Welcome to our exclusive series on Liechtenstein’s banking sector! At Easy Global Banking, we’ve decided to spotlight the principality’s lesser-known financial institutions first, bringing you fresh insights that mainstream publications often overlook. Today, we dive deep into the remarkable transformation of the Sigma Banking Group – a story that perfectly illustrates why Liechtenstein remains Europe’s most intriguing banking destination.

Why Start with the Underdogs?

Most banking guides focus on Liechtenstein’s giants – LGT Bank and Liechtensteinische Landesbank. However, we believe the real stories lie with the ambitious challengers reshaping this alpine financial landscape. These institutions often offer more personalized services, innovative approaches, and surprisingly competitive advantages that larger banks simply cannot match.

Enter the Sigma Banking Group – a fascinating tale of strategic transformation, Austrian entrepreneurship, and corporate restructuring that reads more like a financial thriller than a typical banking story.

The Austrian Billionaire Behind the Banking Revolution

At the heart of this compelling narrative stands Martin Schlaff, an Austrian business magnate whose estimated wealth ranges between €1.5 and €8 billion. Born to Jewish refugees in Vienna, Schlaff built his fortune through strategic investments spanning telecommunications, industrial manufacturing, and financial services.

What makes Schlaff particularly intriguing is his unconventional approach to business. Unlike typical financial tycoons, he combines industrial investments with diplomatic initiatives, having facilitated Middle East peace negotiations and prisoner releases across multiple continents. This unique blend of business acumen and international networking has created opportunities that traditional bankers rarely access.

His telecommunications ventures alone generated extraordinary returns. Through strategic acquisitions of Bulgarian Mobiltel, Serbian Mobtel, and Belarussian Velcom, Schlaff demonstrated an uncanny ability to identify undervalued assets in emerging markets. These successes provided the capital foundation for his ambitious move into Liechtenstein banking.

The Great Corporate Reversal: A Banking First

(see the generated image above)

Perhaps the most remarkable aspect of the Sigma story involves a corporate restructuring that financial experts still discuss today. Originally, Sigma Kreditbank AG served as the parent company, controlling Sigma Bank AG as its subsidiary. However, in January 2022, the entire structure was completely inverted.

This transformation wasn’t merely cosmetic. Sigma Bank AG became the new parent company, with Sigma Kreditbank AG becoming its 100% subsidiary. The restructuring included a massive capital injection of CHF 76.5 million, elevating total share capital to CHF 129.0 million.

Why would anyone undertake such a complex reversal? The answer reveals sophisticated strategic thinking. By positioning Sigma Bank AG as the parent company, the group gained:

- Enhanced regulatory positioning within Liechtenstein’s banking hierarchy

- Improved market credibility for universal banking services

- Greater operational flexibility for European expansion

- Stronger foundation for acquiring distressed banking assets

Two Banks, Two Completely Different Worlds

(see the generated image above)

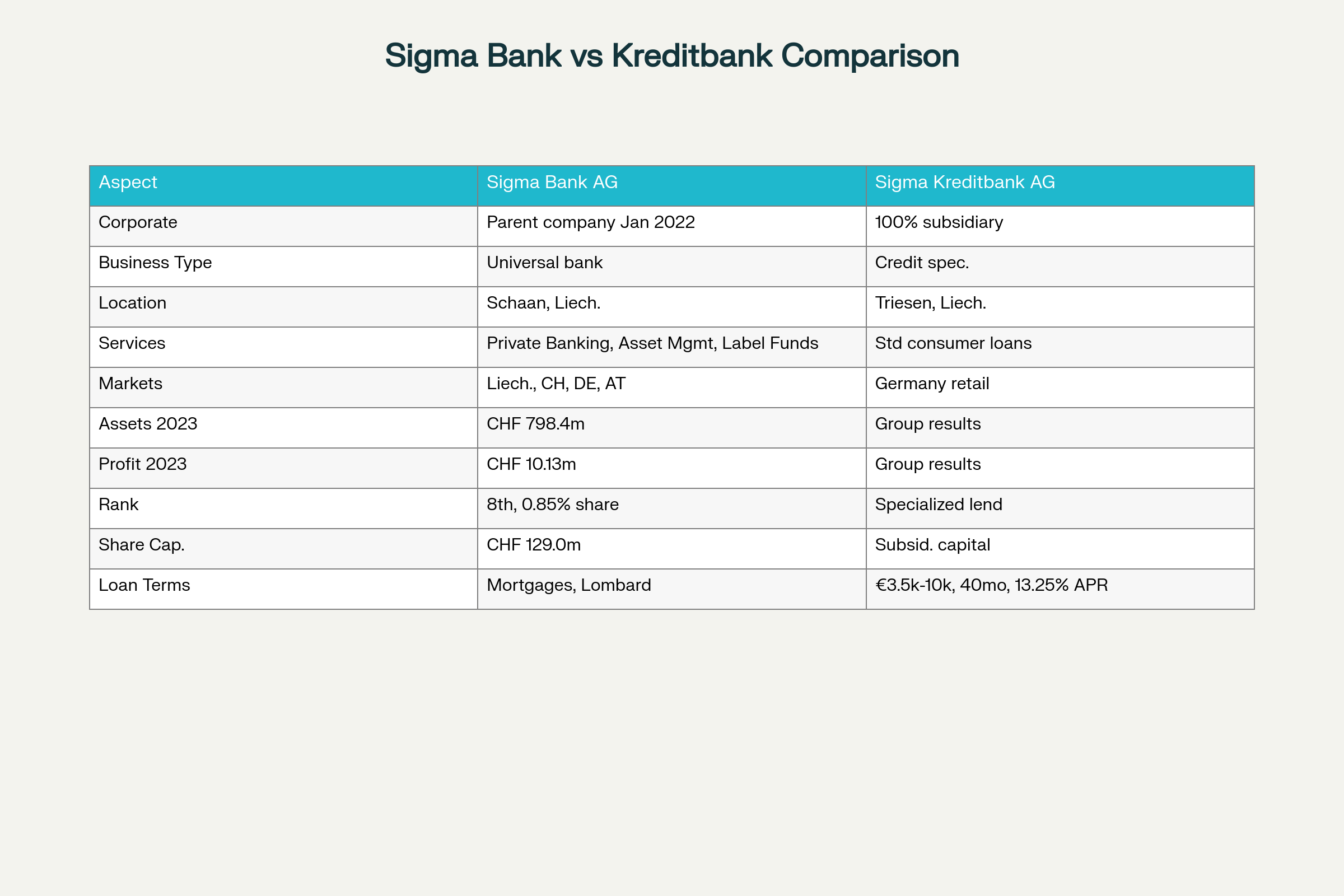

The genius of the Sigma structure lies in how dramatically different these two institutions operate, despite their corporate connection.

Sigma Bank AG: The Universal Banking Powerhouse

Operating from Schaan, Liechtenstein, Sigma Bank AG functions as a comprehensive universal bank targeting sophisticated international clients. Their service portfolio reads like a private banking wish list:

Private Banking Excellence: With approximately CHF 3.6 billion in customer assets under management, the bank specializes in individualized investment advisory services for high-net-worth clients. Unlike larger institutions that often treat clients as numbers, Sigma Bank AG maintains the personalized approach that made Swiss and Liechtenstein banking legendary.

Geographic Diversification: Rather than focusing solely on domestic markets, Sigma Bank AG actively serves clients from Liechtenstein, Switzerland, Germany, and Austria. This multi-national approach provides natural currency hedging and reduces dependence on any single economy.

Private Label Funds: The bank serves as depository bank and custodian for various investment funds, providing crucial infrastructure services that generate steady fee income.

Sigma Kreditbank AG: The German Credit Specialist

Meanwhile, in Triesen, Liechtenstein, Sigma Kreditbank AG operates an entirely different business model. This institution focuses exclusively on standardized German consumer lending:

Laser-Focused Strategy: The bank offers consumer loans ranging from €3,500 to €10,000 with fixed 40-month terms. This standardized approach enables efficient processing while maintaining competitive pricing.

Attractive Returns: Interest rates range from 13.25% to 13.27% effective annual percentage rate, generating steady returns in an increasingly low-yield environment.

Underserved Market: By targeting German residents who face challenges obtaining credit from traditional banks, Sigma Kreditbank AG captures market segments that larger institutions often ignore.

Performance That Surprises Industry Veterans

Comprehensive comparison between Sigma Bank AG and Sigma Kreditbank AG showing their distinct roles within the Sigma Group

Despite being relative newcomers to universal banking, the numbers speak volumes about Sigma’s success. In 2023, Sigma Bank AG achieved the 8th position among Liechtenstein banks with a respectable 0.85% market share. However, the real shocker came with profitability metrics.

The bank secured the 2nd position for profitability relative to total assets within Liechtenstein’s banking sector. Consider these impressive 2023 figures:

- Total Assets: CHF 798.4 million

- Net Profit: CHF 10.13 million

- Return on Assets (ROA): 1.21%

- Return on Equity (ROE): 6.41%

These metrics demonstrate exceptional operational efficiency, particularly remarkable given the competitive pressure from established giants like LGT Bank (62% market share) and Liechtensteinische Landesbank (18% market share).

The Volksbank Acquisition: From Controversy to Success

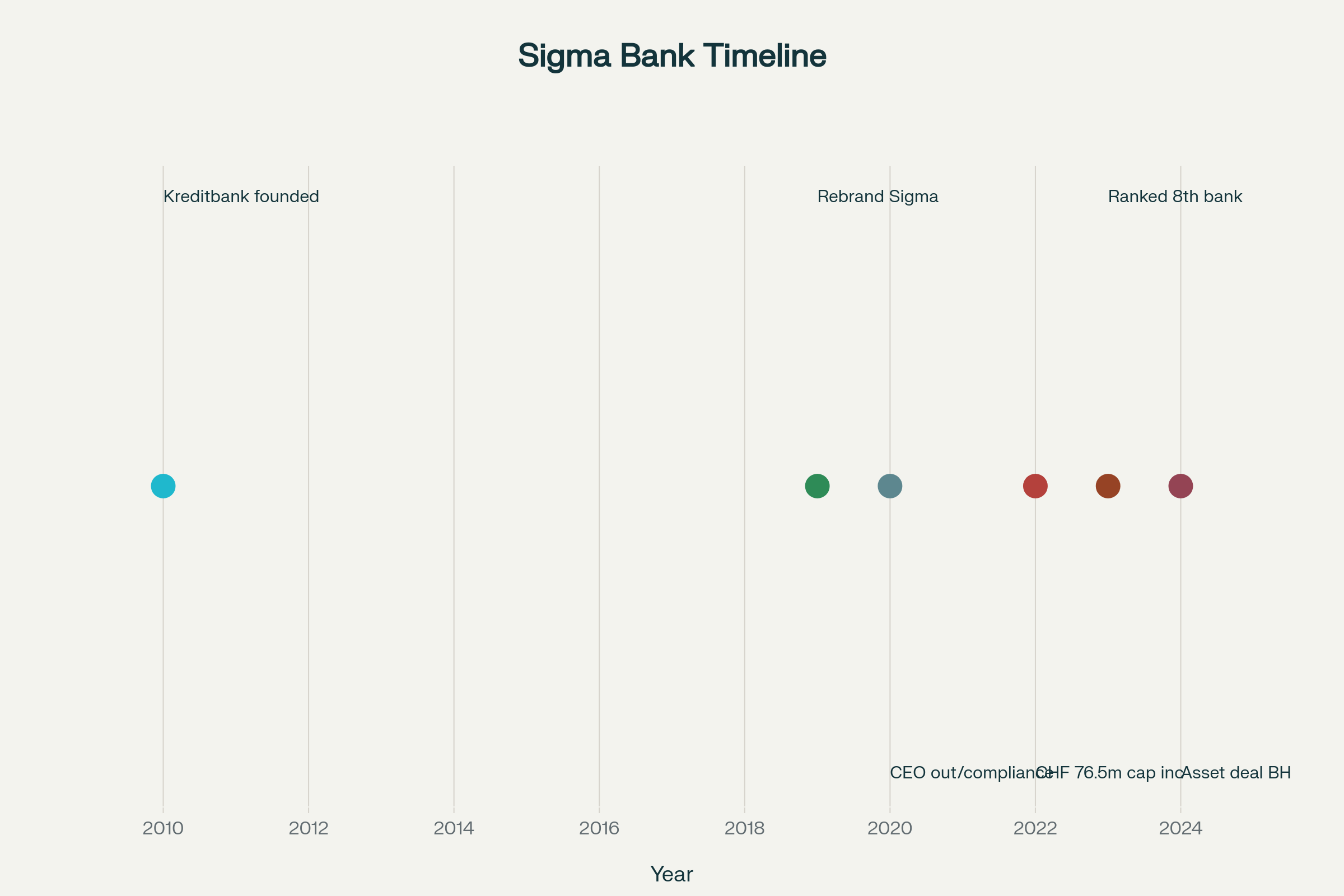

Timeline of key milestones in the Sigma Bank AG and Sigma Kreditbank AG relationship from 2010 to 2024

The transformation story includes its share of drama. In March 2019, Sigma Kreditbank AG acquired Volksbank AG Liechtenstein from Austrian Volksbank Vorarlberg. This strategic move represented Martin Schlaff’s entry into comprehensive banking services, expanding beyond specialized credit operations.

However, integration proved challenging. Stefan Wolf, who expected to receive a 7% stake in the acquired bank, was abruptly dismissed in 2020 following a compliance review. The dismissal stemmed from alleged compliance deficiencies inherited from the Volksbank era.

Wolf subsequently filed multiple lawsuits against both Sigma institutions, claiming breach of contract. While legal proceedings continue, the bank successfully navigated the compliance issues and established robust operational frameworks under new leadership.

This experience demonstrates the due diligence challenges inherent in banking acquisitions, particularly when acquiring institutions with complex regulatory histories. However, it also showcases management’s ability to address problems decisively and maintain operational continuity during turbulent periods.

Strategic Opportunities in a Changing Landscape

Recent developments highlight the Sigma Group’s opportunistic approach to market expansion. During 2024, Sigma Bank AG emerged as a key player in the Banque Havilland liquidation process. Following the collapse of British billionaire David Rowland’s banking group, Sigma Bank AG secured a referral deal potentially worth CHF 400 million in client assets.

This transaction demonstrates several crucial capabilities:

Market Intelligence: The bank identified and capitalized on a distressed asset opportunity that many competitors overlooked

Operational Scalability: Management proved capable of absorbing additional client relationships without compromising service quality

Regulatory Competence: The bank navigated complex cross-border regulations involved in acquiring assets from a liquidated institution

Why Liechtenstein’s EEA Advantage Matters More Than Ever

Unlike Swiss banks that face increasing regulatory isolation, Liechtenstein institutions benefit from European Economic Area (EEA) membership. This provides crucial advantages:

EU Passporting Rights: Banks can offer services across European markets without additional licensing requirements

Regulatory Harmony: Liechtenstein regulations align with EU frameworks while maintaining operational flexibility

Political Stability: The principality maintains AAA credit ratings and demonstrates exceptional continuity

For international clients seeking European banking relationships without traditional EU complexities, Liechtenstein institutions like Sigma Bank AG offer compelling advantages.

The Family Business Approach in Modern Banking

The Schlaff family’s involvement in day-to-day operations distinguishes Sigma from typical institutional banking. William Benjamin Schlaff (Martin’s son) serves as Board President, while Jam Schlaff (Martin’s brother) holds a board position. Michael Hason, described as the family’s “right hand,” serves as Vice President.

This family involvement ensures long-term strategic thinking rather than quarterly earnings pressure that plagues publicly traded banks. Decisions prioritize sustainable growth and client relationship building over short-term profit maximization.

Lessons for International Banking Clients

The Sigma Group’s evolution offers valuable insights for anyone considering Liechtenstein banking relationships:

Specialization Creates Value: Rather than competing directly with banking giants, successful institutions identify underserved market segments and excel within those niches.

Geographic Diversification Matters: Banks serving multiple European markets provide natural hedging against single-country economic risks.

Family Ownership Advantages: Privately held institutions often offer more personalized service and greater operational flexibility than large corporate banks.

Regulatory Positioning: Liechtenstein’s EEA membership provides European access without Swiss regulatory complications.

What This Means for Your Banking Strategy

For international clients evaluating Liechtenstein banking options, the Sigma Group represents a compelling alternative to traditional powerhouses. Their combination of universal banking capabilities with specialized market focus creates unique value propositions:

- Private banking services competitive with Swiss institutions

- European market access through EEA regulatory frameworks

- Family business approach ensuring personalized attention

- Proven acquisition capabilities suggesting long-term stability

- Strong profitability metrics indicating sound management

However, potential clients should also consider size limitations compared to larger institutions and recent operational changes as the group continues evolving its structure.

The Future of Liechtenstein’s Banking Evolution

The Sigma Group’s success illustrates broader trends reshaping Liechtenstein’s banking landscape. As European regulations become increasingly complex and Swiss banking faces mounting pressure, Liechtenstein institutions gain competitive advantages through their unique regulatory positioning.

Furthermore, the principality’s progressive approach to financial technology regulation, including comprehensive crypto-asset frameworks, positions institutions like Sigma Bank AG to capture emerging market opportunities.

The group’s dual-bank structure provides both stability and flexibility to adapt to changing conditions while serving diverse client needs across multiple markets. This structural innovation may inspire similar approaches among other mid-tier European banking groups.

Conclusion: Expert Guidance for Your Banking Journey

The Sigma Banking Group’s remarkable transformation from specialized lender to sophisticated universal bank demonstrates the dynamic opportunities within Liechtenstein’s financial sector. Their success story illustrates why savvy international clients increasingly look beyond traditional banking powerhouses to discover institutions offering superior service, competitive pricing, and innovative approaches.

As you explore international banking opportunities, remember that choosing the right institution requires deep market knowledge and expert guidance. At Easy Global Banking, our experienced team understands the nuances that distinguish exceptional banks from merely adequate ones.

Whether you’re interested in Liechtenstein’s unique advantages, Swiss banking alternatives, or emerging financial centers worldwide, we’re ready to support your foreign bank account opening journey. Our specialists have cultivated relationships with premier institutions across multiple jurisdictions, ensuring you receive personalized service that matches your specific requirements.

Contact Easy Global Banking today to discover how our expertise can simplify your international banking experience and unlock opportunities you never knew existed. Your perfect banking relationship awaits – let us help you find it.

This article represents the first installment in our comprehensive Liechtenstein banking series. Stay tuned for our upcoming features on other fascinating institutions that make this alpine principality Europe’s most intriguing financial destination.