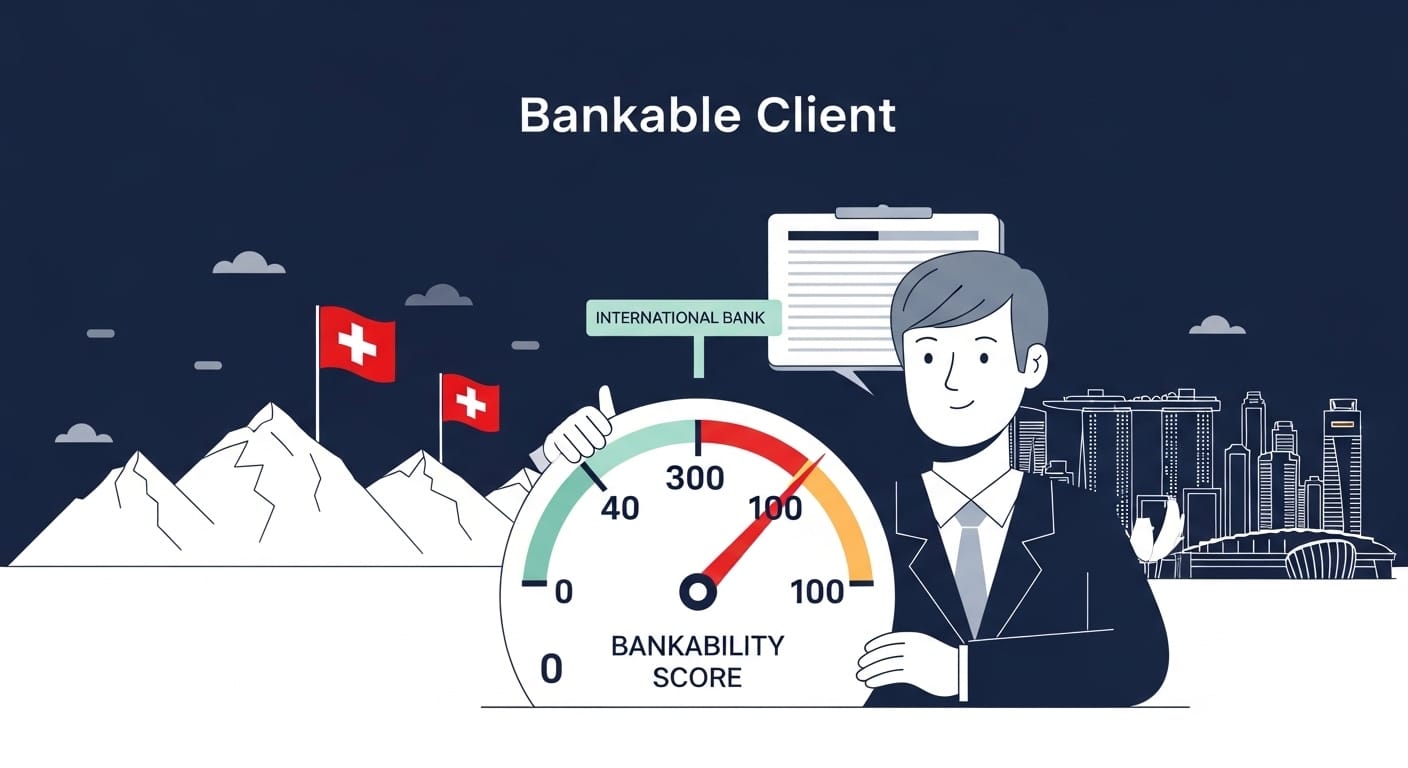

When a Swiss or Singapore bank looks at your file, it quietly answers one core question: “Is this client openable?”

To make that judgment transparent, I use a simple metric in my advisory work: the Bankability Score (0–100). It is a structured score that estimates how likely you are to obtain an account with a serious Swiss or Singapore bank, based on five measurable factors:

- Transparency of Source of Wealth (0–30)

- Jurisdiction Risk (0–20)

- Business / Activity Complexity (0–20)

- Public Reputation & PEP Proximity (0–15)

- Documentation Readiness (0–15)

In formula form:

Clients use this framework to self-assess before they try to open a foreign bank account through my firm, Easy Global Banking, and it often predicts their onboarding experience with surprising accuracy.

Why Banks Already Think in “Bankability” Scores

Regulators in Switzerland and Singapore push banks to use a risk-based approach for customer due diligence. That means banks must assess your risk level, then dial due diligence up or down accordingly, instead of treating all clients the same.

In practice, compliance teams classify clients as low, medium, or high risk based on:

- Your country of residence and company registration

- Your source of wealth and source of funds

- Your business model or professional activity

- Any public red flags (sanctions, adverse media, PEP links)

Swiss banks must follow strict rules under FINMA and the Swiss banks’ due diligence code, including verifying your identity, beneficial owner, and origin of funds before they accept you. Singaporean banks, under MAS guidelines, must also run structured Customer Due Diligence (CDD) checks and adjust procedures for higher-risk profiles.

So, whether you see it or not, someone already “scores” you. The Bankability Score simply makes this logic public, numerical, and usable from your side of the table.

The Public Formula: Bankability Score (0–100)

I built the Bankability Score to mirror how real compliance teams think, while staying simple enough for non-bankers to use. Here is the high-level structure:

| Factor | Weight (Max Points) | What a High Score Looks Like |

|---|---|---|

| Transparency of Source of Wealth (SoW) | 0–30 | Documented income history, tax filings, contracts, sale agreements clearly support your net worth. |

| Jurisdiction Risk | 0–20 | You live and bank in countries with stable regulation, no sanctions, and strong AML frameworks. |

| Business / Activity Complexity | 0–20 | Straightforward income model (salary, dividends, professional services, standard trade). |

| Public Reputation / PEP Proximity | 0–15 | No negative media, no sanctions, no close ties to politically exposed persons. |

| Documentation Readiness | 0–15 | You can provide complete, recent KYC/AML documentation without delay or resistance. |

Add the five components, and you get a number between 0 and 100.

- 85–100: Very strong candidate for Tier‑1 banks in Switzerland or Singapore.

- 70–84: Bankable; approval likely with some clarifications.

- 50–69: Borderline; still “openable” but with more friction and questions.

- 30–49: Weak profile for top-tier banks; mid-tier or alternative jurisdictions may suit you better.

- Below 30: Very low probability at regulated international banks; structural changes usually required.

Now let’s break down how each factor really works.

Factor 1: Transparency of Source of Wealth (0–30)

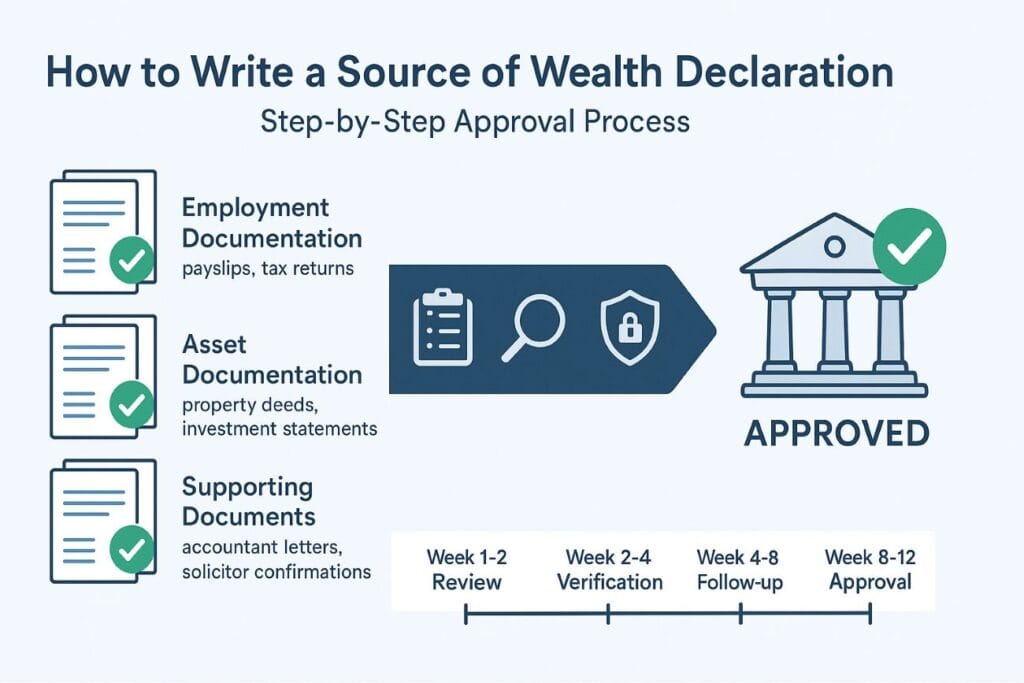

Source of Wealth (SoW) explains how you accumulated your money over time — not just where one transfer came from. Banks care deeply about this because regulators expect them to detect money laundering and unexplained enrichment.

In my framework, I score SoW as follows:

- 25–30 points:

- You provide tax returns, audited financials, employment or sale contracts, and bank statements that tell one consistent story.

- Major events (sale of company, inheritance, bonuses) have paperwork to match.

- 15–24 points:

- Your story is basically sound, but some periods are lightly documented.

- You can still fill gaps with additional explanation or partial evidence.

- 5–14 points:

- You rely heavily on cash, informal deals, peer‑to‑peer transfers, or unrecorded income.

- Crypto gains exist but lack clear transaction history and fiat on‑ramp/off‑ramp traceability.

- 0–4 points:

- You cannot convincingly explain how you built your current net worth.

- Documents conflict with your narrative or do not exist.

In real onboarding, this category often decides everything. A solid SoW can compensate for a medium-risk jurisdiction, but the reverse rarely holds.

Factor 2: Jurisdiction Risk (0–20)

Banks evaluate both where you live and where your companies sit. They cross-check this against FATF, sanctions lists, and transparency indices to gauge the inherent risk of doing business with you.

In the Bankability Score, a typical mapping looks like this:

- 16–20 points (Low Risk):

- Residency and core business operations in well-regulated jurisdictions such as Switzerland, EU countries with strong AML, the UK, Singapore, or similar.

- 8–15 points (Moderate Risk):

- Mixed footprint: you may live in a solid jurisdiction but operate or sell heavily into countries with weaker enforcement.

- 0–7 points (High Risk):

- Main residency or business registration in countries under sanctions pressure, with systemic corruption issues or severe AML gaps.

You cannot instantly change your passport, but you can often adjust where your primary operating entity sits, which already shifts this factor.

Factor 3: Business / Activity Complexity (0–20)

Compliance teams prefer simple stories. Clear business models mean fewer unknowns, less guesswork, and quicker approval. Highly layered structures, on the other hand, create friction.

Here is how I translate that into a score:

- 16–20 points (Simple):

- Salaried executives, listed‑company employees, regulated professionals, standard trading / consulting with one or two companies.

- 8–15 points (Moderate Complexity):

- Multiple operating entities, cross‑border invoicing, or holding structures, but all with logical functions and transparent ownership.

- 0–7 points (High Complexity):

- Long chains of offshore entities, trusts, nominees, opaque joint ventures, or activities in sectors that banks classify as sensitive (certain types of crypto, gambling, unregulated financial services).

When I prepare files, I often “flatten” structures: one clean holding company instead of four unnecessary layers. This alone can release 5–7 points on the Bankability Score.

Factor 4: Public Reputation & PEP Proximity (0–15)

Banks now run automated checks against sanctions lists, PEP databases, and adverse media. MAS explicitly expects Singaporean institutions to screen for such issues at onboarding and during ongoing monitoring.

The scoring here remains straightforward:

- 12–15 points:

- No negative media, no litigation tied to fraud or corruption, no sanctions, and no close political ties.

- 6–11 points:

- Some neutral or minor negative press that you can explain (e.g., commercial dispute), but nothing tied to financial crime.

- 0–5 points:

- Active or historical involvement in scandals, corruption allegations, or close connections to PEPs, especially in higher-risk states.

You cannot rewrite history, but you can prepare a calm, factual explanation for any negative search result and support it with documents.

Factor 5: Documentation Readiness (0–15)

Even very strong profiles lose momentum when documentation arrives late, incomplete, or inconsistent. Swiss and Singaporean banks expect a full KYC/AML pack before they confirm onboarding.

In my rubric:

- 12–15 points:

- You can produce all key documents within days: passport, proof of address, corporate registry extracts, full shareholding structure, financial statements, SoW and SoF evidence, tax residency certificates, contracts.

- 6–11 points:

- Core documents exist but need translation, legalization, or updating. Some missing items delay the file.

- 0–5 points:

- Major gaps (unavailable corporate docs, expired IDs, no tax evidence) or reluctance to share information.

When clients work with my team, we often start with a documentation sprint before we even approach a bank. That sprint alone can take a profile from unopenable to realistic.

Example Profiles and Their Bankability Scores

To show the formula in action, here are three anonymized composite profiles based on real cases I see regularly:

| Profile | Factor Breakdown | Bankability Score |

|---|---|---|

| Crypto‑heavy nomad (multi‑chain trading, no stable residency, limited tax filings) | SoW 10/30 (fragmented), Jurisdiction 8/20 (unstable footprint), Complexity 10/20 (unregulated digital activity), Reputation 7/15 (no major issues), Docs 7/15 (wallet screenshots, incomplete contracts) | 42 / 100 |

| Classic EU corporate executive (senior manager at listed company, paid in EUR, clear savings path) | SoW 28/30 (strong payroll and bonus track), Jurisdiction 18/20 (EU residency), Complexity 15/20 (salary + standard investments), Reputation 10/15 (neutral public profile), Docs 7/15 (some items need updating) | 78 / 100 |

| Turkish SME owner with clean books (manufacturing, audited accounts, mid‑risk country) | SoW 22/30 (audited financials), Jurisdiction 10/20 (moderate‑risk location), Complexity 13/20 (standard trading business), Reputation 10/15 (no adverse media), Docs 10/15 (generally ready) | 65 / 100 |

In practice, the crypto‑nomad can still open accounts, but usually with more niche or fintech‑style providers, not the conservative private banks in Zurich or Singapore. The EU executive, by contrast, often obtains a Swiss or Singapore relationship on the first attempt, sometimes with minimal additional questions.

How to Actively Increase Your Bankability Score

The biggest misconception is that your profile is fixed. In reality, you can deliberately engineer a higher Bankability Score over 6–18 months. Here is where I usually focus with clients:

- Consolidate and evidence your Source of Wealth

- Reconstruct your income history year by year.

- Align tax returns, bank statements, contracts, and sale documents.

- For crypto, create a clear audit trail from fiat in, on‑exchange activity, and fiat out where possible.

- Upgrade your structural footprint

- Move your main operating entity to a more acceptable jurisdiction when feasible.

- Avoid unnecessary offshore layers; if you keep them, document their purpose precisely.

- Simplify your story

- Present one primary business model, not five loosely connected “side projects.”

- Close dormant entities and stray accounts that add noise.

- Prepare a reputation file

- Collect explanations and judgments for any dispute, article, or legal case that appears online.

- Show how regulators or courts resolved the matter, not just your opinion.

- Treat documentation as a project, not an afterthought

- Create a shared folder with all KYC items, updated at least annually.

- Obtain certified translations and apostilles in advance if you come from a non‑English or non‑German / French jurisdiction.

With coordinated work, I often see profiles improve by 15–25 points, which moves a client from “borderline and frustrating” into “openable at a serious institution”.

How I Use the Bankability Score with Clients

When a client approaches Easy Global Banking to Open a Swiss Bank Account options or explore Singapore, I start with a structured diagnostic using this exact framework.

First, we estimate each factor based on questionnaires, existing documentation, and a reputational check. Then we:

- Identify quick wins (for example, refreshing corporate extracts and proof of address).

- Flag structural issues (such as an over‑engineered offshore setup).

- Decide whether a Swiss or Singapore bank is realistic now, or whether we should first strengthen the profile.

For some clients, the honest answer is: “You can open, but not yet in Switzerland; let’s use another jurisdiction while we improve your score.” That kind of clarity saves both time and reputation with future banks.

If your goal is ultimately to hold assets with conservative institutions in Zurich, Geneva, or Singapore, the Bankability Score becomes your roadmap, not a judgment.

Turn Your Score into a Strategic Advantage

Bankers, regulators, and auditors already assess you through their own risk lenses. By adopting a transparent formula, you take back control and manage that perception proactively.

If you are serious about opening or upgrading your banking relationships in Tier‑1 jurisdictions, start by scoring yourself honestly on each factor. Then decide which 10–20 points you can realistically gain in the next year.

When you are ready for a professional, confidential assessment, my team and I can review your documentation, assign a Bankability Score, and position you with the right institution at the right time. For many of my clients, that path leads to a successful Open Swiss Bank Account mandate and, in parallel, tailored options in Singapore and beyond.

If your current profile feels “too complicated” or your last bank said no without a clear reason, that is precisely when this framework creates value. You do not need another generic checklist; you need a quantified, strategic plan to become truly bankable.