Introduction: The Debanking Crisis and Why High-Risk Industries Need Solutions Now

The financial world has transformed dramatically. Entrepreneurs launching crypto exchanges, online gaming platforms, forex brokers, and other high-risk ventures face an unprecedented banking challenge: debanking. In 2024, complaints about account closures surged 44% in the UK alone. Banks are increasingly slamming the door shut on entire sectors, leaving promising businesses stranded without essential payment infrastructure.

Yet this crisis presents an opportunity. Getting banked in high-risk industries is achievable if you understand the landscape, prepare meticulously, and choose the right jurisdictions and partners. This comprehensive guide reveals exactly how to navigate regulatory mazes, secure reliable banking solutions, and scale your business globally—whether you’re building a crypto exchange, launching an iGaming platform, or operating any other high-risk venture.

What Makes an Industry “High-Risk” in the Eyes of Banks?

Before tackling solutions, you must understand why banks label entire sectors as “high-risk.” This isn’t arbitrary discrimination; it’s rooted in genuine compliance challenges and financial exposure.

The Five Core Risk Factors

Banks categorize industries as high-risk primarily due to five interconnected factors:

- Regulatory Barriers (30%) – Navigating complex, jurisdiction-specific regulations creates compliance headaches. AML/KYC rules, cross-border restrictions, and evolving crypto legislation force banks to invest heavily in monitoring.

- Fraud & AML Risk (25%) – High-risk sectors attract fraudsters and money launderers. Crypto’s pseudonymous nature and gaming’s high-value transactions make these industries attractive to criminals, forcing banks to implement expensive detection systems.

- Chargeback Rates (20%) – Certain sectors experience elevated chargebacks and reversals. Adult entertainment, forex trading, and gaming platforms report 2–5x higher chargeback ratios than mainstream businesses.

- Reputational Risk (15%) – Association with controversial sectors can damage a bank’s brand. Adult content, cannabis, gambling, and crypto all carry stigma in conservative markets and media narratives.

- Business Model Volatility (10%) – Unproven or rapidly evolving business models (like blockchain gaming or DeFi platforms) create unpredictability, making risk assessment difficult for traditional banks.

Understanding these factors is crucial because they directly influence your banking strategy. You’ll need to address each one in your approach.

The Expanding List of High-Risk Sectors

Today’s high-risk industries extend far beyond casinos. They include:

- Cryptocurrency exchanges, custodians, and mining operations – Extreme volatility, regulatory flux, and money-laundering concerns top the list.

- Online gaming and casinos (iGaming) – High transaction volumes, chargebacks, and addiction-related liability.

- Forex and binary options brokers – Market manipulation risks, customer losses, and regulatory action.

- Adult entertainment and content platforms – Reputational concerns and content moderation challenges.

- Cannabis and CBD businesses – Federal legal conflicts, banking restrictions, and inconsistent state regulations.

- Crowdfunding and peer-to-peer lending – Complex fund flows and difficulty verifying project legitimacy.

- Virtual reality and metaverse platforms – New, unregulated sectors with unclear liability frameworks.

Why Traditional Banks Reject High-Risk Clients

The debanking phenomenon isn’t new, but it’s accelerating. Banks implement “de-risking”—the systematic elimination of high-risk clients or sectors—to comply with regulations and protect shareholder value. However, the practice has become controversial, even prompting regulatory intervention in the US and EU.

The Debanking Epidemic (2024–2025)

Recent data reveals the severity:

- UK Financial Ombudsman complaints about account closures rose 44% in 2024 to nearly 3,900, with a higher proportion upheld by regulators.

- Crypto businesses report average account survival rates of only 18 months before closure.

- Gaming operators face repeated service terminations, sometimes with minimal notice (as short as 30 days).

- Payment processor failures often cascade, leaving gaming platforms without backup options.

The result? High-risk businesses are trapped in a vicious cycle: rejected by mainstream banks, forced into expensive alternatives, and perpetually vulnerable to service termination.

Why Even Compliant Businesses Get Debanked

Here’s the paradox: even fully licensed, compliant gaming or crypto businesses get shut down. Why? Banks often prioritize reputational risk over actual compliance. A single negative news story about a sector can trigger mass account closures across institutions.

For example, after media scrutiny of unregulated crypto platforms in 2022, major US banks (JPMorgan Chase, Bank of America, Wells Fargo) implemented soft freezes on all crypto-adjacent accounts, regardless of regulatory status. This wasn’t driven by compliance violations but by reputational calculus.

Understanding this dynamic is critical: you need a banking partner that specializes in your sector and has made a deliberate, long-term commitment to supporting it—not a mainstream bank forced by circumstance to tolerate your business.

The Global Map: Best Jurisdictions for High-Risk Banking

Geography is destiny in high-risk banking. Some jurisdictions have deliberately built crypto-friendly, gaming-friendly banking ecosystems; others remain hostile. Your jurisdiction choice determines your access to banking, your compliance burden, and your ultimate business viability.

Top Six Jurisdictions Ranked by Regulatory Friendliness

Chart 1: Top Countries for High-Risk Banking – Regulatory Friendliness Score

The chart above visualizes the relative friendliness of leading jurisdictions for high-risk banking. Here’s the detailed breakdown:

1. Malta (9/10) – The EU’s Gaming Hub

Best for: Established gaming operators, EU market access, fintech startups.

Malta is the undisputed leader for iGaming banking. The Malta Gaming Authority (MGA) license is globally respected, and crucially, Maltese banks actively support licensed operators.

Key advantages:

- Prestigious MGA license opens doors to EU banking relationships.

- Multiple banks specialize in gaming (Mizuho Bank Malta, certain local institutions).

- Clear regulatory framework with predictable compliance expectations.

- Corporate tax incentives for gaming businesses (6% gaming tax on profits, EU standard corporate taxes elsewhere).

- Access to SEPA payments and Euro-denominated transactions.

Challenges:

- Licensing process takes 3–6 months and requires substantial documentation.

- Higher compliance overhead than offshore jurisdictions.

- Subject to increasing EU AML/FATF scrutiny.

Account opening timeline: 3–6 weeks post-licensing (4–10 weeks total with licensing).

2. Curaçao (9/10) – The Speed Operator’s Paradise

Best for: Rapid market entry, startups, crypto-gaming hybrids.

Curaçao, a Caribbean island nation, has dominated the online gaming licensing market since 1993. The island’s appeal: minimal regulatory overhead with global reach.

Key advantages:

- Fastest licensing in the industry (2–3 weeks for account opening, often concurrent with licensing).

- Single comprehensive license covering all gaming verticals (casino, poker, betting, sports).

- No VAT; corporate tax of 2% on net profits (extremely competitive).

- Powerful IT infrastructure and data center facilities.

- Global market recognition despite being an offshore jurisdiction.

Challenges:

- Less prestigious than Malta; EU market access is more limited.

- Subject to increased international scrutiny for regulatory gaps.

- Higher chargeback rates on Curaçao-licensed platforms (regulatory perception).

Account opening timeline: 2–3 weeks (fastest globally).

3. Switzerland (8/10) – The Crypto Champion

Best for: Crypto trading, DeFi, fintech innovation, high-net-worth clients.

Switzerland is the undisputed leader for crypto banking. The Swiss Financial Market Supervisory Authority (FINMA) created the first comprehensive crypto banking framework globally, spawning a thriving ecosystem of crypto-native banks.

Key institutions:

- Sygnum Bank – Fully licensed crypto bank offering trading, custody, and asset management.

- SEBA Bank – Institutional-grade crypto services.

- Bank Frick (Liechtenstein, EU-regulated) – Tokenization and blockchain services.

- Hypothekarbank Lenzburg – Banking services for fintech companies.

Key advantages:

- World-leading regulatory clarity (FINMA guidelines are templates for global regulators).

- Tax efficiency (no capital gains tax for individuals on long-term holdings; Zug and Lugano accept Bitcoin tax payments).

- Institutional-grade security and custody.

- “Crypto Valley” ecosystem (Zug) with 1,000+ blockchain companies.

Challenges:

- Accounts take 4–8 weeks to establish (slower than offshore).

- Minimum account sizes often €500K–$1M+.

- Stricter compliance documentation required upfront.

Account opening timeline: 4–8 weeks.

4. Seychelles (8/10) – The Emerging Darling

Best for: Startups, offshore crypto firms, rapid scaling.

Seychelles, a small Indian Ocean island nation, has rapidly become a destination for crypto and gaming startups. The appeal: minimal bureaucracy, fast setup, and a truly offshore regulatory environment.

Key advantages:

- Fastest account opening (2–4 weeks).

- Minimal local regulatory oversight; no resident banking required.

- No corporate or capital gains taxes on international business.

- Very low operational costs.

- Growing ecosystem of crypto-friendly EMIs (Electronic Money Institutions).

Challenges:

- Minimal regulatory credibility; banks often view Seychelles incorporation as a red flag.

- Limited access to traditional banking; relies on EMI and crypto payment processors.

- Reputational risk for consumer-facing platforms (implies “hiding”).

Account opening timeline: 2–4 weeks (but may be EMI account rather than traditional banking).

5. United Kingdom (7/10) – The EMI Specialist

Best for: Non-resident crypto firms, fast market entry, SEPA access.

The UK uniquely supports high-risk businesses through Electronic Money Institutions (EMIs). While traditional UK banks shun crypto and gaming, UK-regulated EMIs actively support these sectors.

Key EMI providers:

- Wise (fintech transfers for gaming operators).

- Rapyd, Skrill, Neteller (payment processing with EMI banking).

- Various UK-licensed EMIs specializing in crypto merchant services.

Key advantages:

- EMI accounts open in 2–6 weeks; no minimum balance requirements.

- Regulatory credibility (FCA oversight, though lighter than banking).

- SEPA access for Euro payments and EU fund transfers.

- Non-resident friendly (no UK residency required).

Challenges:

- EMI accounts are not full banking (limited lending, derivatives, etc.).

- Subject to increasing FCA scrutiny on high-risk sectors.

- Payment processor integration sometimes blocked by traditional acquirers.

Account opening timeline: 2–6 weeks.

6. Canada (7/10) – The Transparent Path

Best for: Regulated crypto platforms, legitimate gaming startups, North American focus.

Canada has emerged as a surprising leader in crypto banking, driven by regulatory clarity and forward-thinking financial institutions willing to support compliant businesses.

Key advantages:

- Growing ecosystem of crypto-friendly banks (Kraken integration, DeFi protocols).

- Strong regulatory framework (FINTRAC for AML, provincial gaming authorities).

- High trust among institutional investors and customers.

- No upfront licensing required for crypto exchanges (only for money transmission, which is provincial).

Challenges:

- Strict KYC/AML enforcement; compliance documentation extensive.

- Provincial fragmentation (different rules by province).

- Account opening slower (2–6 weeks) due to rigorous vetting.

Account opening timeline: 2–6 weeks.

Comparative Banking Solutions Table

| Jurisdiction | Specialization | Account Speed | Account Type | Licensing Required? | Best For |

|---|---|---|---|---|---|

| Malta | Gaming, iGaming, fintech | 3–6 weeks | Traditional bank account | Yes (MGA gaming license required) | EU gaming, established operators, payment flexibility |

| Curaçao | Gaming, crypto-gaming | 2–3 weeks | Traditional bank account | Yes (e-Gaming license required) | Fast crypto/gaming market entry, startups, cost optimization |

| Switzerland | Crypto, DeFi, fintech | 4–8 weeks | Full banking relationship | Depends on crypto type | Crypto with compliance, Swiss privacy, institutional clients |

| Seychelles | Crypto, offshore ventures | 2–4 weeks | EMI or offshore account | No | Small firms needing speed, offshore cryptocurrency |

| United Kingdom | Crypto, fintech, gaming | 2–6 weeks | EMI account (not full banking) | No | UK EMI for non-residents, SEPA access, fintech |

| Canada | Crypto, regulated fintech | 2–6 weeks | Traditional bank account | Depends on province | Transparent, regulated business, North American focus |

Step-by-Step: How to Secure a High-Risk Business Bank Account

Getting banked isn’t just about choosing a jurisdiction—it’s a methodical process that separates successful applicants from those facing rejection. Here’s the exact playbook:

Step 1: Define Your Profile and Choose Your Jurisdiction

Before applying anywhere, crystallize:

- Your business model – Are you a crypto exchange, gaming operator, payment processor, forex broker, or something else?

- Your target markets – Do you need EU access, Asian reach, North American focus?

- Your compliance posture – Are you regulated (licensed)? Do you have AML/KYC policies in place?

- Your team’s expertise – Do you have compliance professionals on staff?

Match this profile to the jurisdiction table above. A EU-focused gaming startup should prioritize Malta. A crypto startup wanting rapid scaling should consider Seychelles or Curaçao. A high-net-worth crypto investor should target Switzerland.

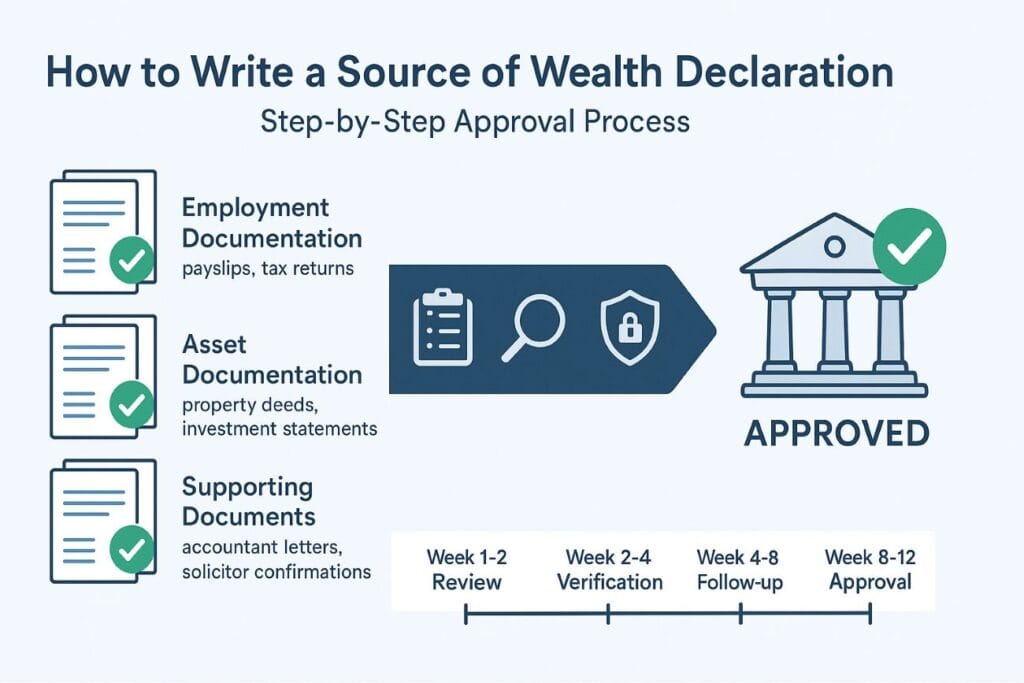

Step 2: Prepare Your Documentation Package

Banks don’t just want assurances; they want evidence. Your documentation package should be exhaustive and pristine:

Essential documents:

- Company Formation & Governance

- Articles of incorporation and bylaws.

- Shareholder registry and cap table.

- Board meeting minutes and resolutions.

- Proof of registered office/legal address.

- Beneficial Ownership & Directors

- Passports/government-issued ID for all directors and beneficial owners (>25% stake).

- Proof of address (utility bill, lease, or official government document) dated within 3 months.

- Curriculum vitae for each director and beneficial owner.

- Background check authorization forms (banks often run independent checks).

- Compliance Framework

- AML/KYC policy document.

- Customer due diligence (CDD) procedures.

- Transaction monitoring policy.

- Suspicious activity reporting (SAR) procedures.

- Code of conduct for staff.

- Business Documentation

- Business plan (2–5 pages, covering market, model, revenue projections).

- Updated financial statements (if established; if startup, 12-month projections).

- Audited financials (required for most institutional banks; EMIs often waive for startups).

- List of key software/technology providers.

- Insurance policies (liability, cyber, etc.).

- Regulatory & Licensing

- Gaming license (if applicable) – copy of license from MGA, Curaçao authority, etc.

- Crypto license or registration (if applicable).

- Legal opinions on business legitimacy in target jurisdictions.

- Proof of any professional certifications (ISO 27001 for security, etc.).

- Source of Funds & Capitalization

- Bank statements showing initial capitalization (3–6 months history).

- Documentation of founder wealth (real estate deeds, brokerage statements, corporate ownership docs).

- If funded by external investors, shareholder agreements and investor background verification.

- Technical & Operational

- Description of platform/technology (white papers for blockchain projects).

- Security certifications or audit reports.

- Data processing agreements (GDPR compliance for EU customers).

Step 3: Research and Select a Banking Partner

Not all banks are equal in high-risk sectors. Your selection should be targeted and strategic.

Tier 1 approach: Specialist banks

- These banks have deliberately positioned themselves in high-risk sectors.

- Examples: SEBA Bank (crypto), Sygnum Bank (crypto/fintech), specialized gaming banks in Malta.

- Advantage: They understand your sector, have streamlined processes, and are unlikely to suddenly debank you.

- Drawback: Often higher fees and more rigorous compliance.

Tier 2 approach: Niche EMIs

- Electronic Money Institutions in the UK, EU, and beyond that specialize in gaming or crypto.

- Examples: Wise, Rapyd, Skrill, specialized fintech EMIs.

- Advantage: Faster onboarding, lower fees, more accessible.

- Drawback: Limited banking services (no lending, derivatives, etc.); higher debanking risk if regulatory pressure mounts.

Tier 3 approach: Traditional banks with programs

- Certain mainstream banks (especially regional institutions) have crypto or gaming programs.

- Examples: Hypothekarbank Lenzburg (fintech partners), DBS Bank Singapore (institutional crypto).

- Advantage: Full banking services, regulatory prestige.

- Drawback: Extremely rigorous vetting; very slow onboarding; potential for sudden closure.

Strategy: Start with Tier 1 (specialist banks). They’re built for your sector and less likely to ghost you. Use Tier 2 (EMIs) as backup or secondary accounts for payment processing. Avoid Tier 3 unless you’re established and have significant institutional backing.

Step 4: Submit Your Application

Most banks offer two pathways:

Online application portal:

- Upload all documents.

- Fill out standardized questionnaires.

- May take 3–8 weeks for review.

- Suited for EMIs and newer fintech banks.

White-glove banking consultant:

- Work with a bank’s relationship manager or a third-party banking consultant.

- Pre-vetting before formal application; faster resolution of missing docs.

- Personal guidance through compliance review.

- Suited for specialist crypto banks and high-minimum-balance institutions.

Recommendation: For first-time applicants in high-risk sectors, hire a banking consultant or work with a bank’s dedicated relationship team. The upfront cost ($1,000–$5,000) often saves weeks of back-and-forth and rejection risk.

Step 5: Undergo Enhanced Due Diligence (EDD)

Banks take an “Enhanced Due Diligence” (EDD) approach to high-risk sectors. This is far more rigorous than standard onboarding:

EDD components:

- Background checks on all directors/beneficial owners (criminal history, sanctions screening, PEP verification).

- Source of wealth verification – banks want to know exactly where your initial capital came from.

- Source of funds validation – for each incoming transfer, banks may request documentation.

- Business model validation – bankers will review your platform, test your controls, and grill you on operations.

- Regulatory compliance audit – third-party review of your AML/KYC systems.

- Customer list verification – if you already have customers, banks may request a sample for independent verification.

Timeline: 2–6 weeks, depending on complexity.

Pro tip: Anticipate EDD questions. Prepare written responses to tough questions (e.g., “How will you prevent money laundering on your platform?”). Transparency and detailed process documentation significantly speed approval.

Step 6: Maintain Ongoing Compliance

Opening the account is just the beginning. Banks maintain continuous monitoring of high-risk accounts:

- Monthly transaction reporting – submission of account activity summaries.

- Annual compliance certifications – renewal of compliance documentation and officer sign-offs.

- Regulatory liaison – direct communication with the bank’s compliance team on evolving regulations.

- Regular audits – third-party audits of your AML/KYC systems (often annual or semi-annual).

Budget for ongoing compliance costs: $5,000–$50,000+ annually, depending on account size and sector.

Why Compliance Is Your Competitive Advantage

Here’s a counterintuitive truth: compliance isn’t an obstacle—it’s your strongest moat.

Platforms that implement “compliance by design” enjoy several competitive edges:

- Reduced debanking risk – Banks trust operators who proactively manage compliance, making surprise account closures far less likely.

- Premium customer base – Compliant platforms attract institutional investors, accredited players, and serious businesses that avoid “sketchy” platforms.

- Regulatory moat – Once you’re licensed and banking, new competitors face the same barriers, reducing competition.

- Operational efficiency – Strong compliance processes reduce fraud, chargebacks, and customer disputes, improving profitability.

- Exit value – Investors and acquirers heavily discount businesses with compliance red flags; strict compliance increases valuation multiples.

Why Payment Processors Are Your Backup Plan

Even with a bank account, most high-risk businesses need secondary payment infrastructure because traditional payment gateways often refuse to process high-risk merchant categories.

Top Payment Processors for Crypto and Gaming

| Provider | Best For | Cryptocurrencies | Key Benefit |

|---|---|---|---|

| CoinPayments | Crypto gaming, multi-asset platforms | 100+ cryptocurrencies | Low fees, wallet integration |

| BitPay | Trusted crypto platforms, fiat settlement | BTC, ETH, stablecoins | Industry standard, security focus |

| CoinGate | Diverse crypto ecosystem | 70+ cryptocurrencies | Transparent fees, global reach |

| Coinbase Commerce | Institutional players | BTC, ETH, USDC | Trusted brand, seamless UX |

| XAIGate | Stablecoin focus, no-KYC model | USDT, USDC, PYUSD+ | Rapid API setup, cost-efficient |

| Adyen | Global scaling, advanced fraud detection | Fiat + crypto options | Enterprise SLA, 24/7 support |

Integration strategy: Use your primary bank for core business banking (payroll, ops, treasury). Layer payment processors on top for customer-facing transactions (gaming payouts, crypto settlement, etc.).

Real-World Case Study: The Path of a Crypto-Casino Startup

Let’s make this concrete with a detailed case study:

The Venture: HashRoll, a decentralized gaming platform accepting Bitcoin, Ethereum, and stablecoins.

The Challenge: Founded by three engineers in Singapore, HashRoll is fully licensed under Malta’s remote gaming license (MGA). They’re profitable. But when they tried to open a traditional bank account in Singapore, every bank rejected them. When they approached a major US banking partner, they were offered a single 30-day window to close their account.

The Strategy:

- Repositioned geographically – Moved legal entity to Malta to leverage MGA prestige and access Maltese banking.

- Built compliance-first – Implemented blockchain-based transaction monitoring via Chainalysis partnership; employed a full-time compliance officer.

- Selected a specialist bank – Approached Hypothekarbank Lenzburg (Switzerland), which has a dedicated fintech program.

- Comprehensive documentation – Prepared 300+ pages of business documentation, including technical architecture, player verification procedures, and AML controls.

- Engaged a banking consultant – Hired a Swiss banking consultant who had relationships with the bank’s compliance team; expedited review from 8 weeks to 3.5 weeks.

- Layered payment processors – BitPay for player crypto settlements; CoinGate as backup; Wise for EUR/USD operations.

Result: Within 6 months, HashRoll had secured:

- Primary operating account in Malta (with MGA-licensed bank).

- Secondary cryptocurrency custody account in Switzerland (Sygnum).

- Payment processing via BitPay and Wise.

Lessons:

- Specialization + licensing + documentation = success.

- Blockchain-based compliance tools significantly boost banker confidence in crypto firms.

- Layering multiple banking partners reduces single-point-of-failure risk.

The Roadmap to Global Banking Success

High-risk industries can get banked. The path is neither quick nor simple, but it’s navigable for entrepreneurs willing to invest in compliance, documentation, and strategic geographic positioning.

Your 90-day action plan:

Weeks 1–2: Define and Document

- Clearly define your business model and target markets.

- Compile all documentation (governance, director IDs, AML policies, business plan).

- Obtain any regulatory licenses (gaming, crypto, etc.).

Weeks 3–4: Research and Select

- Identify 3–5 target banks or EMIs based on the jurisdiction table.

- Contact their relationship managers or hiring consultants.

- Assess realistic timelines and fee structures.

Weeks 5–8: Apply and Engage

- Submit formal applications (online portal or white-glove process).

- Prepare for enhanced due diligence questions.

- Respond rapidly to information requests; delays kill applications.

Weeks 9–12: Obtain and Optimize

- Activate your primary account once approved.

- Implement secondary payment processors (BitPay, CoinGate, etc.).

- Begin monthly compliance reporting and annual audit cycles.

By following this roadmap and the strategies detailed throughout this article, even the most innovative high-risk businesses can secure reliable banking—and protect their future growth.

Frequently Asked Questions

Q: Can a non-resident open a bank account for a gaming or crypto company?

A: Yes, absolutely. Non-residents are common in gaming and crypto banking. Your best options:

- Malta or Curaçao banks (non-residency is standard).

- UK EMIs (designed for international users).

- Swiss banks (wealth management division for institutions).

Non-residency doesn’t disqualify you; it just means banks will scrutinize your source of funds and beneficial ownership more closely. Work with a banking consultant who has experience with non-residents to streamline the process.

Q: My gaming/crypto platform was rejected by three banks. What’s my next move?

A: Rejection often signals opportunity for differentiation:

- Request specific feedback – Email each bank asking why (compliance gap, sector policy, etc.).

- Address the gap – If it’s compliance-related, hire a compliance consultant and re-apply with enhanced documentation.

- Shift geography – Try a different jurisdiction (e.g., if US-based banks reject you, pivot to Malta or Switzerland).

- Layer solution – Combine multiple EMIs and payment processors instead of hunting for a single “perfect” bank.

- Hire a consultant – A banking consultant often has direct relationships with underwriters and can advocate on your behalf.

Q: How much does it cost to open a high-risk business bank account?

A: Costs vary widely:

| Component | Cost Range |

|---|---|

| Banking consultant (optional but recommended) | $3,500–$25,000 |

| Regulatory licenses (gaming/crypto, if required) | $1,000–$50,000+ |

| Compliance software/setup | $2,000–$15,000 |

| Account opening fees | $0–$2,000 (usually free with EMIs) |

| Annual compliance & audit | $5,000–$50,000+ |

| Total first-year estimate | $11,500–$142,000 |

For startups, $20,000–$40,000 is a realistic budget to secure banking plus ongoing compliance infrastructure.

Q: Do I need a physical office in the banking jurisdiction?

A: Not necessarily, but it helps significantly:

- Malta, Curaçao, Seychelles: Virtual offices suffice; banks verify via video call.

- Switzerland: Physical presence often expected for larger accounts; virtual addresses work for smaller EMI accounts.

- Canada, UK: No physical presence required; verification via video/remote documentation.

Pro tip: If you’re optimizing for cost, Malta with a virtual office is a strong balance of regulatory credibility and cost efficiency.

Q: How long before my account gets shut down?

A: This depends entirely on your banking partner and ongoing compliance:

- Specialist banks (Sygnum, SEBA, Hypothekarbank): Extremely low closure risk (< 1% annually) if compliance is maintained.

- EMIs (Wise, Rapyd): Moderate risk (2–5% annually) as they face regulatory pressure.

- Mainstream banks with programs: High risk (10–20% annually) as they retreat from high-risk sectors.

Mitigation: Maintain multiple banking relationships. If your primary account closes, activate a secondary EMI or processor immediately.

The Hidden Advantage: Why High-Risk Banking Is Consolidating

A counterintuitive opportunity: the crisis in high-risk banking is consolidating the market. Weak players are exiting; specialized operators are expanding.

This means:

- Specialist banks are offering better terms to retain quality clients.

- Compliance infrastructure is improving (better detection tools, more efficient processes).

- Regulatory clarity is increasing (governments are establishing clearer rules).

For entrepreneurs who invest in compliance now, the next 12–24 months offer an unprecedented window to establish reliable banking relationships before the market hardens.

Ready to Scale? Partner With Easy Global Banking

High-risk industries need high-touch banking solutions. Whether you’re launching a crypto exchange, scaling an iGaming platform, or building the next fintech unicorn, you need a partner who understands both your sector and the global regulatory landscape.

Easy Global Banking specializes in exactly this challenge. With deep relationships in Malta, Switzerland, Singapore, and beyond, we’ve helped 500+ high-risk businesses secure reliable banking, maintain compliance, and scale globally.

Why Choose Easy Global Banking?

- Expert Consulting – Our team has navigated the banking landscape for crypto, gaming, forex, and fintech platforms. We know which banks say “yes” and which say “no.”

- Relationship Access – Direct connections to relationship managers and underwriters at specialist banks reduce rejection risk and accelerate approvals.

- Compliance Infrastructure – We help you build AML/KYC systems that bankers trust, significantly improving approval odds.

- Multi-Jurisdiction Expertise – Whether you’re targeting Malta, Switzerland, Singapore, or Curaçao, we’ve successfully positioned clients in each jurisdiction.

- Ongoing Support – Compliance evolves; we help you stay ahead of regulatory changes to prevent account closures.

Your Next Step

Don’t leave your banking future to chance. Start with a free consultation to assess your specific situation, identify the best banking jurisdictions for your business model, and develop a targeted strategy for securing reliable accounts.

Open a foreign bank account with expert guidance from Easy Global Banking. Whether you need a Swiss Bank Account, a Singapore Bank Account, or a solution tailored to your jurisdiction, we’ll navigate the complexity so you can focus on scaling.

The best time to secure banking is before you desperately need it. Start today.

Conclusion: The Future Is Compliant, Specialized, and Global

The era of high-risk businesses operating from the shadows is ending. Banks are consolidating; regulators are tightening; customers demand legitimacy.

But this isn’t a threat—it’s an opportunity. Platforms that embrace compliance, document meticulously, and partner with specialists are winning. They’re building moats around their businesses, attracting premium customers, and scaling at rates their less-compliant competitors can’t match.

If you’re in a high-risk industry, the question isn’t whether to get banked—it’s whether you’ll do it strategically or scramble when crisis hits.

Choose the former. Start now. Your future self will thank you.