By Asel Mamytova, Swiss Banking & Wealth Management Specialist | Updated February 2026

Searching for the top Swiss banks for foreigners is not as straightforward as most guides suggest — and that gap between expectation and reality is exactly what this article closes. Switzerland has earned its private banking reputation over centuries, and the numbers continue to justify it. Swiss banks held a record CHF 9.24 trillion in total assets under management at the close of 2024, according to the Swiss Banking Barometer 2025. The sector grew further through 2025, with major private banks posting record AuM figures in their full-year results. In cross-border private wealth management specifically, Switzerland retained its global number one position — managing CHF 2.43 trillion in foreign client assets, a figure that grew 10% year on year on a currency-adjusted basis. These numbers explain why so many foreigners look to Switzerland first. What they do not explain is which Swiss bank will actually open its doors to you.

But here is something most generic guides fail to tell you: not all Swiss banks are equally accessible to foreigners, and the bank that suits you depends enormously on how much you plan to deposit — and where you are from.

After 12 years of advising international clients on Swiss banking structures, I have learned that walking into the wrong bank wastes months of your time. I have watched clients with entirely legitimate wealth get declined at the first step simply because they approached the wrong institution for their profile. So instead of giving you a flat list of “the best Swiss banks,” I want to walk you through the landscape the way a practitioner actually sees it — organized by deposit tier and shaped by the compliance realities every non-resident faces today.

Why Deposit Size and Nationality Both Matter More Than You Think

Before we get into specific institutions, you need to understand one foundational truth about Swiss private banking in the post-FATCA, post-CRS era: compliance costs money, and banks distribute those costs by client tier.

A bank that spends CHF 15,000 per year on KYC, ongoing monitoring, and enhanced due diligence can justify that cost when a client holds CHF 5 million. It cannot justify it for a CHF 400,000 relationship — unless that client is low-risk, easy to onboard, and simple to service. This economic reality is what drives selectivity. The KPMG and University of St. Gallen annual study confirms the trend: the number of private banks in Switzerland has been falling consistently. From 85 at the start of 2024, fewer than 80 remain by the end of 2025. Consolidation is accelerating because compliance costs keep rising while margins from smaller accounts stay thin.

The Nationality Rule Nobody Tells You

Here is the rule I apply consistently when advising clients: European clients with clean, documented wealth fall into the standard risk category. Everyone else — regardless of how legitimate their funds are — Swiss compliance departments automatically classify as enhanced due diligence, or high risk. That single distinction reshapes the entire banking landscape for non-EU foreigners.

If you come from outside Western Europe, most Tier 1 banks will redirect you to the CHF 5 million-plus category before any real conversation begins. This is not discrimination — it is arithmetic. Understanding this upfront saves you enormous time and frustration.

With that context established, let us go tier by tier.

Quick Reference: Top Swiss Banks for Foreigners at a Glance

| Bank | Tier | Minimum Deposit | Best For | Nationality Openness |

|---|---|---|---|---|

| Swissquote | Tier 1 | CHF 300,000 | Digital-first trading & custody | Broad, incl. non-EU |

| ZKB / Basler Kantonalbank | Tier 1 | CHF 300,000 | European clients with Swiss ties | Western Europe |

| Banca del Sempione | Tier 1 | CHF 300,000 | Italian/Ticino cross-border clients | European focus |

| AXION SWISS BANK | Tier 1 | CHF 300,000 | Non-resident international clients | European focus |

| CIM Banque | Tier 1 | CHF 300,000 | Remote digital banking, low fees | Relatively broad |

| UBP | Tier 2 | CHF 1 million | Multi-asset wealth management | Broad international |

| Vontobel | Tier 2 | CHF 1 million | Discretionary quantitative management | Broad international |

| Mirabaud & Cie | Tier 2 | CHF 1 million | Long-term partnership advisory | Broad international |

| Bordier & Cie | Tier 2 | CHF 1 million | LatAm & Middle East clients | High openness |

| BIL | Tier 2 | CHF 1 million | Swiss–Luxembourg dual structures | Broad international |

| EFG International | Tier 2 | CHF 1 million | Emerging market clients | High openness |

| Julius Baer | Tier 3 | CHF 5 million | Global, multi-jurisdiction families | Very high openness |

| UBS Wealth Management | Tier 3 | CHF 5 million | Complex, large-scale relationships | Universal |

| Pictet & Cie | Tier 3 | CHF 5 million | Investment excellence & discretion | Universal |

| Lombard Odier | Tier 3 | CHF 5 million | Sustainable & tech-driven portfolios | Universal |

| Safra Sarasin | Tier 3 | CHF 5 million | Emerging market & complex origins | Universal |

Minimum deposits are approximate entry points and may vary by client profile and relationship context.

Tier 1: CHF 300,000 to CHF 1 Million — The Entry-Level Private Client

This tier is where Switzerland’s reputation can be somewhat misleading. Countless articles promise access to Swiss private banking from as little as CHF 250,000 or even less. Technically true. Practically, far more complicated.

Switzerland does offer a meaningful selection of banks that actively serve non-resident clients at this deposit level. However, the honest reality is that the vast majority will only work with low-risk European clients in this bracket. If you are French, German, Dutch, Scandinavian, or from another Western European country with straightforward, documented income, you will find doors open to you. If you come from the United States, the Middle East, Southeast Asia, Latin America, Africa, or the post-Soviet space, most banks in this tier will decline before any serious conversation begins. The compliance burden exceeds what your deposit size can justify, and banks will reclassify you as high risk.

Digital and Cantonal Banks: The Practical Starting Point

For eligible European clients, Swissquote Bank offers a genuinely modern digital platform and accepts a wider range of nationalities than traditional private banks. Keep in mind, though — Swissquote functions more as a custody and trading platform than a wealth management relationship. It suits clients who want Swiss-based investment infrastructure and efficient online execution rather than a dedicated relationship manager.

Certain cantonal banks — particularly Zürcher Kantonalbank (ZKB) and Basler Kantonalbank — accommodate non-resident European clients who can demonstrate documented ties to Switzerland. Business ownership, Swiss property, or family connections all strengthen an application meaningfully. ZKB carries an AAA credit rating from Standard & Poor’s — one of the highest of any bank globally — which makes it a compelling option for security-conscious clients who prioritise financial solidity above all else.

Lugano-Based Options Worth Knowing

Banca del Sempione, headquartered in Lugano, is a practical and often-overlooked option. The bank has built a strong reputation among cross-border Italian and Ticino-region clients. It stands out for its well-developed card product suite — a detail that matters more than people initially think when setting up day-to-day banking as a non-resident. Clients who want genuine transactional functionality alongside a private banking relationship will find Banca del Sempione delivers both, with personal service that larger institutions rarely match at this deposit tier.

AXION SWISS BANK, also based in Lugano and backed by the Banca dello Stato del Cantone Ticino — the Ticino Cantonal Bank — brings an important credential: institutional solidity rooted in cantonal state support. That backing means AXION carries the financial strength of a state-guaranteed institution behind it, which provides meaningful reassurance to non-resident clients placing funds abroad. AXION focuses specifically on international and non-resident clients, having built its compliance framework for cross-border relationships from the ground up rather than adapting a domestic model. The bank offers multi-currency accounts, investment services, and card facilities — a practical combination for clients who want a complete banking experience, not just custody.

Digital-First Banking for Remote Clients

CIM Banque in Geneva rounds out this tier meaningfully. CIM attracts international clients who prioritise efficient online access, competitive fee structures, and the ability to manage their Swiss account remotely without constant in-person interaction. The onboarding process runs more smoothly than at traditional cantonal or private banks, and account maintenance costs sit among the most competitive in Switzerland for this deposit range. For non-residents who want genuine Swiss banking without the friction of legacy private bank processes, CIM is a smart starting point.

What to Actually Look for in This Tier

Since most reputable Western European banks now carry financial strength ratings broadly comparable to Swiss institutions, the case for choosing a Swiss bank at CHF 300,000–1 million must rest on more than the Swiss flag alone. I always advise clients to evaluate three criteria together: a solid investment-grade credit rating, a genuine range of services including credit card facilities (which many pure-play private banks still do not offer), and low account maintenance costs relative to what you actually receive. These three criteria separate the banks that genuinely deserve your business from those trading purely on Switzerland’s heritage and reputation.

Manage your expectations carefully at this tier. You gain Swiss account security, currency diversification, and access to stable financial infrastructure — genuine and real value. But you are not accessing the full private banking experience that Swiss banking marketing tends to project.

Tier 2: CHF 1 Million to CHF 5 Million — The Core Private Banking Sweet Spot

This is where Switzerland genuinely comes into its own. The range of institutions willing to engage with a broader international clientele expands significantly. Compliance teams can justify deeper onboarding at this level, and relationship managers carry enough revenue per client to deliver real, personalized service rather than a templated product offering.

This tier represents the heart of the Swiss private banking industry. According to the KPMG/HSG Clarity on Swiss Private Banks 2025 report, Swiss private banks generated CHF 21.4 billion in income in 2024, up from CHF 20.5 billion the prior year. The institutions serving this bracket built their entire operational model around non-resident clients — not as an afterthought, but as a deliberate strategic core.

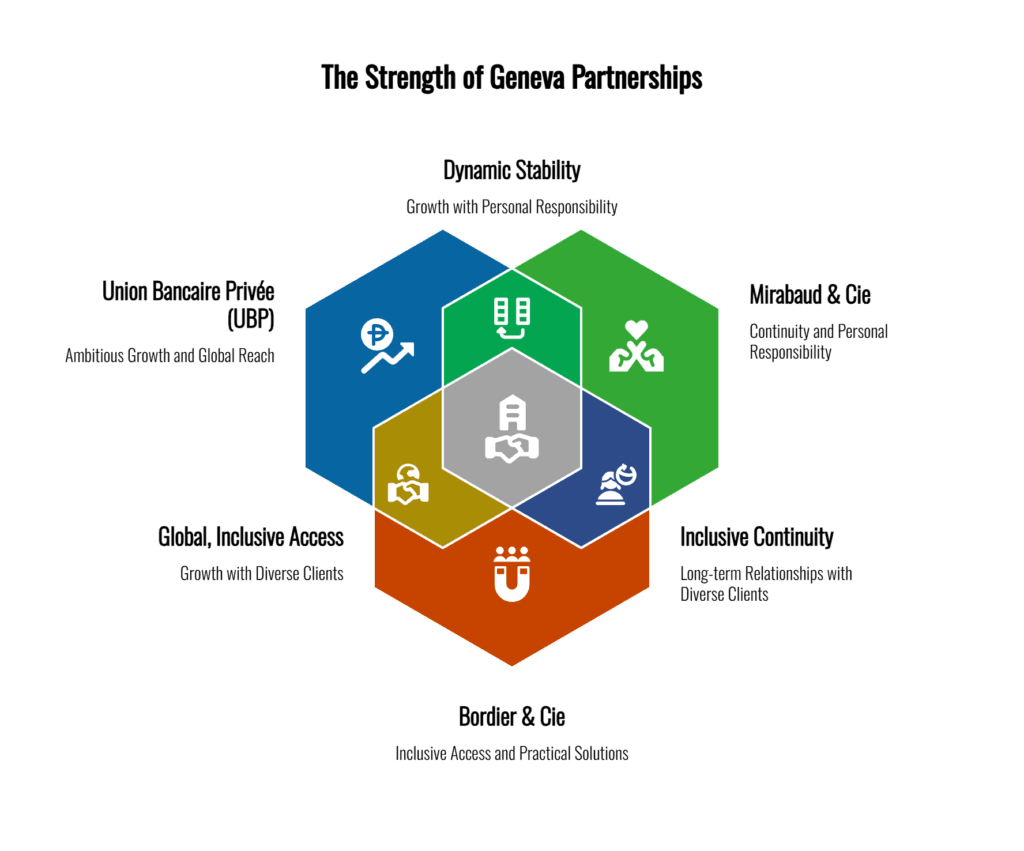

Geneva Partnerships: Stability and Skin in the Game

Union Bancaire Privée (UBP) is one of my most consistent recommendations at this level. Geneva-based and family-controlled, UBP delivered standout results in 2025: client assets grew 19.5% to CHF 184.5 billion, total income reached CHF 1.51 billion (+12.5%), and group profit rose to CHF 268.6 million. Much of that growth came from the strategic acquisitions of Société Générale’s private banking businesses in Switzerland and the UK — a sign of genuine ambition and international reach. UBP also opened a new office in Riyadh in 2025, signalling its deepening commitment to Middle Eastern clients. The bank has earned its reputation for pragmatic onboarding of clients from diverse backgrounds without compromising compliance standards.

Mirabaud & Cie is one of Geneva’s most respected independent private banks. Founded in 1819, it operates as a partnership — the partners carry personal accountability for client outcomes, not just professional accountability. That structure genuinely shapes how relationships develop over time. Mirabaud suits clients who value continuity, personalized advisory, and a bank that will not be sold or merged out from under them mid-relationship.

Bordier & Cie occupies a similar partnership space. With deep roots in the Latin American and Middle Eastern client base, Bordier shows notably more openness to clients from non-European backgrounds than most comparable institutions. For a client at CHF 1–2 million who might otherwise struggle to access quality private banking, Bordier frequently provides the most practical answer in this tier.

Zurich-Based Specialists for Performance-Driven Clients

Vontobel brings a different character — Zurich-based, publicly listed, and analytically rigorous. The bank finished 2024 with CHF 111 billion in private client assets under management, up 12% year on year, driven by both strong markets and CHF 4.6 billion in net new money. Vontobel attracts clients who care about investment performance as much as banking infrastructure. Its private banking team serves international clients from a wide range of jurisdictions and applies a quantitative, evidence-driven approach that produces meaningfully differentiated portfolios rather than generic model allocations.

Cross-Border Structures and Emerging Market Expertise

Banque Internationale à Luxembourg (BIL) bridges the Swiss and Luxembourg private banking ecosystems efficiently. While Luxembourg serves as its headquarters, BIL maintains a Swiss presence and suits clients who hold assets or structures across both jurisdictions. The bank takes a rigorous institutional approach to compliance — thorough in process, consistent in outcome. For clients whose wealth sits across multiple European jurisdictions, BIL eliminates the need to maintain entirely separate banking relationships in each.

EFG International rounds out this tier strongly. In 2025, EFG posted record full-year figures: net profit reached CHF 325.2 million, operating income grew 11% to CHF 1.7 billion, and assets under management climbed 12% to a record CHF 185 billion. The bank has since acquired Quilvest, a Swiss private bank with an established Latin America footprint, further broadening its emerging market credentials. EFG builds its model around independent asset managers and relationship bankers who bring their own client books. This creates a personalized, entrepreneurial culture. The bank handles clients from emerging markets with more sophistication than most competitors, making it a natural choice for non-European clients in this bracket.

For clients on the upper end approaching CHF 4–5 million, it is worth approaching Tier 3 institutions as well. Some will accommodate you — particularly when the relationship shows clear longer-term growth potential.

Tier 3: Above CHF 5 Million — Where the Best Doors Open Unconditionally

At this level, the conversation changes fundamentally. A CHF 5 million-plus deposit justifies serious KYC investment, dedicated relationship management, and access to the full depth of what Swiss private banking offers. This tier is also where nationality becomes largely irrelevant to accessibility — compliance processes remain rigorous, but the bank’s willingness to engage stops being a question entirely.

The scale of this tier is staggering. Collectively, the major Swiss private banks reported record assets under management in their full-year 2025 results, driven by strong equity markets, disciplined net new money generation, and Switzerland’s enduring appeal as the world’s premier offshore wealth management centre.

The Global Powerhouses

UBS Wealth Management is the obvious starting point. As the world’s largest wealth manager, UBS grew its Global Wealth Management invested assets to USD 4.18 trillion by the end of 2024 — a 6.6% increase on 2023 — and continued growing through 2025. The platform depth, global infrastructure, and institutional capabilities are unmatched by any other institution. Families with multi-jurisdictional structures, business owners managing liquidity events, clients requiring lending against portfolios — UBS has the machinery for all of it. The trade-off is scale. Below CHF 20–30 million, you will rarely feel like a priority in the relationship. At CHF 5–10 million, UBS works best as an anchor bank for clients who value brand recognition, global trade finance infrastructure, and the security of the world’s largest private wealth balance sheet behind their account.

Julius Baer deserves equal prominence. In many respects, Julius Baer is the most internationally minded of the large Swiss private banks — and the 2025 results back that up. Full-year AuM grew 5% to a record CHF 521 billion, supported by CHF 14.4 billion in net new money flowing predominantly from clients in Asia, Western Europe, and the Middle East. Unlike UBS, Julius Baer operates exclusively in wealth management. There is no retail bank, no investment banking division, and no corporate lending book competing for the firm’s attention. The business focuses entirely on private clients, and that singular focus shows in relationship management quality. Julius Baer operates across 25 countries and 60 locations, and in 2025 it opened new offices in Abu Dhabi and Lisbon — signals of genuine global expansion, not just existing-market consolidation. For clients who travel frequently, operate across multiple jurisdictions, or want a bank that adapts to their life rather than expecting them to come to Zurich, Julius Baer often represents the strongest fit in this tier.

The Geneva Partnerships: Where Legacy Meets Investment Excellence

Pictet & Cie represents, in many practitioners’ views, the absolute pinnacle of Swiss private banking. The 2025 full-year results speak for themselves: assets under management or custody grew 4.5% to a record CHF 757 billion, with CHF 19 billion in net new money across all business lines. The same founding families have owned the bank since 1805, structured as a full partnership throughout. Pictet does not accept retail deposits, does not offer mortgages, and does not chase market share. It manages wealth with a level of investment sophistication, institutional discipline, and partner-level accountability that very few global competitors approach. Its total capital ratio stood at 21.6% at year-end 2025 — well above FINMA’s 12% minimum — and its liquidity coverage ratio reached 191%, reflecting genuinely fortress-grade financial strength. Once you become a Pictet client, the difference in service quality and investment access is immediately apparent.

Lombard Odier sits alongside Pictet as one of Geneva’s most prestigious independent houses. Also a partnership, also founded in the eighteenth century, Lombard Odier closed 2025 with client assets at a record CHF 223 billion — lifted by solid net new money and top-quartile investment performance delivered for clients. The bank has distinguished itself through genuine commitment to sustainable investing and technology-driven portfolio management. Its proprietary technology platform ranks as arguably the most sophisticated in independent Swiss private banking, and its investment philosophy stays rigorously evidence-based. Clients who want a bank that thinks as carefully about the future as it respects the past will find Lombard Odier a compelling and differentiated choice.

The Emerging Market Specialist

Safra Sarasin — part of the J. Safra Group — rounds out this elite tier. With roots in Brazil, deep expertise in the Middle East and Latin America, and a genuinely international client base, Safra brings something the Geneva partnerships sometimes lack: real comfort with clients from emerging markets and complex jurisdictions. The bank completed its landmark acquisition of Saxo Bank in 2025 — the largest Swiss private banking deal of the past decade, according to KPMG — which adds significant digital trading infrastructure to Safra’s already strong private banking capabilities. The compliance team approaches cases with experience rather than reflexive caution. For clients from outside Europe entering this tier, Safra frequently delivers the smoothest onboarding experience of any institution in this group.

Practical Takeaways Before You Begin

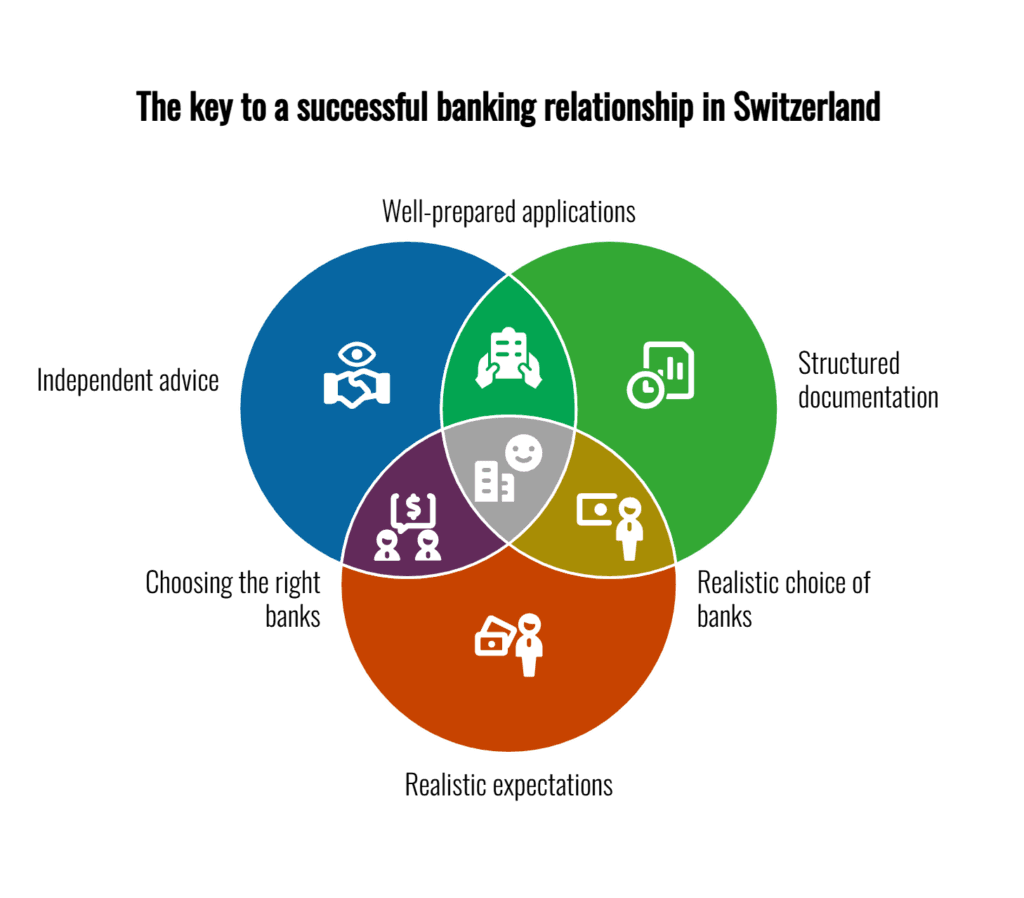

Opening a Swiss private banking relationship as a non-resident goes well beyond filling out forms. You need to document your source of wealth comprehensively, provide years of tax returns, and explain your business or asset structure in detail. Compliance approval typically takes four to twelve weeks at Tier 2 and Tier 3 banks. At Tier 1 institutions with streamlined digital processes, it can move faster — but never assume that speed reflects reduced scrutiny.

Three Rules That Will Save You Time

Work with an independent advisor who understands the Swiss compliance landscape before approaching any bank directly. Banks respond far more positively to well-prepared clients who arrive with complete documentation and a clear, coherent wealth narrative. Approach that conversation poorly and no amount of eligible assets will save the application.

Structure your documentation thoughtfully before the first call. Compliance officers need to see not just that your wealth exists, but how it was built, where it has been held, and why it is now moving to Switzerland. The clearer that story, the shorter the process.

Finally, be honest about which tier genuinely fits your deposit size and risk profile — not the tier you hope a bank will make an exception for. In my experience, the clients who struggle most are those who approach Tier 3 institutions with Tier 2 assets and expect the same welcome. The system rewards those who understand it.

A Final Word on Bank Selection

Switzerland’s private banking system rewards clients who approach it correctly. It tolerates no shortcuts. But for those who invest the effort, the result — genuine financial security, world-class investment management, and a banking relationship built to last decades — justifies every step of the process.

If you are unsure which bank fits your specific situation — your deposit size, nationality, asset structure, and the day-to-day services you actually need — feel free to reach out to me directly. I will help you identify the right institution precisely, so you avoid banks that will decline you and do not settle for one that underserves you. The right Swiss banking relationship exists for almost every client profile. Finding it simply takes knowing where to look.

Asel Mamytova is a Chur-based Swiss banking expert with extensive hands-on experience working directly with Swiss banks and helping foreign clients find the right banking solution for their individual profile. She holds an MBA and multiple professional certifications in cross-border banking, AML compliance, and international financial regulation. Throughout her career, Asel has developed deep working relationships across private, cantonal, and independent Swiss banks — giving her a practical, inside view of how these institutions evaluate and onboard non-resident clients. She specialises in matching international clients to the Swiss bank that genuinely fits their deposit size, nationality, and service needs.