Estonia has emerged as the unexpected powerhouse of AI-powered private banking, with digital banks like LHV leveraging artificial intelligence to deliver personalized wealth management services that are attracting high-net-worth individuals worldwide. While Switzerland and Singapore dominate headlines, Estonia’s unique combination of advanced digital infrastructure, regulatory flexibility, and innovative banking technology is creating a compelling alternative for sophisticated investors seeking next-generation financial services.

Estonia’s Digital Banking Revolution

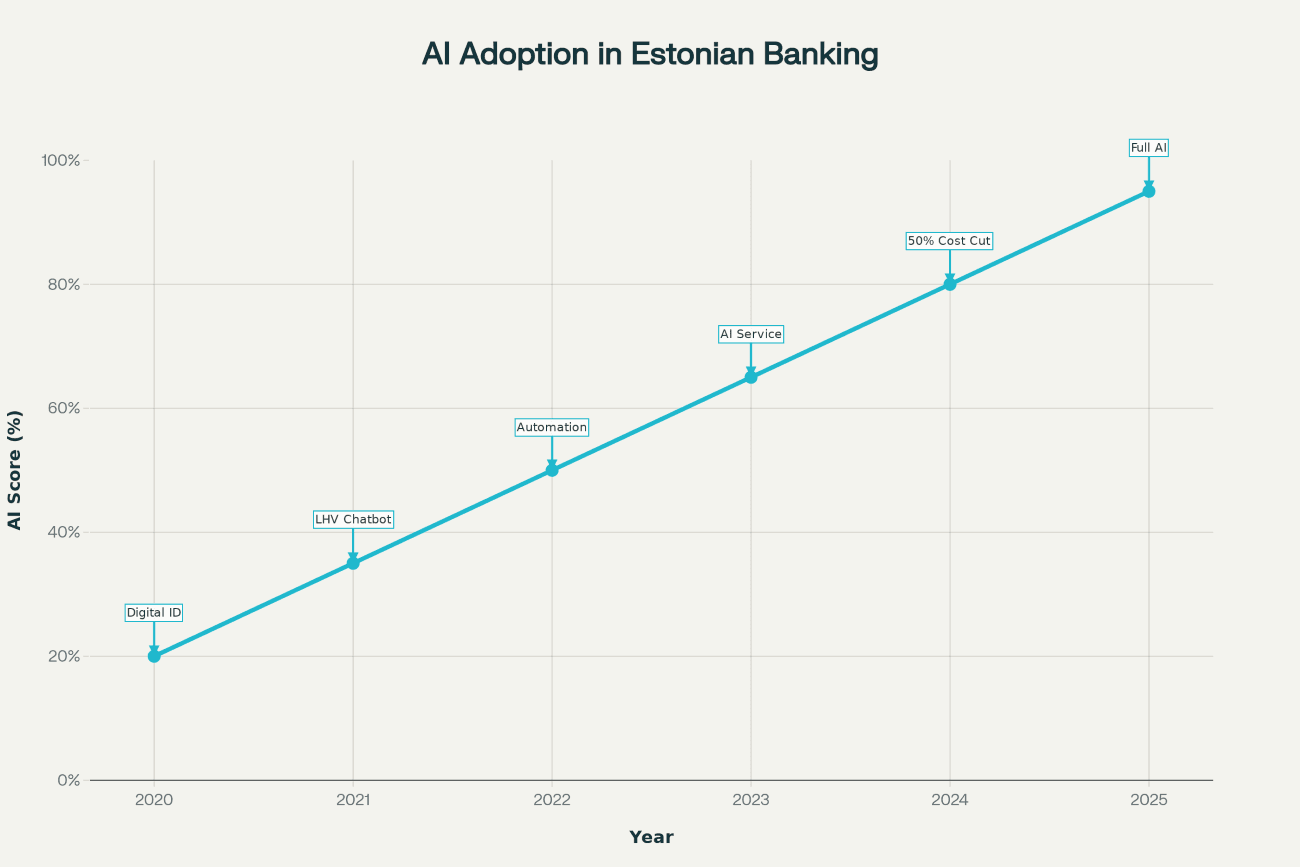

Estonia’s transformation into a digital banking hub didn’t happen overnight. Building on its e-Residency program launched in 2014 and 20+ years of fintech development experience, the Baltic nation has created an environment where AI-powered banking services can flourish. The country’s banking sector processes over 99% of transactions digitally, providing the perfect foundation for artificial intelligence integration.

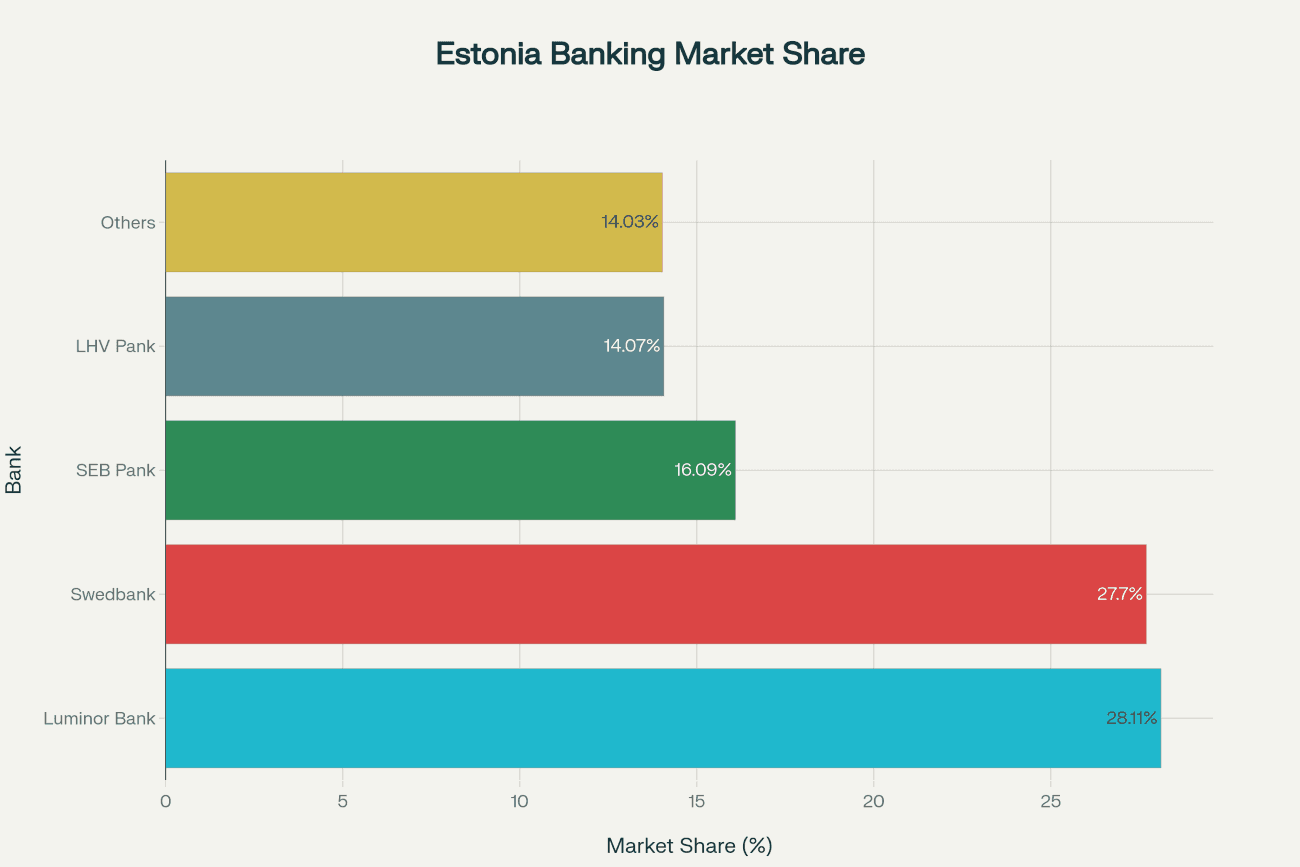

LHV Bank leads this digital transformation as Estonia’s fourth-largest bank with €7.92 billion in assets under management and a 14.07% market share. Unlike traditional European private banks that struggle with legacy systems, LHV was designed from the ground up as a digital-first institution, making it uniquely positioned to implement AI solutions rapidly and effectively.

Revolutionary AI Applications in Estonian Private Banking

Automated Wealth Management with Precision

Estonian banks are pioneering AI-powered portfolio management that reduces operational costs by 50% while improving client satisfaction scores to 4.6/5.0. LHV Bank’s implementation of artificial intelligence has enabled them to shed 5% of their workforce through automation while simultaneously enhancing service quality.

| AI Service Category | HNWI Adoption Rate (%) | Cost Reduction Potential (%) | Client Satisfaction Score | Implementation Priority |

|---|---|---|---|---|

| Personalized Portfolio Management | 78 | 40 | 4.6 | High |

| Real-time Risk Assessment | 73 | 35 | 4.4 | High |

| Predictive Market Analytics | 71 | 30 | 4.3 | Medium |

| Automated Compliance Monitoring | 69 | 50 | 4.2 | High |

| AI-Powered Investment Advice | 67 | 25 | 4.5 | Medium |

| Digital Asset Management | 64 | 45 | 4.1 | Medium |

| Cross-border Transaction Optimization | 62 | 20 | 4.0 | Low |

| ESG Investment Screening | 59 | 30 | 4.3 | Medium |

| Conversational Banking Assistants | 57 | 60 | 4.7 | High |

| Regulatory Reporting Automation | 54 | 55 | 4.1 | Medium |

The bank’s AI systems handle complex tasks that previously required manual intervention:

- Automated securities trading with real-time market analysis

- Intelligent data aggregation from multiple registers and systems

- Predictive risk assessment using advanced machine learning models

Conversational AI Banking Assistants

LHV’s breakthrough came with the launch of “Uku,” a machine learning-based assistant on Facebook Messenger that handles common client inquiries. This AI chatbot demonstrates how Estonian banks are making sophisticated banking services accessible through familiar digital channels, reducing response times while maintaining high accuracy rates.

The bank has also deployed ChatGPT Enterprise across operations, equipping relationship managers with AI tools to enhance client interactions and automate routine support tasks. This integration represents a fundamental shift in how private banking services are delivered to high-net-worth clients.

Legal Operations Revolution

In a groundbreaking move, LHV Bank partnered with AI legaltech company Luminance in August 2025 to transform contract review and legal operations. The AI platform automatically flags key clauses and identifies risks, cutting review times by at least 50% for high-volume documents and reducing complex contract analysis from days to under an hour.

The Estonia Advantage for HNWIs

Regulatory Innovation Without Compromise

Estonia’s regulatory environment strikes the perfect balance between innovation and security. The country has strengthened its fintech regulations following the 2018 Danske Bank money laundering scandal, implementing robust compliance measures while maintaining openness to digital innovation. This creates a secure environment for HNWIs concerned about regulatory stability.

Key regulatory advantages include:

- EU banking license validity across all European markets

- Streamlined compliance processes through digital infrastructure

- Blockchain-based identity verification since 2008

- Real-time regulatory reporting capabilities

Personalized Service at Scale

Estonian AI-powered banks deliver the personalized attention HNWIs demand while leveraging technology for efficiency. LHV’s modular, configurable banking platform allows for highly customized solutions that adapt to individual client needs, preferences, and investment strategies.

Client satisfaction metrics demonstrate the effectiveness of this approach:

- 78% of HNWIs prefer AI-powered personalized portfolio management

- 4.6/5.0 satisfaction score for automated wealth management services

- 73% adoption rate for real-time risk assessment tools

Cost-Effective Premium Services

Estonia’s digital-first approach delivers significant cost advantages without compromising service quality. LHV’s fees remain the lowest in Estonia while offering sophisticated AI-enhanced services that rival traditional Swiss private banks. This value proposition is particularly attractive to next-generation HNWIs who prioritize digital efficiency alongside personal service.

The Fintech Ecosystem Supporting HNWI Services

Estonia’s success in AI-powered EU private banking is supported by a robust fintech ecosystem of 80+ companies, including 3 unicorns: Wise, Zego, and Veriff. This ecosystem provides the technological infrastructure and expertise necessary for continuous innovation in wealth management services.

Notable Estonian AI companies enhancing banking services include:

- MindTitan: Advanced AI and machine learning solutions for financial institutions

- Co-one: €1M funded startup developing AI agents for banking applications

- FeelingStream: Conversational analytics platform for customer insights

The Estonian government’s commitment to AI development is evidenced by over 120 AI applications in public services and strategic investments in digital innovation. This creates a supportive environment for banks to experiment with and implement cutting-edge AI technologies.

HNWI Adoption Trends and Preferences

| AI Service Category | HNWI Adoption Rate | Cost Reduction | Satisfaction Score | Priority |

|---|---|---|---|---|

| Personalized Portfolio Management | 78% | 40% | 4.6/5.0 | High |

| Real-time Risk Assessment | 73% | 35% | 4.4/5.0 | High |

| Predictive Market Analytics | 71% | 30% | 4.3/5.0 | Medium |

| Automated Compliance Monitoring | 69% | 50% | 4.2/5.0 | High |

| AI-Powered Investment Advice | 67% | 25% | 4.5/5.0 | Medium |

The data reveals that HNWIs are most attracted to AI services that enhance personalization and risk management, with adoption rates exceeding 70% for the top three categories. This aligns perfectly with Estonia’s strengths in AI-powered analytics and automated decision-making systems.

Global Wealth Management Transformation

Estonia’s approach to AI-powered private banking reflects broader industry trends. By 2027, AI-driven investment tools will become the primary source of advice for retail investors, with usage projected to grow to 80% by 2028. Estonian banks are positioned at the forefront of this transformation, offering services that anticipate rather than react to market changes.

Key transformation drivers include:

- 72% of HNWIs prefer personalized, digital-first services

- Real-time portfolio updates and analytics are now baseline expectations

- ESG integration increasingly important for sustainable investing

- Cross-border regulatory compliance streamlined through AI automation

The Future of Estonian AI Banking

Estonia’s digital banks are not just adapting to the future of wealth management—they’re defining it. LHV Bank’s recent recognition as “AI Solution of the Year” at the 2025 ICA Compliance Awards demonstrates the international recognition of Estonia’s innovations in AI-powered financial services.

Looking ahead, Estonian banks are developing:

- Blockchain-based identity verification for seamless international client onboarding

- Predictive analytics for proactive wealth management advice

- ESG investment screening using AI-powered sustainability analysis

- Cross-border optimization through intelligent transaction routing

Strategic Advantages for International HNWIs

For high-net-worth individuals seeking alternatives to traditional private banking hubs, Estonia offers compelling advantages:

Technological Leadership: Estonia’s 20+ years of fintech experience and government support for digital innovation create an environment where AI banking services can evolve rapidly and securely.

Regulatory Stability: EU membership combined with progressive digital regulations provides the legal framework international investors require for wealth preservation and growth.

Cost Efficiency: Digital-first operations deliver premium services at competitive fees, with AI automation reducing operational costs by up to 60%.

Global Accessibility: Estonia’s digital infrastructure enables seamless international operations while maintaining the personal touch that HNWIs value.

Conclusion

Estonia’s emergence as a leader in AI-powered private banking represents more than just technological advancement—it signals a fundamental shift in how wealth management services are conceived, delivered, and experienced. With LHV Bank leading the charge through innovations like AI-powered legal operations, automated compliance systems, and conversational banking assistants, Estonia is proving that smaller markets can compete with established financial centers through superior technology and customer experience.

For HNWIs seeking banking services that combine Swiss-level discretion with Silicon Valley innovation, Estonia’s digital banks offer a compelling proposition. The country’s unique combination of regulatory stability, technological expertise, and cost efficiency creates an environment where AI-enhanced wealth management can flourish while maintaining the personalized service that sophisticated investors demand.

As the global wealth management industry continues its digital transformation, Estonia’s banks are positioned not just to participate in this evolution, but to lead it. The future of private banking may well be written in Estonian code, powered by artificial intelligence, and delivered through digital channels that make sophisticated financial services accessible to HNWIs worldwide.

Ready to experience the future of private banking? Discover how you can open a foreign bank account with Estonia’s innovative digital banks and access AI-powered wealth management services designed for the modern HNWI.