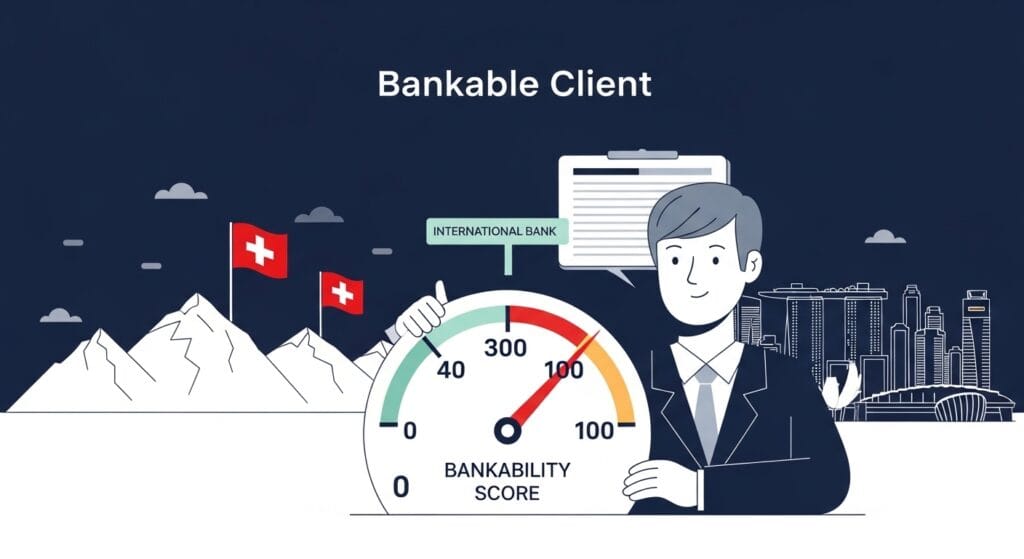

The Bankability Score: A Public Formula to Rate How “Openable” You Are for Swiss & Singapore Banks

When a Swiss or Singapore bank looks at your file, it quietly answers one core question: “Is this client openable?” To make that judgment transparent, I use a simple metric in my advisory work: the Bankability Score (0–100). It is a structured score that estimates how likely you are to obtain an account with a serious Swiss […]