A Revolution Hidden in Plain Sight

Beneath the serene waters of Lake Geneva and amidst the towering peaks of the Swiss Alps, a profound shift is underway—one that will redefine wealth, legacy, and banking for generations to come. The world’s most storied private banks, guardians of centuries-old fortunes, now face the greatest challenge and opportunity in their history. They stand at the crossroads of tradition and innovation, navigating an unprecedented tidal wave: the transfer of nearly $124 trillion from aging Baby Boomers to heirs who think, invest, and connect differently than any before them.

Among these heirs, Generation Z—those digital natives born after 1997—are poised to inherit as much as $15 trillion. This is no ordinary inheritance; it is a seismic transfer of not just capital, but values, expectations, and power that will reshape global finance forever.

Meet Sophia, a 24-year-old entrepreneur in Zurich, just beginning to receive her family’s wealth. Unlike her parents, she doesn’t want bankers in hushed rooms deciding her future. Her world is digital, transparent, and impact-driven. She expects her investments to reflect her commitment to climate action and social justice while delivering returns. For her, wealth is a tool to shape the future—not an end in itself.

Sophia’s story reflects a generation rewriting the rules—and Swiss banking must rewrite its playbook to keep up.

The Great Wealth Transfer: A $124 Trillion Game-Changer

Over the next two decades, an estimated $84 to $124 trillion will pass from one generation to the next worldwide. Switzerland, the epicenter of private banking, stands at the front lines. The inheritors are not passive recipients—they are active players determined to wield their legacy purposefully.

What makes this transfer extraordinary isn’t just the scale—it’s the velocity. Increasingly, wealthy parents are choosing to “give while living,” entrusting their heirs with financial control earlier than ever before. This accelerates the timeline for change and forces banks to engage heirs now, not just when assets formally transfer.

Sophia is part of this accelerated wave. Her parents gifted her shares in a renewable energy startup last year, igniting her passion and giving her a stake in the future decades before the formal inheritance arrives.

A Generation Defining Their Own Wealth

Gen Z heirs exhibit investment philosophies and values that starkly contrast the conservative traditions of Swiss banking.

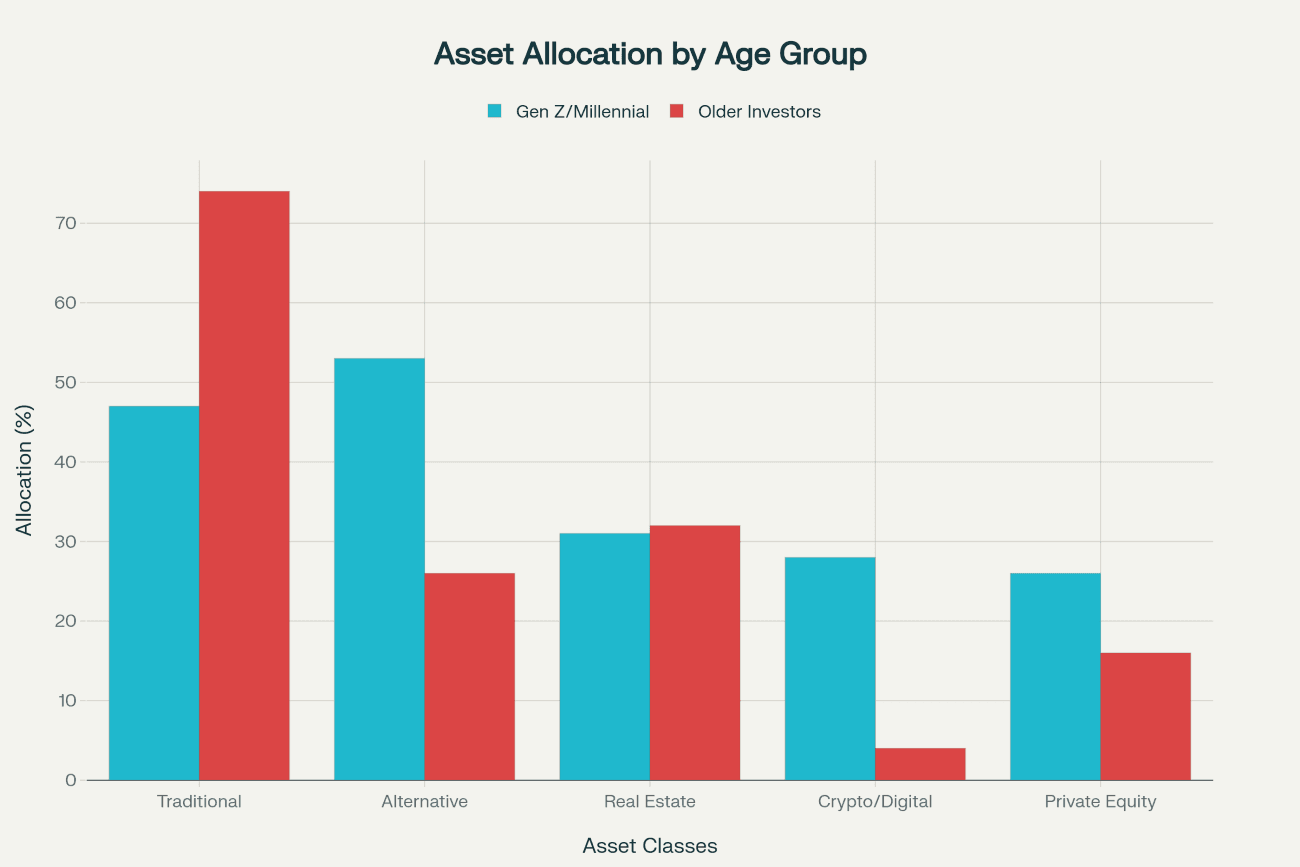

- A New Portfolio Mix: Where older investors hold about 74% in traditional stocks and bonds, young investors allocate only 47%. Instead, they pursue alternatives—private equity, real estate, crypto, and passion investments like art and collectibles. Crypto, in particular, has exploded, accounting for up to 28% of Gen Z’s portfolio, compared to a mere 4% for previous generations.

- Purpose Over Profit: Nearly 75% of Gen Z millionaires are willing to accept lower financial returns if it means investing in causes they believe in—climate action, social equity, and ethical governance.

- Digital Natives with Skepticism: Raised on social media and tech, Gen Z approaches finance with curiosity but caution. They often reject traditional advisors, seeking transparency, education, and digital-first solutions.

Chart: Generational Investment Divide – Traditional vs Alternative Assets

| Asset Class | Gen Z & Millennials | Older Investors (44+) |

|---|---|---|

| Traditional Assets | 47% | 74% |

| Alternative Investments | 53% | 26% |

| Real Estate | 31% | 32% |

| Crypto/Digital Assets | 28% | 4% |

| Private Equity | 26% | 16% |

Banking Reinvented: The Swiss Response

Switzerland’s banks have long symbolized stability and discretion. But the “quiet revolution” of wealth transfer demands a cultural and technological transformation. Swiss banks have identified the stakes: losing the confidence of the next generation means losing trillions in assets and industry relevance.

To engage heirs like Sophia, Swiss banks have adopted a three-pillar strategy:

- Advisory Tailored for Digital Natives: Shifting from product pushers to trusted mentors helping heirs navigate complex family wealth and personal ambitions.

- Education as Empowerment: Offering dynamic learning experiences—online modules, peer networks, leadership programs—that equip heirs for financial stewardship and personal growth.

- Global Partnerships: Connecting heirs to like-minded peers and external experts through institutions like the Young Investors Organisation and elite universities.

Meanwhile, technology is the backbone of this transformation. AI-powered tools augment advisors’ ability to deliver hyper-personalized, timely insights. Digital platforms provide seamless real-time reporting with transparency and control. Rather than replacing advisors, technology frees them to focus on meaningful mentorship.

Stories Behind the Strategy: UBS, Julius Baer, Pictet, and Lombard Odier

Each Swiss banking giant is carving a unique path in this renewal:

- UBS doubles down on scale and tech, integrating Credit Suisse’s Next Gen programs and investing heavily in AI-enhanced advisory.

- Julius Baer builds exclusive communities fostering intellectual and social bonds among young clients passionate about thematic and sustainable investing.

- Pictet leans into centuries of tradition, emphasizing bespoke family charters and legacy preservation coaching.

- Lombard Odier pioneers a “digital and dialogue” approach, blending cutting-edge client platforms with meaningful multigenerational communication forums.

This mosaic of approaches reflects the fragmented preferences of Gen Z heirs. Some crave vast ecosystem access; others seek intimate, deeply personalized counsel.

The Future: From Secrets to Transparency and Impact

Swiss banking’s hallmark secrecy is fading under international regulations and generational demands for radical transparency. To thrive, Swiss banks must become champions of purpose-driven capital. Sustainability is no longer a marketing add-on but a core investment criterion, often viewed by Gen Z as the key to long-term growth.

Philanthropy is evolving, too. It’s becoming more innovative and integrated with investing—blending social impact and financial returns to build lasting change.

For Sophia and her peers, wealth management is as much about making a positive difference in the world as it is about growing money.

The Age of Opportunity and Urgency

Swiss banks face an urgent imperative. The Great Wealth Transfer isn’t a distant event but an unfolding reality. Early gifts create high-stakes “first impressions” that can secure loyalty or trigger asset flight. The banks best positioned for future success are those that blend tradition with transparency, investing aggressively in digital capabilities while deepening authentic human relationships.

Sophia’s generation demands nothing less: advisory that respects their values, education that empowers their decisions, and platforms that place control firmly in their hands. The future of Swiss banking is theirs to shape—and theirs to inherit.

Chart: Projected Great Wealth Transfer by Generation (trillions USD)

| Generation | Inheritance Share |

|---|---|

| Gen X | $45T |

| Millennials | $46T |

| Gen Z | $15T |

Join the Transformation: Open Your Door to Global Wealth

Whether poised to inherit, build, or invest wealth with purpose, now is the moment to act. Easy Global Banking stands ready to guide you with unmatched expertise and seamless solutions for opening foreign bank accounts worldwide.

Begin your journey with Easy Global Banking—your gateway to opening a Swiss bank account and securing your financial future.