Overview:

Turkish business owners and high-net-worth individuals increasingly explore international banking relationships, including Swiss accounts. This guide provides factual information about the regulatory environment, operational considerations, and practical framework for understanding Swiss banking as part of international financial planning. The information presented is educational and intended to inform decision-making, not to encourage specific actions.

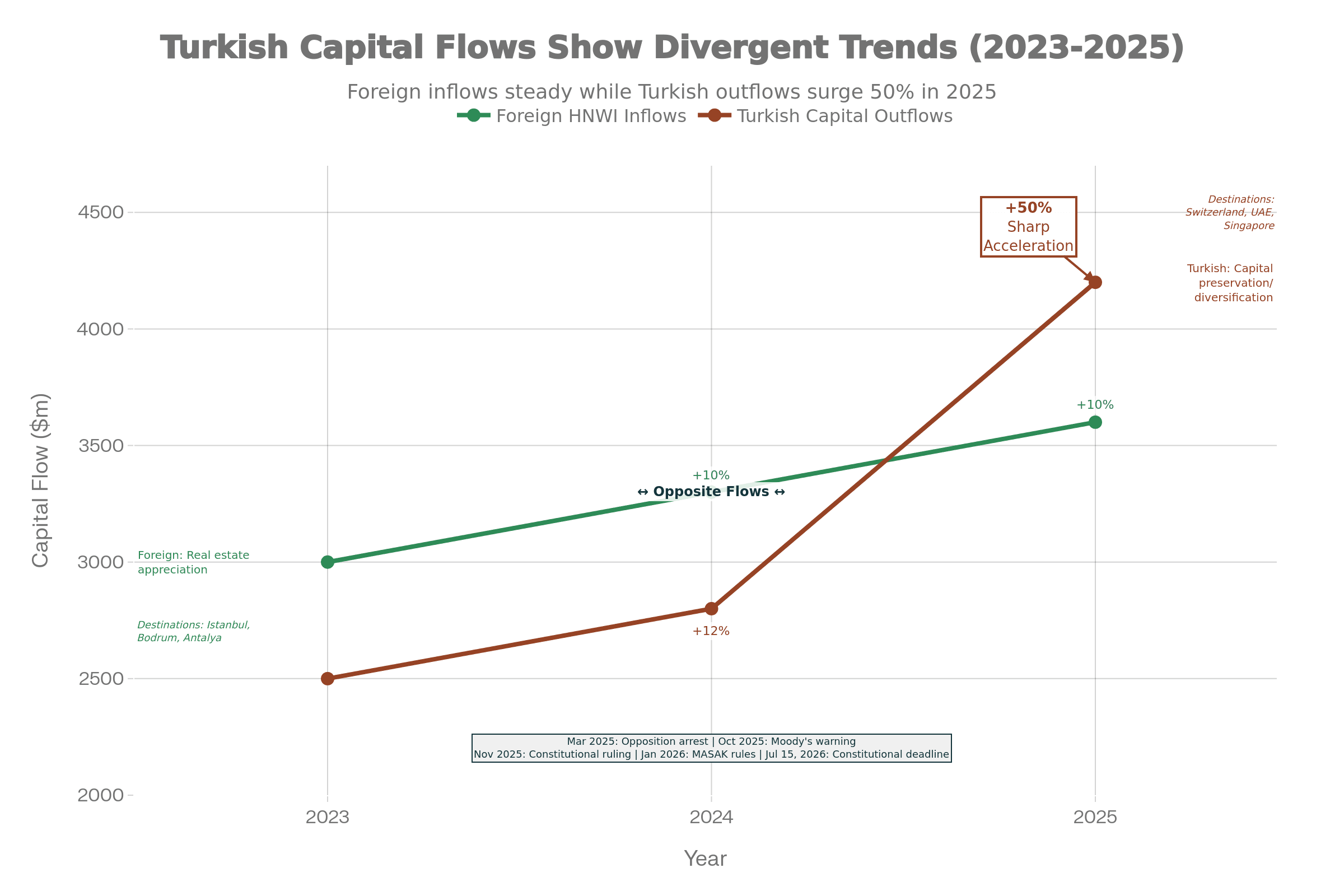

International Banking Trends Among Turkish Wealth Holders

Wealth holder behavior across emerging markets shows diversification patterns worth understanding. Global data from 2025 indicates that 142,000 high-net-worth individuals (HNWIs) relocated internationally, representing normal wealth management practices.

Turkey presents an interesting case: the country simultaneously attracts foreign investment while some domestic wealth holders maintain international banking relationships.

Foreign investment inflows: Foreign HNWIs have increased presence in Turkish real estate markets, particularly Istanbul, Bodrum, and Antalya. Growth rates in foreign HNWI real estate investment approximated 10% in 2024 compared to prior years. This reflects Turkey’s citizenship-by-investment program (USD 400,000 real estate investment for citizenship pathway) and property market characteristics.

International banking relationships: Some Turkish business owners and wealth holders establish banking relationships outside Turkey, according to available data. These relationships typically serve operational, diversification, or institutional considerations rather than single-purpose rationales.

The two patterns—foreign real estate investment increasing while some Turkish wealth holders maintain offshore banking—represent different investment objectives and risk considerations.

Current Regulatory Environment: MASAK Rules and Constitutional Framework

Turkey’s financial monitoring system underwent significant regulatory adjustments in 2025-2026, creating an important context for understanding current banking requirements.

MASAK Regulations (Effective January 1, 2026):

The Financial Crimes Investigation Board (MASAK) implemented enhanced financial monitoring requirements:

- Bank transfers exceeding TRY 200,000 require documentation of transfer purpose

- Transfers exceeding TRY 20 million require source-of-funds documentation including property or equivalent verification

- Financial institutions must maintain detailed transaction audit trails

- Non-compliance penalties: TRY 453,342+ per violation

These regulations operate within a broader framework focused on preventing money laundering and illegal financial activity. The requirements apply to domestic and international transfers and represent standard compliance practices across emerging markets.

Constitutional Framework Status:

On November 19, 2025, Turkey’s Constitutional Court issued a ruling affecting the legal basis for capital control regulations. The court invalidated certain provisions of existing capital control regulations, establishing July 15, 2026 as a deadline for Parliament to enact replacement legislation.

This creates a technical situation: current regulations remain in effect but operate under a legal foundation that requires legislative renewal. Parliament must either pass new legislation by July 15, 2026, or the framework lapses, creating a regulatory transition period.

This is a factual regulatory circumstance, not inherently indicative of future direction. Outcomes could include:

- New legislation maintaining or modifying current restrictions

- Modified regulatory framework with different parameters

- Temporary period without specific legislative foundation (though administrative requirements would likely persist)

The Constitutional deadline represents a scheduled legislative review point, not a regulatory crisis or urgency trigger.

Operational Characteristics of International Banking

Turkish business owners who establish international banking relationships cite operational considerations:

Multi-currency management: Businesses operating across multiple currencies (USD, EUR, TRY) benefit from institutional infrastructure for currency trading, hedging, and international payments. Swiss banks provide these operational tools as standard banking services.

Institutional diversification: International banking relationships represent portfolio diversification—distributing banking relationships across multiple jurisdictions and institutions rather than concentrating banking exclusively in domestic institutions.

Currency exposure management: Some wealth holders maintain holdings in multiple currencies as part of normal portfolio construction. The Turkish lira, like all emerging market currencies, experiences volatility. Holding francs, euros, or dollars represents a normal diversification approach to currency exposure.

Institutional stability characteristics: Switzerland’s banking system operates with specific institutional features:

- Regulatory continuity and predictable legal frameworks

- Custodial asset separation (client assets held separately from bank balance sheets)

- AEOI reporting requirements (account information reported to Turkish tax authorities)

- Full transparency to Turkish authorities

- Standard international banking compliance standards

None of these represent secrecy or privacy protection. They represent institutional operational characteristics that some wealth holders value as part of international banking strategy.

AEOI: Automatic Information Reporting to Turkish Authorities

Any Turkish tax resident with a Swiss account must understand automatic information exchange requirements:

How AEOI Functions:

- Swiss banks identify accounts held by Turkish tax residents

- Annually (as of December 31), banks compile account information: account holder identification, account number, account balance, and all income (interest, dividends, capital gains)

- Data transmission occurs through Swiss Federal Tax Administration to Turkish Revenue Administration

- Information reaches Turkish authorities by June 30 following the reporting year

Tax Residency Determination:

Turkish tax residency is the trigger for reporting. Individuals who reside in Turkey, work in Turkey, or maintain substantial economic ties in Turkey are typically classified as Turkish tax residents. Non-Turkish tax residents would not be reportable, but most Turkish citizens establishing Swiss accounts are tax residents.

Reporting Is Comprehensive:

All account types are reportable. No exemptions exist based on account purpose, amount, or designation. The reporting is mandatory and automatic.

Tax Implications:

Reported account income must be declared to Turkish tax authorities and is subject to Turkish taxation. This is standard practice for Turkish residents with international income sources. Double taxation treaties exist between Switzerland and Turkey to prevent duplicate taxation.

Turkish Market Context: Economic and Political Conditions

To understand international banking decisions, context regarding Turkish economic conditions is relevant:

Economic Growth and Inflation:

Turkey achieved GDP growth of 5.1% (2023) and 5.7% (Q1 2024). Inflation declined from 75% (2022) to 31% (2025) as Central Bank tight monetary policy took effect.

However, underlying economic conditions show constraints:

- Short-term external debt: USD 185.9 billion, creating refinancing requirements

- Current account deficit: approximately USD 40 billion annually, unsustainable at current trajectory

- Commercial loan rates: 52-60% for select borrowers (reflecting Central Bank tight policy)

- Credit expansion constraints: Consumer/auto loan growth capped at 2% monthly by Central Bank regulation

Political Context:

In March 2025, the Istanbul Mayor (opposition leader) was arrested on corruption charges. This triggered anti-government demonstrations and subsequent arrests of opposition officials. According to reporting, approximately 500+ opposition-affiliated individuals faced detention or pre-trial detention.

The arrests prompted business investment cautious recalibration. Companies delayed expansion plans and conducted more frequent risk assessments. Moody’s Ratings noted in October 2025 that “credit momentum has reached a plateau,” indicating that earlier credit improvements have stalled. The agency attributed this to political tensions affecting investor confidence.

Credit Rating Trajectory:

Turkey’s credit rating peer group includes Pakistan, Egypt, and Tunisia—countries with emerging market debt service challenges. This represents the institutional assessment of Turkey’s creditworthiness relative to global markets.

These conditions—strong growth alongside inflation, external debt constraints, and political uncertainty—create the context in which some Turkish wealth holders consider international banking relationships.

Understanding the “Wealth Bifurcation” Phenomenon

Data suggests two simultaneously occurring patterns regarding wealth and Turkey:

Pattern 1: Foreign Investment Inflows

Foreign HNWIs are increasing real estate investment in Turkey at approximately 10% annual growth rates. Citizenship-by-investment pathways attract international capital. Turkish real estate forecasts suggest 6% CAGR through 2030, with 2025 Istanbul property appreciation at 17.4%.

Pattern 2: Turkish Wealth International Relationships

Concurrently, some Turkish business owners and accumulated wealth holders establish banking relationships outside Turkey. UBS forecasts 43% growth in Turkish millionaires by 2028.

These patterns are distinct: foreign capital inflows pursue real estate and property appreciation, while some Turkish wealth holders maintain banking diversification. Both trends can coexist. They reflect different risk perceptions and investment objectives:

- Foreign investor perspective: Turkey offers growth and property appreciation

- Turkish wealth holder perspective: International diversification offers institutional stability and currency management

Neither pattern represents a crisis. Both represent normal market behavior in emerging markets with mixed growth and political uncertainty.

Practical Framework: International Banking Considerations

If a Turkish resident considers international banking relationships, several practical factors merit evaluation:

Capital Requirements:

International banks serving non-EU clients typically maintain minimum deposit requirements:

- Online platforms: CHF 50,000-100,000

- Institutional banks: CHF 100,000-500,000

- Private banking: CHF 1,000,000+

Minimum requirements vary by institution and account type and may be subject to change.

Approval Timeline:

Account opening processes typically require 12-18 weeks for non-EU applicants. Timeline variability depends on documentation clarity and complexity of financial history. Straightforward business income documentation accelerates approval; complex multi-source capital extends timelines.

Documentation Requirements:

International banks require standard compliance documentation:

- Valid passport

- Proof of residence (recent utility bill, government documentation)

- Source-of-funds documentation with supporting evidence

- Tax identification number

- PEP screening (if applicable)

- Business documentation (if applicable)

The stringency of documentation review reflects regulatory requirements for non-EU applicants and is standard across institutions.

Fees and Costs:

Banking fees vary significantly:

- Account maintenance: CHF 1,000-3,000 annually

- Wealth management: 0.5-1.5% of assets annually

- International transfers: CHF 30-50 per transaction

- Currency conversion: 2-3% typical markup

Total costs depend on capital amount, account activity, and institution selection.

Regulatory Reporting:

All Turkish tax residents must understand AEOI reporting implications. Account information automatically reported to Turkish authorities. Income subject to Turkish taxation. This is non-negotiable and applies to all Swiss accounts held by Turkish residents.

Timing Considerations and Constitutional Deadline

The July 15, 2026 Constitutional deadline for new capital control legislation represents a legislative review point rather than a crisis date.

Wealth holders considering international banking may evaluate:

Current-Environment Considerations:

- MASAK rules are active and established

- Regulatory framework is known (though temporary)

- Current approval timelines are predictable (12-18 weeks for account opening)

- Compliance requirements are documented and understood

Post-July 15 Considerations:

- New legislative framework will be established

- Regulatory requirements may change (tightening, loosening, or modification unknown)

- Compliance timelines may shift

- Administrative procedures may be revised

Those considering international banking may evaluate whether to proceed under current known regulatory framework or wait for post-July legislative clarity. Both approaches have merit:

Case for proceeding now: Established regulatory clarity, known procedures, predictable timelines

Case for waiting: New legislative framework provides clarity on long-term requirements

Neither is inherently superior; the choice depends on individual circumstances and risk tolerance.

Swiss Banking: Institutional Characteristics

For those evaluating Swiss banking specifically, understanding its operational characteristics is relevant:

Regulatory Environment:

- Switzerland operates as a non-EU jurisdiction with independent regulatory framework

- FINMA (Swiss Financial Market Supervisory Authority) regulates banking operations

- Banking standards follow international compliance norms

- AML/KYC (anti-money laundering/know-your-customer) requirements match or exceed global standards

Account Characteristics:

- Multi-currency accounts available

- International payment capability (SWIFT, SEPA where applicable)

- Currency trading and FX services available

- Custodial asset protection (client assets separate from bank balance sheets)

Transparency Requirements:

- AEOI reporting to Turkish authorities (mandatory)

- No secrecy or privacy protection for Turkish residents

- Full income reporting

- Account balance reporting

Taxation:

- Swiss banks do not collect Turkish taxes

- Turkish residents responsible for self-reporting and tax compliance

- Double taxation treaty provisions apply

Swiss banking offers operational infrastructure and institutional stability, not tax avoidance or privacy protection.

Comparative Context: Other International Banking Options

Turkish residents considering international banking have several geographic options:

Singapore:

- Higherr capital minimums than Switzerland (from 3 mln usd)

- CRS reporting applies (information shared with Turkish authorities)

- Faster approval timelines

- Strong institutional framework

United Arab Emirates:

- Minimal regulatory overhead

- CRS reporting status evolving

- Good for operational velocity

- Less institutional credibility than Switzerland

Liechtenstein:

- Similar regulatory framework to Switzerland

- AEOI reporting applies

- Sometimes easier access for non-EU clients

- Smaller institutional base

Remaining in Turkey:

- Regulatory clarity

- No international transfer complexity

- Currency exposure concentrated in lira

- Subject to MASAK monitoring and documentation requirements

Each option has distinct characteristics and applicability depending on individual circumstances.

Final Consideration: Informational Framework

This guide provides factual information about international banking options available to Turkish residents. The regulatory environment, institutional characteristics, and practical considerations are presented objectively.

Decision-making regarding international banking involves personal circumstances, risk tolerance, investment objectives, and tax considerations that are beyond the scope of this informational guide.

Individuals considering international banking relationships are advised to:

- Consult with tax professionals regarding Turkish tax obligations

- Evaluate personal financial circumstances and objectives

- Understand regulatory requirements and reporting obligations

- Research institutions and operational characteristics

- Make informed decisions based on individual circumstances rather than external urgency or pressure

International banking is a legitimate tool for wealth management. It is also subject to regulatory requirements, tax obligations, and compliance burdens that must be understood before proceeding.

This guide provides context for understanding these factors. Individual decisions should be made in consultation with qualified financial and tax professionals.

Sources

Swiss State Secretariat for International Financial Matters (2025). “Automatic exchange of information on financial accounts.” https://www.sif.admin.ch/en/automatic-exchange-information-aeoi

Kendris Legal (2018). “AEoI Agreement: Switzerland and Turkey.” https://www.kendris.com/en/news-insights/2018/12/20/switzerland-and-turkey-will-exchange-information-2021-under-aeoi/

Vischer Legal (2022). “Tax treaty between Switzerland and Turkey.” https://www.vischer.com/en/knowledge/blog/tax-treaty-between-switzerland-and-turkey-39045/

Steuern Meili (2025). “Automatic information exchange (AIA/AEOI).” https://www.steuern-meili.ch/individual-states–98

Esports Insider (2026). “Turkey’s new MASAK transfer rules kick in for 2026.” https://www.igamingtoday.com/turkeys-new-masak-transfer-rules-kick-in-for-2026-as-ankara-strengthens-the-financial-net-around-il/

Hurriyet Daily News (2025). “New regulation requires detailed proof for high-value bank transfers.” https://www.hurriyetdailynews.com/new-regulation-requires-detailed-proof-for-high-value-bank-transfers-217260

ESIN Legal (2025). “Constitutional Court Overturns Core Rules on Currency Controls.” https://www.esin.av.tr/2025/11/20/historic-ruling-constitutional-court-overturns-core-rules-on-currency-controls/

RepTur (2025). “A New Era in Money Transfers: Financial Transparency in Turkey’s Financial System.” https://reptur.com/blog/a-new-era-in-money-transfers-strengthening-financial-transparency-and-trust

Finimize (2025). “Turkish Banks Brace For Another Tight Year In 2026.” https://finimize.com/content/turkish-banks-brace-for-another-tight-year-in-2026

ESIN Legal (2025). “MASAK Publishes Draft General Communique on Measures.” https://www.esin.av.tr/2025/09/04/