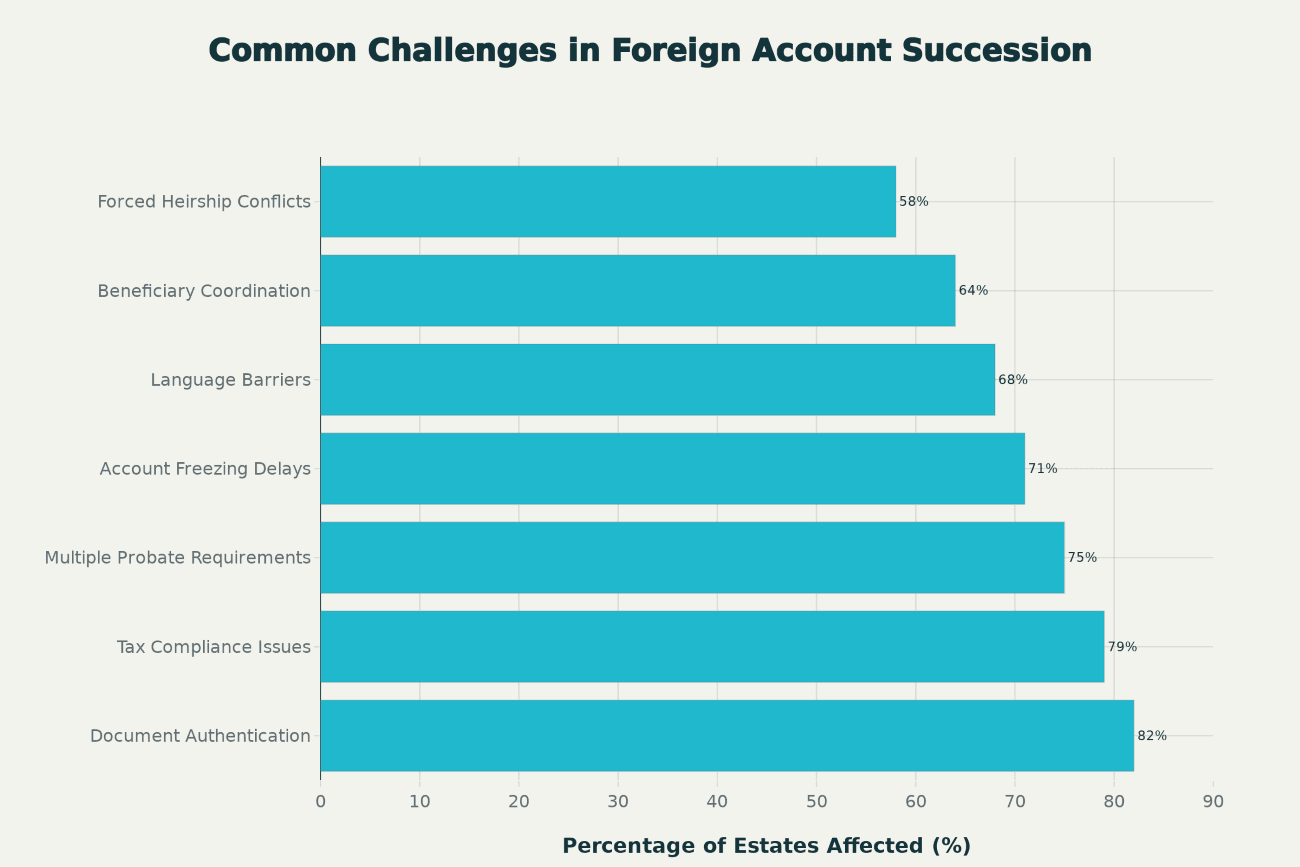

When someone you love passes away, grief combines with unexpected complexity. If that person maintained bank accounts across international borders, an entirely different challenge emerges. Their heirs face frozen assets, conflicting legal systems, overwhelming bureaucracy, and tax obligations that multiply across jurisdictions. This inheritance nightmare isn’t rare—it’s increasingly common as global mobility increases wealth distribution across countries.

The stark reality is that 65% more probate cases now exceed one year to resolve, with many involving frozen foreign accounts that remain inaccessible for months or years. Families discover that a straightforward inheritance transforms into legal battles, mounting expenses, and financial strain precisely when they need liquidity most.

Yet this outcome remains entirely preventable.

Proper structuring of foreign accounts during your lifetime eliminates most succession complications. Strategic planning transforms potential chaos into an orderly transfer process that protects your legacy and spares heirs unnecessary suffering. This guide reveals the exact mechanisms that cause inheritance nightmares and the proven strategies that prevent them.

Why Foreign Accounts Create Succession Complications

Understanding the core problem matters. Unlike domestic assets governed by a single legal system, foreign accounts trigger multiple overlapping jurisdictions simultaneously. Switzerland operates under its own inheritance framework, Singapore follows different probate protocols, and the United States imposes unique reporting requirements that extend to heirs.

When an account holder dies with assets in multiple countries, banks immediately implement protective measures. Most freeze all accounts—including joint accounts—the moment they receive formal notification of death. This freeze persists until the institution receives proof that legal heirs exist and agree unanimously on asset distribution.

Switzerland exemplifies this challenge. Swiss banks require that all legally recognized heirs provide joint, written instructions before releasing funds. Even a single dissenting heir can indefinitely paralyze the account. One heir living abroad, one heir unable to be located, or one heir disagreeing with distribution terms halts the entire process. The surviving family receives no funds, despite clear inheritance rights.

The documentation burden compounds this issue. Swiss banks demand original death certificates, certificates of inheritance, complete probate documentation, valid identification for all heirs, and proof of relationship. Every foreign document requires Apostille certification (standardized authentication under the Hague Convention) and often professional translation into German, French, Italian, or English. This requirement alone consumes weeks or months and costs thousands in legal and translation fees.

Singapore presents a parallel problem. Accounts freeze immediately upon death notification, including joint accounts. The surviving family must obtain either a Grant of Probate or Letters of Administration—a process consuming four to eight months—before banks release any funds. During this entire freeze period, even automatic payments cease, potentially leaving dependents without access to essential funds.

The United States introduces an additional layer: unique reporting obligations. American citizens who inherit foreign financial accounts face immediate FBAR (Foreign Bank Account Report) filing requirements if the aggregate inherited value exceeds $10,000 at any point during the calendar year. The penalty for non-compliance reaches 50% of the unreported account balance—a devastating blow to estates already managing grief and complexity.

The Real Cost of Inadequate Planning

Delays in foreign account succession carry substantial financial consequences. Frozen assets don’t just create inconvenience—they trigger cascading losses across multiple dimensions.

First, probate fees accumulate rapidly. Each jurisdiction where assets exist may require separate legal proceedings, each with distinct court fees, attorney costs, and administrative charges. Without professional guidance, families often overpay by engaging attorneys unfamiliar with international law.

Second, inheritance tax obligations accumulate regardless of asset accessibility. In the UK, inheritance tax must be paid within six months of death—but accounts remain frozen during this entire period. Families often must pay tax bills personally, before receiving any inheritance funds. Interest accrues on unpaid amounts, and penalties compound the burden.

Third, asset values depreciate during extended delays. Properties fall into disrepair. Investments decline in volatile markets. Currency fluctuations erode purchasing power. By the time heirs finally access accounts, the real value of inheritance has already diminished substantially.

Fourth, emotional stress intensifies as the process stretches. Families experience prolonged uncertainty. Relationships fracture over disagreements about the invisible process. Young beneficiaries counting on inherited funds for education or business opportunities face indefinite delays.

Strategic Structuring: Moving Beyond Basic Wills

Offshore trusts and international foundations eliminate most succession complications because they change the fundamental legal structure. Instead of the deceased owning assets individually—triggering probate in multiple jurisdictions—the trust entity owns assets and continues existing after death.

An offshore trust removes foreign bank accounts from personal estate through legal transfer to a trustee who manages assets according to your written instructions for designated beneficiaries. When properly established in jurisdictions like the Cayman Islands, Bermuda, or the British Virgin Islands, trusts bypass forced heirship rules that civil law countries impose.

Forced heirship creates a critical problem in many countries. France mandates that 50% of estates pass to children regardless of the deceased’s will. Germany enforces similar requirements. Italy guarantees minimum shares to close relatives. These mandatory portions override your wishes entirely. Offshore trusts structured before acquiring domicile in these countries remain outside forced heirship rules, preserving testamentary freedom.

Crucially, properly structured trusts avoid probate entirely in many cases. When a trust holds the assets, no triggering event activates the succession machinery across multiple countries. The trust entity continues managing the assets according to established terms. Heirs receive distributions according to the trust document, without requiring court approval or government involvement.

International foundations operate similarly. These entities, recognized in Switzerland, Liechtenstein, and Panama, allow you to set aside assets for specific purposes while maintaining significant control during your lifetime. Upon death, foundations continue operating according to their charter, distributing assets without probate or court involvement.

Beneficiary designations provide a simpler alternative for straightforward situations. By naming specific beneficiaries directly on foreign accounts, you enable institutions to transfer funds directly to those individuals upon death, completely bypassing probate. This mechanism works efficiently for most accounts, particularly retirement accounts and insurance products.

Understanding International Tax Obligations

Tax implications across multiple jurisdictions demand careful attention. Foreign account inheritance triggers taxation in multiple locations based on different triggering events and different legal standards.

Switzerland applies no federal inheritance tax, but cantons (regional governments) each maintain different systems. The canton of Schwyz charges zero inheritance tax, while other cantons impose rates ranging from 0% to 50% depending on inheritance value and heir relationships. Crucially for foreign heirs, if the deceased wasn’t resident in Switzerland, Swiss cantonal inheritance tax generally doesn’t apply to movable assets like bank balances. Inheritance tax liability typically arises in the deceased’s country of last domicile instead.

However, Switzerland levies a 35% federal withholding tax on certain Swiss-source investment income—dividends and interest from Swiss deposits. Foreign heirs may claim refunds of this 35% tax if their country maintains a Double Taxation Agreement (DTA) with Switzerland. These agreements typically allow Switzerland to retain reduced rates (15%, 10%, 5%, or 0%), with refunds due for the difference. The refund process requires filing with the Swiss Federal Tax Administration, and claims must be filed within three years.

France imposes significantly higher inheritance taxes. Children pay progressive rates ranging from 5% to 45% depending on inheritance value, starting after a €100,000 exemption per parent. Siblings face rates from 35% to 45%, while unrelated beneficiaries pay a flat 60% on amounts above minimal exemptions. France’s forced heirship rules also mandate that children receive 50% of the estate regardless of the will.

Germany taxes inheritances according to relationship and value. Children and spouses benefit from exemptions of €400,000 each, with rates ranging from 7% to 30% depending on inheritance size. Distant relatives face rates escalating to 43% or 50%.

Italy offers more favorable treatment. Children receive €1 million exemptions each, with 4% tax rates on amounts above this threshold. Siblings benefit from €100,000 exemptions at 6% rates. Italy’s inheritance taxes rank among the lowest in Europe—significantly more favorable than France or Germany.

The United States imposes no federal inheritance tax on foreign nationals, but American citizens face estate taxes on worldwide assets exceeding $13.61 million (2024) with rates reaching 40%. However, non-citizen spouses receive no marital deduction from this tax, creating unique complications for international marriages.

Double taxation remains a persistent danger. When two countries simultaneously assert taxing rights over identical assets, combined rates can confiscate 60% or more of inherited value. Double taxation treaties between countries provide relief mechanisms, but these treaties remain less developed for inheritance taxes than income taxes. Professional tax planning becomes essential to minimize exposure.

The Documentation Reality: What Actually Gets Required

Documentation requirements vary dramatically by jurisdiction. What suffices in one country proves completely inadequate in another. This mismatch creates delays when families assemble documents meeting one standard only to discover banks require different forms.

Switzerland typically requires an official death certificate, Certificate of Inheritance identifying all heirs and their shares, original wills, valid passports for all heirs, proof of relationship (birth certificates, marriage documents), and tax compliance information. Every document not originally issued in German, French, Italian, or English requires certified professional translation.

Singapore demands either a Grant of Probate (if there’s a will) or Letters of Administration (if intestate), along with the death certificate, original or certified copy of the will, NRIC (National Registration Identity Card) or passport copies for all heirs, evidence of appointments, and specific Singapore bank forms.

The United States requires death certificates, original wills, probate court documents (Grant of Probate or Letters of Administration), valid identification for beneficiaries, and proof of U.S. citizenship where relevant.

Every foreign document requires Apostille certification—a special seal verifying authenticity under the Hague Convention of 1961. Countries not signatories to this convention require the more complex consular legalization process instead. The cost of properly authenticating a complete set of international inheritance documents easily reaches $3,000 to $10,000.

Timing proves critical. Many jurisdictions impose strict deadlines for filing inheritance documents—ranging from 30 days to 6 months depending on location. Missing these deadlines creates penalties, additional fees, and further delays.

The Joint Account Trap: A Common Mistake

Joint bank accounts create unexpected complications during succession, despite many people establishing them specifically to ease asset transfer after death.

The consequences depend on the account’s contractual structure. For “and/or” accounts (where holders have independent access), surviving account holders can often continue independent disposal of funds. However, other heirs entitled to deceased’s share may have information rights without immediate control.

More problematically, joint account designation triggers immediate reporting obligations. For American citizens, adding any co-owner to a foreign account creates FBAR reporting obligations for all parties from the moment of designation. Many people unknowingly create tax compliance burdens for family members who never contributed funds to the account and didn’t even know it existed.

In some jurisdictions, joint accounts don’t automatically pass to surviving holders. Instead, the entire balance becomes subject to inheritance rules and forced heirship provisions. Assuming a joint account provides asset transfer simplicity often proves incorrect.

Beneficiary designation proves superior to joint accounts for most situations. Naming specific beneficiaries directly on accounts enables institutions to transfer funds directly upon death—a clean, straightforward mechanism avoiding probate while creating no reporting obligations for family members.

Making Your Plan: The Essential Steps

Effective succession planning follows a systematic process. Beginning today, you can establish structures that guarantee smooth transfer of foreign accounts to your heirs.

First, create a comprehensive inventory of all foreign accounts. Document account numbers, institution names, approximate values, location details, and any co-owner or beneficiary information. Many heirs never discover foreign assets because the deceased kept inadequate records. Creating an organized inventory solves this immediately.

Second, evaluate the optimal structure for each category of assets based on your specific situation. Consider jurisdictions involved, family complexity, tax implications, and your control preferences. Substantial accounts in multiple countries typically benefit from offshore trusts or international foundations. Simpler situations might use beneficiary designations or coordinated multiple wills.

Third, engage specialized advisors. International succession planning requires coordinated expertise—estate attorneys in each relevant jurisdiction, international tax specialists, and banking professionals who understand foreign institution requirements. While professional guidance costs money upfront, it prevents far greater losses through mistakes.

Fourth, implement your chosen structure through trust deeds, foundation charters, beneficiary designation forms, and powers of attorney properly executed and registered. Each document must meet specific jurisdictional requirements.

Fifth, organize and secure all documentation. Create copies stored in multiple secure locations with access information provided to trusted family members or advisors. Specify exactly where documents are located in written instructions left with your estate executor.

Finally, communicate your plan to heirs. Discussing end-of-life arrangements and financial details feels uncomfortable but prevents far greater distress when the time arrives. Clear communication about asset locations, succession mechanics, required documents, and key contacts enables heirs to act decisively.

Tax Planning Essentials for International Assets

Proactive tax planning reduces inherited wealth loss substantially. The difference between coordinated planning and reactive scrambling often equals 15% to 30% of total inheritance value.

Understand domicile implications. Domicile status—your permanent home under law—determines which country taxes your worldwide assets upon death. Many people don’t realize that changing residence doesn’t change domicile for tax purposes. Establishing clear domicile in a favorable tax jurisdiction requires sustained residency and demonstrable intent to remain.

Consider treaty implications. Double taxation treaties between countries allocate taxing rights and provide relief mechanisms. However, these treaties vary significantly in their treatment of inheritance tax. Professional advisors can identify specific treaty benefits applicable to your situation.

Evaluate structure efficiency. The vehicle holding your assets—individual ownership, trust, partnership, or corporation—determines tax treatment dramatically. Offshore trusts established in low-tax jurisdictions can eliminate inheritance tax on trust assets in some situations. Corporations can defer taxation and provide flexibility for multi-generational transfer.

Plan for reporting compliance. FBAR, FATCA, and CRS reporting requirements create penalties for non-compliance but offer planning opportunities for strategic positioning. Understanding these requirements early enables compliance without penalties.

Implement lifetime gifting strategies. Most countries allow tax-free lifetime gifts up to annual thresholds or cumulative exemptions. Strategic gifting during life reduces estate size subject to inheritance tax upon death.

Modern Estate Planning Mistakes to Avoid

Nearly two-thirds of adults lack essential estate planning documents, according to 2025 research. Among those with plans, common mistakes create substantial complications.

The most dangerous error: waiting for the “right time.” No perfect moment exists. Illness, accident, or unexpected death doesn’t respect plans. The best time to create your succession plan is today. Even a basic plan beats no plan entirely.

Failing to update documents regularly ranks second. Laws change, life circumstances change, asset values change. Switzerland implemented major inheritance law revisions effective January 1, 2025, fundamentally altering rules for international succession. Plans drafted under the old regime may no longer reflect current law. Review your plan every two to three years and immediately after major life changes.

Ignoring digital assets creates modern complications. Cryptocurrency, online accounts, digital valuables, and stored documents possess real value. Your succession plan must address how these assets transfer to heirs, who accesses account credentials, and what happens to these holdings.

Naming wrong executors causes significant problems. Executors manage estates through probate and distribution. An executor lacking understanding of international law, lacking responsibility, or lacking family members’ trust creates unnecessary complications. Choose executors carefully.

Overlooking beneficiary designations allows default legal rules to override your wishes. Retirement accounts, insurance policies, and bank accounts frequently permit direct beneficiary designation. These override wills entirely. Review and update all beneficiary designations regularly.

Failing to fund trusts renders them useless. Establishing a trust means nothing if assets remain in individual names. Trusts only work when actual assets transfer into trust ownership.

Creating Momentum: Beginning Your Plan Today

Foreign account succession planning addresses an uncomfortable topic at a vulnerable time. Yet avoiding this planning guarantees greater suffering for people you love precisely when they’re already grieving.

The inheritance nightmare scenario—frozen accounts, conflicting legal systems, accumulating fees, and years of uncertainty—affects thousands of families annually. Most didn’t expect complications. Most thought simple wills sufficed. Most believed everything would “work out.”

It doesn’t work out without deliberate planning.

Begin immediately. Inventory your foreign accounts. Research the specific requirements for accounts in each location. Consult with international estate planning specialists. Implement appropriate structures—trusts, beneficiary designations, coordinated wills, or international foundations depending on your specific situation. Document everything meticulously. Communicate your plan to heirs.

The investment in proper planning today—hours of your time and modest professional fees—prevents tens of thousands of dollars in unnecessary fees, protects your legacy, and dramatically reduces suffering for your loved ones.

When it comes to structuring foreign accounts for smooth succession, the best time to act was yesterday. The second-best time is right now.

Take Control of Your International Legacy

Your foreign bank accounts represent more than mere numbers in foreign institutions—they embody decades of work, sacrifice, and wealth accumulated to provide for your family’s future. Protecting that legacy deserves your immediate attention.

The complexity of international banking, multiple legal systems, and overlapping tax jurisdictions makes DIY planning dangerous. Professional guidance from specialists who understand cross-border succession delivers peace of mind alongside concrete protection.

Easy Global Banking specializes in helping individuals and families structure international banking relationships that support seamless succession planning. Their Swiss-based experts guide you through account opening procedures that incorporate succession planning from the beginning, ensuring your foreign accounts are positioned for efficient transfer to heirs.

Whether you’re opening new foreign bank accounts or restructuring existing ones for better succession outcomes, specialists who understand both banking requirements and estate planning implications prove invaluable.

For those seeking the security and reputation of Swiss banking combined with strategic succession planning, Easy Global Banking helps you open Swiss bank accounts structured for your specific family situation and objectives.

Similarly, Singapore offers premier banking services for international families. Easy Global Banking facilitates the process of opening bank accounts in Singapore while ensuring succession structures align with your broader estate plan.

Don’t leave your family’s financial future to chance. Begin today by consulting with specialists who combine banking expertise with international succession planning knowledge. Your heirs will be forever grateful for the clarity, protection, and financial security that proper planning provides.