Introduction

When you attempt to open a foreign bank account or make a significant financial transaction, financial institutions don’t simply accept your money and ask questions later. Instead, they follow strict anti-money laundering (AML) rules that require them to understand where your money comes from. This critical process hinges on one document: your source of wealth declaration.

Yet here’s the reality: a source of wealth declaration is not just another bureaucratic hurdle. It’s the gateway to international banking, investment accounts, and large transactions. Many applicants fail at this crucial step, watching their applications get rejected or delayed indefinitely due to incomplete, vague, or poorly constructed declarations.

What separates approval from rejection? Clarity, completeness, and attention to detail. This comprehensive guide reveals exactly how to craft a source of wealth declaration that banks will approve on the first attempt. Whether you’re an expat, entrepreneur, investor, or high-net-worth individual, understanding these principles will streamline your banking relationship and save you months of frustrating back-and-forth communications.

What Is a Source of Wealth Declaration and Why Do Banks Really Want It?

Understanding the Difference Between Source of Wealth and Source of Funds

Before diving into the specifics of crafting your declaration, you need to understand two related but distinct concepts that banks evaluate during the KYC (Know Your Customer) process.

Source of Wealth (SOW) describes the origin of your entire body of assets and how you accumulated them over time. It answers the question: “How did you build your total net worth?” This includes employment income, business profits, investments, inheritance, or a combination of these sources. Banks view SOW as the bigger picture of your financial journey.

Source of Funds (SOF), by contrast, refers to the specific funds used in a particular transaction. It answers: “Where exactly is this money for this specific deposit coming from?” While source of funds is more immediate and transaction-specific, source of wealth is historical and comprehensive.

For foreign bank account opening, you’ll typically need to establish both. This means banks want to verify that your wealth isn’t just legitimate—it needs to align with your profile. Consider this scenario: a 28-year-old claiming they accumulated $5 million from salary alone will face intense scrutiny. An established business owner showing consistent investment returns faces considerably less resistance.

Why Banks Require Source of Wealth Verification

Financial institutions operate under stringent international rules designed to combat money laundering and terrorist financing. A global organization called the Financial Action Task Force (FATF) sets AML standards and mandates that banks implement a risk-based approach to customer due diligence. This means your level of scrutiny depends on several factors: your country of residence, the amount of money involved, your professional profile, and whether you’re classified as a politically exposed person (PEP).

Consider the regulatory pressure: banks face substantial fines—often reaching millions of dollars—if they fail to properly verify customer sources of wealth. This creates a direct impact on you, the applicant. Your bank isn’t being difficult; it’s protecting itself from government penalties and sanctions while maintaining the integrity of the global financial system.

Understanding this context helps you appreciate why banks ask such detailed questions and why vague or incomplete declarations simply won’t work anymore.

The Most Common Mistakes That Get Source of Wealth Declarations Rejected

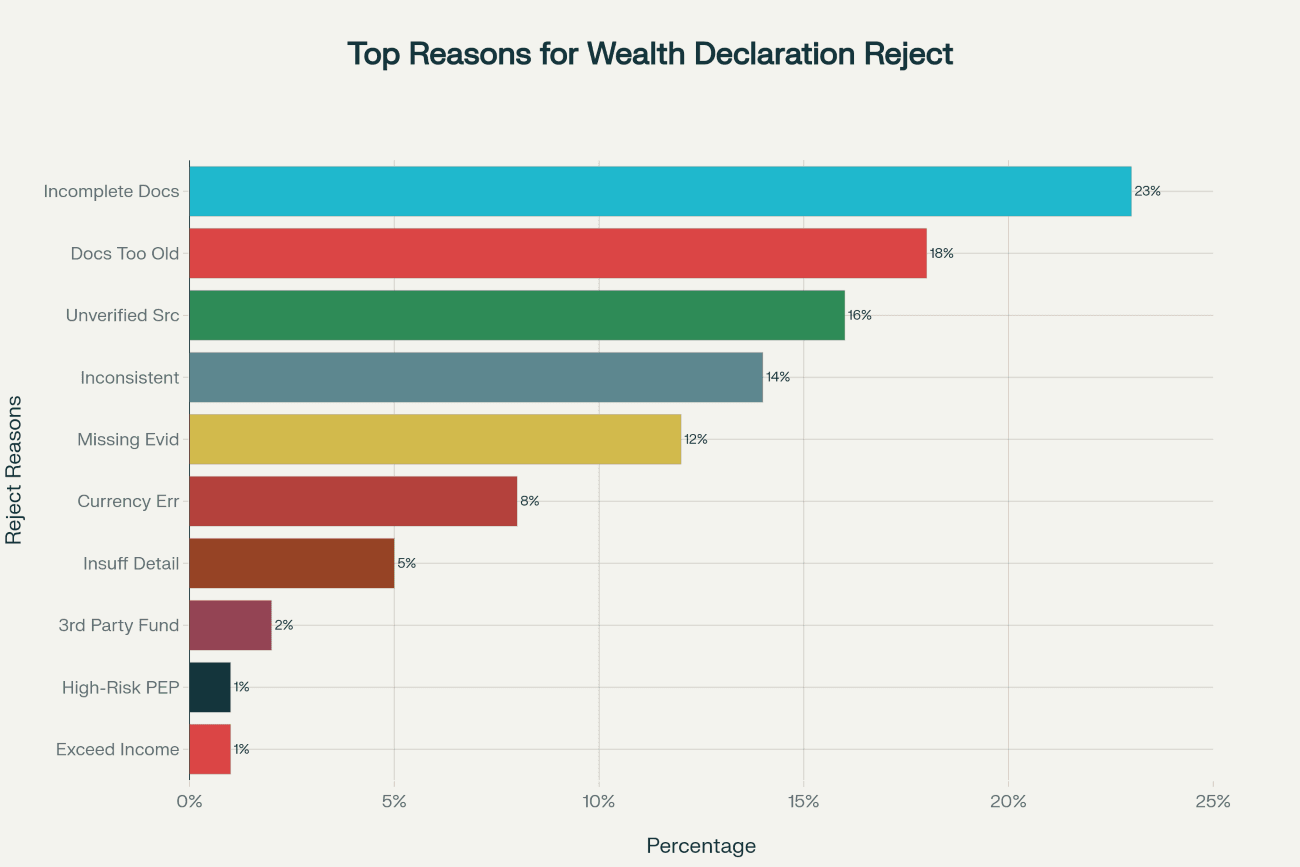

Before learning what to do right, let’s examine what most applicants do wrong. These mistakes consistently lead to application rejections or delays:

1. Providing Incomplete or Vague Information (23% of Rejections)

Here’s the problem: the single biggest reason banks reject source of wealth declarations is incomplete or excessively vague information. Applicants often write something like “salary from employment” or “business income” without providing specific details.

Concrete information is what banks need. Your declaration should include exact salary amounts, specific employer names and addresses, the nature of the business, and confirmation of your employment status. When you write “business profits,” clarify: What does the business do? How long have you owned it? What are the annual revenues? What percentage do you own?

The issue with vague descriptions? They create suspicion. When information is unclear, banks must assume the worst-case scenario. Detailed, specific descriptions, by contrast, demonstrate transparency and make the verification process straightforward.

2. Submitting Outdated Documentation (18% of Rejections)

Outdated financial documentation is a critical problem. A payslip from two years ago doesn’t prove current employment. Bank statements from 2022 don’t prove current savings accumulation. Similarly, investment statements from 2020 don’t reflect your current portfolio value.

What’s the acceptable timeframe? Most banks accept documentation that’s no more than 6 months old for employment income, 12 months old for business tax returns, and 3-6 months old for regular bank statements. Applying for a bank account after losing your job, changing positions, or experiencing significant life changes? Fresh documentation becomes absolutely critical.

Therefore, update your documentation collection regularly—not just when you need a bank account. Maintain current payslips, recent bank statements, and updated tax returns in an organized digital folder so you’re never caught off-guard.

3. Including Unverified or Questionable Sources (16% of Rejections)

Independent verification happens in every case. If your declaration claims you received a large gift, they’ll want corroborating evidence. Claims of inheritance? They’ll verify the will and probate documents. Stating you earned money from an investment? They’ll check your brokerage statements.

Third-party funding creates the biggest problem in this category—when money comes from sources you don’t directly control or understand. Someone else depositing funds into your account? Banks will ask penetrating questions about that person’s source of funds. This creates a chain-of-custody problem: if you can’t explain where that person got their money, banks get nervous.

Furthermore, funds from informal sources, cryptocurrency exchanges with poor regulatory standing, or transactions from high-risk countries trigger additional scrutiny. Your best approach? Document everything. Provide bank statements showing the complete transaction history, not just the final deposit.

4. Presenting Inconsistent Information (14% of Rejections)

Inconsistency kills applications every time. Imagine this: your source of wealth declaration says you earn $100,000 annually, but your bank statements show deposits of $300,000 in a six-month period. That’s a massive red flag.

Multiple data points get compared by banks: your tax returns, your bank statements, your employment letters, and your stated occupation. They look for alignment. A surgeon claiming $50,000 in annual income raises immediate concerns. A recent graduate claiming inherited $2 million needs extensive documentation of the estate.

Your task before submission? Review your entire application package thoroughly. Does your stated income match your tax returns? Do your bank statement deposits align with your employment documentation? Do all your stated dates (employment start dates, inheritance dates, business acquisition dates) create a coherent timeline? Consistency across all documents dramatically increases approval chances.

5. Missing Critical Supporting Documentation (12% of Rejections)

Incomplete submissions fail constantly. You might include a payslip but forget your recent bank statements or employment letter. Maybe you submit a will without the probate documents. Perhaps you include a property sale contract without proof of fund receipt.

Each source of wealth category requires specific supporting evidence. Think of these not as suggestions but as requirements. If the bank requests audited financial statements, a rough income estimate won’t suffice. They ask for inheritance documentation? The will alone isn’t enough—you need the grant of probate or estate distribution documents.

Therefore, anticipate requirements before they’re requested. Submit everything proactively rather than waiting for follow-up requests that delay your application.

The Complete Checklist: Documentation Required by Source of Wealth Type

| Source of Wealth | Essential Information Required | Minimum Supporting Documents |

|---|---|---|

| Employment/Salary | Exact salary amount, employer name & address, job title, nature of business, employment status | Recent payslips (3 months), bank statements showing salary deposits, employment letter or contract, tax returns |

| Business Ownership/Self-Employment | Business name, nature of business, ownership percentage, business registration details, annual revenue | Audited financial statements (last 2 years), corporate tax returns, shareholder registry, business registration documents |

| Investment Income/Portfolio | Investment type, duration held, total value, dividend frequency | Investment statements, brokerage confirmations, dividend receipts, sales confirmations, bank statements showing receipt |

| Property Sale | Property address, sale date, sale amount, proceeds received | Sale contract, property deed/title, valuation report, bank statement showing fund receipt, tax documents |

| Business Sale | Business name, sale date, total sale amount, your ownership percentage | Sale contract, media coverage (if applicable), accountant/solicitor letter, bank statements showing proceeds |

| Inheritance | Deceased’s name, relationship, date of death, inheritance amount received, inheritance date | Will or testament, grant of probate, estate distribution documents, solicitor letter, bank statements |

| Retirement/Pension | Previous employment details, retirement date, pension provider, annual amount | Pension statements (3-6 months), annuity agreements, employer confirmation letter, bank statements |

| Gift | Donor name, relationship, gift date, gift amount, reason for gift | Signed gift letter from donor, donor’s identification, donor’s source of wealth documentation, bank statements showing transfer |

| Divorce Settlement | Settlement date, total amount received, ex-spouse name | Court order, settlement agreement, solicitor letter, bank statements |

| Dividends | Company name, number of shares held, dividend frequency, amount | Dividend statements, investment contracts, share certificates, company accounts, bank statements |

This table represents the baseline requirements. Higher-risk situations (certain countries, large amounts, politically exposed persons) trigger additional documentation requests. When in doubt, provide more documentation rather than less.

How to Write Your Source of Wealth Declaration: A Step-by-Step Framework

Step 1: Organize Your Timeline and Wealth Sources

Start by mapping out your complete wealth history. Create a simple timeline showing when you earned, inherited, received, or acquired money and assets.

Begin with your earliest significant wealth acquisition—the moment your financial journey truly began. If employment is your primary source, look back to your first job. Business owners should note when they established their company. Those with inheritance should identify the date those assets came into their possession. Similarly, investors should mark when they made their first investment.

This timeline answers the crucial question banks ask: “Does this person’s wealth accumulation make sense for their age and background?” Consider these scenarios: a 35-year-old with $10 million accumulated over 12 years through consistent salary and investment looks different from someone claiming the same amount arrived through a single unexpected windfall.

Step 2: Identify Your Primary and Secondary Wealth Sources

Rarely does a single source explain someone’s entire wealth. Your declaration should clearly distinguish between primary sources (which generated most of your wealth) and secondary sources (which contributed additional amounts).

For example: “My primary source of wealth derives from 15 years of employment as a software engineer with TechCorp Inc., earning an average annual salary of $120,000, supplemented by bonuses averaging $30,000 annually. Secondary sources include investment returns from a diversified stock portfolio initiated in 2015, which has generated approximately $45,000 in dividends over the past three years.”

This specificity demonstrates thoroughness and allows the bank to verify each claim systematically.

Step 3: Provide Specific, Quantifiable Information

Replace vague descriptors with exact numbers and clear references. Instead of “good savings habits,” write: “Maintained average monthly savings of $3,000 from 2015-2025, evidenced by bank statements showing consistent deposits.”

Furthermore, instead of “property investments,” specify: “Purchased residential property at 123 Main Street, London in 2018 for £250,000, now valued at £325,000 based on independent appraisal dated [date], generating monthly rental income of £1,200.”

Here’s why this matters: banks don’t accept general statements. They want numbers they can verify against documents. The more specific you are, the more credible your declaration becomes.

Step 4: Explain the Timeline and Logical Progression

Connect the dots for the bank. Show how you moved from one wealth stage to another. “After earning steady employment income for 10 years and accumulating $200,000 in savings, I invested these funds in commercial real estate. The property generated annual rental income of $45,000 for 8 years, which I reinvested in a diversified stock portfolio.”

Additionally, this narrative approach—telling the story of your wealth accumulation—helps banks understand your financial logic. It prevents them from wondering why money suddenly appeared without explanation.

Step 5: Cross-Reference Supporting Documentation

At the end of each wealth source section, explicitly reference the supporting documents you’ve provided. For example: “This employment income is evidenced by the attached payslips dated [dates], employment letter from TechCorp dated [date], and bank statements from [bank name] for the period [dates].”

This cross-referencing accomplishes two critical things: it proves you’ve anticipated the bank’s verification needs, and it makes their job easier by showing exactly where to find the supporting evidence.

Step 6: Address Any Unusual Circumstances

If your wealth came from an unexpected source—perhaps you received a large inheritance or won a lottery—explain it clearly. Don’t just state the fact. Provide context that makes sense.

Poor approach: “Received $500,000 from inheritance in 2022.”

Better approach: “Inherited $500,000 in 2022 following the death of my paternal grandfather, the principal shareholder of [family business]. As evidenced by the attached grant of probate and solicitor’s letter dated [date], I received my designated inheritance as the primary beneficiary.”

Critical Documentation by Country Risk Level

Banks don’t evaluate all applicants equally. Your country of residence and the country where your wealth was generated significantly impact documentation requirements.

Understanding Risk Classifications

According to industry guidelines established by major international financial institutions, countries are classified into three risk categories that determine documentation thresholds:

| Risk Category | Documentation Level & Examples | Single Premium Threshold |

|---|---|---|

| Green (Low Risk) | Standard documentation required. Includes: Australia, Canada, Germany, France, Singapore, Hong Kong, Ireland, UK. Streamlined verification process with recent financial statements sufficient in most cases. | USD $1,250,000+ before evidence required |

| Amber (Medium Risk) | Enhanced documentation required. Includes most developing nations. Multiple supporting documents needed, professional verification often required. | USD $500,000+ before evidence required |

| Red (High Risk) | Strict and comprehensive documentation required. Includes Nigeria, Ukraine, Panama, Egypt, Mongolia. Independent verification and third-party professional confirmation mandatory. Possible enhanced due diligence procedures. | USD $250,000+ before evidence required |

How Risk Categories Affect Your Application

If you reside in or work in a green-category country and your transaction is below the threshold, documentation requirements remain straightforward. However, if you’re in a red-category country, expect banks to demand extensive evidence, including independent verification and possibly professional accountant or solicitor confirmation.

Here’s the reality: this risk-based approach means the same $300,000 inheritance is treated differently depending on whether you’re applying from Switzerland or from a jurisdiction flagged for higher financial crime risk.

What to Include in Your Source of Wealth Declaration Document

Your source of wealth declaration should follow this structure:

Document Structure and Organization

Header Section:

- Full legal name (matching your passport)

- Date of birth

- Current residential address

- Citizenship

- Application date

- Bank name and reference number (if available)

Personal Financial Summary:

- Approximate total net worth (exact amount not always required)

- Estimated composition of assets (percentage in real estate, investments, cash, etc.)

- Time period over which you accumulated this wealth

Detailed Source of Wealth Breakdown:

For each significant source, provide:

- Source category (employment, business, inheritance, etc.)

- Percentage of total wealth derived from this source

- Time period during which wealth was generated

- Specific details and amounts

- Reference to supporting documentation

Declaration of Accuracy:

- Statement confirming the information is true and complete

- Your signature

- Date signed

Attachments:

- Cover letter summarizing the main points

- Organized list of all supporting documents

- Clear reference numbers linking each document to its source section

Important Formatting Notes

Many banks provide specific forms or templates. Always use the bank’s template if provided, as it’s designed specifically for their verification processes.

The Role of Professional Documentation in Approval

While you can prepare basic documentation yourself, certain professional certifications dramatically increase approval odds, particularly for complex sources of wealth.

Types of Professional Documentation That Matter

Accountant Verification Letters: A letter from a regulated accountant or chartered financial professional confirming your income, business performance, or investment returns carries substantial weight. Banks trust professional intermediaries more than self-certification.

Solicitor Confirmation: For property sales, inheritance, divorce settlements, or business sales, a letter from a licensed solicitor confirming the transaction details and amounts provides independent, professional verification.

Tax Authority Records: Official tax returns stamped or filed with your tax authority carry authority that you cannot replicate yourself.

Audited Financial Statements: If you own a business, audited financial statements (as opposed to management accounts) provide third-party verification of your claimed business profits.

When Professional Documents Are Essential

These professional documents particularly matter when you’re in a high-risk category or when your wealth seems disproportionate to your stated income level. Essentially, the professional’s reputation becomes an extension of your credibility.

Navigating Common Challenges and Red Flags

When Your Wealth Includes Cryptocurrency

Cryptocurrency holdings trigger enhanced scrutiny because exchanges vary wildly in regulatory compliance and because crypto’s anonymous nature historically made it attractive for money laundering.

Here’s what you need to do: if part of your wealth comes from cryptocurrency, provide comprehensive documentation: proof of holdings from a regulated exchange, purchase and sale history, identification of the exchange (particularly if it’s a major exchange like Kraken, Coinbase, or Binance), and bank statements showing fund transfers to and from the exchange.

Most critically, trace the original source. Where did the money come from that you used to purchase cryptocurrency? If you bought Bitcoin with salary income, show the salary deposits. Did you buy with business profits? Show the business revenue. Banks don’t typically object to cryptocurrency holdings, but they absolutely object to cryptocurrency with unclear origins.

Managing Third-Party Funding

Perhaps your business partner gave you funds, or a family member helped you purchase a property. This creates what banks call “third-party funding,” which automatically triggers additional verification.

Now you must provide documentation of the third party’s source of wealth. If your father gave you $200,000, the bank wants to know where your father got that money. Provide his source of wealth documentation as well as a gift letter explaining his motivation.

This might seem invasive, but it’s necessary. Money laundering schemes often work through family members or business associates. By understanding the chain of funds, banks verify you’re not an unwitting participant in illegal money movement.

High-Net-Worth Individual Requirements

If you’re classified as high-net-worth (typically assets exceeding $1 million), expect significantly more scrutiny. Enhanced Due Diligence (EDD) applies, which means the bank must understand not just where your money came from, but why you’re making this particular transaction, whether there are any sanctions concerns, and whether you’re a politically exposed person.

Typically, high-net-worth clients might need to provide additional information: business ownership structures, beneficial ownership of entities, details of professional advisors, and even source of wealth for inherited or gifted funds.

Politically Exposed Person Status

If you’re classified as a PEP—which includes government officials, military generals, corporate executives of state-owned enterprises, and their close family members—banks subject you to the most stringent verification.

If you’re a PEP, be prepared to submit comprehensive documentation including: detailed source of wealth information with supporting evidence, explanation of any assets acquired before your government position, media search results for your name, financial disclosure statements if you’re a public official, and possible third-party background checks.

Importantly, many banks simply refuse PEP clients or require additional layers of approval. This isn’t discrimination; it’s regulatory compliance related to corruption risk.

The Application Submission: Best Practices for Success

Organize Your Application Package

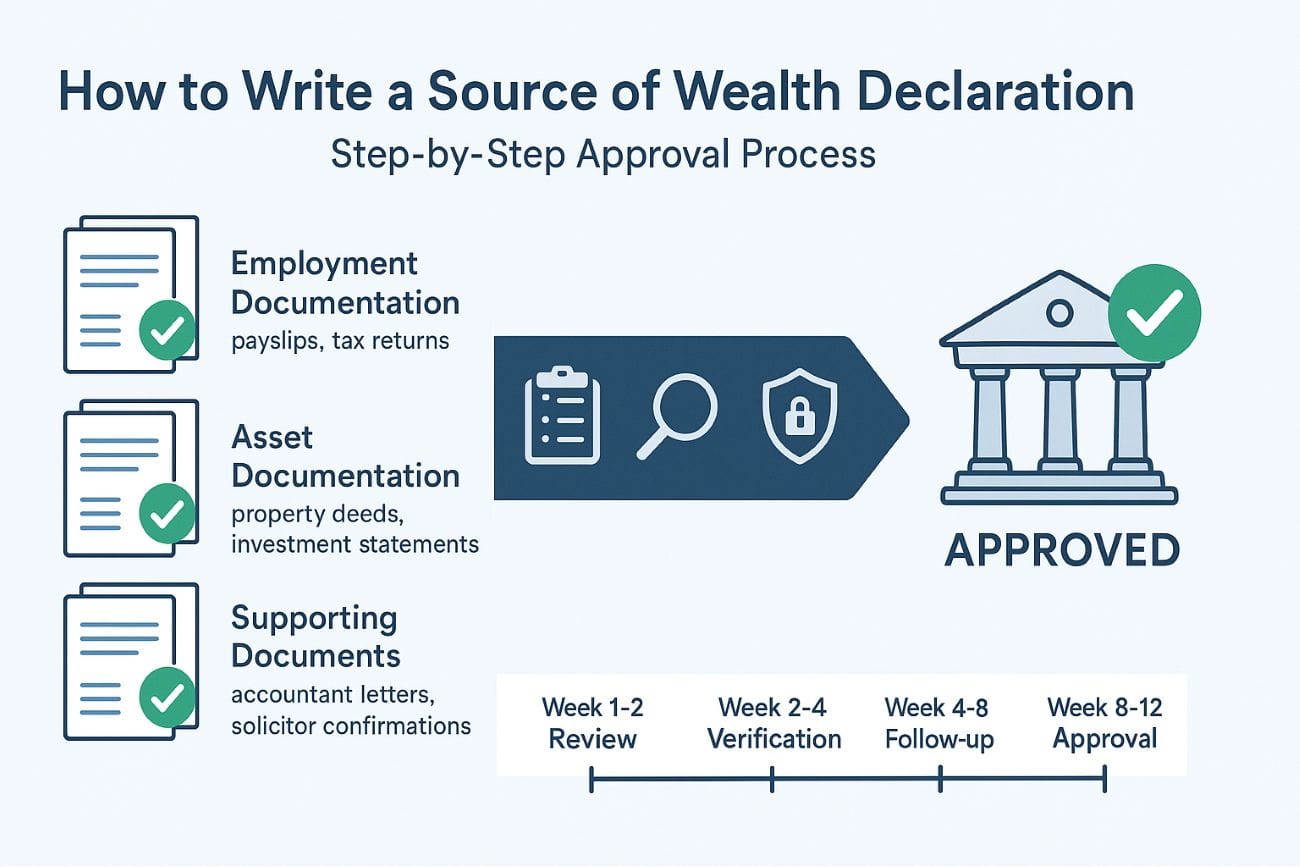

Don’t simply attach random documents. Create a clear folder structure:

Main Folder: [Your Name] – SOW Application – [Bank Name]

- Cover Letter (referencing all attached documents)

- Source of Wealth Declaration (completed form or detailed letter)

- Folder: Employment Documentation

- Payslips

- Employment letter

- Tax returns

- Bank statements showing salary deposits

- Folder: Asset Documentation

- Property deeds

- Investment statements

- Business registrations

- Folder: Supporting Professional Documents

- Accountant letters

- Solicitor confirmations

- Professional certifications

- Index/Document Reference Sheet (listing every document with page numbers)

Write a Compelling Cover Letter

Your cover letter is the bank’s first impression. It should:

- Clearly state your intent to open an account and deposit approximate amounts

- Summarize your professional background and primary occupation

- Briefly describe your primary and secondary wealth sources

- Reference the attached documentation

- Indicate your availability for any additional verification steps

- Express your commitment to the bank’s compliance processes

What’s the benefit? A well-written cover letter demonstrates professionalism and cooperation, making the bank’s job easier and increasing their confidence in your application.

Use Clear, Professional Formatting

Regardless of format, ensure:

- Document legibility (proper font size, clear black text)

- Consistent formatting throughout

- Page numbers on all multi-page documents

- Clear labeling of sections

- Professional tone in all written communication

Here’s the reality: shabby presentation creates negative impressions that can influence subjective approval decisions.

Verify Document Authenticity Requirements

Different banks accept different verification methods:

- Some accept color scans of original documents

- Others require certified copies (stamped by a professional confirming authenticity)

- Still others require documents bearing an apostille stamp (an international certification of authenticity)

- A few still demand original documents by mail

Therefore, contact your specific bank to understand their requirements before spending money on certifications you don’t need—or worse, submitting documents in the wrong format and getting rejected.

Timeline and Response Management

The Realistic Application Timeline

Source of wealth verification doesn’t happen instantly. From initial application to account opening:

- Week 1-2: Initial review and completeness check

- Week 2-4: Document verification and background screening

- Week 4-8: Potential follow-up questions and additional documentation requests

- Week 8-12: Final review and approval (or rejection with specific reasons)

If everything is perfect, you might get approval in 4-6 weeks. However, with any complications or requests for additional documentation, the timeline extends significantly.

Responding to Information Requests

Banks often request clarification or additional documents. Respond promptly—within 3-5 business days. Why? Delays suggest evasion or disorganization. Quick responses demonstrate professionalism and genuine intent to complete the process.

When the bank asks for clarification, provide exactly what they request. Don’t assume you know what they need. Don’t provide alternative documents you think might work better. Follow their specific requirements precisely.

Following Up Appropriately

After 4 weeks without communication, it’s reasonable to follow up. After 8 weeks, definitely follow up. Don’t be aggressive, but be persistent. Usually, a simple email asking for status and reiterating your commitment yields results.

Advanced Strategies for Complex Wealth Profiles

When Your Wealth Comes from Multiple Sources

Applicants with diversified income (employment + business + investments + rental property) sometimes worry about complexity confusing the bank. Actually, diversity strengthens applications significantly.

Why? Multiple legitimate sources equal lower risk profile. The bank knows you’re not dependent on a single unstable income source. Simply document each source thoroughly and show their combined contribution to your wealth.

Create a consolidated summary showing: 60% from employment, 20% from business profits, 15% from investment dividends, 5% from rental income. Then provide detailed evidence for each category.

Handling Inheritance with Family Complexities

Family money can get complicated quickly. Perhaps you inherited partially, then received gifts from relatives, then loaned money to family members who later repaid you.

Your approach? Document everything clearly. Each transaction should have supporting documentation. If you inherited from an estate that included multiple beneficiaries, explain your specific portion. If you received gifts from multiple family members at different times, document each separately.

Here’s what banks appreciate: complexity isn’t a problem—confusion is. Detailed documentation of complex situations often impresses banks because it demonstrates you understand your own finances thoroughly.

Building a Professional Advisory Team

For complex wealth situations, consider engaging professional advisors specifically for the application process:

- Accountant: Prepares comprehensive financial summary and wealth documentation

- Solicitor: Provides professional letter confirming any property transactions or inheritance details

- Tax advisor: Confirms tax status and explains any unusual tax positions

- Business advisor: Provides detailed business valuation for business owners

Notably, these advisors aren’t required for standard applications, but they’re invaluable for complex situations and often pay for themselves through faster approvals and avoided rejections.

The Final Verification: Self-Audit Before Submission

Before sending anything to the bank, conduct a thorough self-audit:

Completeness Check

- ☐ All required forms completed and signed

- ☐ All requested supporting documentation included

- ☐ Cover letter written and proofread

- ☐ Document index or reference sheet prepared

- ☐ All page numbers included

Accuracy Check

- ☐ All dates are consistent across documents

- ☐ Income figures match across all documentation

- ☐ Employment dates align with history

- ☐ Addresses consistent throughout

- ☐ Names spelled identically on all documents

Professionalism Check

- ☐ Documents are legible and well-formatted

- ☐ No grammatical errors in written sections

- ☐ Professional tone throughout

- ☐ Signatures on required pages

- ☐ Clear organization and labeling

Credibility Check

- ☐ Information passes common-sense logic test

- ☐ Wealth sources make sense for your background

- ☐ Timeline is plausible

- ☐ No suspicious gaps or inconsistencies

- ☐ Professional documentation included where appropriate

This self-audit catches errors before the bank sees them, dramatically increasing approval odds.

What Happens After Submission: Timeline to Account Opening

Once you’ve submitted everything, here’s what typically happens:

Initial Processing (Days 1-5)

The bank’s compliance team checks that everything is included and properly formatted. Incomplete applications get rejected immediately for resubmission.

Document Verification (Days 5-20)

Next, the bank reviews each document, verifying authenticity and checking facts. They cross-reference payslips with employment letters, compare bank statements with stated income, and verify property deeds through public records.

Background and Screening (Days 15-35)

Simultaneously, the bank runs your name through sanctions lists, PEP databases, and adverse media searches. They confirm your employment by contacting employers. Additionally, they verify inheritance through probate registries and check your tax status with tax authorities.

Risk Assessment (Days 30-45)

Based on all collected information, the compliance team assigns you a risk score. Low-risk profiles get approved. Medium-risk profiles get approved with monitoring conditions. High-risk profiles might be escalated for senior management review.

Approval or Request (Days 45-60)

Finally, you either receive approval notification with your account details, or you receive a detailed list of additional documentation needed. If additional documentation is needed, the timeline starts over.

Conclusion: Your Path to Bank Approval

Writing a source of wealth declaration that banks will approve isn’t about deception or manipulation. It’s about clarity, organization, professionalism, and transparency. Here’s the truth: banks don’t reject legitimate applicants with complete documentation. They reject incomplete applications, vague statements, and disorganized submissions.

By following the framework outlined in this guide, you’ve dramatically increased your approval odds:

- You understand the distinction between source of wealth and source of funds

- You know the most common rejection reasons and how to avoid them

- You can organize your wealth narrative into a compelling, credible story

- You understand what documentation is required for your specific situation

- You can present your application professionally and completely

Why does this matter? The process exists to protect both you and the bank. It prevents criminal money laundering while ensuring you’re banking with an institution that understands your financial profile. A bank that properly approves you is a bank that truly knows you.

Ready to open a foreign bank account with confidence? The first step is preparing your source of wealth documentation using this guide. Essentially, complete, professional, transparent documentation opens doors to international banking that might otherwise remain closed.

For those ready to take the next step, Easy Global Banking provides expert guidance on source of wealth requirements across international jurisdictions. Whether you’re opening a foreign bank account or navigating complex source of wealth requirements, their specialists understand the exact documentation each institution requires.