Let me be straight with you: opening a Swiss bank account as a non-resident isn’t what most guides claim it is.

The story you’ll read online usually goes something like this—you need CHF 1 million, fill out some forms, and boom, you’re banking in Zurich. The reality is far messier. Your passport matters more than your money. Where you live determines whether you even get through the door. And once you do, the institution that accepts you shapes what you can actually do with your account.

I’ve spent enough time in this space to know what works and what doesn’t. Let me walk you through it.

What Actually Closed (And When)

Between 2018 and 2023, Swiss banks quietly shut their doors to most non-residents. Not all of them, and not in ways they advertised publicly, but systematically nonetheless.

UBS stopped accepting retail non-resident clients years ago. PostFinance won’t touch you unless you’re Swiss or meet very specific EU criteria. Raiffeisen, Migros Bank—same story. The math was simple from the banks’ perspective: compliance costs between CHF 5,000 and CHF 15,000 per non-resident account don’t make sense when you’re managing CHF 50,000. They’d rather not have the headache.

Most people don’t realize this happened. They read an article from 2020, assume it’s current, and waste months pursuing banks that will reject their application automatically.

The Three Cantonal Banks That Still Answer (Sort Of)

Switzerland has 24 cantonal banks. Of those, exactly three will even consider non-residents:

BCV (Banque Cantonale Vaudoise) takes them at CHF 3 million to CHF 5 million and up. BGCE (Banque Cantonale Genève) operates similarly—CHF 3 to CHF 5 million, and they’re pickier about who they let in. ZKB (Zurich Cantonal Bank) sits in the same range but keeps getting more defensive about non-residents.

Here’s the catch: approval at these minimums isn’t guaranteed. Having CHF 5 million doesn’t mean they’ll accept you. They’ll look at your profession, where you’re from, whether you show up on any regulatory lists, and how clean your money trail is. Being from the EU helps considerably. Being from elsewhere makes everything harder. And if you’re a politically exposed person or connected to one? Expect rejection.

The reason these three even exist as options is simple—they’re regional institutions with mandates to serve their cantons’ wealth management needs. That regional focus creates a sliver of flexibility that disappeared from the major banks. But calling them “flexible” would oversell it dramatically.

The Private Banking Tiers (And What Each One Actually Wants)

Think of Swiss private banking like a pyramid. Where you fit depends on what you have to bring to the table.

At the very top sit the giants. Julius Baer, Pictet, and Lombard Odier start at CHF 5 million. That’s the minimum. At that level, you’re barely on their radar. Your relationship manager will have plenty of other clients, your portfolio won’t get the white-glove treatment, and you’ll attend group meetings rather than having bespoke advisory sessions. The real attention, the customized solutions, the deep expertise—that kicks in at CHF 10 million and above.

Below them, you’ve got the mid-market players. Vontobel and UBP (Union Bancaire Privée) operate in the CHF 3 million to CHF 5 million range. These institutions take more time with clients, give you actual relationship managers who know you by name, and structure things around your specific situation rather than a standardized model. The service quality is noticeably better than the giants at comparable capital levels.

Hidden gems

Then there are the smaller banks. These aren’t household names—you won’t see them advertised on billboards or mentioned in business press. They carry strong balance sheets, maintain solid credit ratings, and keep themselves regulated by FINMA like everyone else. What makes them different is their minimums and how they operate.

For European clients, some smaller institutions will consider entry levels from CHF 500,000, while non-European clients should expect a minimum of CHF 1 million. What truly differentiates these banks is their mindset. They actively seek long-term relationships, take the time to understand your objectives, and involve the right internal specialists from the outset. At this level, clients are not treated as account numbers—each relationship genuinely matters.

Accessing these banks is the real hurdle. They do not advertise internationally or compete for attention online. Instead, they operate through trusted professional networks: advisors, accountants, and lawyers who specialise in cross-border wealth. A cold approach almost always fails, but a qualified introduction significantly increases the likelihood of approval.

The Geographic Reality

Here’s where it gets uncomfortable: where your passport was issued matters more than how much money you have.

If you’re based in the EU—France, Germany, Italy, Austria, anywhere in that club—doors open that stay closed for everyone else. Banks move faster with you. Compliance teams give you benefit of the doubt. Minimums sometimes bend a little. The timeline shrinks from 14-16 weeks to 8-10 weeks.

Everyone else faces a different experience. Non-EU clients go through enhanced scrutiny. Timelines stretch. Banks ask more questions. The same CHF 500,000 that might crack open a smaller Swiss bank for a German entrepreneur becomes a hard no for someone from Singapore or Hong Kong or New York.

This isn’t discrimination in the legal sense. It’s risk management. The EU has banking relationships with Swiss authorities. There’s mutual regulatory recognition. Compliance frameworks align. For countries outside that circle, everything becomes more complex.

The effect is stark. An EU resident with CHF 500,000 might genuinely access a smaller Swiss private bank. A non-EU resident with CHF 2 million might face rejection because the compliance infrastructure doesn’t exist in quite the same way.

The Problem Zone (And Why It Matters)

There’s a gap that exists between CHF 500,000 and CHF 1 million for non-EU clients, and it’s worth understanding because it probably applies to you.

At CHF 500,000, you’re too small for most mid-market banks that want CHF 3 million minimum. Too large for the online trading accounts that work fine at CHF 50,000 but aren’t structured for banking. Somewhere in between are institutions that might work, but only if you know who they are and how to reach them.

The smaller Swiss private banks I mentioned earlier? They genuinely will consider CHF 500,000 from an EU client with the right background. But for non-EU applicants, most want CHF 1 million. That’s not coincidental. It’s the threshold where the compliance cost-benefit equation shifts in their favor.

This gap created an interesting dynamic. Clients caught in it sometimes sit tight and wait for one more year, building capital to CHF 1 million. Others explore alternatives or accept that Swiss banking might not be the right move for their current situation. A few get introduced to the right person and discover options they didn’t know existed.

What Actually Works for Smaller Accounts

If you’ve got CHF 100,000 to CHF 250,000, Swiss banking isn’t dead—it’s just different.

CIM Bank in Geneva still accepts non-residents at these minimums. It’s not prestigious. You won’t impress anyone at a dinner party by mentioning it. But it works. You get a real Swiss bank account. Checking, transfers, debit card, multi-currency capabilities. The service is straightforward, fees are transparent, and the compliance process, while thorough, doesn’t treat you like a criminal.

Dukascopy Bank offers something similar with a trading platform built in. If you’re interested in active investing, want exposure to Swiss instruments, and appreciate the convenience of doing it all in one place, that works. The timeline is slightly faster than CIM Bank, and if you’re doing actual trading, the fee structure might be better.

For those with CHF 50,000 to CHF 100,000, online trading platforms like Swissquote, Saxobank, and IG Bank provide entry into Swiss financial markets. That said, understand what you’re actually getting. These are investment accounts, not banks. The restrictions come built in—use it for trading and investing, period. Try to run daily banking through it, move salary deposits, conduct regular transfers like you would through a checking account, and you’ll find your account flagged and restricted.

Professional Investor Status Doesn’t Do What You Think

A lot of people chase professional investor classification under Switzerland’s financial regulations, thinking it unlocks doors. It doesn’t, at least not in the way most people imagine.

Professional investor status exists as a regulatory classification. It determines what investments banks can offer you without providing extensive warnings. It shapes how much paperwork they have to provide. It changes the disclosure requirements. These are real things that affect your experience, but they don’t fundamentally alter minimum deposit requirements at major institutions.

If you have CHF 500,000 and professional credentials—a CFA, an MBA, five years managing money—some smaller banks will listen. They’ll process your application faster and treat your wealth situation with less skepticism. But Vontobel or UBP still want CHF 3 million. Julius Baer still starts at CHF 5 million. Professional status opens no doors there.

Where it actually helps is with smaller, specialist-sourced banks. If you’ve got the credentials plus the capital, they might move you through approval faster. They might waive some documentation. They might get more creative about structuring your relationship. But the minimum deposits still exist.

How The Timeline Actually Works

Approval timelines vary based on several factors, and it’s worth being realistic about what to expect.

EU residents dealing with CIM Bank or Dukascopy typically see approval in 8-12 weeks. Non-EU clients at the same institutions need 12-16 weeks. The difference comes down to enhanced due diligence requirements, additional regulatory checks, and the simple reality that compliance teams move slower for jurisdictions outside Europe.

With private banks, timelines elongate. A smaller institution might take 12-16 weeks. Mid-market banks often run 10-14 weeks. The Tier-1 banks, despite their size, sometimes move faster because their clients have typically already been thoroughly vetted in other banking relationships.

The process itself breaks down predictably. Week one and two cover initial assessment—does your profile fit what they accept? Weeks three and four involve compliance interviews and preliminary questions. Weeks five through eight are documentation submission and initial review. Weeks nine through twelve cover deeper compliance checking, source-of-funds verification, and regulatory screening. By week thirteen, you either have approval or a polite rejection.

This timeline assumes clean documentation and straightforward circumstances. If there’s anything unusual about your background, your source of funds, or your regulatory exposure, add 4-8 weeks minimum.

What The Banks Actually Check

Understanding what triggers additional scrutiny helps you prepare documents properly and avoid delays.

Every bank wants to verify your identity—no surprise there. But they also need proof you actually live where you say you live. This trips people up more than it should. They want recent utility bills, lease agreements, or government registration documents. Older than three months doesn’t count.

Source of funds documentation matters enormously. Where did this money actually come from? If you’re moving investment proceeds from a liquidated business, they want the sale agreement. If it’s inheritance, they want the will and probate documents. Property sale? The deed and closing documents. Bank statements from wherever the money currently sits? They almost always want six months of history.

Then there’s PEP screening—politically exposed person screening. If you work in government, if your family includes anyone with political roles, if you’re connected to state-owned enterprises, that triggers deeper review. It doesn’t automatically disqualify you, but it extends the timeline and requires more documentation.

Sanctions screening happens monthly. Banks check you against OFAC, EU sanctions lists, and UN designations. Being from a country under international scrutiny makes this more complicated. If you’re from a region experiencing sanctions or banking restrictions, expect extra attention.

Finally, tax compliance documentation. For US citizens or others with tax obligations in multiple jurisdictions, additional forms and certifications are required. This varies by your personal situation, but it’s worth anticipating.

The Cost Reality

Minimum deposits aren’t the only cost. Annual fees shape the true economics of banking somewhere.

At CIM Bank or Dukascopy, expect to pay CHF 1,000 to CHF 2,500 annually. That covers account maintenance, some international transfers, currency conversion markups. If you’re actively trading, commissions layer on top. It’s not cheap, but it’s transparent and predictable.

Smaller private banks charging 0.5-2% of assets under management shift the math. At CHF 500,000, that’s CHF 2,500 to CHF 10,000 per year in advisory fees alone. Add account maintenance and you’re at CHF 5,000-10,000 minimum. At CHF 1 million, you’re looking at CHF 10,000-20,000 annually.

Mid-market banks operate similarly. Vontobel, UBP, and their peers typically charge 0.5-1% in wealth management fees, sometimes bundled with account maintenance. At CHF 3 million, that’s CHF 15,000-30,000 per year. At CHF 5 million, you’re in the CHF 25,000-50,000 range.

The major banks don’t publicize fees the way smaller institutions do. It gets negotiated. But broadly speaking, CHF 5 million gets you in the door, and you’re probably paying between CHF 25,000-50,000 annually for the privilege once everything is bundled together.

The EU vs. Everyone Else Breakdown

I mentioned geographic differences earlier, but it deserves a clearer breakdown because it genuinely changes what’s available to you.

EU residents with CHF 500,000: You can approach smaller private banks directly. Some will consider you. Timeline runs 12-14 weeks typically.

EU residents with CHF 1-3 million: Mid-market banks become realistic options. Vontobel and UBP will have conversations with you. Timeline runs 10-14 weeks.

EU residents with CHF 3-5 million: The three cantonal banks might work. So will mid-market institutions offering more customized treatment. Timeline runs 12-16 weeks. Approval isn’t guaranteed, but it’s genuinely possible.

Non-EU residents with CHF 500,000-1 million: This is the difficult zone. Most Swiss institutions want no part of it. CIM Bank or Dukascopy work at the lower end of this range. Beyond that, options narrow sharply. Timeline runs 14-18 weeks if you find someone willing.

Non-EU residents with CHF 1-3 million: Smaller private banks become realistic. They require CHF 1 million minimum, but they work with non-EU clients. Timeline runs 14-18 weeks.

Non-EU residents with CHF 3 million and above: You move into territory where conversations happen. Mid-market banks engage seriously. Cantonal banks unlikely, but possible with right documentation. Timeline runs 12-16 weeks.

The pattern is clear: same wealth threshold, different access depending on your passport.

The Specialist-Sourced Banks Nobody Talks About

Here’s what surprised me most about researching current Swiss banking: the most accessible private banks for CHF 500-1000,000 clients are institutions most people have never heard of.

They have strong balance sheets. They maintain solid credit ratings. FINMA regulates them identically to better-known banks. Their relationship managers are experienced, thoughtful professionals. The service quality often exceeds what you’d get at a Tier-1 bank at comparable capital levels.

What makes them invisible is simple—they don’t advertise, don’t market internationally, and don’t have obvious public presence. They build relationships through referrals, through tax advisors and wealth lawyers and accountants who specialize in international clients.

If you’ve got CHF 500,000 as an EU resident or CHF 1 million as non-EU, and you want genuine private banking relationship that doesn’t require CHF 3 million minimum, these banks are worth pursuing. But pursuing means finding someone who knows them and can make an introduction. Direct applications don’t work.

What Approval Actually Looks Like

After weeks of documentation and checking, you’ll get either a yes or a no. More often than you’d expect, it comes as a detailed conversation rather than a simple email.

An approval comes with account numbers, wire instructions, and access credentials. You transfer the minimum deposit—and yes, they’ll verify it came from the source you claimed. Once they confirm receipt, your account activates. Within a few days, physical cards ship out. Within a week, you have full access to online banking. Boom—you’ve got a Swiss account.

A rejection comes with minimal explanation. Banks aren’t eager to spell out why they declined you. Sometimes it’s source-of-funds concerns that didn’t fully resolve. Sometimes regulatory screening flagged something that takes months to clear up. Sometimes they just decided the relationship wasn’t worth the compliance overhead. Appeals rarely work.

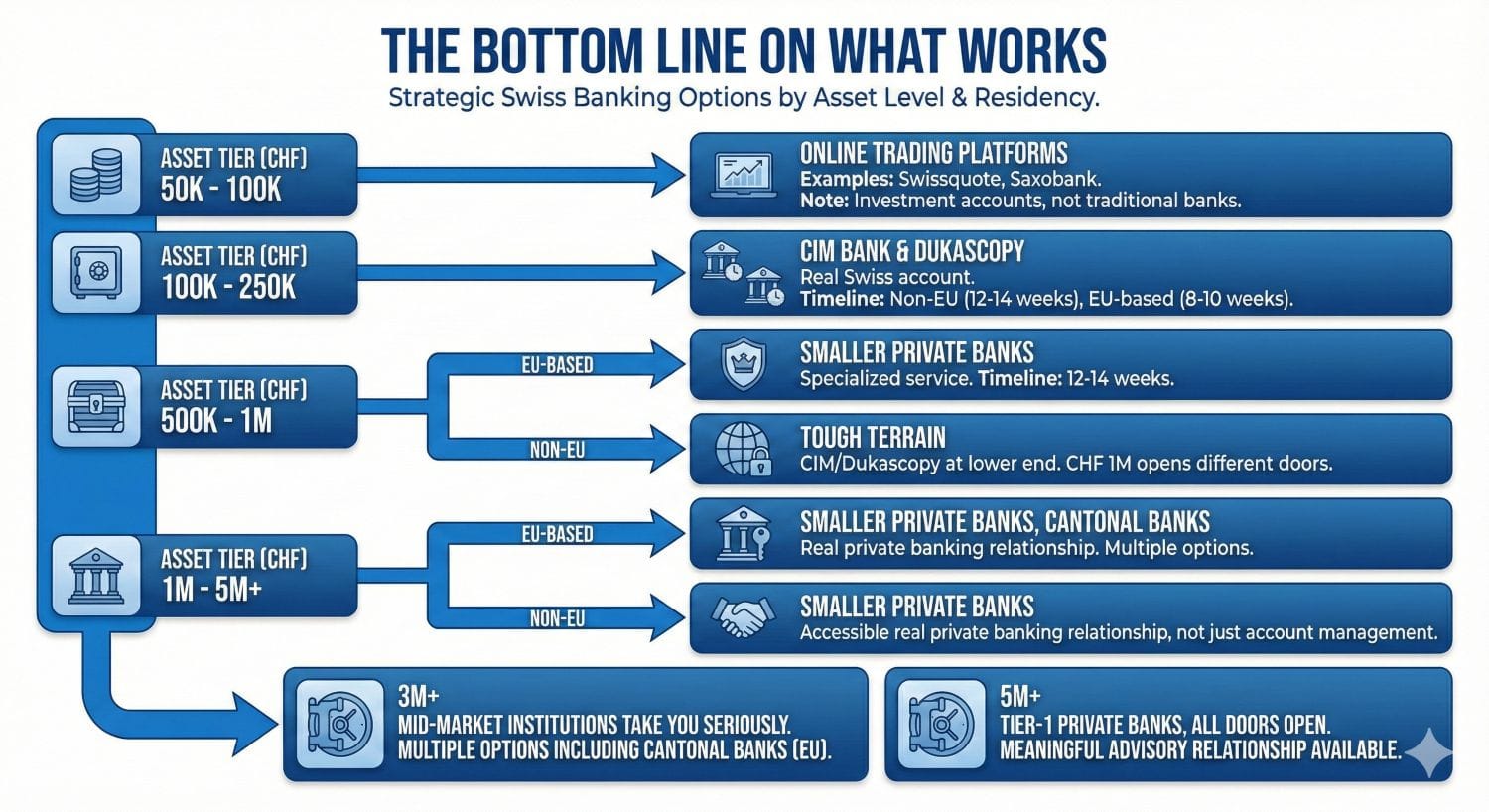

The Bottom Line on What Works

Let’s cut through everything and just talk about what actually works for different situations:

You’ve got CHF 50,000 to CHF 100,000: Online trading platforms (Swissquote, Saxobank) work. Understand they’re investment accounts, not banks.

You’ve got CHF 100,000 to CHF 250,000: CIM Bank and Dukascopy genuinely work. You’ll have a real Swiss account. Plan for 12-14 weeks if non-EU, 8-10 weeks if EU-based.

You’ve got CHF 500,000 and are EU-based: Smaller private banks are worth pursuing through the right advisors. Expect specialized service and 12-14 week timeline.

You’ve got CHF 500,000 to CHF 1,000,000 and are non-EU: This is tough terrain. CIM or Dukascopy works at the lower end. Beyond that, waiting until CHF 1 million opens different doors.

You’ve got CHF 1,000,000 and are non-EU: Smaller private banks become accessible. Real private banking relationship at that level, not just account management.

You’ve got CHF 3,000,000 and above: Multiple options open, including cantonal banks if you’re EU-based. Mid-market institutions take you seriously.

You’ve got CHF 5,000,000 and above: Tier-1 private banks, all doors open, meaningful advisory relationship available.

What Doesn’t Work (So You Don’t Waste Time)

Let me save you some frustration by naming things that don’t actually work despite what you might read online:

Calling major Swiss banks directly and asking about non-resident accounts wastes time. They’ll route you to a standard answer. Your application will get processed but almost certainly rejected. Don’t bother.

Opening neobank accounts and expecting Swiss banking access doesn’t work. These platforms serve specific nationalities and regions. Geographic restrictions exist whether they advertise them or not.

Expecting regional ties to matter at cantonal banks is wishful thinking. Compliance requirements are identical regardless of regional connections.

Assuming professional investor status opens private banking doors at lower minimums mostly doesn’t work. It helps, but doesn’t fundamentally change what institutions will accept.

Trying to negotiate minimums significantly downward doesn’t work with major institutions. CIM Bank and Dukascopy operate on relatively firm terms. Private banks might budge slightly, but not dramatically.

Making Your Move

If you’ve read this far and decided to actually pursue Swiss banking, here’s how the practical process works:

Gather your documentation first. Get recent proof of address, six months of bank statements, clear explanation of where your funds originate. If that explanation involves anything complex, get supporting documents together. Don’t waste the banks’ time with incomplete applications.

Identify which institution actually fits your situation. Use the guidelines above. Don’t contact institutions where your capital falls below their realistic minimum.

For larger accounts or specialist-sourced banks, find the right introduction. An advisor, lawyer, or accountant who works in this space and maintains banking relationships makes a difference. Cold applications mostly fail.

For CIM Bank or Dukascopy, you can approach directly. Email their business development team. Keep your initial inquiry brief—nationality, approximate capital, general account type you’re after. Ask about preliminary eligibility.

Plan for the full timeline. Don’t expect approval in six weeks. Assume 12-16 weeks unless you’re EU-based at CIM/Dukascopy, where 8-10 weeks is realistic.

Be thorough with every compliance question and document request. Banks aren’t trying to hassle you—they’re managing regulatory risk. The faster you provide what they ask for, the faster things move.

Once approved, wire the minimum deposit from a documented source. That source needs to match what you claimed in your application. Expect the bank to verify it before your account fully activates.

Why This Matters

Swiss banking for non-residents in 2026 isn’t the open door people imagine. It’s more like a series of gates. Some gates won’t open for you regardless of capital. Some require specific documentation or background. Some exist because of regulations you never agreed to but have to navigate anyway.

But for people who fit the right profile—those with genuine legitimate wealth, clean documentation, and realistic expectations about what’s available at their capital level—Swiss banking works. It provides real banking infrastructure, regulatory credibility, and institutional stability that matters.

The key is knowing which gate actually opens for your specific situation, rather than wasting months pursuing options that were never realistic in the first place.

That’s what this guide tried to map out. Know where you stand, approach institutions that actually accept people like you, and organize your documentation properly. Everything else follows from those three things.

Easy Global Banking works with clients who want honest assessment of what’s actually accessible in Swiss banking and other jurisdictions. We specialize in introductions to institutions that actively serve non-residents at various capital levels.

Get Honest Guidance on Your Options

You don’t need to waste months chasing closed doors or mismatched institutions. We’ll assess your actual situation and connect you with banks that genuinely accept people like you.