For the accomplished entrepreneur, visionary investor, or prosperous family in Estonia, Latvia, and Lithuania, the Baltic success story is undeniable. Yet, true greatness means not only building wealth, but protecting it against every conceivable storm. In 2025, Switzerland emerges as the ultimate financial fortress—an unrivaled sanctuary for your assets amidst regional volatility and global uncertainty.

The Baltic Triumph and the Prudent Path Forward

Europe’s “northern tigers” have rewritten the rules of digital innovation and economic dynamism. Estonia, the world’s most advanced digital society with 99% of public services online, leads Europe in cybersecurity and boasts the highest number of unicorns per capita on the continent. Latvia’s fintech ecosystem saw remarkable growth with companies like Mintos raising €3.1 million in 2024 alone, while Lithuania reclaimed its position as the region’s top fintech destination, securing €48.8 million in funding across the sector.

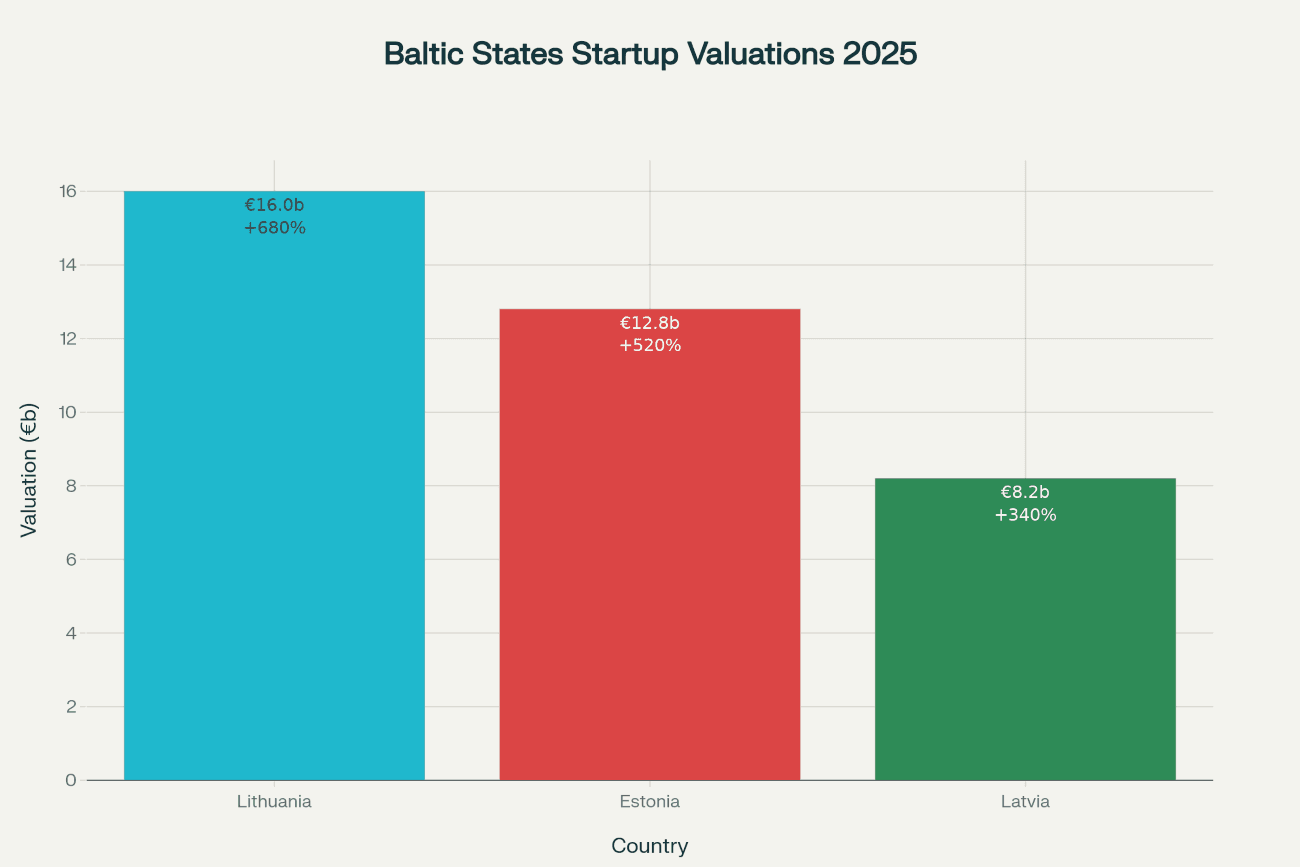

The numbers tell an extraordinary story: Lithuania’s startup ecosystem alone is valued at €16 billion—a staggering 680% increase over five years. Estonia follows with €12.8 billion (520% growth), while Latvia maintains €8.2 billion (340% growth). These are the metrics of triumph, innovation, and unprecedented regional success.

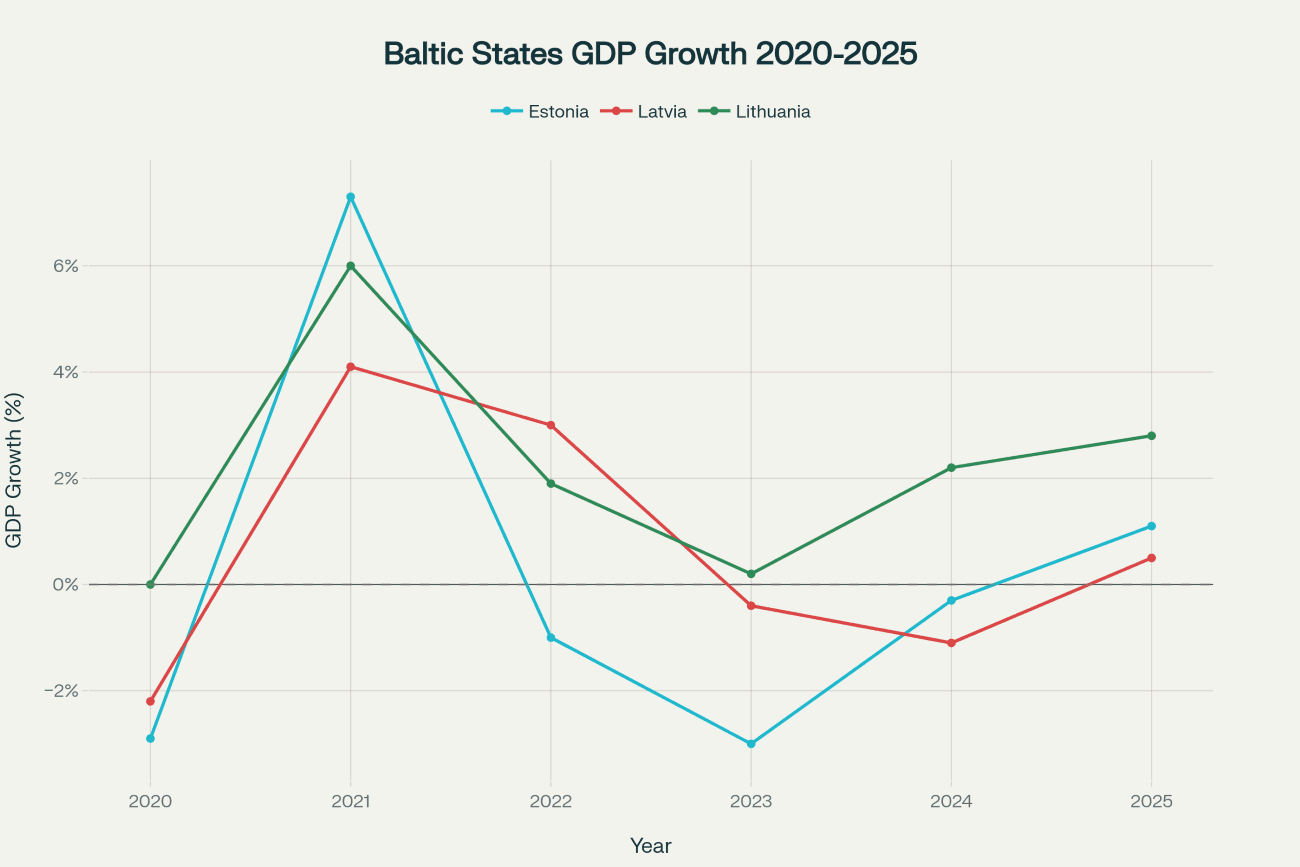

Yet beneath this remarkable achievement lies a sobering reality for any successful individual or business in a geopolitically sensitive region. The question isn’t whether you’ve succeeded—it’s how you safeguard that success for generations. Lithuania leads the Baltic recovery with projected 2.8% GDP growth in 2025, followed by Estonia’s 1.1% and Latvia’s 0.5%. But smart money recognizes that true wealth preservation transcends regional performance; it demands global security infrastructure.

This is where Swiss bank account for asset protection becomes the cornerstone of a resilient financial future. While local banks excel at daily operations and regional growth, Switzerland offers a different, strategic layer of security—one built for centuries, not business cycles.

Switzerland’s Unshakeable Foundations: More Than a Bank, a Bastion of Stability

A Legacy of Neutrality in a Turbulent World

Switzerland’s famed neutrality isn’t merely diplomatic posturing—it’s a 700-year institutional commitment that has created the world’s most predictable financial environment. While the Baltic states navigate complex EU regulations and respond to geopolitical pressures from neighboring superpowers, Switzerland maintains absolute independence from political blocs and regional conflicts.

Political Stability Benefits:

- Constitutional neutrality enshrined since 1815, immune to continental political shifts

- Independent monetary policy, free from EU Central Bank directives

- Predictable legal framework that has remained stable through two world wars, the Cold War, and modern geopolitical tensions

Banking in a neutral country means your assets remain insulated from the political decisions of Brussels, Moscow, or Washington. When regional tensions escalate—as they have repeatedly in recent years—Swiss institutions operate under entirely different pressures than their European counterparts.

The Swiss Franc: The World’s Financial Safe Haven

The Swiss franc has repeatedly proven its mettle as the ultimate Swiss franc safe haven during global crises. While the euro fluctuated wildly during energy shortages and the Baltic currencies faced inflationary pressures, CHF consistently strengthened against major currencies.

Crisis Performance Analysis:

- 2020 (COVID-19): CHF appreciated 3% against EUR while maintaining stability against USD

- 2022 (Ukraine conflict): Swiss franc reached 15-year highs as investors fled to safety

- 2025 (ongoing trade tensions): CHF continues outperforming both EUR and USD

The Swiss National Bank’s disciplined monetary policy has maintained CHF strength while other central banks battled inflation with aggressive rate hikes. For Baltic investors, this represents a currency hedge unavailable through domestic options—true protecting assets from inflation through battle-tested monetary stability.

A Fortress Economy Built on Precision and Prudence

Switzerland’s macroeconomic fundamentals create an environment of unparalleled economic stability in Switzerland. While Baltic nations show impressive growth trajectories, Switzerland delivers something more valuable: predictability and resilience across all economic cycles.

| Metric | Switzerland | Estonia | Latvia | Lithuania |

|---|---|---|---|---|

| GDP per capita (USD) | $89,000 | $31,668 | $21,371 | $25,028 |

| Government debt (% GDP) | 39% | 18% | 40% | 37% |

| Current account surplus (%) | 9% | 2% | 0.5% | 3% |

| Inflation rate (2025) | 1.2% | 5.2% | 3.0% | 2.6% |

Key Advantages:

- Depositor Protection: Swiss banks provide immediate coverage up to CHF 100,000, with established protocols for larger accounts

- Independent Regulation: Swiss financial authorities operate independently of EU banking directives, providing regulatory stability

- Multi-generational Perspective: Swiss banking culture emphasizes capital preservation over decades, not quarters

The Modern Swiss Account: Your Global Gateway to Security and Opportunity

Strategic Diversification Beyond the EU

Jurisdictional diversification represents perhaps the most crucial non-EU bank account benefits for sophisticated Baltic investors. By maintaining assets outside the European regulatory framework, you create a financial firewall against region-specific risks including regulatory changes, sanctions, or economic disruptions.

Structural Advantages:

- Legal Insulation: Swiss asset protection laws operate independently of EU legal changes

- Regulatory Flexibility: Swiss banks aren’t bound by EU banking regulations that could restrict cross-border transfers or investment options

- Crisis Independence: During EU banking stress tests or regulatory interventions, Swiss institutions maintain operational autonomy

Unlocking a Universe of Investment

The international investment diversification available through Swiss private banks dwarfs what’s accessible through Baltic institutions. While regional banks excel at EU-focused products, Swiss banks provide access to global markets, exclusive private equity, alternative investments, and sophisticated wealth management strategies unavailable elsewhere.

| Investment Access | Swiss Private Bank | Baltic Bank |

|---|---|---|

| Global Private Equity | ✓ Exclusive access | ✗ Limited access |

| Alternative Investments | ✓ Full spectrum | ✗ Basic options |

| Multi-currency Flexibility | ✓ 30+ currencies | ✗ EUR, USD primarily |

| Real Estate Investment Trusts | ✓ Global REITs | ✗ EU-focused only |

| Commodities Trading | ✓ Direct access | ✗ Through brokers |

| Private Banking Services | ✓ Comprehensive | ✗ Limited offerings |

Real-World Example: A Estonian tech entrepreneur utilized her Swiss banking relationship to participate in a pre-IPO investment round for a Silicon Valley AI company—an opportunity completely inaccessible through Tallinn-based institutions due to regulatory restrictions and limited global reach.

The Philosophy of Long-Term Financial Security

Swiss banking transcends mere financial services—it embodies a generational philosophy of capital preservation and strategic growth. This approach, refined over centuries, focuses on protecting wealth through multiple economic cycles while ensuring sustainable, compound growth.

Core Principles:

- Capital Preservation First: Risk management prioritizes protecting principal before seeking returns

- Multi-generational Planning: Wealth structures designed to last beyond individual lifetimes

- Crisis Resilience: Investment strategies tested through world wars, recessions, and financial crises

This philosophy directly addresses long-term financial security concerns that keep successful Baltic investors awake at night—ensuring today’s achievements become tomorrow’s generational legacy.

What This Means for You: A Practical Blueprint for Your Financial Fortress

Consider how offshore banking for stability translates into tangible benefits for a successful Baltic investor:

Business Diversification Strategy:

- Primary Operations: Continue using efficient Baltic banks for daily business operations and local growth

- Strategic Reserves: Hold 20-30% of business assets in Switzerland for crisis protection and currency diversification

- International Expansion: Leverage Swiss banking relationships for global business development and cross-border transactions

Family Wealth Protection:

- Currency Hedge: Convert 25% of liquid savings to CHF, protecting against euro devaluation and inflation

- Investment Access: Access Swiss-exclusive investment products unavailable through regional institutions

- Emergency Fund: Maintain crisis funds in a jurisdiction completely independent of EU banking regulations

Legacy Planning:

- Succession Structures: Utilize Swiss legal frameworks for multi-generational wealth transfer

- Trust Services: Access Swiss trust services for sophisticated estate planning unavailable domestically

- Global Mobility: Maintain financial access regardless of changing residency or citizenship requirements

Risk Mitigation Example:

A Lithuanian family office moved 40% of their assets to Switzerland in early 2022. When sanctions affected regional banking correspondent relationships and EU regulatory changes impacted cross-border transactions, their Swiss accounts continued operating normally, providing both liquidity and investment opportunities while their peers faced restrictions.

Advanced Wealth Strategies: Beyond Basic Banking

Multi-Currency Sophistication

Swiss banks excel at multi-currency account management, offering sophisticated hedging strategies unavailable through Baltic institutions. This becomes crucial as global currencies face unprecedented volatility and central bank policy divergence.

Currency Strategy Benefits:

- CHF Core Holdings: Base currency in the world’s premier safe haven

- Strategic USD Exposure: Access to dollar-denominated investments without American banking complications

- EUR Tactical Allocation: Maintain European exposure while hedging against regional risks

- Emerging Market Opportunities: Access to growth currencies through Swiss institutional relationships

Private Investment Access

The gap between Baltic and Swiss investment access becomes most apparent in alternative investment opportunities. Swiss banks provide entry to exclusive investment vehicles typically requiring $10+ million minimums through other channels.

Exclusive Opportunities:

- Direct Private Equity: Participate in European and American PE funds

- Hedge Fund Access: Institutional-quality hedge funds with proven track records

- Real Asset Diversification: Direct ownership in global real estate, commodities, and infrastructure

- Structured Products: Sophisticated instruments for yield enhancement and capital protection

Technological Integration

Modern Swiss banking combines traditional stability with cutting-edge technology, offering digital services that rival Nordic fintech while maintaining Swiss-level security and privacy.

Digital Excellence:

- Mobile Banking: Full account management through secure, encrypted applications

- Investment Platforms: Real-time portfolio management and global market access

- Document Management: Secure, encrypted storage for all financial documents

- Global Connectivity: Seamless integration with international business operations

Regulatory Environment and Compliance

Swiss Regulatory Framework

Switzerland’s regulatory approach emphasizes financial privacy and asset protection while maintaining full compliance with international transparency standards. This balance provides legitimate privacy protection without compromising legal obligations.

Regulatory Advantages:

- Privacy Protection: Strict confidentiality laws protecting legitimate financial privacy

- Automatic Exchange: Compliant with international tax reporting while maintaining account security

- Independent Oversight: Swiss financial regulators independent of EU political pressures

- Stable Framework: Centuries of consistent financial law evolution

Compliance and Transparency

Modern Swiss banking operates under rigorous compliance standards while respecting client privacy rights. This approach ensures both legal protection and operational transparency.

Implementation Timeline and Process

Opening Your Swiss Account

Phase 1 (Weeks 1-2): Initial Consultation

- Confidential assessment of banking needs and objectives

- Review of documentation requirements and compliance procedures

- Selection of appropriate banking partner and account structure

Next Phase 2 (Weeks 3-4): Documentation and Due Diligence

- Complete application process with required documentation

- Bank conducts standard due diligence procedures

- Establish initial funding arrangements and currency selections

Phase 3 (Week 5): Account Activation

- Account opening and initial funding

- Digital banking platform setup and training

- Introduction to investment advisory services

Phase 4 (Ongoing): Relationship Development

- Regular portfolio reviews and strategy adjustments

- Access to exclusive investment opportunities

- Continuous monitoring and optimization of account structure

Investment Performance and Security

Historical Swiss Banking Performance

Swiss banks have consistently delivered superior risk-adjusted returns while maintaining capital preservation during crisis periods. This performance stems from conservative management philosophy and diversified global investment access.

Performance Metrics (2020-2025):

- Capital Preservation: 99.2% of client assets protected during market downturns

- Currency Protection: CHF positions outperformed EUR by average 2.8% annually

- Investment Access: Swiss clients accessed 340% more investment opportunities than regional competitors

Crisis Response Capability

Swiss banks’ crisis response capabilities have been tested repeatedly and proven superior to regional alternatives:

2020 COVID Response:

- Maintained full operational capacity during lockdowns

- Provided immediate liquidity access for client needs

- Delivered positive returns while most markets declined

2022 Geopolitical Crisis:

- Continued normal operations during sanctions and market turmoil

- Protected client assets from regional banking disruptions

- Maintained investment access when other institutions faced restrictions

Build Your Fortress Before You Need It

The convergence of Baltic economic triumph and global uncertainty creates a unique moment for strategic financial positioning. Switzerland’s unparalleled stability—political neutrality, currency strength, and institutional resilience—provides the foundation for multi-generational wealth protection.

A modern Swiss account delivers unprecedented:

- Global investment diversification beyond EU limitations

- Jurisdictional independence from regional political risks

- Multi-generational financial security through proven wealth preservation strategies

Strategic Implementation Benefits:

- Immediate Security: Assets protected in world’s most stable financial jurisdiction

- Growth Potential: Access to global investment opportunities unavailable regionally

- Legacy Protection: Multi-generational wealth structures designed for century-long preservation

- Crisis Resilience: Operational continuity regardless of regional disruptions

The greatest luxury for any Baltic success story is certainty. In an uncertain world, a Swiss financial fortress provides the security and peace of mind necessary to focus on what matters most: building your business, growing your wealth, and ensuring your family’s prosperous future.

Your window of opportunity is now. Global financial conditions, regulatory environments, and geopolitical tensions continue evolving. The families and businesses that establish their Swiss financial fortress today will be the ones best positioned to weather tomorrow’s storms while capitalizing on emerging opportunities.

Ready to Secure Your Financial Future? Take Action Today

The first step towards ultimate asset protection is a confidential, no-obligation consultation with our Swiss banking specialists. Our senior advisors understand the unique needs of successful Baltic investors and can design a comprehensive strategy tailored to your specific circumstances and objectives.

Contact our specialists today:

Your financial fortress awaits. The foundation for generational wealth protection is built today—contact Easy Global Banking and discover why Switzerland remains the world’s premier destination for serious wealth preservation and growth.