Discovering you’re a United States citizen when you’ve never truly lived there can feel like stepping into a legal minefield. For thousands of “Accidental Americans” across the globe, this revelation often arrives not through a welcome letter but through a banking crisis—frozen accounts, denied services, or demands for documentation they never knew they needed. The Foreign Account Tax Compliance Act (FATCA) stands at the center of this upheaval, transforming everyday banking into a bureaucratic nightmare for individuals who only hold American citizenship by birthright.

Understanding how FATCA affects Accidental Americans and discovering viable solutions has become essential for maintaining financial stability. Whether you’re considering compliance strategies or exploring international banking alternatives, navigating this complex landscape requires both knowledge and strategic planning.

Who Are Accidental Americans and Why Does It Matter?

An Accidental American is someone who possesses United States citizenship—often unknowingly—but maintains minimal or no connection to the country. This citizenship typically arises through specific circumstances that many people don’t realize carry lifelong tax implications.

The most common scenarios include being born on American soil to foreign parents who later returned to their home country, or being born abroad to at least one U.S. citizen parent who registered the birth at an American embassy. Under the legal principle of jus soli (right of the soil), anyone born in the United States automatically becomes a citizen regardless of their parents’ immigration or tax status. Similarly, citizenship can transfer through parentage even if the child never sets foot in America.

Many Accidental Americans live their entire lives unaware of their status until a triggering event occurs. Foreign banks, now required to comply with FATCA regulations, have become the primary mechanism forcing this discovery. When these institutions identify potential U.S. citizenship indicators—such as a U.S. birthplace on a passport or an American parent listed on account documents—they request immediate compliance documentation.

The United States employs citizenship-based taxation rather than residence-based taxation, making it one of only two countries worldwide (along with Eritrea) to tax citizens on their global income regardless of where they live. This fundamental difference means that while most nations only tax residents, America pursues its citizens everywhere, creating obligations that catch Accidental Americans completely off guard.

Understanding FATCA: The Law That Changed Everything

The Foreign Account Tax Compliance Act entered into force on July 1, 2014, as part of the 2010 HIRE Act signed by President Barack Obama. Congress designed FATCA to combat tax evasion by Americans hiding wealth in offshore accounts, but the legislation’s broad reach has ensnared countless individuals with no intention of evading taxes.

FATCA operates through a two-pronged approach that creates obligations for both foreign financial institutions and U.S. taxpayers. On the institutional side, foreign banks, investment funds, insurance companies, and other financial entities must identify U.S. account holders and report their financial information to the Internal Revenue Service. Institutions failing to comply face a devastating 30% withholding tax on U.S.-source payments, creating powerful incentives for cooperation.

Currently, 113 countries have established FATCA agreements with the United States through two primary models. Model 1 agreements allow foreign financial institutions to report customer information to their domestic tax authority, which then automatically shares it with the IRS. Model 2 agreements require direct reporting from foreign banks to the IRS, though Switzerland recently transitioned from Model 2 to Model 1 in a new agreement signed in June 2024.

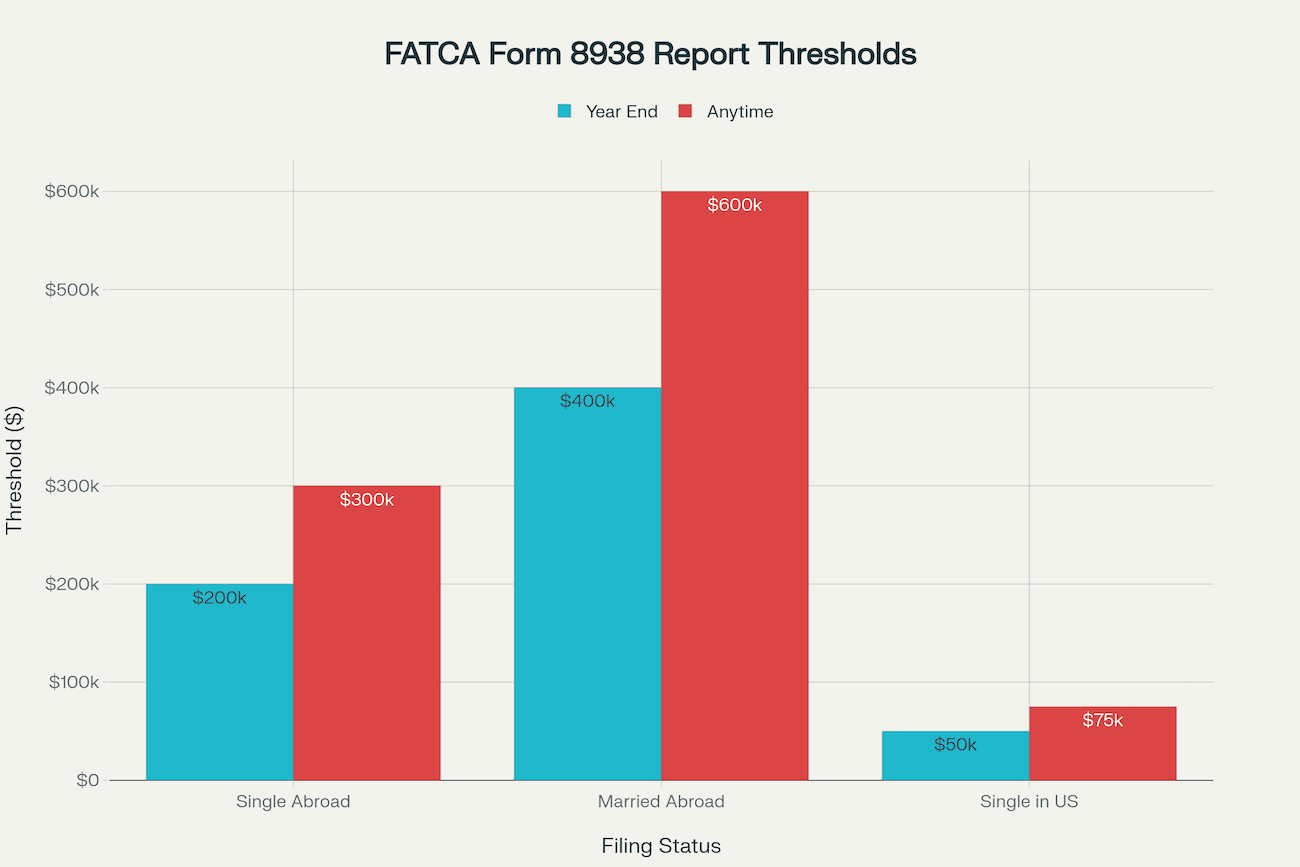

For individual taxpayers, FATCA introduced Form 8938 (Statement of Specified Foreign Financial Assets), which requires reporting when foreign assets exceed specific thresholds. Americans living abroad must file this form when their foreign financial assets exceed $200,000 on the last day of the tax year or $300,000 at any point during the year for single filers. Married couples filing jointly face thresholds of $400,000 and $600,000 respectively. For those residing in the United States, the thresholds drop dramatically to just $50,000 and $75,000 for single filers.

FATCA Form 8938 reporting thresholds vary significantly based on residency and filing status

These reporting requirements exist in addition to the longstanding FBAR (Foreign Bank and Financial Accounts Report), filed on FinCEN Form 114, which applies when the aggregate value of foreign accounts exceeds $10,000. The overlapping compliance obligations create confusion and substantially increase the risk of inadvertent violations.

The Banking Crisis: How FATCA Disrupts Financial Access

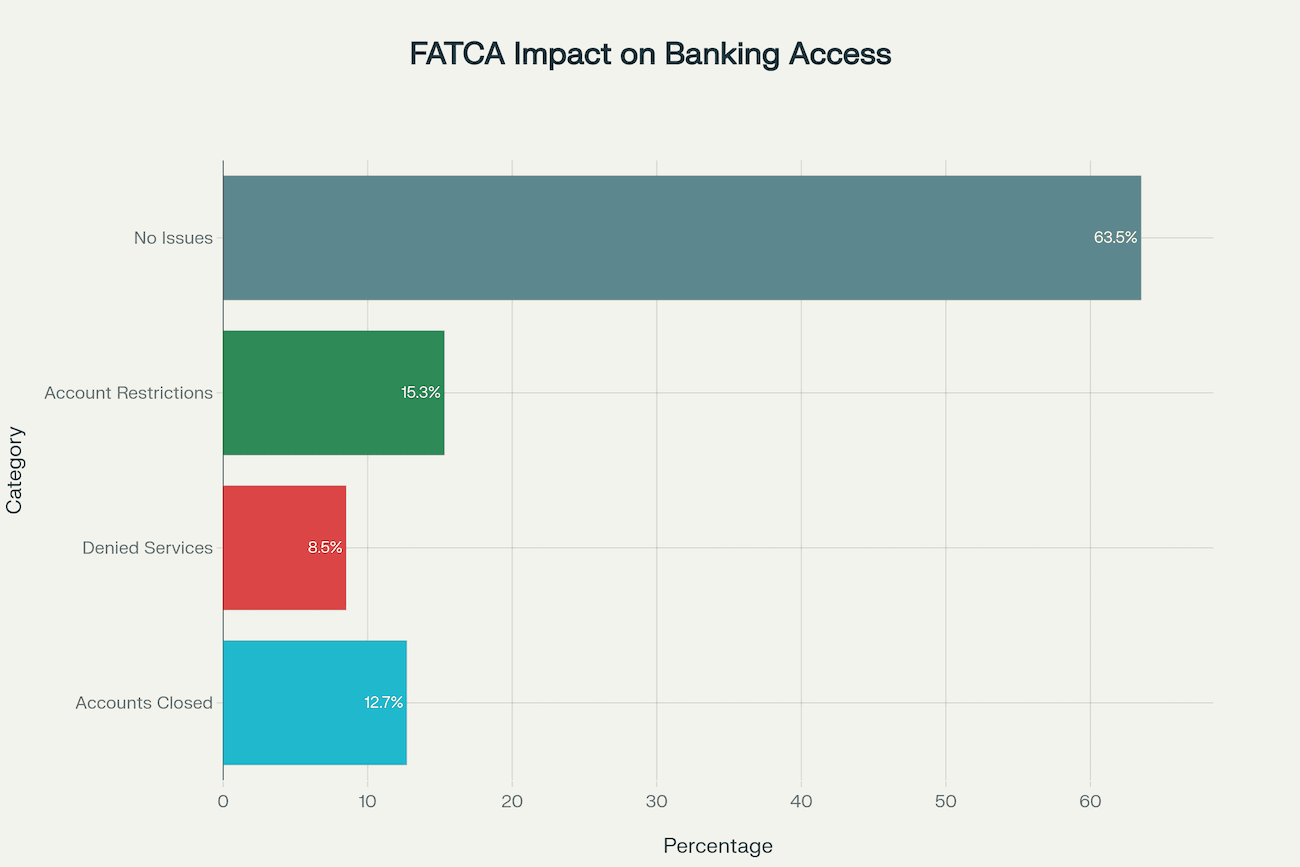

FATCA has fundamentally altered the relationship between foreign banks and American citizens, creating what many describe as “financial exile” for those living abroad. Research from Democrats Abroad’s 2014 survey revealed that 12.7% of respondents had experienced account closures due to their U.S. citizenship. More troubling still, the percentage facing some form of banking restriction—including denied services, higher fees, or limited account types—reached approximately 36.5%.

FATCA’s impact on banking access for Accidental Americans, showing the percentage experiencing various banking challenges

Foreign financial institutions face substantial compliance costs and legal risks when serving U.S. clients. Each American account requires enhanced due diligence procedures, annual reporting to the IRS, and ongoing monitoring to ensure continued compliance. For smaller regional banks with few American customers, the administrative burden simply doesn’t justify the relationship.

Major European institutions including Deutsche Bank, BNP Paribas, and UBS have sent termination letters to American clients in recent years. German online brokerage FlatexDEGIRO AG informed its approximately 1,000 American clients in December to find alternative services. Investment firms including Wells Fargo, Merrill Lynch, Charles Schwab, and Fidelity have closed expat brokerage accounts or stopped accepting Americans as new clients.

The Netherlands has witnessed particularly severe impacts, with Dutch citizens holding accidental American status losing bank accounts when they cannot provide U.S. Tax Identification Numbers (TINs) or Social Security Numbers (SSNs). Finance Minister Wopke Hoekstra’s response to parliamentary questions acknowledged the growing problem but offered limited solutions, leaving thousands in financial limbo.

Susan, an American living in Denmark, experienced the ultimate frustration when she was “de-banked” for the third time solely due to FATCA. Despite being a loyal customer for years, two banks recently demanded she close her accounts with the same message: “We’re sorry, but we can no longer keep American clients”. She and her husband were forced to separate their finances entirely to prevent him from being penalized for her nationality.

Banks increasingly demand Form W-9 from customers identified with U.S. connections, and failure to comply triggers account freezes or closures. Some institutions freeze accounts immediately, leaving customers without access to their funds until they demonstrate U.S. tax compliance—an impossible demand for those just discovering their status. Others simply close accounts and mail checks for the balances, severing the relationship entirely.

Tax Obligations That Accidental Americans Must Understand

Even without having lived in the United States or earned a single dollar of American income, Accidental Americans face comprehensive annual tax filing requirements. The IRS expects Form 1040 reporting worldwide income every year, regardless of residence location or where the income originates.

Beyond standard tax returns, foreign account reporting creates additional layers of obligation. The FBAR requirement kicks in when the combined balance of all foreign financial accounts exceeds $10,000 at any point during the calendar year. This threshold is aggregate, meaning even multiple small accounts can trigger the filing requirement when totaled together.

FATCA’s Form 8938 operates with higher thresholds but captures a broader range of assets. While FBAR focuses specifically on bank and financial accounts, Form 8938 includes foreign stocks, securities, partnership interests, and interests in foreign entities. The form must be filed alongside the annual tax return, making it subject to the same deadline extensions available to Americans abroad.

Penalties for non-compliance can be financially devastating, even when no actual tax is owed. The IRS imposes a 5% monthly penalty on unpaid taxes for late returns, capping at 25% of the total amount. Returns more than 60 days late face a minimum penalty regardless of the amount owed.

FBAR violations carry particularly harsh consequences. Non-willful failures to file can result in penalties up to $12,500 per year per unreported account. Willful violations trigger the greater of $100,000 or 50% of the account’s highest balance. For someone with multiple accounts spanning several years of non-compliance, these penalties can easily exceed the total value of the accounts themselves.

Form 8938 penalties begin at $10,000 for failure to file and increase with continued non-compliance. Unlike income tax penalties, these information return penalties apply regardless of whether any tax is actually owed, punishing the paperwork violation itself.

| Violation Type | Penalty Amount | Details |

|---|---|---|

| Failure to File Tax Return | 5% per month (max 25%) | Of unpaid tax amount; minimum penalty after 60 days |

| Late FBAR Filing (Non-Willful) | Up to $12,500 per year | Per unreported account |

| Late FBAR Filing (Willful) | $100,000 or 50% of account balance | Whichever is greater |

| FATCA Form 8938 Non-Filing | $10,000+ | Increasing penalties for continued non-compliance |

| Renunciation Fee | $2,350 | US State Department fee to renounce citizenship |

Fortunately, most Accidental Americans can eliminate or substantially reduce actual tax liability through provisions like the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC). The FEIE allows qualifying taxpayers to exclude approximately $120,000 of foreign-earned income from U.S. taxation in 2024. The FTC permits dollar-for-dollar credits for taxes paid to foreign governments, preventing most double taxation.

Practical Solutions: The Streamlined Filing Procedure

The IRS Streamlined Filing Compliance Procedures represent the primary pathway for Accidental Americans to achieve tax compliance without facing crushing penalties. Introduced in 2012 and expanded in subsequent years, this amnesty program specifically targets taxpayers whose failure to file resulted from non-willful conduct rather than intentional evasion.

The program requires submission of three years of delinquent or amended tax returns, six years of FBAR filings, and Form 14653 certifying that the non-compliance was unintentional. The certification requires a detailed explanation of circumstances leading to the failure to file, demonstrating good faith and lack of willful intent.

| Requirement | Details |

|---|---|

| Tax Returns to File | 3 most recent years |

| FBAR Filings | 6 most recent years |

| Certification Form | Form 14653 (certifying non-willful conduct) |

| Eligibility – Non-Residency | 330+ days outside US in one of last 3 years |

| Eligibility – Conduct | Failure to file must be non-willful |

| Eligibility – IRS Contact | No prior IRS audit or contact |

| Penalties | Generally waived if qualified |

Eligibility requires meeting several key criteria. Applicants must have spent at least 330 full days outside the United States during one of the last three tax years and cannot have maintained a primary residence in the U.S. during that period. The failure to file must have been non-willful, encompassing honest mistakes, misunderstanding, negligence, or genuine ignorance of the requirements.

Critically, the program becomes unavailable once the IRS initiates contact regarding delinquent filings or opens an audit. This creates urgency for Accidental Americans who discover their status—acting proactively before IRS enforcement action preserves access to the streamlined option.

The major advantage of qualifying for the Streamlined Procedures is complete penalty relief. While participants must pay any actual taxes owed (minus applicable credits and exclusions), the IRS waives the substantial late filing, failure to pay, and information return penalties that would otherwise apply.

Processing streamlined submissions typically takes several months, and applicants need a Social Security Number or Individual Taxpayer Identification Number to file. Those who never obtained an SSN can apply for one through U.S. consulates or embassies, though recent years have seen frustrating delays in this process.

Alternative Solution: Renouncing U.S. Citizenship

For Accidental Americans with no genuine connection to the United States and no intention of ever living there, renouncing citizenship offers a permanent solution to eliminate future tax obligations. However, this path involves significant complexity, cost, and potential tax consequences that require careful consideration.

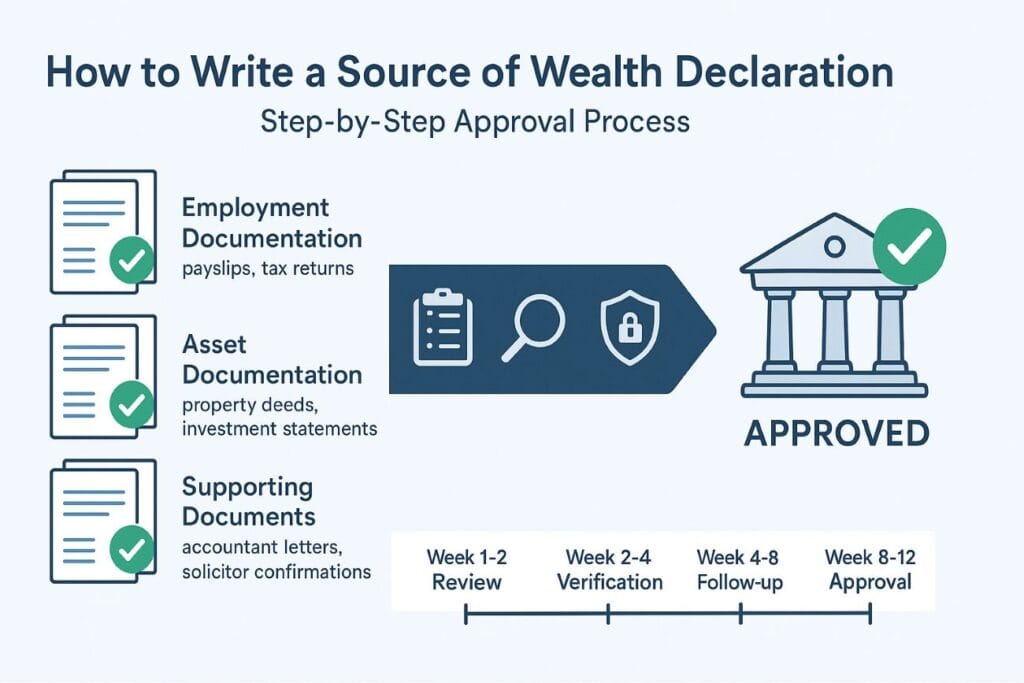

The renunciation process begins with obtaining a second citizenship, as the United States will not approve applications that would render someone stateless. Applicants must then complete multiple State Department forms including DS-4079 (Request for Determination of Possible Loss of United States Nationality), DS-4080 (Oath/Affirmation of Renunciation), and DS-4081 (Statement of Understanding Concerning Consequences).

The renunciation appointment must occur at a U.S. embassy or consulate abroad, where a consular officer will ensure the applicant understands the permanent, irrevocable nature of the decision. The State Department charges a $2,350 fee for processing renunciation cases, one of the highest such fees anywhere in the world.

Tax compliance represents a critical prerequisite for clean renunciation. The IRS requires Form 8854 (Initial and Annual Expatriation Statement) filed with the final tax return, certifying five years of tax compliance prior to expatriation. Failure to properly complete this process can result in continuing tax obligations and substantial penalties even after citizenship ends.

Certain high-net-worth individuals may face an “exit tax” upon renunciation. The Expatriation Tax applies to “covered expatriates”—those with a net worth exceeding $2 million or average annual income tax liability above $190,000 for the five years preceding expatriation. This tax treats worldwide assets as if sold on the day before expatriation, potentially triggering capital gains obligations.

Fortunately, relief procedures specifically designed for Accidental Americans can simplify this process. For those who acquired citizenship at birth, relinquished it before age 18.5, and meet certain residence requirements, special provisions may eliminate exit tax obligations entirely. Similarly, dual citizens from birth who have minimal U.S. ties may qualify for exemptions.

The total cost of renunciation can range from €10,000 to €20,000 when including professional tax preparation, legal advice, and compliance work required to satisfy all IRS requirements. Despite these obstacles, the number of Americans renouncing citizenship has increased significantly since FATCA implementation, reaching record levels in recent years.

Banking Solutions for Accidental Americans

Despite FATCA’s challenges, viable banking options still exist for Americans living abroad. Success often requires persistence, strategic selection of financial institutions, and sometimes accepting limitations compared to what non-American clients receive.

Several major international banks continue to serve American clients while maintaining FATCA compliance. HSBC Expat offers multi-currency accounts designed specifically for expatriates, with support for USD, EUR, and GBP denominated accounts. The bank provides global money accounts facilitating international payments, foreign exchange services, and access to investment products.

Citibank International Personal Banking leverages the institution’s global presence across more than 60 countries to deliver comprehensive services for Americans abroad. The CitiGold tier, requiring $200,000 in combined balances, provides dedicated multilingual relationship managers and waives many transaction fees. Standard Chartered International Banking focuses on Africa, Asia, and the Middle East, offering sophisticated multi-currency platforms with 48-hour account setup for verified applicants.

U.S.-based institutions often provide the most straightforward option, avoiding many FATCA complications since they already operate under U.S. jurisdiction. Charles Schwab High Yield Checking offers unlimited worldwide ATM fee rebates and zero foreign transaction fees, making it popular with expats and frequent travelers. Fidelity Investments’ Cash Management Account similarly provides no-fee international ATM withdrawals and eliminated its foreign exchange surcharge in 2025.

For Americans prioritizing Swiss banking’s stability and privacy protections, recent developments have created renewed opportunities. Working with Swiss wealth managers who utilize U.S. custodian banks like Merrill Lynch, Morgan Stanley, or Interactive Brokers allows access to Swiss investment management expertise without triggering FATCA reporting requirements. Since the assets reside with U.S. custodians, clients avoid the foreign account reporting obligations that apply to Swiss-held accounts.

Singapore represents another attractive jurisdiction for Americans seeking international banking options. The city-state maintains a Model 1 Intergovernmental Agreement with the United States, streamlining FATCA compliance through the Inland Revenue Authority of Singapore. Major Singaporean banks remain open to American clients who can provide proper documentation including Form W-9, passport, proof of address, and evidence of tax compliance.

When traditional banking proves impossible, digital banking platforms and fintech solutions offer alternatives. Wise (formerly TransferWise) provides multi-currency accounts holding 50+ currencies at real mid-market exchange rates, though it functions as a payment platform rather than a traditional bank. Revolut delivers similar multi-currency capabilities with real-time exchange rates and international transfer features, appealing to digital nomads comfortable with app-based banking.

Opening accounts remotely has become increasingly feasible, though requirements vary by institution and jurisdiction. Georgia, Portugal, Cyprus, and the UAE permit remote account opening for U.S. citizens with appropriate intermediary assistance and proper documentation. However, premium private banking services typically still require in-person visits and substantial minimum deposits ranging from $10,000 to over $1 million depending on the institution and service level.

Proactive Steps for Accidental Americans

Discovering your status as an Accidental American demands immediate action to avoid escalating complications. The longer compliance issues persist, the more penalties accumulate and the fewer resolution options remain available.

First, verify your citizenship status definitively by contacting the U.S. embassy or consulate in your country of residence or reaching out to U.S. Citizenship and Immigration Services. Birth certificates, parents’ citizenship documents, and any previous passport applications provide crucial documentation.

Once citizenship is confirmed, assess your tax compliance situation by determining which years require filing and what foreign accounts need reporting. Calculate whether your foreign asset balances exceed FATCA thresholds and whether the aggregate value of foreign accounts triggers FBAR requirements.

Obtain a Social Security Number or Individual Taxpayer Identification Number if you don’t already have one, as this is essential for filing returns and accessing compliance programs. U.S. consulates can process SSN applications, though recent processing delays mean starting this early is crucial.

Engage qualified professionals experienced in expatriate taxation and Accidental American issues. Cross-border tax specialists understand the nuances of Foreign Earned Income Exclusion, Foreign Tax Credits, tax treaties, and available compliance programs. Their expertise often saves substantially more than their fees through optimized filing strategies and penalty avoidance.

Evaluate whether to pursue compliance through Streamlined Filing Procedures or to consider renunciation based on your individual circumstances, future plans, and connection to the United States. This decision depends on factors including net worth, income levels, family ties, business interests, and whether you might ever want to live or work in America.

Importantly, respond promptly to any correspondence from foreign banks requesting U.S. tax documentation. Ignoring these requests typically results in account freezes or closures, creating immediate financial emergencies. Even if you’re not yet tax compliant, communicating with your bank and providing available documentation can often buy time to resolve the underlying issues.

Take Control of Your Financial Future

The intersection of FATCA and Accidental American status creates genuine hardship for thousands of individuals who never chose U.S. citizenship and maintain no meaningful connection to the country. Banking access that others take for granted becomes a bureaucratic obstacle course, while tax obligations materialize from nowhere demanding immediate attention and potentially substantial penalties.

However, understanding the challenges enables proactive solutions. The Streamlined Filing Compliance Procedures provide a clear path to achieve tax compliance without devastating penalties for those acting in good faith. For individuals with no desire to maintain American citizenship, renunciation offers permanent resolution despite its costs and complexity. Strategic banking relationships with FATCA-compliant institutions preserve essential financial services even in this challenging environment.

The key is acting decisively rather than hoping the problem will simply disappear. FATCA enforcement continues to intensify, and foreign banks grow increasingly sophisticated in identifying U.S. connections among their customers. Every year of non-compliance adds another layer of penalties and shrinks the window of available solutions.

Whether you’re struggling with denied banking services, facing demands for U.S. tax documentation, or simply trying to understand your obligations as an Accidental American, professional guidance makes all the difference. If you’re ready to open a foreign bank account while navigating FATCA requirements effectively, Easy Global Banking specializes in helping Americans access international banking services in premier jurisdictions.

For those specifically interested in Switzerland’s unparalleled banking stability and privacy protections, discover how to open a Swiss bank account with full FATCA compliance. Alternatively, Singapore’s sophisticated financial sector offers excellent options for Americans seeking Asian banking relationships—learn how to open a bank account in Singapore as a U.S. citizen while maintaining regulatory compliance.

Don’t let FATCA complexity prevent you from accessing the international banking services you need. Easy Global Banking provides expert guidance through every step of account opening, documentation, and compliance, ensuring you maintain both banking access and peace of mind. Visit Easy Global Banking today to schedule your free consultation and discover the right international banking solution for your unique situation.