Swiss banking stands at an unprecedented crossroads. While the industry’s legendary reputation for stability and discretion remains intact, a quiet revolution is transforming how these institutions operate, serve clients, and compete in the global marketplace. From AI-powered wealth management platforms to blockchain-based digital assets, Swiss banks are rapidly embracing cutting-edge technologies that promise to redefine the very essence of private banking.

The Digital Awakening: Swiss Banks Embrace AI Revolution

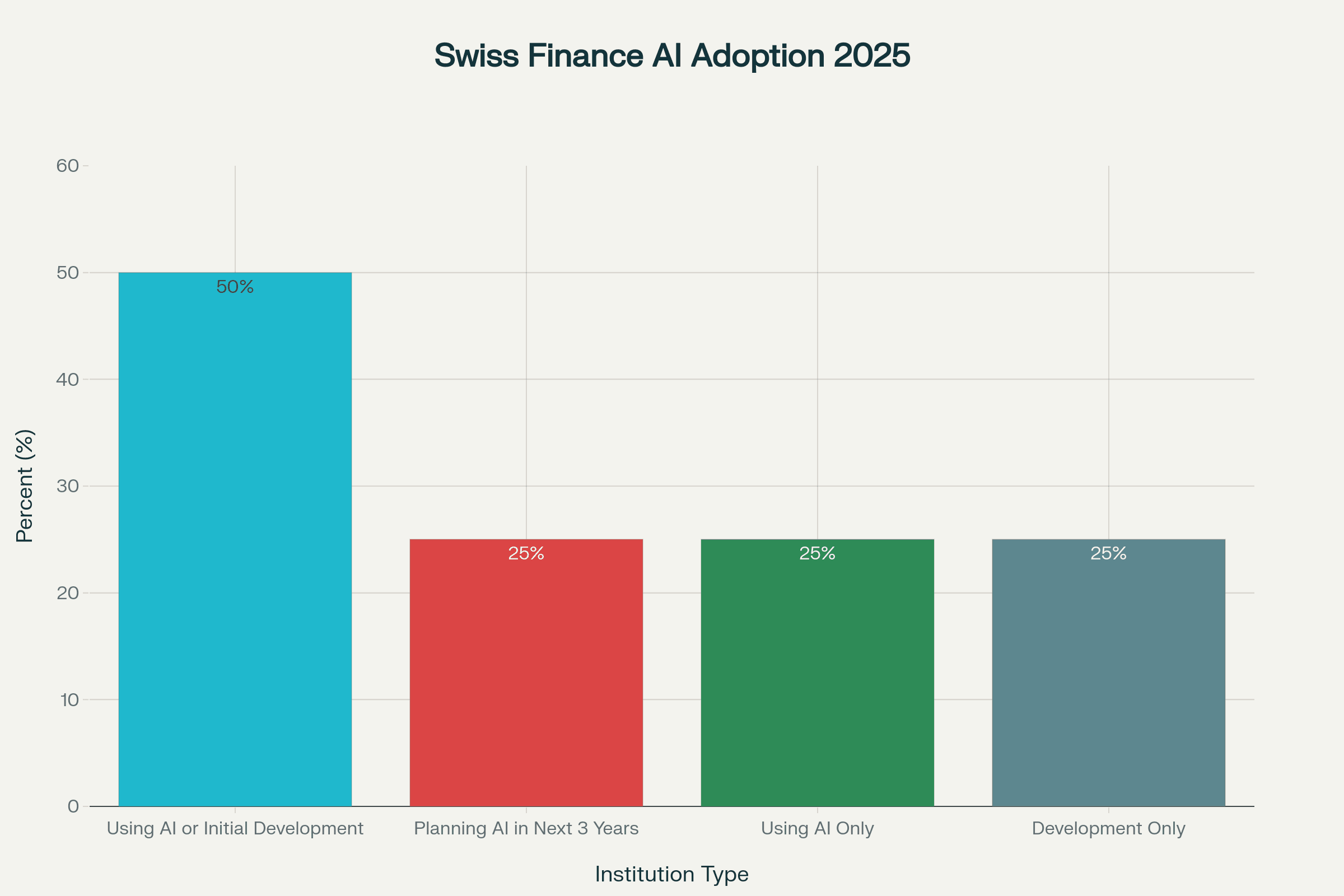

The transformation is already well underway. According to FINMA’s comprehensive 2025 survey of approximately 400 Swiss financial institutions, 50% are currently using AI or have initial applications in development. Moreover, an additional 25% plan to implement AI within the next three years, indicating that Swiss banking’s digital evolution is accelerating at breakneck speed.

AI Adoption Among Swiss Financial Institutions – FINMA Survey 2025

This surge in AI adoption represents more than just technological upgrading—it’s a strategic imperative. As one industry expert noted, “successful GenAI implementation is not a sprint, but a strategic transformation process”. The technology is being deployed across multiple fronts, fundamentally changing how banks operate and serve their clients.

AI-Powered Wealth Management: The New Advisory Paradigm

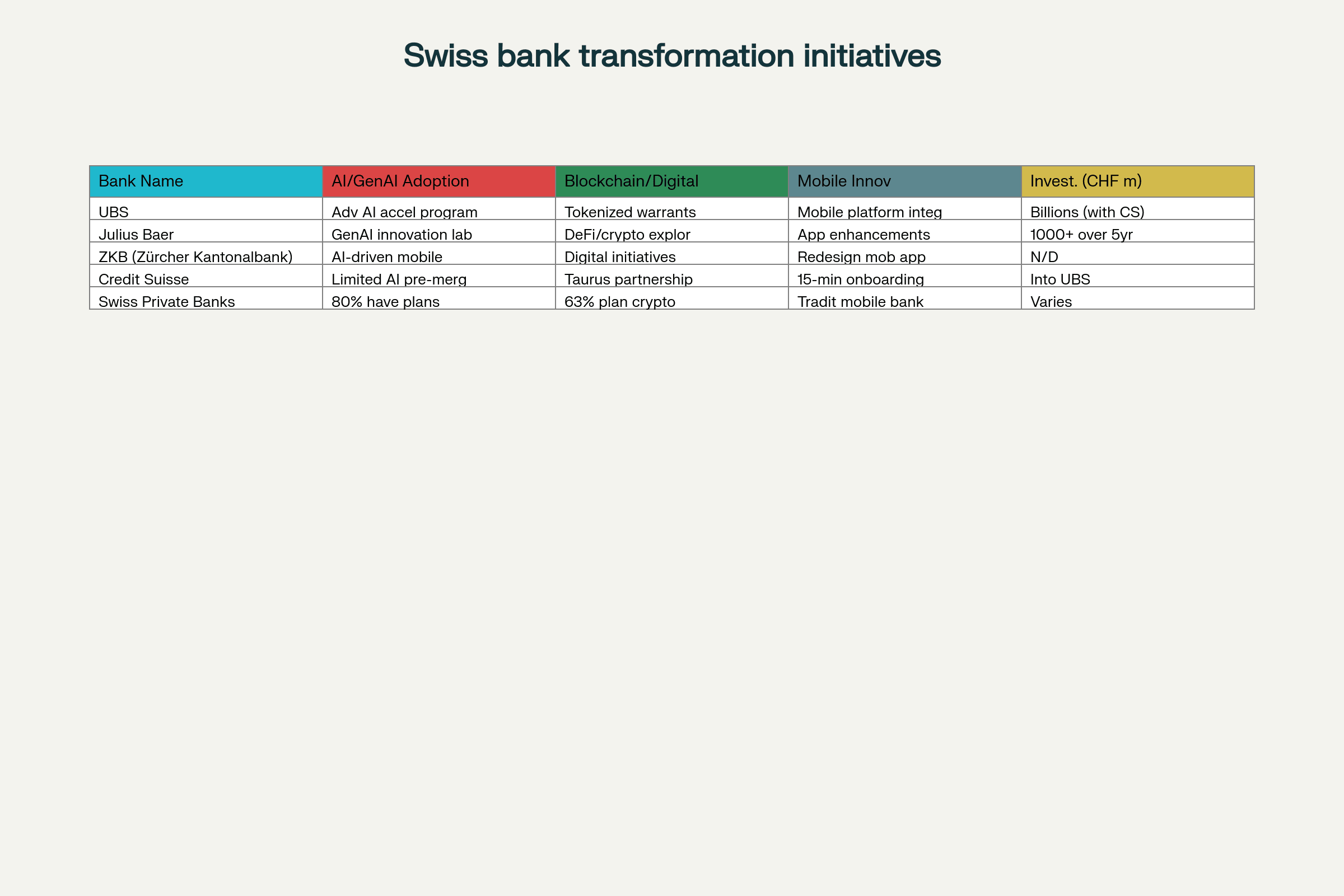

Julius Baer leads this transformation with remarkable ambition. The bank has invested over one billion Swiss francs in technology over the past five years and shows no signs of slowing down. Their Singapore-based innovation lab, Launchpad, actively experiments with generative AI and large language models, developing AI-powered capabilities that augment rather than replace human advisors.

The impact on portfolio management is particularly striking. AI systems now process vast amounts of data—from traditional market indicators to social sentiment, earnings call tone, and even satellite imagery. These sophisticated algorithms enable real-time rebalancing strategies that adapt to market movements while controlling costs and tax implications. Recent studies show that AI-driven portfolios have achieved stronger risk-adjusted returns, particularly in volatile markets.

UBS has similarly accelerated its AI adoption across the firm. The bank is implementing an in-house AI assistant and expanding Microsoft Copilot access, focusing on differentiation, scalable client solutions, and operational efficiency. These investments are projected to boost operating margins and profitability through enhanced automation and reduced expense ratios.

However, the true innovation lies in how AI is reshaping the relationship manager role. Rather than eliminating human advisors, AI is redefining their value proposition. While algorithms handle complexity and scale, relationship managers focus on building trust, providing long-term guidance, and delivering the “human touch” that high-net-worth clients still demand.

Blockchain Integration: Switzerland’s “Crypto Valley” Advantage

Switzerland’s position as the world’s “Crypto Valley” provides a significant competitive advantage in blockchain adoption. The University of St. Gallen’s comprehensive 2024 study reveals that over 80% of Swiss banks are either planning or actively expanding their blockchain offerings, with 63% pursuing concrete cryptocurrency plans.

Digital Transformation Initiatives Across Major Swiss Banks (2024-2025)

The focus centers on three key areas: custody services (60% of banks), trading services (60%), and exchange-traded products (60%). This strategic approach reflects Swiss banks’ methodical entry into digital assets, prioritizing regulatory compliance while capturing market opportunities.

UBS has made particularly bold moves, launching Hong Kong’s first-ever tokenized warrant on the Ethereum network. This innovative product utilizes the bank’s in-house tokenization service, UBS TokenizeLink, demonstrating how traditional banks can leverage blockchain technology for sophisticated financial instruments.

The integration extends beyond cryptocurrencies. Nearly half (48%) of Swiss banks are planning or conducting tokenization initiatives, exploring applications in trade finance, settlement, and other advanced blockchain use cases. This positions Switzerland at the forefront of the tokenization revolution that many experts believe will transform traditional finance.

Mobile Banking Revolution: From Legacy to Leading Edge

The mobile banking transformation represents perhaps the most visible change for everyday clients. Traditional Swiss banks, once criticized for lagging behind global digital leaders, are making significant strides in mobile innovation.

Zürcher Kantonalbank (ZKB) exemplifies this evolution with its comprehensive mobile app redesign. The new version 2.0 features a fast, simple, and beautiful interface that matches modern user expectations while maintaining the bank’s traditional reliability. The app includes intuitive home screen shortcuts, streamlined navigation, and a design system that enables consistent future development.

The challenge was substantial—redesigning an app used by nearly a quarter-million users while preserving established user habits. The result demonstrates how traditional Swiss banks can successfully compete with neobanks like Revolut and other digital-first competitors.

BCGE has pioneered self-onboarding capabilities, allowing customers to open accounts and access banking services entirely online. This fully digitalized platform operates 24/7, with identification and document signing available Monday through Saturday from 8am to 10pm.

However, challenges remain. According to Deloitte’s 2024 Digital Banking Maturity Study, Swiss banks achieved an average digital maturity level of only 39 points, below the global average of 41. None qualified as “Digital Champions,” highlighting the work still needed to match international standards.

The Robo-Advisor Revolution: Democratizing Wealth Management

Swiss robo-advisors are transforming investment accessibility, offering sophisticated portfolio management at a fraction of traditional costs. Finpension Invest leads with 0.39% base fees and comprehensive customization options, including access to private markets—unique among Swiss robo-advisors.

The sector caters to changing client expectations, with minimum investments as low as 500 Swiss francs. These platforms use modern portfolio theory and comprehensive market analysis to create diversified ETF portfolios, removing emotional decision-making while maintaining professional-grade investment strategies.

True Wealth, a pioneer since 2013, offers automated ETF-based asset management, while newer entrants like Alpian and Selma Finance combine traditional Swiss financial expertise with technological innovation. This democratization of wealth management allows smaller investors to access sophisticated strategies previously available only to high-net-worth clients.

Fintech Partnerships: Collaborative Innovation

Swiss banks increasingly recognize that innovation often comes through partnership rather than internal development. The fintech sector’s remarkable H1 2025 recovery, matching 2024’s entire deal volume in just six months, demonstrates the vitality of Switzerland’s financial technology ecosystem.

Notable partnerships include Deutsche Bank’s global agreement with Swiss digital asset provider Taurus, and HSBC’s collaboration with Swiss quantum computing startup Terra Quantum. These relationships allow traditional banks to access cutting-edge technology while maintaining their regulatory compliance and client relationships.

The Swiss Fintech Innovations (SFTI) association facilitates these collaborations, standardizing APIs for payments, account access, and other services. This infrastructure enables seamless integration between traditional banks and innovative fintech solutions, creating a more connected and efficient financial ecosystem.

Digital Payment Evolution: TWINT and Beyond

Switzerland’s payment landscape is rapidly modernizing. The Swiss Interbank Clearing (SIC) launched instant payments in November 2023, with larger banks required to accept instant payments since August 2024. This infrastructure supports the growing popularity of TWINT, Switzerland’s leading mobile payment system.

The shift toward digital payments represents a fundamental change in Swiss consumer behavior. 73% of Swiss residents now use online banking, significantly above the EU average of 55%. Mobile banking adoption, while lower at 43% overall, jumps to 65% among young adults aged 18-25, indicating generational change that will drive future growth.

Regulatory Adaptation and Risk Management

Swiss financial regulators are adapting to support digital innovation while maintaining the country’s reputation for stability. FINMA’s 2025 AI survey reveals that institutions are prioritizing data quality, data protection, and explainability when implementing AI systems.

The regulatory framework supports innovation through initiatives like the fintech license, which allows companies to accept up to CHF 100 million in public deposits under simplified regulations. This balanced approach enables innovation while maintaining the robust oversight that underpins Swiss banking’s global reputation.

Challenges and Future Outlook

Despite impressive progress, Swiss banks face significant challenges in their digital transformation. The integration of Credit Suisse into UBS—involving 1.3 million clients and 110 petaoctets of data—illustrates the complexity of modern banking technology integration.

Cybersecurity remains paramount, with increasing dependence on BigTech providers for AI services raising concerns about operational resilience. Swiss banks must balance innovation with the privacy and security expectations that define their brand globally.

The competitive landscape continues evolving as neobanks like Neon, Yapeal, and Alpian offer streamlined digital experiences. Traditional banks must match this convenience while leveraging their advantages in trust, regulatory compliance, and comprehensive service offerings.

The Path Forward: Hybrid Innovation Model

Swiss banking’s digital future appears to center on a hybrid model that combines technological innovation with traditional banking strengths. AI enhances rather than replaces human expertise, blockchain enables new products while maintaining regulatory compliance, and mobile platforms deliver convenience without sacrificing security.

The transformation requires substantial investment—Julius Baer’s billion-franc commitment over five years exemplifies the scale needed. However, early results suggest this investment pays dividends through improved margins, enhanced client experiences, and competitive positioning.

Switzerland’s banking sector stands uniquely positioned to lead global finance’s digital evolution. The combination of regulatory support, technological expertise, traditional banking excellence, and collaborative fintech ecosystem creates conditions for sustained innovation leadership.

As the industry moves “beyond the vault,” Swiss banks are proving that digital transformation and traditional banking values can coexist successfully. The institutions embracing this dual identity—technological sophistication wrapped in Swiss reliability—appear best positioned to thrive in the digital age while preserving the trust and excellence that made Swiss banking legendary.

The revolution is quiet but profound, transforming every aspect of how Swiss banks operate. From AI-powered investment algorithms to blockchain-based digital assets, from instant mobile payments to robo-advisor platforms, the new face of Swiss banking combines cutting-edge innovation with timeless principles of trust, security, and client service. This synthesis of old and new may well define the future of global banking.

Conclusion

In summary, Swiss banking is no longer confined to the vault. Through strategic investments in AI, blockchain, and mobile innovation, the industry is evolving into a dynamic digital powerhouse. Whether you’re looking to open a Swiss bank account or seeking advanced wealth management solutions, Swiss banks now offer seamless, secure, and tech-driven services that blend tradition with innovation. As part of Easy Global Banking’s mission to make international finance more accessible and seamless, these advancements pave the way for clients worldwide to benefit from Switzerland’s legendary stability—delivered at the speed of digital.