The $83.5 trillion wealth transfer is already underway. By 2048, this staggering sum will shift from Baby Boomers to Generation X, Millennials, and Generation Z—fundamentally reshaping the global private banking landscape. For high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) navigating this monumental transition, selecting the right private banking jurisdiction represents one of the most consequential financial decisions of their lifetime.

Here’s the reality: 81% of younger HNWIs plan to switch wealth management firms after inheritance unless institutions adapt to their digital-first expectations and risk-forward investment preferences. Meanwhile, Asia’s private wealth management industry anticipates annual growth of at least 6% over the next five years, with Singapore’s cross-border assets projected to explode at 12% annually—outpacing every major wealth center globally.

This comprehensive comparison cuts through the marketing noise to deliver unfiltered insights into the four dominant private banking jurisdictions: Switzerland, Singapore, USA, and UK. Whether you’re an entrepreneur building generational wealth, an inheritor managing newfound assets, or a family office seeking optimal diversification, understanding these elite financial hubs is non-negotiable in 2025.

The Private Banking Revolution: Why 2025 Changes Everything

Private banking is experiencing its most dramatic transformation in generations, driven by three seismic forces that no HNWI can afford to ignore.

Artificial Intelligence is Redefining Wealth Management

AI has moved from boardroom buzzword to practical necessity. J.P. Morgan’s Coach platform now delivers personalized investment recommendations in real-time, while UBS’s AI-driven portfolio management tools process market data at speeds no human analyst can match. The implications are profound: private banks leveraging AI provide faster insights, identify opportunities before competitors, and deliver hyper-personalized advisory that was impossible just three years ago.

The stakes couldn’t be higher. As Avishek Nandy of Bain & Company warns, “The rate of change in financial markets is staggering. Clients expect private banks to help them capitalize on opportunities in real-time, and AI is the only way to do this at scale”. Institutions that embrace AI are pulling ahead; those that hesitate risk obsolescence.

Digital-First Experiences Are Non-Negotiable

Today’s HNWIs—particularly those under 50—demand banking experiences that rival the seamless interfaces they enjoy from Amazon, Apple, and Netflix. 55% of HNW clients now cite digital capabilities as a top selection factor when choosing wealth management providers. This isn’t about fancy apps; it’s about fundamental expectations for real-time portfolio access, instant transaction execution, and omnichannel communication that remembers context across devices.

Singapore leads this digital revolution, with institutions like DBS Private Bank earning recognition as Asia’s most innovative wealth manager. Switzerland and the UK, traditionally relationship-focused, are racing to modernize their digital infrastructure before losing clients to more technologically advanced competitors.

The Great Wealth Transfer Demands Generational Strategies

Nearly $100 trillion will transfer from Baby Boomers and older generations through 2048, representing 81% of all wealth transfers. More critically, $62 trillion of this total (50%) comes from households currently classified as HNW or UHNW—despite representing just 2% of all households.

This creates urgent imperatives for private banks and their clients. Millennials, who will inherit $46 trillion over the next 25 years, demonstrate fundamentally different preferences than their parents: higher risk tolerance, appetite for alternative investments (private equity, cryptocurrency), and expectations for ESG-aligned portfolios. Simultaneously, $40 trillion will pass to widowed women in the Baby Boomer generation, creating unprecedented opportunities and responsibilities for wealth managers who understand this demographic.

The verdict is clear: private banking in 2025 demands technological sophistication, generational sensitivity, and jurisdictional expertise that previous generations never required.

Critical Disclaimer: Minimum Deposits and Client Acceptance Vary Dramatically

Before diving into jurisdictional comparisons, understand this fundamental reality: minimum account sizes, fee structures, and client acceptance policies depend heavily on your nationality, tax residency, and risk profile. The figures presented in this analysis represent general benchmarks only—your individual experience will vary significantly based on multiple factors.

Nationality and Tax Residency Matter Immensely

Banks assess clients through complex risk frameworks influenced by geopolitical factors, tax treaty networks, and regulatory compliance costs. For example:

- US citizens face unprecedented challenges opening accounts outside America due to FATCA reporting requirements, with many foreign institutions refusing US clients entirely to avoid compliance burdens

- Clients from sanctioned countries or jurisdictions with weak AML controls encounter rejection rates exceeding 90%, regardless of wealth levels

- European Union residents may find Singapore access restricted without demonstrable regional business ties, while Swiss banks require clear rationales for account opening

Risk Profile Determines Entry Requirements

Your professional background, source of wealth, and transaction patterns dramatically influence whether banks accept you—and at what minimum threshold. Enhanced due diligence for high-risk clients can add CHF 1,000-3,000 annually in compliance costs, while some institutions simply decline complex profiles regardless of asset levels.

Banks conduct extensive KYC (Know Your Customer) reviews examining:

- Source of wealth: How you accumulated assets (inheritance, business sale, professional income)

- Nature of profession: Politically exposed persons (PEPs), high-risk industries, or complex ownership structures trigger additional scrutiny

- Geographic exposure: Where you live, conduct business, and plan to transact

- Transaction expectations: Anticipated deposit volumes, cross-border flows, and currency diversification needs

Singapore’s True Minimum: $2 Million USD for Private Banking

Despite marketing materials suggesting lower thresholds, Singapore’s premier private banking relationships realistically require minimum deposits starting at SGD 2 million (approximately USD 1.5 million), with top-tier institutions like Bank of Singapore demanding $5 million minimum AUM.

Breaking down Singapore’s actual entry points:

- DBS Treasures Private Client: S$1.5 million minimum (≈ USD 1.1 million)

- UOB Privilege Reserve: S$2 million minimum (≈ USD 1.5 million)

- Bank of Singapore: $5 million minimum

- DBS Private Bank: Increasing to USD 5 million minimum effective January 1, 2026

The S$200,000-S$350,000 figures often cited refer to Priority Banking (premier services for mass affluent), not true Private Banking relationships with dedicated wealth management teams.

With these critical caveats established, let’s examine each jurisdiction in depth.

Switzerland: The Unshakeable Pillar of Global Wealth Management

Why Switzerland Remains the World’s Premier Private Banking Destination

Switzerland didn’t earn its reputation as the private banking gold standard through marketing—it built centuries of credibility through political neutrality, legal stability, and unwavering discretion. Despite increased transparency requirements, Switzerland manages $2.4 trillion in private banking assets, more than any jurisdiction globally, with institutional knowledge spanning multiple economic cycles, world wars, and financial crises.

The Swiss advantage manifests in tangible ways. Switzerland imposes no capital gains tax on private investors, meaning profits from selling stocks, bonds, real estate, or most cryptocurrencies remain completely tax-free. For HNWIs generating substantial investment returns, this single factor can save millions annually compared to the UK’s 20% capital gains tax or the USA’s combined federal and state obligations.

Moreover, Swiss political neutrality ensures that your assets remain insulated from geopolitical conflicts that might freeze or seize funds in other jurisdictions. When Russia invaded Ukraine, Swiss banks maintained operational independence while institutions in Europe and North America faced sanctions compliance nightmares. This reliability matters immensely for internationally active entrepreneurs and families with complex cross-border structures.

Switzerland’s Elite Private Banking Institutions

The Swiss private banking ecosystem offers distinct specializations, with each institution serving specific client profiles and needs.

UBS: The Global Wealth Management Giant

Following its acquisition of Credit Suisse, UBS now commands an unprecedented $4.2 trillion in Global Wealth Management invested assets, making it the world’s largest wealth manager by significant margin. UBS’s scale provides unmatched advantages: access to exclusive investment opportunities, global market intelligence, and integrated banking solutions spanning continents.

UBS excels for clients requiring comprehensive global services, from securities-based lending and foreign exchange to complex structured products and alternatives access. However, this scale sometimes translates to less personalized service compared to boutique competitors, with relationship managers covering larger books of business.

Pictet: The Private Banking Powerhouse

Managing CHF 724 billion in assets (14% growth in 2024), Pictet represents Swiss private banking at its finest: privately held, partner-managed, and committed to multi-generational wealth preservation. Pictet’s partners invest their own capital alongside clients, aligning interests in ways publicly traded banks cannot match.

Pictet shines in sophisticated wealth planning, trust structuring, and alternative investments, offering family office-caliber services without requiring ultra-high-net-worth minimums. The bank’s reputation for discretion and personalized attention makes it ideal for families seeking long-term banking relationships spanning generations.

Lombard Odier: Innovation Meets Tradition

With CHF 215 billion under management (12% growth in 2024), Lombard Odier combines 227 years of history with forward-thinking sustainability and technology initiatives. The bank pioneered ESG investing before it became fashionable, developing proprietary methodologies for impact measurement and climate-aware portfolios.

Lombard Odier particularly appeals to next-generation HNWIs who demand both traditional Swiss reliability and progressive investment approaches. The bank’s digital platforms rank among Switzerland’s most sophisticated, offering seamless omnichannel experiences that rival Singapore’s tech leaders.

Vontobel: The Boutique Excellence Leader

Managing CHF 111 billion in private client assets (12% growth), Vontobel earned the #1 ranking in the 2025 Swiss Private Banking Identity Index, recognizing its exceptional brand clarity, client experience, and strategic positioning.

Vontobel differentiates through specialized investment expertise, particularly in structured products, derivatives, and alternative strategies. The bank’s boutique approach delivers highly customized solutions without the bureaucracy larger institutions impose, making it ideal for sophisticated investors seeking tailored portfolio construction.

BIL Suisse: The Entrepreneurial Specialist

BIL Suisse has carved a unique niche serving internationally active entrepreneurs and family offices, combining traditional wealth management with corporate advisory, M&A support, and structured lending solutions.

What makes BIL Suisse exceptional is its integrated approach: relationship managers understand both personal wealth management and business financing needs, providing holistic solutions that most private banks cannot match. For entrepreneurs exiting businesses, expanding internationally, or navigating succession planning, BIL Suisse offers specialized expertise backed by the balance sheet of Luxembourg’s largest bank.

BIL Suisse won multiple 2024 Citywealth Magic Circle Awards, including Best Boutique Bank, recognizing its “unique offering and growing track record focused on entrepreneurs and single-family offices, combining tailor-made financing and corporate advisory solutions”.

The bank’s entrepreneurial focus makes it the top choice for business owners seeking banking partners who understand both wealth accumulation and corporate growth.

Switzerland’s Entry Requirements and Fee Reality

Swiss private banks typically require $500,000 to $1 million minimum deposits, with premier institutions setting higher thresholds for UHNW clients. However, these minimums represent starting points—banks may accept smaller balances for clients with compelling profiles or reject wealthy applicants whose risk profiles trigger compliance concerns.

Swiss fee structures reflect premium positioning:

- Discretionary Portfolio Management: 0.60% – 1.20% annually

- Advisory Mandates: 0.50% – 1.00% annually

- Custody Fees: 0.20% – 0.40% annually, often with CHF 200-500 quarterly minimums

- Transaction Fees: 0.25% – 1.50% depending on asset class

- Enhanced Due Diligence: CHF 1,000 – 3,000 annually for high-risk clients

These fees, while higher than Singapore or competitive US platforms, reflect centuries of expertise, unmatched stability, and tax advantages that often justify the premium.

Switzerland’s Tax Optimization Opportunities

Switzerland’s tax framework offers sophisticated optimization opportunities that reward strategic planning:

Capital Gains Tax Exemption: Private investors pay zero tax on stock market gains, bond profits, cryptocurrency appreciation, or most investment sales. This exemption alone can save HNWIs 15-25% annually compared to other jurisdictions.

Cantonal Tax Variation: Switzerland’s 26 cantons set independent tax rates, creating significant planning opportunities. Low-tax cantons like Zug, Schwyz, and Nidwalden offer combined federal-cantonal rates below 15%, while high-tax cantons can exceed 40%.

Lump-Sum Taxation: Wealthy non-Swiss nationals can negotiate annual tax payments based on living expenses rather than worldwide income. This regime, available in certain cantons, can dramatically reduce effective tax rates for international HNWIs.

Wealth Tax Optimization: While Switzerland levies annual wealth taxes (0.3% – 1.0% depending on canton), strategic asset allocation and residency selection minimize impact.

Singapore: Asia’s Digital-First Wealth Management Juggernaut

Why Singapore Is Capturing Global Wealth at Record Pace

Singapore has achieved what few financial centers accomplish: disrupting a centuries-old industry through innovation, regulation, and strategic positioning. Bloomberg Intelligence projects Singapore’s cross-border wealth will grow at 12% annually—faster than Switzerland, the UK, or USA. This isn’t marketing hype; it’s reflected in net new money flows, bank expansions, and wealthy families relocating to access Asian markets.

Singapore’s advantages compound across multiple dimensions. The city-state’s territorial tax system means foreign-sourced income often escapes taxation entirely, creating opportunities for sophisticated wealth structuring unavailable in progressive tax jurisdictions. Simultaneously, Singapore maintains no capital gains tax, no inheritance tax, and no estate duty—a trifecta that makes wealth accumulation and transfer exceptionally efficient.

Moreover, Singapore serves as the undisputed gateway to Asia-Pacific’s explosive growth markets. HNWIs banking in Singapore gain privileged access to Chinese equity IPOs, Southeast Asian infrastructure projects, Indian technology investments, and emerging opportunities across the region’s 4 billion population.

The government’s commitment to maintaining Singapore as a premier financial hub manifests in world-class infrastructure, English as the business language, political stability (ranked among the world’s least corrupt nations), and regulatory clarity that gives investors confidence.

Singapore’s Premier Private Banking Institutions

Singapore’s private banking sector blends global giants with regional specialists, each offering distinct value propositions.

DBS Private Bank: Asia’s Most Innovative Wealth Manager

DBS earned recognition as the world’s best private bank for HNWIs in 2025, a remarkable achievement for an institution that’s transformed from regional player to global leader in less than two decades. Managing $200.7 billion in wealth assets, DBS combines Singapore’s digital sophistication with comprehensive wealth solutions.

DBS’s digital platforms lead the industry, offering real-time portfolio insights, AI-powered investment recommendations, and seamless omnichannel experiences that satisfy tech-savvy clients. The bank pioneered mobile-first private banking, enabling clients to execute complex transactions, access research, and communicate with relationship managers entirely through smartphones.

Important note: DBS Private Bank is increasing its minimum AUM requirement to USD 5 million effective January 1, 2026, reflecting its positioning as a premier institution serving ultra-high-net-worth clients. For clients with $1.5-5 million, DBS Treasures Private Client provides an intermediate tier with dedicated relationship managers and comprehensive wealth services.

Bank of Singapore: The Pure-Play Private Bank

As a dedicated private bank (rather than a universal bank with wealth management divisions), Bank of Singapore manages $121 billion focusing exclusively on UHNW clients. This specialization delivers advantages: relationship managers aren’t distracted by retail banking, corporate lending, or investment banking priorities.

Bank of Singapore requires $5 million minimum AUM, positioning it squarely in the UHNW space. The bank excels in alternative investments, structured products, and family office services, offering institutional-grade capabilities with boutique-level attention.

UBS Global Wealth Management Asia: Swiss Expertise, Asian Presence

UBS’s Asian operations manage $665 billion in assets, bringing Swiss private banking heritage to Asia’s growth markets. For clients desiring both Asian market access and Swiss institutional credibility, UBS offers an ideal combination.

UBS Singapore provides seamless integration with the bank’s global network, enabling clients to access European real estate financing, American alternative investments, and Asian equity markets through a single relationship. This global connectivity proves invaluable for internationally diversified families.

HSBC Private Banking: The Global Network Advantage

Managing $354 billion in Asian assets, HSBC leverages its unparalleled geographic footprint spanning 62 countries. HSBC excels for clients conducting business across multiple jurisdictions, offering on-the-ground banking capabilities in markets where competitors maintain limited presence.

HSBC’s trade finance expertise, foreign exchange capabilities, and emerging market access make it particularly valuable for entrepreneurs and family offices with complex cross-border operations.

J.P. Morgan Private Bank: American Excellence in Asia

J.P. Morgan’s Asian private bank manages $169 billion, bringing Wall Street sophistication to Asia-Pacific wealth management. The bank’s alternative investment platform, credit solutions, and capital markets access rival any global competitor.

J.P. Morgan particularly appeals to clients with US connections or dollar-denominated wealth, offering integrated solutions spanning American real estate, private equity, and tax-optimized structuring.

Singapore’s Real Minimum Requirements: The $2 Million Reality

Despite persistent marketing suggesting six-figure minimums, Singapore’s true private banking entry point sits at approximately $2 million USD for most premier institutions.

Accurate Singapore Minimums (2025-2026):

| Institution | Tier | Minimum AUM |

|---|---|---|

| DBS Private Bank | Ultra-HNW | USD 5 million (effective Jan 2026) |

| DBS Treasures Private Client | HNW | SGD 1.5 million (≈ USD 1.1 million) |

| Bank of Singapore | Private Banking | USD 5 million |

| UOB Privilege Reserve | Priority Banking | SGD 2 million (≈ USD 1.5 million) |

| Standard Chartered Priority Private | HNW | USD 2.5 million |

| HSBC Jade | Priority Banking | SGD 200,000 (≈ USD 150,000) |

Critical distinction: Priority Banking (S$200K-350K minimums) delivers premier services suitable for mass affluent clients but lacks the dedicated wealth management teams, alternative investment access, and customized solutions that define true Private Banking.

Singapore’s Competitive Fee Structures

Singapore’s private banks typically charge 0.50% – 1.00% annual management fees, positioning them as more cost-competitive than Switzerland’s 0.60% – 1.20% or the UK’s 0.50% – 1.45% ranges.

Transaction fees, custody charges, and performance fees vary by institution and asset allocation. Notably, Singapore banks increasingly offer transparent, flat-fee structures rather than hidden transaction charges, appealing to sophisticated clients who demand clarity.

Singapore’s Tax Advantages for International Wealth

Singapore’s territorial tax system creates extraordinary planning opportunities for HNWIs:

Foreign-Sourced Income: Generally untaxed if not remitted to Singapore, enabling tax-efficient wealth accumulation

Zero Capital Gains Tax: Investment profits remain completely tax-free

No Estate Duty: Abolished in 2008, eliminating inheritance taxes

No Gift Tax: Wealth transfers to heirs or family members escape taxation

Competitive Corporate Rates: Effective rates as low as 5-10% for qualifying structures

For internationally mobile HNWIs, Singapore’s combination of favorable taxation, world-class banking, and strategic Asian positioning proves compelling.

Singapore’s Strict Client Acceptance Policies

Singapore banks maintain rigorous standards for accepting non-resident clients:

Regional Ties Required: Banks typically demand legitimate reasons for Singapore banking, such as:

- Business operations in Asia-Pacific

- Residency or employment in the region

- Significant regional investments

- Family connections to Singapore or neighboring countries

Western Residents Face Restrictions: Singapore banks are “extremely tough on residents of the US, Canada, EU, and UK”, often declining applications from these jurisdictions without compelling regional ties due to regulatory complexity and compliance costs.

Enhanced Due Diligence: Extensive KYC requirements include source of wealth documentation, business plans for regional activities, tax residency certificates, and detailed background checks.

Account Opening Timeline: 4-8 weeks minimum, extending to 3-4 months for complex structures or clients from high-risk jurisdictions.

United States: Domestic Dominance and Integrated Excellence

Why US Private Banking Excels for American-Connected Clients

The United States private banking market, valued at $110-115 billion, serves the world’s largest concentration of HNWIs through a sophisticated ecosystem of global financial institutions. American private banks excel at delivering seamlessly integrated solutions that combine retail banking, commercial lending, investment management, and capital markets access under unified platforms.

For US citizens, residents, and entrepreneurs with primarily domestic operations, American private banks offer unmatched convenience. Manage personal checking accounts, business credit lines, residential mortgages, and multi-million dollar investment portfolios through a single relationship manager who understands the intricacies of US tax law, regulatory requirements, and market dynamics.

US banks lead globally in alternative investment access, providing clients with opportunities in private equity, venture capital, private credit, and hedge funds that often remain inaccessible through foreign institutions. Bank of America’s new Alts Expanded Access Program, launching fall 2025 for clients with $50 million+ net worth, exemplifies how American banks continuously innovate to deliver institutional-grade investment opportunities to qualifying individuals.

Moreover, US private banks leverage advanced AI and digital platforms that rival or exceed Singapore’s technological sophistication. J.P. Morgan’s Coach platform, Goldman Sachs’ IndexGPT, and Morgan Stanley’s data analytics tools demonstrate how American institutions deploy cutting-edge technology to enhance advisory capabilities.

America’s Premier Private Banking Institutions

J.P. Morgan Private Bank: The $10 Million Gold Standard

Requiring $10 million minimum investable assets, J.P. Morgan Private Bank serves ultra-high-net-worth clients with comprehensive wealth solutions. The bank’s integration with J.P. Morgan’s investment banking division provides unparalleled advantages: M&A advisory for entrepreneurs, IPO access for qualified investors, and structured lending solutions backed by one of the world’s strongest balance sheets.

J.P. Morgan’s digital innovation sets industry benchmarks. The bank’s Coach platform delivers AI-powered portfolio insights, real-time market analysis, and personalized recommendations that enable relationship managers to provide more proactive, sophisticated advisory.

Bank of America Private Bank: Comprehensive Wealth Integration

Bank of America Private Bank, also requiring $10 million minimums, leverages the bank’s extensive domestic network (3,700 retail financial centers, 15,000 ATMs) to deliver convenience unmatched by boutique competitors.

The bank’s Alts Expanded Access Program, launching fall 2025, demonstrates commitment to innovation. This program provides UHNW clients ($50 million+ net worth) with institutional-grade private market opportunities, addressing the growing appetite for alternative investments among wealthy Americans.

Bank of America excels at serving clients with complex financial lives spanning business ownership, real estate holdings, and multi-generational wealth transfer needs.

Morgan Stanley Private Wealth Management: The Advisor Powerhouse

Morgan Stanley’s PWM division combines retail broker-dealer capabilities with private banking sophistication, offering flexibility in how clients engage. Minimums vary by service tier, with full private banking relationships typically requiring $5-10 million.

Morgan Stanley’s technology platforms and research capabilities rank among the industry’s finest, providing advisors with tools to deliver institutional-quality insights to individual clients.

Goldman Sachs Private Wealth Management: Wall Street Sophistication

Goldman Sachs PWM requires $10 million minimums, positioning it exclusively in ultra-high-net-worth territory. The bank’s investment banking heritage manifests in sophisticated structured products, alternative investments, and capital markets strategies unavailable elsewhere.

Goldman’s IndexGPT represents the firm’s AI ambitions, offering algorithm-driven portfolio construction customized to individual risk preferences and market outlooks.

Citibank Private Bank: The Global American

Citibank’s private bank requires $1 million minimum, making it more accessible than ultra-high-net-worth competitors. Citi’s global footprint (operations in 100+ countries) provides advantages for internationally active clients who value American banking standards with global reach.

US Private Banking: Tiered Entry Points

American private banks demonstrate dramatic variation in minimum requirements:

Entry-Level Options ($150K – $250K):

Mid-Tier Private Banking ($1M – $5M):

- Citibank Private Bank: $1 million

- UBS Wealth Management USA: $1 million

- Morgan Stanley (varies): $2-5 million depending on services

Ultra-High-Net-Worth ($10M+):

- J.P. Morgan Private Bank: $10 million

- Bank of America Private Bank: $10 million

- Goldman Sachs PWM: $10 million

This tiered approach allows clients to access increasingly sophisticated services as wealth grows, with seamless upgrades as asset levels increase.

US Tax Environment: Planning is Critical

The US tax system presents both challenges and opportunities for HNWIs:

Tax Obligations:

- Federal income tax: Progressive rates up to 37%

- Long-term capital gains: 0%, 15%, or 20% depending on income

- Short-term capital gains: Taxed as ordinary income

- Net Investment Income Tax: Additional 3.8% on investment income for high earners

- State taxes: 0% to 13.3% depending on state residency

- Estate tax: Federal exemption of $13.6 million per individual in 2025, dropping to approximately $7 million in 2026

Planning Opportunities:

- Strategic state residency: Moving from California (13.3% state tax) to Texas or Florida (0% state tax) saves high earners hundreds of thousands annually

- Qualified Opportunity Zones: Defer and potentially eliminate capital gains taxes through strategic real estate investments

- Estate freeze techniques: Lock in current $13.6 million exemption before 2026 reduction

- Charitable strategies: Donor-advised funds, charitable remainder trusts, and foundation vehicles optimize tax efficiency while supporting causes

United Kingdom: Historic Prestige Meets Post-Brexit Reality

Why UK Private Banking Maintains Global Relevance

The United Kingdom’s private banking sector, managing £500+ billion in assets, combines centuries of institutional knowledge with London’s status as a major international financial center. British private banks offer access to European and global markets, sophisticated trust and estate planning under English law, and prestigious institutions whose names carry weight across continents.

UK banks like Coutts & Co (founded 1692) and C. Hoare & Co (founded 1672) provide multi-generational experience serving royal families, aristocracy, and UHNW dynasties. This institutional memory proves invaluable for complex succession planning, trust administration, and wealth transfer strategies requiring century-long perspectives.

London’s position as a global financial hub ensures UK private banks maintain connections to international markets, investment opportunities, and professional services (law firms, tax advisors, family office consultants) that rival or exceed other centers.

UK’s Leading Private Banking Institutions

Coutts & Co: The Royal Prestige Bank

As banker to the British Royal Family, Coutts represents the pinnacle of UK private banking prestige. Requiring clients to either invest or borrow £1 million, or deposit £3 million, Coutts delivers white-glove service, comprehensive wealth planning, and unmatched discretion.

Coutts particularly excels in trust and estate services, leveraging centuries of experience navigating complex inheritances, aristocratic wealth structures, and multi-generational planning.

Barclays Private Banking: The £139 Billion Powerhouse

Managing £139 billion in private banking assets, Barclays requires £3 million investment portfolio minimums, positioning it squarely in UHNW territory. Barclays’ scale provides advantages in alternative investment access, structured lending, and global market connectivity.

HSBC Global Private Banking: The International Connector

HSBC’s UK private bank requires £1.5 million in assets, offering clients access to the bank’s 62-country network. For internationally active families, HSBC provides on-the-ground banking in markets where competitors lack presence.

Lloyds Private Banking: The Tiered Approach

Lloyds offers multiple entry points: £250,000 in savings/investments or £750,000 mortgage for basic private banking, with Mayfair Banking requiring £2 million. This flexibility allows clients to access private banking services earlier in their wealth journey.

UK Entry Requirements: Steep Thresholds

UK private banks impose substantial minimums:

- Arbuthnot Latham: £500,000 (≈ $625,000)

- Lloyds Private Banking: £250,000 savings/investments or £750,000 mortgage

- Lloyds Mayfair Banking: £2 million (≈ $2.5 million)

- HSBC Global Private Banking: £1.5 million (≈ $1.875 million)

- Coutts & Co: Invest/borrow £1 million or deposit £3 million

- Barclays Private Banking: £3 million investment portfolio (≈ $3.75 million)

These minimums exclude many affluent individuals who might qualify for Singapore or US private banking.

UK Tax Environment: Progressive and Complex

The UK operates a progressive tax system with significant implications for HNWIs:

Tax Structure:

- Income tax: Progressive rates up to 45% for highest earners

- Capital gains tax: 10% or 20% depending on income (higher rates for property)

- Inheritance tax: 40% on estates exceeding £325,000 (with various reliefs)

- Stamp duty: Substantial taxes on property transactions

Post-Brexit Considerations: The UK’s departure from the EU has created regulatory complexity for cross-border transactions, though UK banks maintain strong European connections.

The Comprehensive Comparison: Making Your Decision

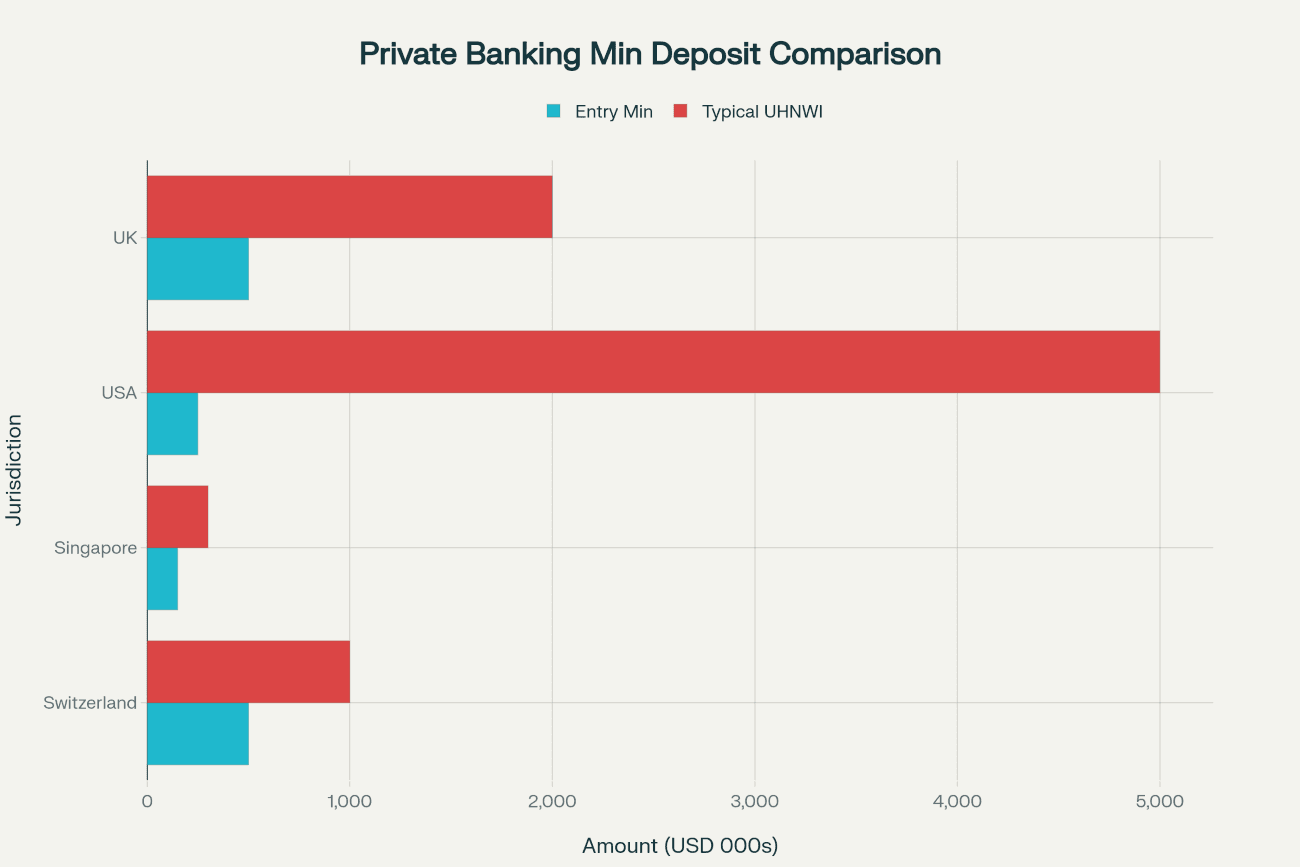

Comparison of minimum deposit requirements across major private banking jurisdictions, showing both entry-level and typical UHNWI thresholds (in thousands USD)

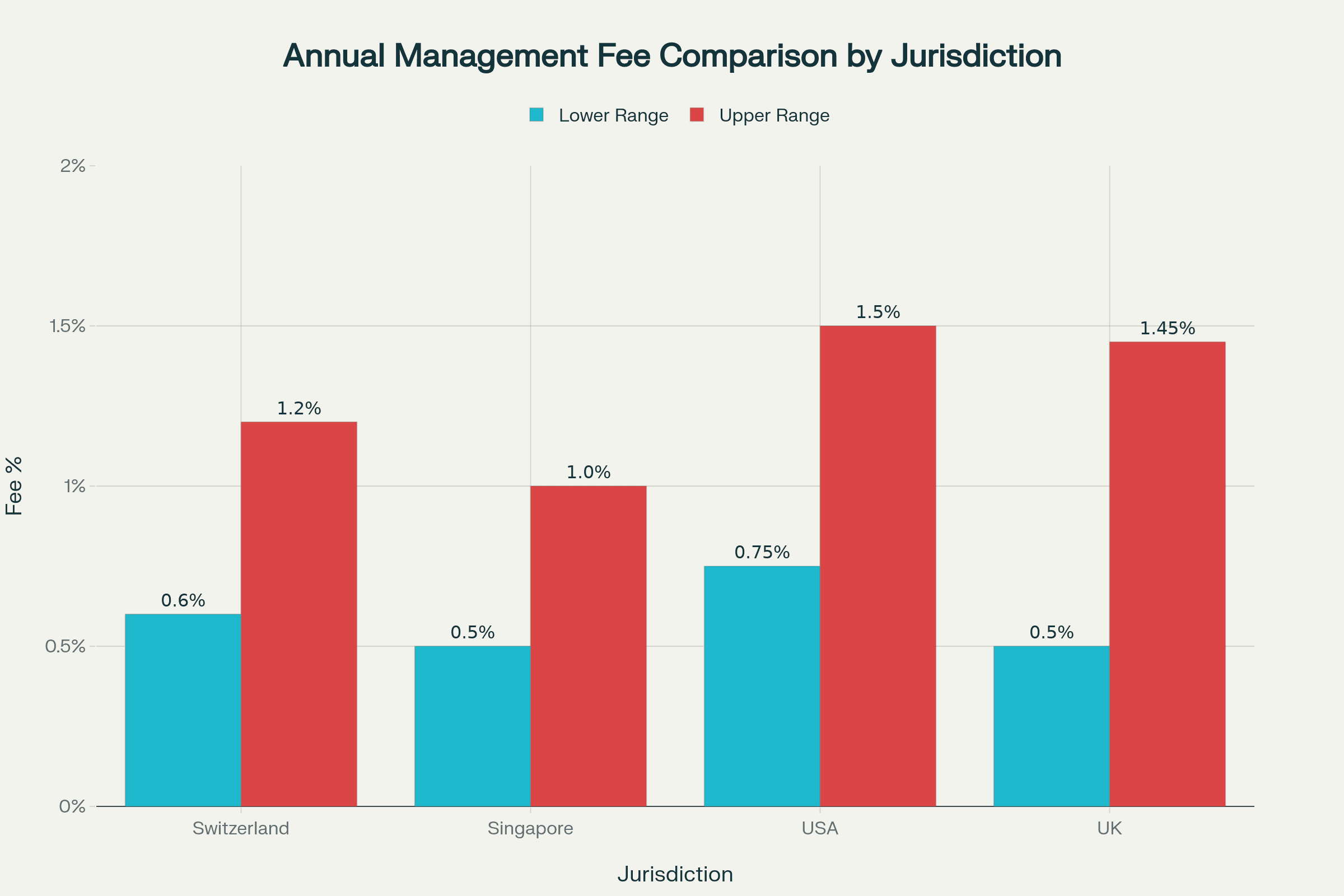

Annual management fee ranges for private banking services across Switzerland, Singapore, USA, and UK, showing the typical lower and upper bounds of fee structures

Strategic Selection Framework

Choose Switzerland when:

- You possess $1 million+ in liquid assets and prioritize legendary stability

- No capital gains tax policy creates substantial annual savings

- Multi-generational wealth preservation requires centuries of institutional expertise

- Political neutrality protects assets from geopolitical risks

- You value commercial confidentiality protections while complying with tax reporting

- Complex international structures demand sophisticated wealth planning

Switzerland’s specialized institutions allow precise matching: UBS for global scale, Pictet for multi-generational planning, Lombard Odier for ESG focus, Vontobel for structured products, and BIL Suisse for entrepreneurs needing integrated business and personal banking.

Choose Singapore when:

- You have $2 million+ investable assets and maintain legitimate Asian connections

- 12% annual wealth growth in Asia-Pacific markets aligns with your investment thesis

- Digital-first banking experience is non-negotiable

- Territorial tax system optimizes your international income structure

- Gateway to Chinese, Southeast Asian, and Indian opportunities matches your strategy

- You’re under 50 and demand technological sophistication rivaling consumer tech leaders

Singapore’s blend of DBS innovation, Bank of Singapore’s UHNW focus, and UBS’s Swiss-Asian hybrid provides options across the wealth spectrum.

Choose the USA when:

- You’re a US citizen, resident, or entrepreneur with primarily domestic operations

- Seamless integration across banking, lending, and investment services matters

- Alternative investment access (private equity, venture capital, hedge funds) is critical

- Advanced AI and digital platforms enhance your advisory relationship

- Business financing needs integrate with wealth management

- You value extensive domestic branch networks and geographic coverage

US banks’ tiered approach allows starting at $150K and upgrading to $10M+ ultra-high-net-worth services as wealth grows.

Choose the UK when:

- You have £500,000+ ($625,000+) and maintain strong UK or European ties

- Centuries of prestige (Coutts, C. Hoare & Co) matters for your family’s reputation

- Trust and estate planning under English law provides optimal structure

- London’s financial markets and professional services ecosystem is valuable

- English-speaking service within Europe facilitates communication

- Multi-generational succession planning requires institutional experience

The Multi-Jurisdictional Strategy: Optimizing Through Diversification

For many HNWIs, particularly those with $5 million+ in assets, the optimal strategy involves maintaining banking relationships across 2-3 jurisdictions. This approach delivers multiple advantages:

Risk Diversification: Protects against single-country economic downturns, political instability, or currency devaluations

Tax Optimization: Leverages each jurisdiction’s favorable treatment of different income types

Market Access: Combines Switzerland’s global expertise, Singapore’s Asian opportunities, USA’s alternatives access, and UK’s European connections

Regulatory Protection: Ensures at least one banking relationship remains unaffected if regulatory changes impact specific jurisdictions

Strategic example for a $10 million UHNWI:

- Switzerland (50%): Core wealth preservation in Swiss franc, zero capital gains tax benefit, alternative investments through Pictet or Lombard Odier

- Singapore (30%): Asian equity exposure, territorial tax advantages, access to China/Southeast Asia growth through DBS or Bank of Singapore

- USA (20%): Dollar-denominated holdings, American real estate, US-based private equity through J.P. Morgan or Goldman Sachs

Preparing for the Future: 2025 Trends You Cannot Ignore

The $83.5 Trillion Wealth Transfer Accelerates

Nearly $100 trillion will transfer from Baby Boomers through 2048, with $62 trillion (50%) coming from HNW and UHNW households representing just 2% of families. This creates urgent imperatives:

For inheritors: Evaluate whether your parents’ banking relationships align with your digital expectations, risk tolerance, and investment preferences. 81% of younger HNWIs plan to switch firms—be intentional about where you transition assets.

For wealth holders: Engage children and grandchildren in financial education now. Family meetings facilitated by relationship managers build continuity and prevent the 90% asset loss that typically occurs by the third generation.

For all HNWIs: Recognize that $40 trillion will pass to widowed Baby Boomer women, creating new decision-makers who may approach wealth management differently than their spouses did.

AI Transforms Every Aspect of Wealth Management

Artificial intelligence has moved from experimental to essential. J.P. Morgan’s Coach, DBS’s AI advisory tools, and UBS’s algorithmic portfolio management demonstrate how leading institutions deploy AI to deliver faster insights, identify opportunities, and personalize recommendations.

The implication: Banks that embrace AI pull ahead; those that hesitate fall behind. When selecting private banking relationships, evaluate institutions’ technological sophistication—it directly impacts the quality of advisory you’ll receive.

Alternative Investments Become Mainstream

HNWIs now allocate 15-20% of portfolios to alternatives, up from historical levels of 3-5%. Bank of America’s new Alts Expanded Access Program for $50 million+ clients and Singapore’s growing private credit platforms exemplify how institutions are democratizing access to private equity, venture capital, and hedge funds.

The opportunity: Alternatives provide higher return potential, inflation protection, and diversification. Ensure your private bank offers robust alternatives platforms rather than limiting you to public market investments.

Take Action: Open Your International Private Banking Account Today

The global private banking landscape offers extraordinary opportunities for HNWIs willing to think strategically about jurisdictional selection. Whether you’re drawn to Switzerland’s legendary stability, Singapore’s digital innovation, America’s integrated excellence, or the UK’s historic prestige, the right choice aligns with your wealth level, geographic focus, tax situation, and long-term objectives.

Remember these critical factors:

- Minimums vary by nationality, tax residency, and risk profile—the figures here represent general benchmarks only

- Singapore truly requires $2 million USD minimum for premium private banking, despite marketing suggesting lower thresholds

- Enhanced due diligence and compliance costs can add thousands annually depending on your profile

- Multi-jurisdictional strategies optimize tax efficiency, risk diversification, and market access

Ready to explore international private banking opportunities tailored to your specific situation? Easy Global Banking specializes in helping high-net-worth individuals navigate the complex landscape of global wealth management.

Whether you’re considering opening a Swiss bank account for its unparalleled stability and zero capital gains tax advantages, or opening a bank account in Singapore to access Asia’s 12% annual wealth growth, our expert team provides comprehensive guidance matched to your unique circumstances.

Our services include:

- Jurisdictional analysis based on your nationality, tax residency, and investment goals

- Bank matchmaking with institutions specializing in your wealth level and profile

- Documentation preparation and compliance support

- Multi-jurisdictional structuring for optimal tax efficiency

- Ongoing relationship management and strategic advisory

Don’t leave your wealth management to chance. Contact Easy Global Banking today for a complimentary consultation and discover how strategic international private banking can transform your financial future.

The $83.5 trillion wealth transfer is already underway. Position yourself—and your heirs—for success.

Essential Resources for Informed Decision-Making

Deepen your understanding of global private banking, tax optimization, and wealth management strategies through these authoritative resources:

- World Wealth Report 2025 – Comprehensive analysis of HNWI trends, generational wealth transfer, and next-gen expectations

- Bank for International Settlements – Global banking standards, regulatory frameworks, and cross-border wealth management insights

- Singapore Monetary Authority – Official guidance on Singapore’s wealth management ecosystem, regulatory requirements, and industry developments

- Swiss Financial Market Supervisory Authority (FINMA) – Swiss banking regulations, compliance standards, and consumer protections

About Easy Global Banking

Easy Global Banking is the premier platform for high-net-worth individuals seeking to open a foreign bank account in top-tier jurisdictions worldwide. Our mission is democratizing access to international private banking, providing expert guidance, comprehensive support, and personalized service that empowers clients to optimize their global wealth management strategies.

With deep expertise in Swiss and Singaporean private banking, multi-jurisdictional structuring, and regulatory compliance, we serve as your trusted partner in navigating the complex world of international finance. Whether you’re building generational wealth, managing inheritance, or optimizing tax efficiency, Easy Global Banking delivers solutions tailored to your specific needs.

The future of wealth management is global. Let us guide you there.