Stop surrendering half your income to the government. The global tax landscape is shifting, and savvy high-net-worth individuals, entrepreneurs, and digital nomads are discovering that your zip code determines your tax rate more than your citizenship ever will. In 2025, a record 142,000 millionaires are packing their bags and relocating to jurisdictions where personal income tax, capital gains tax, and inheritance tax simply don’t exist.

This isn’t just about saving money—it’s about fiscal residency strategy, wealth preservation, and building a legacy that doesn’t get decimated by taxation. The days when offshore living was reserved for billionaires are over. Today, anyone earning six figures or more can legally eliminate their tax burden by establishing residency in the right country. After analyzing 2025 migration patterns, investment requirements, and quality-of-life metrics, we’ve identified the five destinations where you can live tax-free while living well.

Why 2025 Is the Year of Strategic Relocation

Global wealth migration has reached unprecedented levels. The UAE alone is projected to welcome 9,800 millionaires this year, bringing approximately $63 billion in investable wealth. Meanwhile, the United Kingdom is hemorrhaging 16,500 high-net-worth individuals—the largest single-year wealth exodus ever recorded. This isn’t random; it’s strategic tax planning in action.

The traditional tax havens are evolving. Countries that once relied solely on banking secrecy are now offering comprehensive residency programs, world-class infrastructure, and legitimate pathways to open a foreign bank account that supports your new tax-free lifestyle. The combination of zero taxation, political stability, and high living standards has created a perfect storm for what experts are calling “the largest voluntary transfer of private capital in modern history”.

Understanding Fiscal Residency: The 183-Day Rule

Before diving into specific countries, understanding tax residency is crucial. Most nations use the 183-day rule as a threshold for determining tax residency. If you spend 183 days or more (roughly half the year) in a country, you typically become a tax resident there. However, this rule varies by jurisdiction and can be influenced by factors like permanent housing, economic ties, and treaty provisions.

The strategy isn’t just about minimizing days in high-tax countries—it’s about establishing genuine tax residency in a zero-tax jurisdiction. This requires meeting physical presence requirements, obtaining proper visas, and in some cases, making qualifying investments. The good news? Once established, you can legally structure your wealth to eliminate taxation on salaries, dividends, capital gains, and inheritance.

| Country | Residency Type | Minimum Stay Required | Investment Amount | Processing Time |

|---|---|---|---|---|

| UAE | Golden Visa (10 years) | 90-183 days/year | AED 2M (~$545k) or $200k+ | 3-6 months |

| Monaco | Residence Card (Renewable) | 90+ days/year | €500k-€1M | 3-6 months |

| Bahamas | Permanent Residence | None specified | $1 million | 3-6 months |

| Cayman Islands | Certificate (25 years) | 1-30 days/year | $1.2M-$2.4M | 3-6 months |

| Vanuatu | Citizenship | None | $130k-$165k | 3-6 months |

1. United Arab Emirates: The Modern Wealth Magnet

The UAE has evolved from a desert outpost into the world’s premier destination for tax-free living. While the country introduced a 9% corporate tax in 2023 for business profits exceeding AED 375,000 (approximately $102,000), personal income remains entirely tax-free. This means zero taxation on salaries, freelance income, dividends, rental earnings, and capital gains from personal investments.

Why the UAE Dominates in 2025

The numbers tell the story. The UAE is attracting 9,800 millionaires in 2025—more than any other country globally. This surge isn’t accidental; it’s the result of deliberate policy innovation designed to attract global capital. The Golden Visa program offers 10-year residency to investors who purchase real estate worth AED 2 million (approximately $545,000) or establish a business. For freelancers and remote workers, the Virtual Work Visa provides a lower barrier to entry with significantly reduced investment requirements.

The UAE’s tax residency criteria are clearly defined under Cabinet Resolution 85 of 2022. You become a UAE tax resident if you spend 183 days in the country during a 12-month period, maintain a permanent home there for at least 183 days, or spend 90 days in the UAE while maintaining your center of vital interests (business, family, economic ties) in the country. This flexibility makes it accessible for business owners who travel frequently.

Cost of Living Reality Check

Dubai and Abu Dhabi aren’t cheap. Monthly living costs for a single person range from $3,500 to $5,000. Luxury apartments in downtown Dubai can exceed $2,000 monthly, while suburban areas offer more affordable options around $1,200 to $1,500. Groceries, dining, and entertainment carry premium price tags, but the trade-off is saving 40-50% on taxes that you’d pay in high-tax jurisdictions.

The lifestyle advantages are undeniable: world-class healthcare, international schools, luxury shopping, exceptional safety, and a cosmopolitan environment where English is widely spoken. Summer temperatures can soar above 45°C (113°F), making May through September challenging for those unaccustomed to extreme heat.

Banking and Financial Infrastructure

The UAE’s banking system is sophisticated and internationally connected. Major institutions like Emirates NBD, ADCB, and international banks like HSBC offer multi-currency accounts, investment platforms, and seamless global transfers. Opening a bank account typically requires your Emirates ID, passport, proof of address, and visa documentation. For those seeking to open a foreign bank account with enhanced privacy and asset protection, specialized services can facilitate connections to premium Swiss and Singaporean banks without requiring travel.

Minimum investment required for tax-free residency varies significantly, with Vanuatu offering the most affordable entry point at $147.5k while Cayman Islands requires up to $1.8 million

2. The Bahamas: Caribbean Proximity with Zero Taxation

If geographical proximity to the United States matters, The Bahamas offers unbeatable access. Located just one hour from Miami, this archipelago of 700 islands provides a pure tax haven status with zero personal income tax, no corporate tax, no capital gains tax, and no inheritance tax.

Investment Requirements and Permanent Residency

The Bahamas Economic Permanent Residency program requires a minimum investment of $1 million as of 2025, representing an increase from previous thresholds. This investment can be made through approved real estate purchases or Zero-Coupon Bonds issued by the Central Bank of The Bahamas, with a mandatory 10-year holding period. For those seeking accelerated consideration, property investments of $1.5 million or higher may expedite processing.

The application process involves comprehensive due diligence, including criminal background checks, financial solvency verification, and proof that you can support yourself without local employment. The Bahamas government generates revenue through import duties and a 12% Value Added Tax on goods and services rather than taxing income or wealth.

Living in Paradise: The Trade-Offs

The Bahamas delivers on the island lifestyle promise: pristine beaches, world-class boating, year-round sunshine, and a relaxed Caribbean pace. English is the official language, making integration seamless for Anglophone expats. Monthly living costs for a single person range from $4,500 to $6,000, driven primarily by the fact that virtually everything is imported.

Groceries cost 30-50% more than in the United States. A basic restaurant meal runs $25-30, a loaf of bread costs nearly $5, and fuel prices hover around $5.70 per gallon. Real estate prices have appreciated consistently over three decades, and with zero capital gains tax, owners retain 100% of the appreciation. Rental income is similarly untaxed, creating opportunities for tax-free passive income streams.

Healthcare and Education

Nassau and Freeport offer quality healthcare facilities, though serious medical conditions may require travel to the United States. International schools cater to expatriate families, with options following American, British, and International Baccalaureate curricula. The Bahamas’ proximity to Florida makes frequent travel convenient for business, family visits, or accessing specialized services.

3. Cayman Islands: The Sophisticated Financial Fortress

The Cayman Islands isn’t just a tropical paradise—it’s the world’s fifth-largest financial center and the global hedge fund capital. This British Overseas Territory offers zero direct taxation: no personal income tax, no corporate tax, no capital gains tax, and no inheritance tax.

Residency Pathways and Investment Options

The Cayman Islands offers multiple residency routes tailored to different needs. The Certificate of Permanent Residence with Right to Work requires approximately eight years of continuous ordinary residence, satisfaction of a points-based system (minimum 110 points), and substantial property ownership. For high-net-worth individuals seeking faster entry, the Persons of Independent Means program requires proof of annual income of at least CI$145,000 (approximately $174,000 USD) if applying with a spouse and dependents, plus significant real estate investment.

The most direct route for wealthy investors is the substantial business presence pathway or the certificate for persons of independent means, both typically offering 25-year residency certificates. Real estate investment requirements range from $1.2 million to $2.4 million depending on the specific program. Physical presence requirements are remarkably flexible, requiring just 1 to 30 days per year depending on your residency type.

Infrastructure and Quality of Life

Grand Cayman feels more like a polished version of South Florida than a remote Caribbean island. The capital, George Town, features modern infrastructure, high-speed internet, sophisticated medical facilities, and an international airport with direct flights to major North American cities. The island’s currency is pegged to the US Dollar at a fixed rate, eliminating foreign exchange risk for Americans.

Monthly living costs are substantial, ranging from $5,500 to $7,500 for a single person. A one-bedroom apartment in George Town costs around $1,600 to $2,000 monthly, while beachfront properties command premium prices. Groceries, dining, and utilities are expensive due to import costs, but the trade-off is living in one of the world’s most politically stable and financially sophisticated jurisdictions.

Banking and Corporate Services

The Cayman Islands hosts over 100 licensed banks, including subsidiaries of every major global financial institution. Opening a personal bank account requires extensive documentation: passport, proof of address, bank references, professional references, and comprehensive source-of-funds documentation. Minimum deposits vary but typically start at $25,000 for basic accounts and can reach $250,000 or more for private banking relationships.

For those seeking to open a bank account in Singapore or establish multi-jurisdictional banking relationships, the Cayman Islands serves as an excellent complement to Asian financial centers, providing asset diversification across multiple time zones and regulatory frameworks.

4. Monaco: The European Crown Jewel

Monaco represents the pinnacle of tax-free European living. This sovereign city-state on the French Riviera offers zero personal income tax for residents (with the exception of French nationals subject to bilateral treaties). There are no capital gains taxes, no wealth taxes, and generous inheritance tax exemptions for direct heirs.

Residency Requirements: The Price of Prestige

Monaco doesn’t pretend to be accessible. This is explicitly designed for the ultra-wealthy. To obtain Monaco residency, applicants must deposit at least €500,000 (approximately $540,000) in a Monaco bank—though in practice, many private banks require minimum deposits of €1 million or more. Additionally, you must rent or purchase property in Monaco, which is no small feat given that Monaco has the world’s most expensive real estate market.

A small one-bedroom apartment typically costs €2 million or more, while luxury properties exceed €50,000 per square meter. Monthly rental costs start around €4,000 for basic accommodations and climb rapidly from there. The application process requires proof of clean criminal record, comprehensive financial documentation demonstrating the legal origin of your wealth, evidence of sufficient financial means to support yourself, and valid health insurance.

The Monaco Lifestyle

Monaco’s appeal extends far beyond taxation. This 2-square-kilometer principality offers unparalleled safety (the highest police-to-resident ratio in the world), pristine cleanliness, world-class cultural events (Monte Carlo Ballet, Philharmonic Orchestra, Opera), exclusive social scene (Monaco Yacht Club, Monte Carlo Country Club), and easy access to the French and Italian Rivieras.

Monthly living costs for a single person easily exceed $10,000. Dining at restaurants typically costs €100-200 per person at mid-range establishments, while Michelin-starred venues command significantly higher prices. Groceries from the Carrefour in Fontvieille are expensive but not prohibitive; a week’s shopping for one person might run €150-250.

Physical Presence Requirements

While Monaco doesn’t publish explicit physical presence requirements, authorities expect proof of genuine residence. In practice, this means spending at least 90 days per year in Monaco and maintaining demonstrable ties through utility bills, local spending, and community involvement. Extended absences may jeopardize residency renewal. After 10 years of continuous residence, you may apply for Monaco citizenship through naturalization, though approval is discretionary and granted by Sovereign Ordinance.

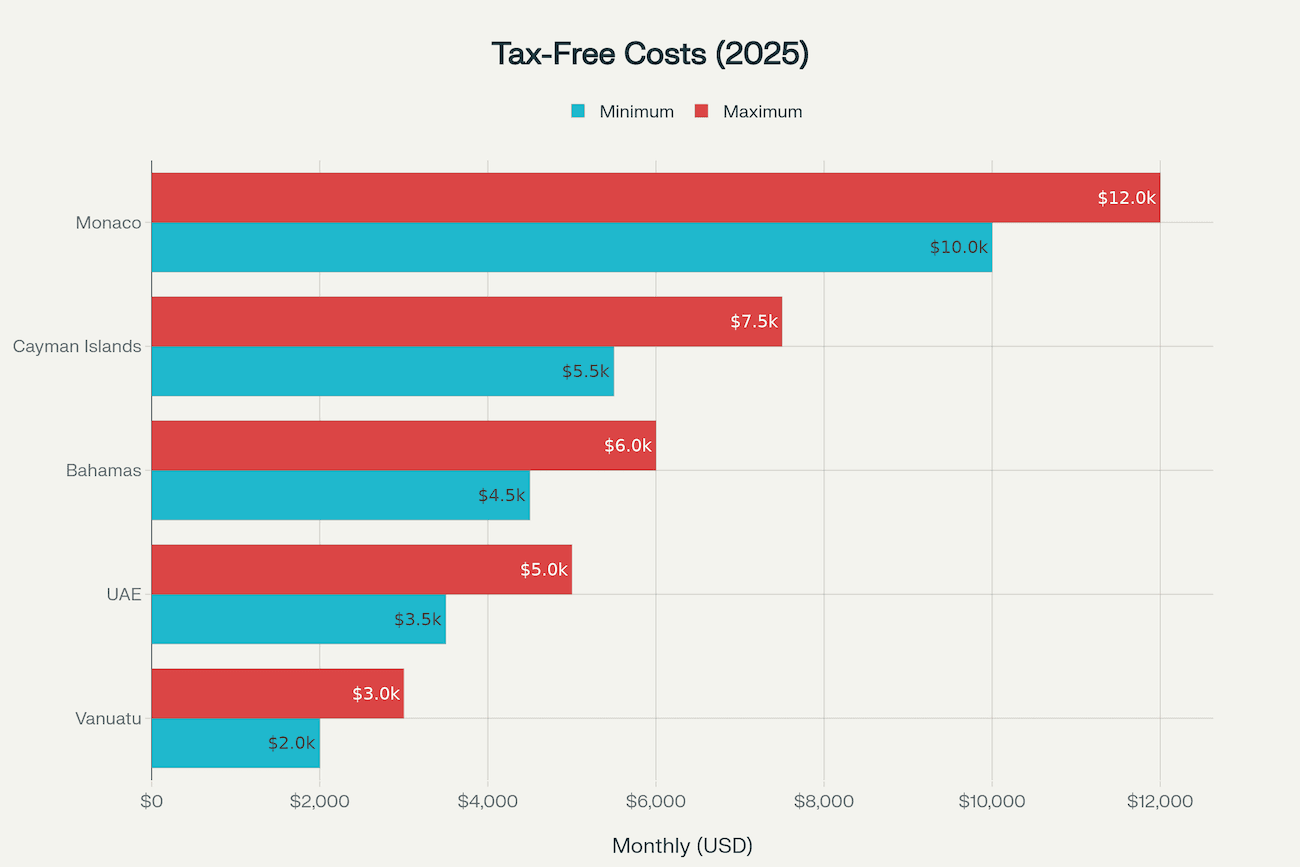

Monaco has the highest cost of living among tax-free destinations at $10,000-$12,000 per month, while Vanuatu offers the most affordable lifestyle at $2,000-$3,000 monthly

5. Vanuatu: The Fast-Track Pacific Option

Vanuatu is the wildcard in zero-tax relocation strategies. This South Pacific archipelago of 80 islands offers the world’s fastest citizenship by investment program, delivering complete tax exemption: no income tax, no wealth tax, no capital gains tax, no inheritance tax, and no corporate tax.

The Development Support Program Advantage

Vanuatu’s appeal lies in speed and simplicity. Through the Development Support Program (DSP), you can obtain full citizenship and a passport in as little as 2-3 months by making a non-refundable donation of approximately $130,000 for a single applicant or $150,000 for a married couple. Family applications covering up to four members (including two children under 25) start at $165,000 through the Capital Investment Immigration Plan (CIIP), which offers a $50,000 refundable component after four years.

There are zero physical residence requirements—no minimum stay, no need to visit, no language tests, no interviews. This makes Vanuatu ideal as a “Plan B” passport, providing visa-free or visa-on-arrival access to approximately 96 countries including the United Kingdom, Ireland, Russia, Hong Kong, and Singapore. The passport serves as a genuine tax residency option for those who need documented domicile outside high-tax jurisdictions.

Real Estate Investment Alternative

For those preferring tangible assets, Vanuatu offers citizenship through approved real estate investments starting at $200,000. These pre-approved developments provide ownership of physical property while still qualifying for the citizenship program. However, most applicants opt for the DSP due to its simplicity and lower total cost when factoring in property maintenance and management.

Living in Vanuatu: The Reality

Vanuatu isn’t for everyone. Monthly living costs are remarkably low at $2,000 to $3,000 for a single person, making it the most affordable option among zero-tax countries. However, infrastructure is developing rather than developed. Internet connectivity can be unreliable, healthcare facilities are basic (serious conditions require evacuation to Australia or New Zealand), and the islands’ remote location means limited direct international flights.

That said, Vanuatu delivers authentic South Pacific beauty: world-class diving sites, pristine beaches, active volcanoes, and a relaxed island culture. Port Vila, the capital, offers reasonable amenities including restaurants, grocery stores, and a small expatriate community. For many, Vanuatu serves primarily as a paper residency while maintaining actual residence elsewhere, though the country’s natural beauty attracts retirees and adventurers genuinely seeking island life.

Comparative Analysis: Choosing Your Strategy

| Country | Personal Income Tax | Monthly Cost of Living (Single) | Min Investment for Residency | Capital Gains Tax | Inheritance Tax |

|---|---|---|---|---|---|

| UAE | 0% | $3,500 – $5,000 | ~$370k (Real Estate) or Freelance Visa | 0% | 0% |

| Bahamas | 0% | $4,500 – $6,000 | $1 million (Property) | 0% | 0% |

| Cayman Islands | 0% | $5,500 – $7,500 | $2.4 million (Property) or Income proof | 0% | 0% |

| Monaco | 0% | $10,000+ | €500k Deposit + Property | 0% | 0% |

| Vanuatu | 0% | $2,000 – $3,000 | ~$130k (Citizenship) | 0% | 0% |

Selecting the right zero-tax jurisdiction requires alignment between your financial situation, lifestyle preferences, and business needs. Here’s the strategic breakdown:

Choose the UAE if you:

- Want to build or expand a business in a globally connected hub

- Prefer modern infrastructure, luxury amenities, and diverse culture

- Need access to Asia, Europe, and Africa within reasonable flight times

- Can afford $3,500-5,000 monthly living costs

- Value safety, education, and healthcare quality

Think about The Bahamas if you:

- Require proximity to the United States (one hour from Florida)

- Want to maintain your US time zone for business operations

- Enjoy island living with developed infrastructure

- Can afford $4,500-6,000 monthly expenses

- Value English as the official language

Try Cayman Islands if you:

- Work in finance, hedge funds, or require sophisticated banking

- Need political stability and British common law jurisdiction

- Don’t mind higher costs ($5,500-7,500 monthly) for premium services

- Value a jurisdiction pegged to the US Dollar

- Prefer minimal physical presence requirements (potentially just days per year)

Choose Monaco if you:

- Possess substantial wealth (realistically $5-10 million minimum)

- Want European lifestyle with access to France, Italy, and Switzerland

- Can afford $10,000+ monthly living expenses

- Value prestige, culture, and an exclusive social environment

- Require zero taxation within the European context

Relocate to Vanuatu if you:

- Need a second passport quickly (2-3 months)

- Want the lowest entry cost ($130,000-165,000)

- Value zero physical presence requirements

- Seek a “Plan B” citizenship for geopolitical diversification

- Don’t mind remote living or prefer to maintain residence elsewhere

Establishing Your Banking Infrastructure

Successfully executing a zero-tax strategy requires sophisticated international banking. Simply moving to a tax-free country isn’t enough—you need banking relationships that support your new structure, protect your assets, and facilitate global transactions.

The challenge is that many international banks have tightened requirements for non-resident account opening. Major institutions in Switzerland, Singapore, and other financial centers now require minimum deposits ranging from $100,000 to $350,000 for non-residents. The application process demands extensive documentation: passport, proof of address, bank references, source-of-funds verification, and often in-person visits.

This is where specialized services become invaluable. Firms like Easy Global Banking have relationships with premium banks across multiple jurisdictions, enabling clients to open a Swiss bank account or open a bank account in Singapore without traveling and with guidance through complex compliance requirements. These services typically include personalized bank matching, document preparation, application management, and ongoing support—critical components when your financial infrastructure spans multiple countries.

Tax Residency Considerations and Compliance

Establishing tax residency in a zero-tax jurisdiction doesn’t automatically eliminate all tax obligations, particularly for citizens of countries like the United States that tax based on citizenship rather than residency. American citizens must continue filing US tax returns and reporting worldwide income regardless of where they live, though foreign earned income exclusions (up to approximately $120,000 in 2025) and foreign tax credits can significantly reduce US tax liability.

For citizens of most other countries, tax obligations are determined by residency rather than citizenship. The key is properly severing tax residency in your home country while establishing genuine residence in the new jurisdiction. This typically requires:

Formal tax deregistration in your home country

Physical presence meeting the new country’s requirements (typically 90-183 days)

Establishing economic ties in the new country (banking, business, property)

Maintaining documentation proving genuine residence (utility bills, lease agreements, local spending records)

Filing required tax returns in your home country declaring non-resident status

Professional tax advice is essential. The interplay between domestic tax laws, bilateral tax treaties, and anti-avoidance provisions can be complex. Countries are increasingly scrutinizing high-net-worth individuals claiming non-residence, making proper documentation and genuine relocation critical.

The Bigger Picture: Global Wealth Migration in 2025

The movement toward zero-tax jurisdictions reflects broader trends in global capital mobility. Tax authorities worldwide are implementing increasingly aggressive policies targeting wealth: higher income taxes, expanded capital gains taxation, wealth taxes, and inheritance levies. The UK’s abolition of non-dom status (effective April 2025) is driving an estimated 16,500 millionaires to relocate—a cautionary tale of how tax policy changes can trigger massive capital flight.

Simultaneously, countries like the UAE, Saudi Arabia, and Portugal are aggressively competing for mobile capital through favorable tax regimes, streamlined residency programs, and infrastructure investments. The result is unprecedented wealth migration: 142,000 millionaires relocating in 2025, projected to increase to 165,000 in 2026. These individuals bring investable capital, entrepreneurial energy, and spending power to their new homes.

This isn’t tax evasion—it’s legal tax planning through strategic residence. The difference is crucial: evasion involves hiding assets and income from tax authorities; legal tax optimization involves openly restructuring your residence and affairs within the boundaries of the law. Every country mentioned in this guide offers legitimate pathways to residency and explicitly welcomes foreign capital through published programs with clear requirements.

Taking Action: Your Next Steps

If you’re considering a zero-tax relocation strategy, here’s how to proceed:

1. Assess Your Situation

Calculate your current tax burden, considering income taxes, capital gains taxes, and potential inheritance taxes. Determine your annual savings from zero-tax residency and compare this against relocation costs and investment requirements.

2. Evaluate Lifestyle Compatibility

Visit your target countries for extended periods (2-4 weeks). Experience the climate, culture, expat community, and daily life. Speak with current residents who have made similar moves. Consider factors beyond taxation: healthcare quality, education options for children, safety, accessibility, and whether you can genuinely envision building a life there.

3. Engage Professional Advisors

Consult with international tax attorneys who specialize in cross-border taxation and residency planning. Work with immigration specialists experienced in your target country’s visa and residency programs. Engage wealth managers who can help restructure your financial affairs to optimize your new tax position.

4. Establish Banking Infrastructure

Before relocating, establish international banking relationships. Consider opening accounts in multiple jurisdictions for asset diversification. Services like Easy Global Banking can facilitate connections to premium Swiss and Singaporean banks, providing the foundation for managing wealth across borders. This often requires 3-6 months, so begin well before your planned move.

5. Execute a Phased Transition

Rather than burning bridges, execute a gradual relocation. Maintain flexibility while establishing genuine ties in your new country. Document everything—residency certificates, utility bills, local spending, banking relationships. This evidence is crucial should tax authorities in your home country question your relocation.

The Strategic Imperative

The question isn’t whether to consider a zero-tax strategy—it’s why you’d choose to surrender 40-50% of your income when legal alternatives exist. In 2025, staying in a high-tax jurisdiction is a choice, not a requirement. The world is more connected than ever, with digital banking, remote work capabilities, and international travel making geographical location increasingly flexible.

For high-net-worth individuals, entrepreneurs, and those building wealth, strategic relocation represents one of the most powerful wealth preservation tools available. The five countries detailed here—the UAE, Bahamas, Cayman Islands, Monaco, and Vanuatu—each offer proven pathways to zero personal income tax, capital gains exemption, and inheritance tax elimination. The right choice depends on your individual circumstances, but the opportunity is clear.

Your wealth is waiting in a jurisdiction that values it. The only question is whether you’re ready to claim it.

Take Control of Your Financial Future with Easy Global Banking

Successful international relocation requires more than just a change of address—it demands a sophisticated global banking infrastructure. Whether you’re establishing UAE residency, relocating to Monaco, or obtaining Vanuatu citizenship, your wealth management strategy needs banking partners who understand cross-border complexity.

Easy Global Banking specializes in helping high-net-worth individuals open a foreign bank account in the world’s premier financial centers. With Swiss-based expertise and direct relationships with top-tier banks in Switzerland, Singapore, and beyond, we simplify what’s typically a complex, frustrating process. Our services include complimentary strategy consultations, personalized bank recommendations matched to your profile, complete application management with a 100% money-back guarantee, and ongoing support after account activation.

Don’t leave your financial infrastructure to chance. Whether you need to open a Swiss bank account for asset protection and privacy or open a bank account in Singapore for Asian market access, our experts provide the guidance and connections you need—no travel required. Contact Easy Global Banking today and secure your financial future across borders.