The Email Arrived at 3 PM on a Tuesday.

“After careful review of your account application, we regret to inform you that [Major Bank Name] is unable to open a personal offshore banking account at this time. Your profile does not meet our risk assessment criteria.”

That email—or one like it—lands in hundreds of crypto traders’ inboxes every month. They’ve tried:

- JPMorgan (declined)

- Citibank international (declined)

- HSBC private banking (declined)

- Switzerland’s largest banks (declined)

- Singapore banks (declined)

The reason? Their profile triggered an automated rejection algorithm. And once you’re rejected, trying other major banks becomes even harder—they see the previous rejection and auto-decline.

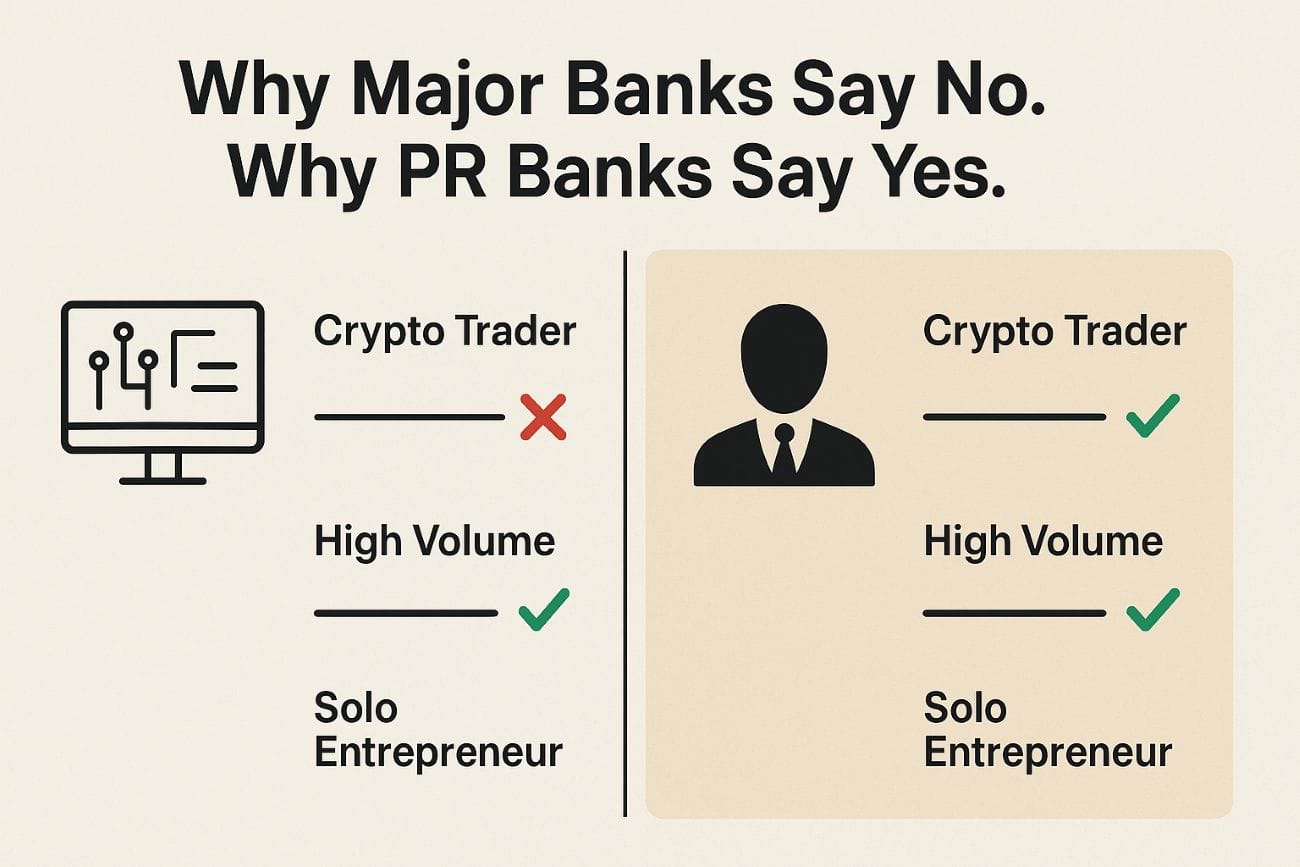

Then they discover something that changes everything: Puerto Rico private banks say yes.

The Algorithm Wall: Why Major Banks Reject Legitimate Clients

To understand why this is happening, you need to understand how modern banking actually works—and why bigger isn’t always better.

Major banks (JPMorgan, HSBC, Citibank, major Swiss/Singapore banks) handle hundreds of thousands of account applications annually.

With that volume, relationship managers simply don’t have time to evaluate each application individually. The math doesn’t work:

- 100,000 applications per year

- 50 relationship managers

- = 2,000 applications per manager annually

- = 8 applications per business day

- = 60 minutes per application maximum

There’s physically no time for detailed, contextual evaluation.

So major banks use automated risk-scoring algorithms that evaluate your application against predetermined criteria:

Algorithm Inputs:

- Age (under 40 = higher risk score)

- Occupation (crypto = automatic risk elevation)

- Transaction volume (above threshold = risk flag)

- Number of countries involved (multiple = suspicious)

- Business type (solo entrepreneur = higher risk)

- Income stability (variable income = risk elevation)

- Account purpose (international transfers = elevated scrutiny)

If your total risk score exceeds the bank’s threshold: AUTOMATIC REJECTION.

No human review. Without context evaluation. No appeal.

The irony? These algorithms reject the exact profiles of people building legitimate wealth in 2025: crypto traders, digital nomads, remote workers, solo entrepreneurs, people with international businesses.

Why Bigger Banks Don’t Care About Your Rejection

Here’s the uncomfortable truth: Major banks don’t need you.

When JPMorgan rejects your application, they’re not worried about losing your potential account. Why?

- They receive 50+ applications for every account they open

- They have more potential clients than capacity to serve them

- Rejecting borderline cases protects them from regulatory risk

- Their brand attracts endless new applicants regardless

The calculus is simple: Risk of approving you (potential regulatory scrutiny) > Value of your account (replaceable).

So they default to rejection. The algorithm catches anything unusual, flags it, and declines automatically.

This creates a perverse dynamic:

The more prestigious the bank → The more applications they receive → The more selective their algorithm → The higher the rejection rate → The more they can afford to say no.

HSBC doesn’t worry that rejecting crypto traders will hurt their business. They have 100 other applicants waiting.

The Flexibility Advantage: Why Smaller Puerto Rico Banks Operate Differently

Smaller Puerto Rico private banks face the opposite dynamic.

They DON’T receive 100,000 applications annually. They receive hundreds.

This creates completely different economics:

- 500 applications per year

- 5 relationship managers

- = 100 applications per manager annually

- = 1-2 applications per week

- = Several hours per application for evaluation

There’s actually TIME for relationship managers to evaluate context.

This changes everything:

Major Bank Evaluation:

- Automated algorithm scoring

- 30-60 minutes total review

- No relationship manager involvement until after approval

- Binary decision: approve or reject based on score

- No appeal process

Smaller PR Bank Evaluation:

- Initial algorithm screening (basic check)

- Then: Relationship manager personal review

- Manager evaluates SOURCE of funds, not just pattern

- Manager understands crypto trading as legitimate business

- Manager can override algorithm if context makes sense

- Decision based on holistic assessment, not just score

The result: Profiles that major banks auto-reject, PR banks approve after human evaluation.

The Pure Private Banking Security Advantage (What Major Banks Don’t Offer)

Here’s the second critical difference: Puerto Rico pure private banks offer a fundamentally different security model.

When you deposit money at JPMorgan, Citibank, or any traditional bank—even major Swiss or Singapore banks—here’s what happens:

Your money goes onto the bank’s balance sheet.

Traditional Bank Model:

You deposit $1 million → Bank receives it → Bank places it on their balance sheet → Bank now owes you $1 million (liability) → Bank uses your deposit for lending, trading, operations → If bank fails, your money becomes a claim in bankruptcy → FDIC/deposit insurance covers only $250K max

You are exposed to the bank’s counterparty risk.

When SVB (Silicon Valley Bank) collapsed in March 2023:

- Customer deposits sat on SVB’s balance sheet

- Bank failure froze $175 billion in customer funds

- Depositors couldn’t access money for weeks

- FDIC insurance covered only $250K per account

- Billions of dollars trapped in bankruptcy proceedings

When FTX collapsed in November 2022:

- Customer crypto sat on FTX’s balance sheet (commingled)

- Company failure froze $8 billion in customer assets

- Customers couldn’t withdraw

- Assets trapped in bankruptcy (still ongoing)

- Recovery timeline: years, if ever

The pattern: When your money sits on an institution’s balance sheet, bank failure = your money trapped.

How Pure Private Banks Eliminate This Risk Completely

Puerto Rico pure private banks operate under a completely different model.

Your money NEVER goes on the bank’s balance sheet. Here’s what actually happens:

Pure Private Bank Model:

You deposit $1 million → Bank receives it → Bank immediately transfers it to an independent prime custodian (BNY Mellon, Euroclear, Citibank Global Custody) → Custodian creates sub-account with YOUR NAME on it → Your money held separately, isolated → Bank administers account but CANNOT touch your money → If bank fails, your money completely unaffected (held elsewhere)

Your assets are OFF the bank’s balance sheet. Legally held in YOUR name at the custodian.

This is a regulatory requirement in Puerto Rico for pure private banks:

- Client assets MUST be held separately at prime custodians

- Banks CANNOT use client funds for lending

- Banks CANNOT commingle client assets with bank operations

- Banks CANNOT place client deposits on their balance sheets

- Regular third-party audits verify compliance

If the bank fails tomorrow, your money is untouched. It’s at BNY Mellon (or equivalent custodian), in your name, completely separated.

The Real Comparison: Where Your Money Actually Lives

Scenario: $1 Million Deposit

At JPMorgan/HSBC/Major Bank:

textJPMorgan Balance Sheet:

├─ ASSETS

│ ├─ Your $1M deposit (COMMINGLED with others)

│ ├─ 100,000 other depositors' $500B (COMMINGLED)

│ ├─ Bank's own capital

│ └─ $2 trillion in loans (using deposits)

└─ LIABILITIES

└─ Owes you: $1M (subject to bank solvency)

Your legal position: Creditor waiting in line if bank fails

Your insurance: FDIC $250K (only 25% protected)

Bank failure impact: Money frozen 6-24+ months

At Puerto Rico Pure Private Bank:

textPrivate Bank Balance Sheet:

├─ ASSETS

│ ├─ Bank's own $50M capital

│ └─ Administrative fees earned

└─ LIABILITIES

└─ None to you (you're NOT a depositor)

OFF-BALANCE SHEET (Your Assets):

└─ BNY Mellon Custody Account

├─ Sub-account: YOUR NAME

├─ Amount: $1,000,000

├─ Separated from all other clients

├─ Separated from bank operations

├─ Insurance: $2B+ custodian coverage

└─ Legal ownership: YOURS

Your legal position: Owner of assets held in trust

Your insurance: $2B+ custodian insurance (100%+ protected)

Bank failure impact: ZERO (money elsewhere)

The difference is structural, not cosmetic.

Real Case: Why This Matters for Crypto Traders

Meet Marcus—rejected by major banks, approved by Puerto Rico.

Marcus generates $1.5M annually trading crypto. His application journey:

Switzerland (UBS):

- Algorithm detected: Crypto trading activity

- Risk score: Elevated (crypto = automatic high-risk category)

- Human review: None (algorithm rejected before manager saw it)

- Decision: DECLINED

- Timeline: 48 hours

- Reason given: “Risk assessment criteria”

Singapore (DBS Private Bank):

- Algorithm detected: High transaction volume, crypto trading, US resident

- Risk score: Multiple elevation factors

- Human review: Manager asked for extensive documentation

- After 4 months: “Unable to proceed”

- Timeline: 120 days

- Reason given: “Profile incompatibility”

JPMorgan (USA):

- Algorithm detected: $1.5M volume, cryptocurrency, multiple exchanges

- Risk score: Exceeds threshold

- Human review: None

- Decision: DECLINED

- Timeline: 6 weeks

- Reason: “Cannot service account needs”

Puerto Rico Private Bank (Vauban International):

- Algorithm screening: Passed basic AML checks

- Then: Relationship manager personal review

- Manager evaluated: Tax returns showing legitimate income, crypto exchange statements showing trading pattern, no criminal history

- Manager understanding: Crypto trading is legitimate business, high volume makes sense for day trader

- Decision: APPROVED

- Timeline: 4 weeks

- Setup: Account opened, custody established at BNY Mellon, funds held off-balance sheet

Marcus’s result:

- Banking access (couldn’t get anywhere else)

- Off-balance sheet security (funds at BNY Mellon, not bank balance sheet)

- Account stability (no closure risk—bank understands crypto)

- Relationship manager who understands his business

Why Algorithm Rejection Happens (And Why It’s Getting Worse)

Major banks’ algorithms are becoming MORE restrictive, not less:

Regulatory Pressure:

- When regulators find a bank serviced a risky client, bank faces massive fines

- Example: HSBC paid $1.9B for AML failures

- Example: Deutsche Bank paid $630M for sanctions violations

- Banks respond by making algorithms more conservative

Result: Algorithms now reject borderline cases that 5 years ago would’ve been approved.

Volume Justification:

- Banks receive more applications than they can handle

- Rejecting borderline cases reduces workload without losing revenue

- Every rejected application is replaced by 10 new ones

Result: No incentive to approve uncertain profiles.

Crypto Targeting:

- Regulators increasingly scrutinize crypto-related accounts

- Banks see crypto as high-risk category (regardless of legitimacy)

- Easier to reject all crypto than evaluate individually

Result: Legitimate crypto traders rejected alongside bad actors.

What Puerto Rico Private Banks Actually Require (Non-Residents)

- ✗ Puerto Rico residency

- ✗ 183+ days physical presence

- ✗ Property ownership

- ✗ Tax residency change

- ✗ Family relocation

- ✗ Act 60 application

- Valid Passport (government-issued ID)

- Proof of Address (utility bill, bank statement from current residence)

- Source of Funds Documentation

- Tax returns showing business income, OR

- Crypto exchange statements showing trading history, OR

- Business financial statements

- Basic AML/KYC Screening (no criminal history)

- Minimum Deposit ($250 000-$1 000 000 depending on bank)

No algorithm rejection. No correspondent bank approval chains. Just legitimate documentation reviewed by a human relationship manager who understands crypto and international business.

What Non-Residents Actually Get

Banking Access:

- Account approval where major banks rejected you

- Multi-currency accounts (USD, EUR, etc.)

- International wire transfers

- Crypto-friendly banking (no account closure risk)

- Relationship manager who understands your business

Asset Security (The Critical Part):

- Off-balance sheet custody (money at BNY Mellon/Euroclear, not bank balance sheet)

- Protected from bank failure (SVB/FTX lesson learned—your funds completely separated)

- Sub-account in your name (legally YOUR property)

- Prime custodian insurance ($2B+ coverage typical)

- Zero bank counterparty risk (bank cannot use your money, touch your money, or lose your money)

Operational Stability:

- No arbitrary account holds

- No “suspicious activity” freezes (crypto trading expected)

- Fast transaction approvals

- Direct custodian relationships (no correspondent bank delays)

- Account remains open (no sudden closure)

What You DON’T Get (As Non-Resident):

- ✗ Act 60 tax exemptions (requires PR residency)

- ✗ Zero capital gains tax (still pay home country taxes)

- ✗ Puerto Rico tax benefits

But you DO get: Banking access + genuine asset security when major banks say no.

The Cost Reality

Scenario: $1.5M Annual Crypto Trading, Non-Resident

Major Bank (If They Approved—Which They Won’t):

- Monthly fee: $50-$200/month

- Wire fees: $25-$50 per transfer

- Currency conversion: 1-2% markup

- Account closure risk: HIGH (crypto accounts often closed without warning)

- Asset security: Deposits on balance sheet (vulnerable to bank failure)

- Total annual cost: $1,200-$2,400 + wire fees

Puerto Rico Pure Private Bank:

- Monthly fee: $0

- Wire fees: $10-$25 per transfer

- Currency conversion: 0.5-1% markup

- Account closure risk: ZERO (crypto-understanding institution)

- Asset security: Off-balance sheet at prime custodian (protected from bank failure)

- Total annual cost: $0 + lower wire fees

Plus: Actual approval (can’t use a bank that rejects you)

Plus: Security (off-balance sheet custody)

Plus: Stability (account stays open)

Why More People Don’t Know This Exists

PR private banking for non-residents isn’t widely marketed because:

- Smaller banks = smaller marketing budgets (no CNBC ads, no Super Bowl commercials)

- Client acquisition through referrals (existing clients recommend, not advertising)

- Capacity constraints (can’t handle 100,000 applications like JPMorgan)

- Niche positioning (serving clients major banks reject—not mass market)

But for clients that major banks reject: PR private banking is often the ONLY option.

The Easy Global Banking Role

We connect rejected clients with PR private banks that will approve them.

✅ Understand why major banks rejected you (usually algorithm scoring, not actual risk)

✅ Connect with PR private banks (established relationships with Vauban, Tolomeo, Advantage International)

✅ Navigate account opening (4-6 week process, guided)

✅ Verify off-balance sheet custody (confirm funds at BNY Mellon/custodian)

✅ Clarify non-resident limitations (no Act 60 tax benefits, but security + access benefits)

✅ Ongoing support (account maintenance, transaction assistance)

The typical client story:

“I was rejected by JPMorgan, HSBC, and three Swiss banks. Easy Global Banking connected me with a Puerto Rico private bank in 3 weeks. Not only was I approved, but my money is held off-balance sheet at BNY Mellon—safer than my previous bank. My relationship manager actually understands crypto trading.”

Your Next Move

If major banks have rejected your application, it’s not because your wealth is illegitimate or your business is suspicious.

It’s because you don’t fit their algorithm.

Puerto Rico private banks think differently:

- They evaluate context, not just scores

- They understand crypto and international business

- They have time to review your actual situation

- They approve clients that major banks auto-decline

Plus: Off-balance sheet custody means your money is safer than at major banks. Your funds sit at BNY Mellon or Euroclear, in your name, completely separated from bank operations. If the bank fails, your money is untouched.

Schedule a free 30-minute consultation with Easy Global Banking.

We’ll show you:

- Why algorithms rejected you

- Which PR private banks will approve your profile

- How off-balance sheet custody protects your assets

- What timeline to expect (4-6 weeks typical)

- What documentation you need

For non-residents, this isn’t about tax optimization.

It’s about banking access + genuine asset security when traditional banks close their doors.

Your money is legitimate. Your business is real. You just need a bank that:

- Actually evaluates your application (not an algorithm)

- Holds your money safely (off-balance sheet custody)

Puerto Rico private banking delivers both.