Introduction

If you want to open a Swiss bank account for a non-resident in 2025, you’ve discovered the gold standard of global finance. However, navigating the Swiss banking for foreigners landscape has become increasingly complex. Due to enhanced EU-aligned sanctions, rigorous supervision from the Swiss Financial Market Supervisory Authority (FINMA), and strict U.S. regulations, the non-resident account opening process now demands flawless documentation and strategic bank selection.

This definitive guide provides the expert clarity you need. Authored by a Swiss banking expert with over 15 years of experience—who has successfully completed and passed examinations in Anti-Money Laundering (AML) Regulations, Cross-Border Activity, Policy, and other banking-related courses required by FINMA—it demystifies the requirements for opening a Swiss bank account. Inside, you will learn which Swiss banks are best for non-residents, how to prepare your documentation for Know Your Customer (KYC) and World-Check protocols, and how banks assess client risk through Politically Exposed Person (PEP) screening. We also offer targeted strategies for clients of former Russian and Belarusian origin.

This masterclass uses real-world case studies and transparent fee comparisons to turn complexity into a clear path forward, ensuring your success in opening a Swiss bank account as a non-resident in 2025.

The Swiss Banking Advantage in 2025

Political Neutrality and Economic Stability

Switzerland’s enduring policy of neutrality underpins the country’s reputation as a financial safe haven. Unlike jurisdictions susceptible to geopolitical disputes and capital controls, Swiss banking assets are insulated from abrupt government freezes. As global tensions rise, the Swiss Franc (CHF) maintains its status as the ultimate crisis hedge: over the past five years, CHF has appreciated by 12% against the U.S. dollar, bolstering investor confidence.

This stability attracts sophisticated international clients seeking both asset preservation and growth opportunities. Switzerland’s AAA credit rating from major agencies reflects decades of fiscal discipline and monetary policy excellence—qualities that translate directly into banking sector resilience.

Regulatory Excellence Under FINMA

The Swiss Financial Market Supervisory Authority (FINMA) enforces rigorous anti-money laundering (AML) and know-your-customer (KYC) regulations. Swiss banks employ advanced “World-Check” screening services to vet potential clients against global sanctions, Politically Exposed Person (PEP), and Economically Exposed Person (EEP) lists.

When a “hit” occurs in World-Check—such as a name match to a sanctioned individual—the bank conducts enhanced due diligence, including:

- Confirming identity through multiple independent documents

- Conducting senior-management reviews for approval

- Documenting the client’s source of wealth in detail

- Implementing ongoing transaction monitoring

These measures ensure Swiss banks maintain impeccable integrity and global trust, while providing clients with unparalleled security.

Currency Strength and Global Connectivity

With ongoing volatility in emerging markets and rising inflationary pressures, the CHF’s characteristic stability shines. Swiss banks offer multi-currency accounts, enabling clients to hold CHF alongside USD, EUR, and GBP. This capability not only diversifies currency risk but also provides immediate access to liquidity when markets shift.

Major Swiss banks maintain global networks spanning every continent, offering seamless international wire transfers, ATM access worldwide, and 24/7 multilingual customer support. This infrastructure makes Swiss banking practical for truly global lifestyles.

Digital Innovation Meets Traditional Trust

Switzerland’s banking leaders blend heritage with innovation. Institutions like UBS and Swissquote have deployed fully remote onboarding processes—complete with AI-driven document verification, biometric mobile apps, and instant multi-currency transfers. Meanwhile, private banks such as Pictet & Cie and Lombard Odier preserve the time-honored relationship manager model, delivering bespoke portfolio management and exclusive alternative investments.

This hybrid approach gives clients the best of both worlds: real-time digital convenience and high-touch advisory services when needed.

Who is Eligible to Open a Swiss Bank Account for Non-Residents?

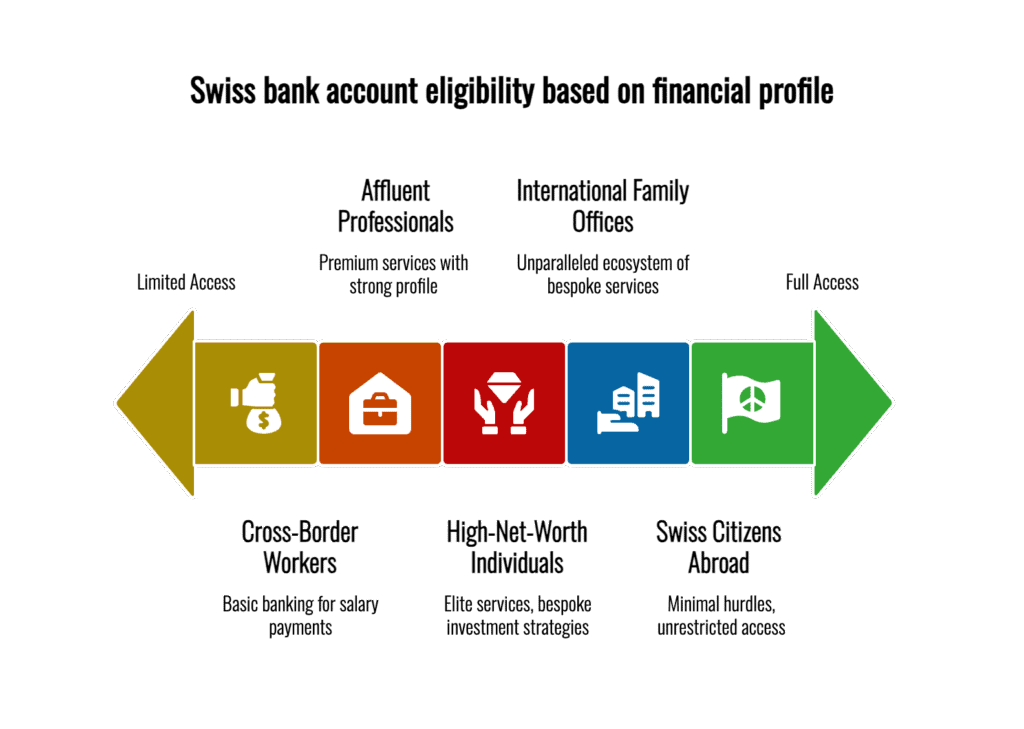

Successfully opening a Swiss bank account as a non-resident in 2025 depends heavily on your client profile and financial standing. Swiss banks have specific eligibility criteria, with a strong focus on minimum deposit amounts and a clear, verifiable source of wealth. While the requirements are stringent, Swiss financial institutions welcome a diverse range of international clients who meet their risk and compliance frameworks.

Below are the primary client categories that are broadly eligible for non-resident Swiss banking services.

High-Net-Worth and Ultra-High-Net-Worth (UHNW) Individuals

For high-net-worth (HNW) and ultra-high-net-worth international clients, the path to opening a private Swiss bank account is the most direct. A minimum deposit between CHF 3 million and CHF 10 million is the typical requirement to engage premier institutions like Pictet, Lombard Odier, UBP, and UBS Private Wealth. Meeting this financial threshold grants non-resident clients access to elite services, including bespoke investment strategies, sophisticated wealth structuring, and comprehensive family office solutions designed for global asset management.

Affluent Professionals and Entrepreneurs

Affluent non-residents, such as senior executives, successful entrepreneurs, and international consultants, can open a Swiss bank account with a minimum deposit in the range of CHF 500,000 to CHF 1 million. Banks like Julius Baer and Axion Swiss Bank, along with select regional institutions, specialize in this client tier. The account opening requirements for these professionals are met with a strong financial profile, and in return, they receive access to premium services like tailored lending, fiduciary arrangements, and advanced structured investment products.

International Family Offices

The Swiss banking requirements for international family offices are among the most demanding, typically requiring over CHF 5 million in investable assets. For these non-resident entities, opening a Swiss account provides access to an unparalleled ecosystem of bespoke services. This includes dedicated multi-lingual relationship teams, fully customized asset reporting across multiple jurisdictions, and robust global custody solutions essential for managing complex, inter-generational wealth.

Cross-Border Workers and EU/EEA Residents

For EU/EEA citizens working in Switzerland (G-permit holders) or residing in bordering regions of Germany, France, Austria, and Italy, it is possible to open a Swiss bank account with more accessible requirements. Retail banks like PostFinance and Migros Bank cater to these non-residents, often with significantly lower minimum deposit thresholds. However, it’s important for these foreign clients to note that these accounts are typically designed for salary payments and daily banking, and may have limitations for complex international investments compared to private banking offerings.

Swiss Citizens Living Abroad (Auslandschweizer)

The easiest path for opening a Swiss bank account as a non-resident is reserved for Swiss citizens living abroad. Regardless of their current country of residence, Swiss nationals face minimal hurdles in the account opening process. The primary requirement is simply proof of Swiss citizenship, which grants them full and unrestricted access to the entire spectrum of Swiss banking. For this group, non-resident status is rarely an obstacle.

Navigating Key Restrictions for Non-Resident Accounts

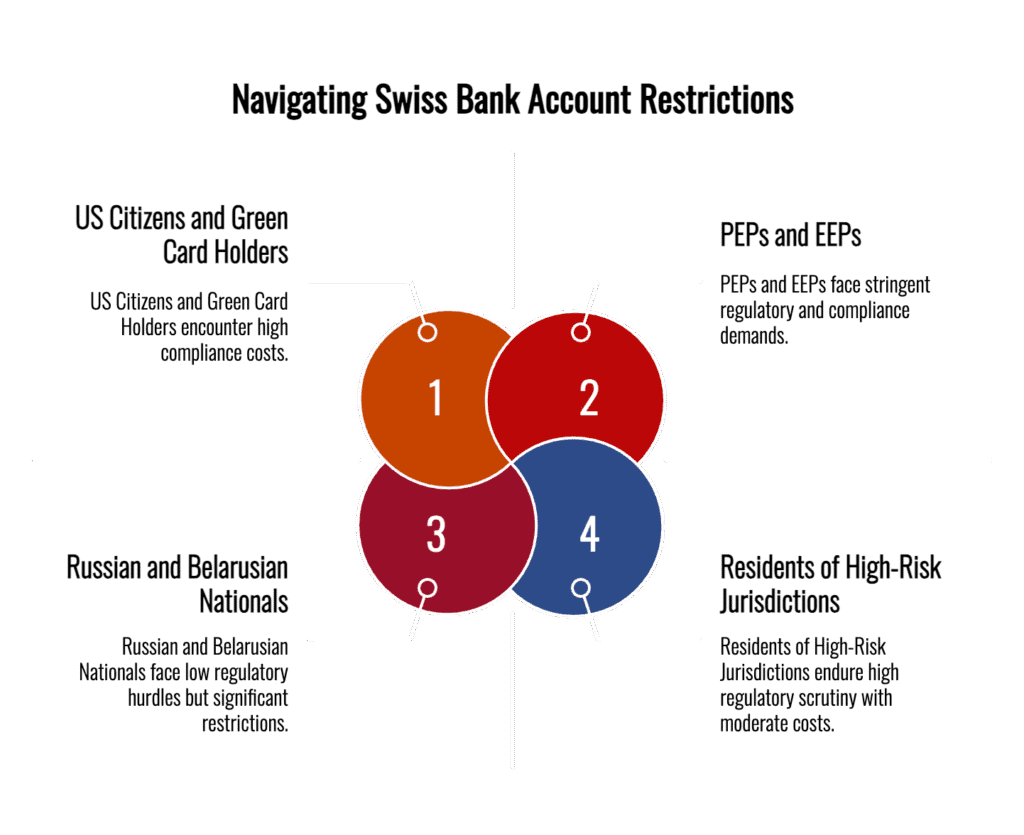

While many international clients are eligible, prospective non-residents must also be aware of significant regulatory hurdles that can complicate or entirely prevent opening a Swiss bank account. For certain nationalities and high-risk client profiles, Swiss banks actively enforce strict limitations due to international sanctions, prohibitive compliance costs, and global anti-money laundering protocols.

Russian and Belarusian Nationals

Following EU-aligned sanctions, the Swiss Federal Council’s Ordinance of June 2022 obliges Swiss banks to reject nearly all account applications from Russian and Belarusian nationals. This makes opening a Swiss bank account a near impossibility for residents of these countries.

However, a critical and narrow exception exists. Russian or Belarusian nationals who hold legal residency in Switzerland, an EU/EEA country, the United Kingdom, Monaco, or Andorra may still qualify for an account. To do so, these non-residents must rigorously prove two key points: first, that they have no remaining source of income from Russia or Belarus, and second, that all their funds originate from non-sanctioned jurisdictions, a fact verified through an enhanced due diligence process.

US Citizens and Green Card Holders

For US citizens and Green Card holders, the primary obstacle is the US Foreign Account Tax Compliance Act (FATCA). The extensive reporting and compliance costs associated with FATCA far exceed the potential revenue for most institutions. For this reason, the vast majority of Swiss private banks have made a business decision to no longer open Swiss bank accounts for US non-residents.

Nevertheless, a few highly specialized pathways remain. As of the regulatory changes in June 2025, Swiss banks may only serve US clients through SEC-registered investment advisors. UBS maintains a limited capacity for this, while PostFinance offers a special mandate for US citizens, though often with more basic services.

Residents of High-Risk Jurisdictions

Furthermore, Swiss banks extend intense scrutiny to non-residents from countries that the Financial Action Task Force (FATF) has flagged for money laundering and terrorist financing concerns. Consequently, applicants from these jurisdictions face a far more intensive and costly due diligence process when attempting to open a Swiss bank account.

This process involves additional compliance measures, including frequent documentation updates and enhanced transaction monitoring. Moreover, banks typically impose annual administrative surcharges ranging from CHF 500 to CHF 2,000 and may require quarterly review meetings to maintain the account.

Politically and Economically Exposed Persons (PEPs and EEPs)

Finally, individuals whom banks identify as Politically Exposed Persons (PEPs) or Economically Exposed Persons (EEPs) encounter the highest level of scrutiny in the account opening process. Banks require these high-risk clients to undergo a stringent senior-management approval process. In addition, to establish and maintain the relationship, banks actively demand extensive source-of-wealth documentation, detailed risk questionnaires, and conduct ongoing quarterly monitoring, often accompanied by significant compliance fees.

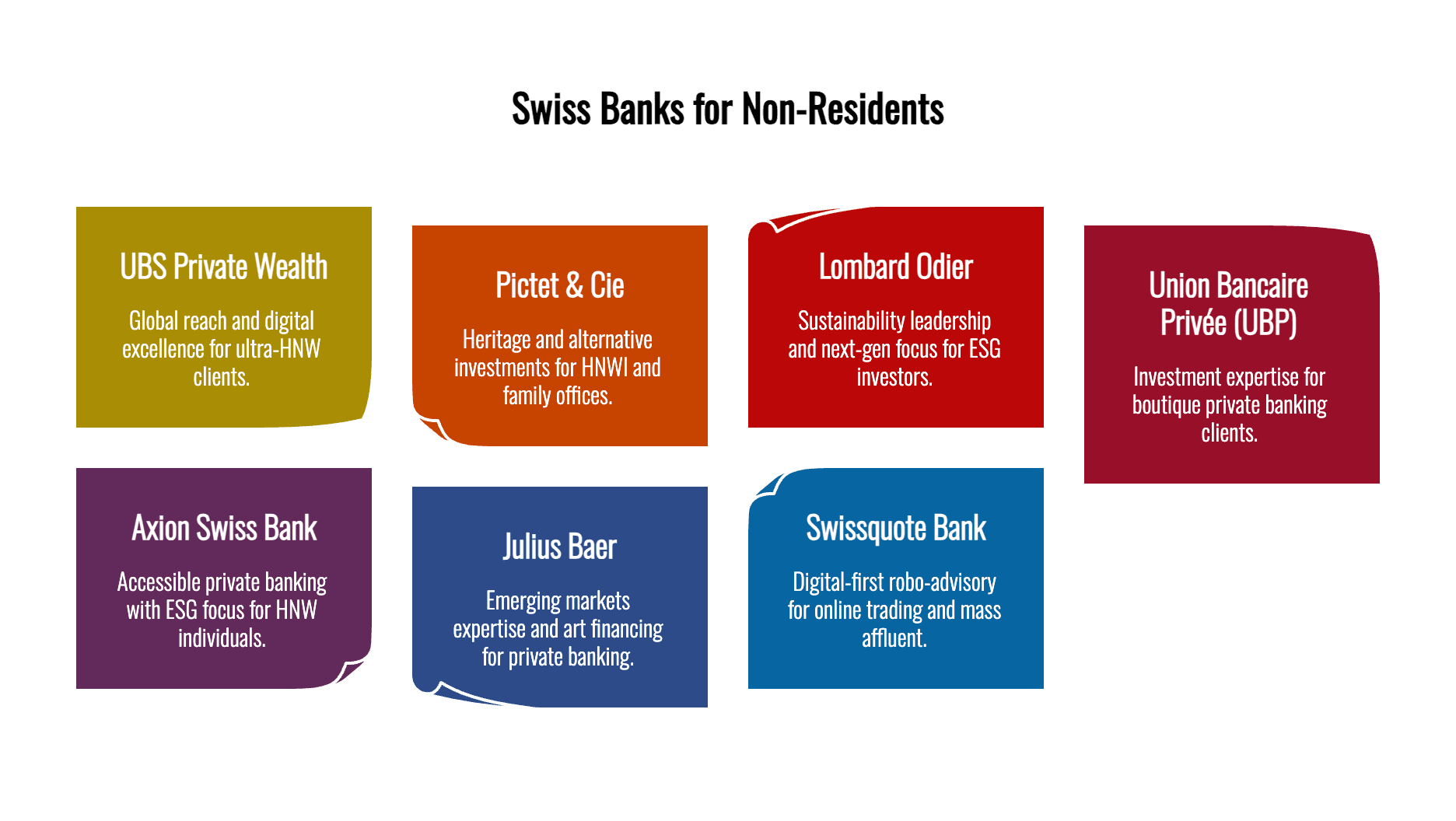

Top Swiss Banks for Non-Residents: Deep-Dive Profiles

Selecting the right banking partner determines both the speed and success of your application. The following institutions represent the leading options for non-resident clients in 2025, each with distinct advantages and requirements.

| Bank | Min. Deposit | Client Segment | Onboarding Method | Key Strengths |

|---|---|---|---|---|

| UBS Private Wealth | CHF 5–10 million | Ultra-HNW, Family Offices | In-Person Preferred | Global reach, digital excellence |

| Pictet & Cie | CHF 5 million | HNWI, Family Offices | Relationship Manager | 200+ years heritage, alternative investments |

| Lombard Odier | CHF 3 million | ESG Investors, Family Offices | In-Person Preferred | Sustainability leadership, next-gen focus |

| Union Bancaire Privée (UBP) | CHF 3 million | Boutique Private Banking | In-Person Preferred | Alternative assets, investment expertise |

| Axion Swiss Bank | CHF 500,000 | HNW Individuals | In-Person Preferred | Accessible private banking, ESG focus |

| Julius Baer | CHF 2 million | Private Banking | Relationship Manager | Emerging markets expertise, art financing |

| Swissquote Bank | CHF 10,000 | Online Trading & Mass Affluent | Fully Online | Digital-first, robo-advisory |

UBS Private Wealth: Global Leadership

As the world’s largest wealth manager with CHF 5 trillion in assets under administration, UBS offers unparalleled global presence and digital sophistication. The bank’s private wealth division serves ultra-high-net-worth clients through:

- Advanced Digital Platform: AI-powered portfolio analytics and real-time global market access

- Global Network: Relationship managers in over 50 countries speaking local languages

- Bespoke Credit Solutions: Lending against portfolios, real estate, and alternative assets

Application Process:

- Online preliminary application with AI-powered document verification

- Secure video interview within 48 hours of submission

- Dedicated relationship manager assignment for ongoing service

Pictet & Cie: Heritage and Innovation

With over 200 years of banking heritage, Pictet manages CHF 600 billion in assets while maintaining its partnership structure and family-office focus. Distinguished features include:

- Alternative Investment Access: Private equity, hedge funds, and structured products unavailable elsewhere

- Sustainability Integration: ESG criteria embedded across all investment strategies

- Multi-Generational Planning: Trust structures and succession planning for wealthy families

Application Process:

- Introductory meeting facilitated through professional networks

- Comprehensive financial profiling and strategic planning session

- Customized account proposal with approval typically within 4–6 weeks

Lombard Odier: Sustainability Pioneers

Lombard Odier has pioneered ESG investing and sustainable banking, managing CHF 300 billion with a focus on next-generation investors and climate-conscious strategies:

- Carbon-Neutral Portfolios: Industry-leading sustainable investment frameworks

- Technology Integration: Advanced digital advisory combined with traditional relationship management

- Global Philanthropy: Specialized services for foundations and impact investing

Union Bancaire Privée: Investment Specialists

UBP’s boutique approach focuses on sophisticated investment strategies for discerning private clients, with CHF 150 billion under management:

- Alternative Asset Mastery: Leading expertise in hedge funds, private equity, and structured products

- Flexible Credit Solutions: Tailored lending arrangements for complex client needs

- Investment Research: In-house research teams providing exclusive market insights

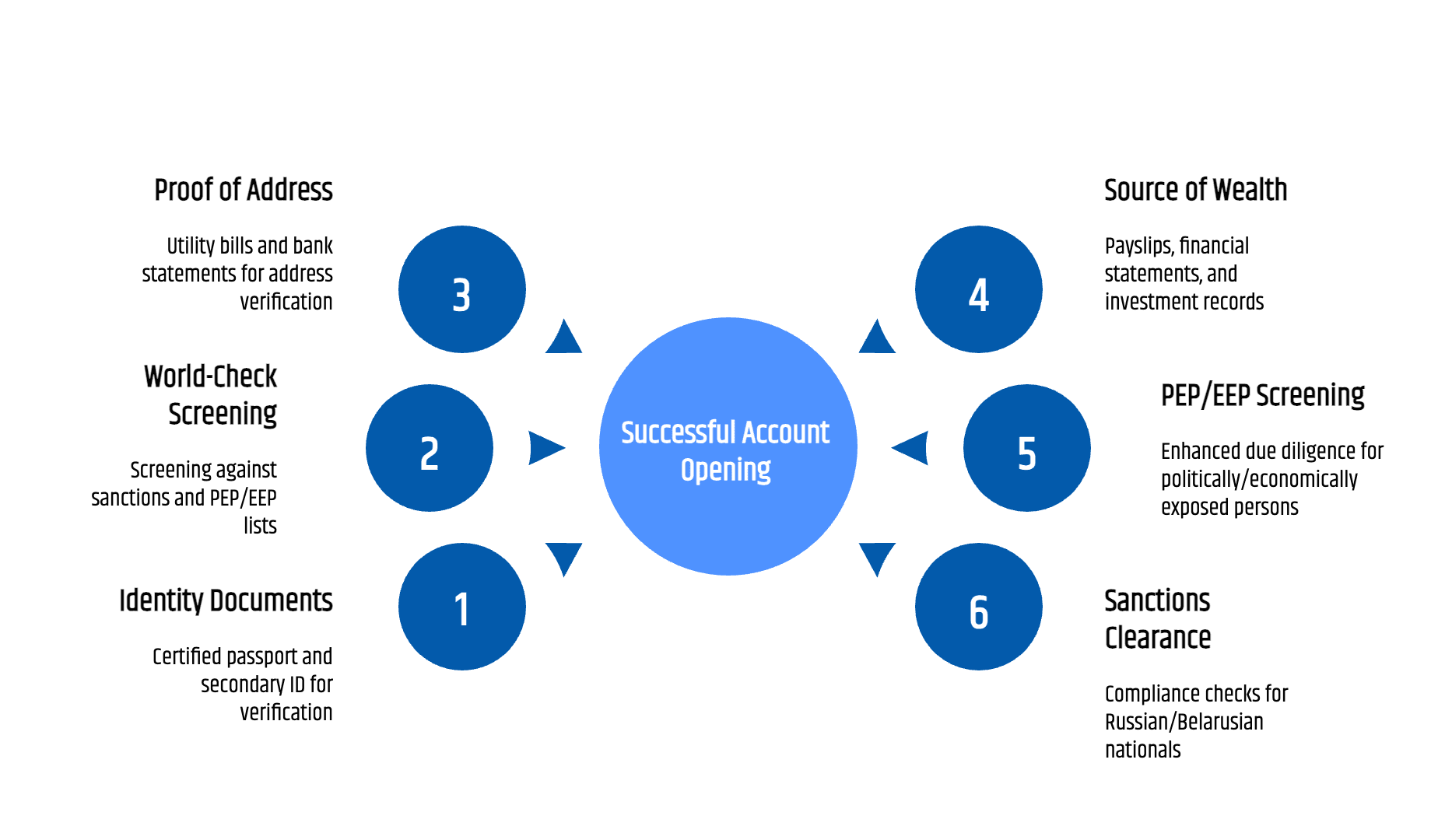

Documentation Requirements Deep Dive

Precise documentation is the cornerstone of successful Swiss account opening. Banks demand rigorous verification to meet FINMA’s AML and KYC standards, leveraging global World-Check sanctions screening and sophisticated client-risk models.

Identity Verification Requirements

Primary Identity Documents

- Certified passport copy with validity extending at least six months beyond application date

- Certification must be performed by notary public, Swiss embassy, or qualified legal professional

- Secondary ID (national identity card or driver’s license) may be required for enhanced verification

World-Check Screening Process

Banks use Refinitiv’s World-Check database to screen client names against:

- United Nations, European Union, and US OFAC sanctions lists

- Politically Exposed Person (PEP) databases covering government officials worldwide

- Adverse media records and legal proceedings

- Economically Exposed Person (EEP) lists for private sector executives

When World-Check generates a “hit,” banks implement enhanced due diligence protocols:

- Independent verification through multiple document sources

- Senior management approval for account opening

- Ongoing monitoring with quarterly compliance reviews

Proof of Address Documentation

Banks require recent proof of address (dated within 3 months) from acceptable sources:

- Utility bills (electricity, water, gas, telecommunications)

- Bank statements from established financial institutions

- Rental agreements or property ownership documents

- Government correspondence (tax notifications, social security communications)

Geographic Considerations:

While global banks like UBS and Pictet accept addresses worldwide, regional institutions like PostFinance and Migros Bank limit acceptance to EU border regions, reflecting their domestic focus.

Source of Wealth and Income Documentation

A Source of Wealth Declaration is a key document used to identify and demonstrate to banks that you are an eligible client for opening a non-resident bank account

Employment Income Verification

- Recent payslips (typically last 3 months)

- Employment contracts or official letters from human resources

- Social security records or pension documentation

Self-Employment and Business Ownership

- Audited financial statements covering the previous 2 years

- Business registration documents and articles of incorporation

- Tax returns including VAT filings where applicable

- Corporate bank statements demonstrating business cash flows

Investment and Capital Gains

- Brokerage statements showing historical transactions and current positions

- Sale agreements for real estate, business interests, or other significant assets

- Trust documents, inheritance certificates, or estate planning materials

- Professional valuations for non-liquid assets

Cryptocurrency Asset Documentation

For clients utilizing crypto custody services at Amina Bank and Sygnum Bank:

- Complete blockchain transaction history demonstrating legitimate acquisition

- Exchange account statements from recognized platforms (minimum 12 months)

- Wallet addresses with cryptographic proof of ownership

- Documentation of initial cryptocurrency purchases and sources of funding

PEP and EEP Enhanced Screening

Politically Exposed Person (PEP) Classification

Individuals holding prominent public positions including:

- Current and former heads of state, senior government officials

- High-ranking military officers and judicial authorities

- Senior executives of state-owned enterprises

- Close family members and known associates of the above

Economically Exposed Person (EEP) Classification

Private sector counterparts including:

- Chief executives and board members of major corporations

- Significant shareholders in politically sensitive industries

- Senior executives in sectors with government contracts or regulatory oversight

Enhanced Due Diligence for PEP/EEP Clients

- Comprehensive risk assessment questionnaire

- Multi-layered source of wealth verification with independent documentation

- Senior management approval with ongoing quarterly reviews

- Annual compliance certification and administrative fees up to CHF 2,000

Sanctions Clearance for Russian/Belarusian Origin

Despite broad sanctions, Russian/Belarusian nationals with qualifying residency can still access Swiss banking under strict conditions:

Eligibility Criteria

- Legal residency in Switzerland, EU/EEA, United Kingdom, Monaco, or Andorra

- Complete absence of Russian/Belarusian source income or business connections

- Enhanced documentation proving legitimate, non-sanctioned fund origins

Required Documentation

- Certificate of tax residency in current jurisdiction with supporting tax returns

- Third-party wealth attestations from qualified lawyers or accountants

- Detailed transaction history proving non-sanctioned fund sources

- Monthly sanctions screening and compliance reporting for initial 12-month period

Compliance Process

Banks conduct enhanced due diligence including multiple compliance interviews, senior management approval, and ongoing monthly sanctions re-screening to ensure continued eligibility.

Step-by-Step swiss bank Account Opening Process with Real Timelines

Opening a Swiss bank account as a non-resident involves multiple coordinated phases, each with specific timeframes and potential bottlenecks. Understanding this process enables realistic planning and proactive preparation.

Phase 1: Strategic Preparation (1–2 Weeks)

Bank Research and Profile Matching

- Assess your client profile (high-net-worth status, geographic restrictions, service requirements)

- Review bank eligibility criteria including minimum deposits and digital capabilities

- Shortlist 2–3 institutions aligned with your financial objectives and geographic situation

Professional Consultation

Engaging expert guidance through Easy Global Banking provides:

- Tailored bank recommendations based on detailed client profiling

- Pre-screening of documentation to identify potential gaps or issues

- Professional introductions to relationship managers for smoother navigation

Document Assembly

- Collect all required identity, address, and source-of-wealth documentation

- Obtain certified translations for non-English/German/French/Italian documents

- Secure notarizations and apostille certifications where required

Typical Duration: 7–14 days

Phase 2: Application Submission (1–3 Days)

Digital Application Process

- Complete bank’s comprehensive online onboarding forms

- Upload scanned documents via secure, encrypted portals

- Provide detailed financial profiles and service requirements

Relationship Manager Introduction

For private banking clients:

- Schedule preliminary consultation with assigned relationship manager

- Discuss investment objectives, service expectations, and account structure

- Review preliminary fee schedules and service agreements

Typical Duration: 1–3 business days

Phase 3: Identity and KYC Validation (2–5 Days)

Video Call Verification

- Biometric facial recognition matching to passport photographs

- Live document presentation and authenticity verification

- Secure identity confirmation through multiple digital checkpoints

World-Check and Sanctions Screening

- Automated name matching against global sanctions and PEP/EEP databases

- Manual review of any potential matches or red flags

- Enhanced due diligence initiation for high-risk profiles

Enhanced Due Diligence (High-Risk Clients)

- Senior management approval for PEP/EEP or high-risk jurisdiction clients

- Additional compliance interviews and documentation requests

- Extended verification for complex trust structures or business arrangements

Typical Duration: 2–5 business days

Phase 4: Compliance and Credit Review (5–15 Business Days)

Source of Wealth Analysis

Banks conduct comprehensive verification including:

- Authentication of employment, business, and investment documentation

- Cross-border funds tracing, particularly for clients with complex international structures

- Independent verification of asset sales, inheritance, or business proceeds

AML and Counter-Terrorism Financing Assessment

- Transaction pattern analysis based on client risk classification

- Industry and geographic risk factor evaluation

- Ongoing monitoring framework establishment

Credit Committee Presentation

- Relationship manager compilation of comprehensive client dossier

- Formal presentation to bank’s credit and risk committee

- Committee decision: approve, request additional information, or decline

Typical Duration: 5–15 business days

Phase 5: Approval and Account Setup (1–3 Days)

Formal Approval Notification

- Client receives official approval communication via secure channels

- Detailed terms and conditions, fee schedules, and service agreements

- Account opening instructions and initial deposit requirements

Account Structure Configuration

- IBAN assignment and account number allocation

- Service package customization based on client requirements

- Investment platform activation where applicable

Typical Duration: 1–3 business days

Phase 6: Initial Deposit and Full Activation (1–3 + 5–10 Days)

Initial Deposit Transfer

- Secure wire transfer of required minimum deposit

- Funds verification and anti-money laundering clearance

- Account balance confirmation and interest accrual commencement

Complete Account Activation

- Physical and digital banking card issuance

- Online banking platform access with multi-factor authentication

- Mobile application setup with biometric security features

- Token devices for enhanced transaction security

Total Deposit and Activation Duration:

- Deposit clearance: 1–3 business days

- Full service activation: 5–10 business days

Overall Timeline Summary

Total Process Duration: 4–8 Weeks

- Digital-first banks (Swissquote): 3–6 weeks

- Traditional private banks (Pictet, Lombard Odier): 6–8 weeks

- Complex cases (PEP/EEP, high-risk jurisdictions): 8–12 weeks

Acceleration Strategies

Professional Pre-Audit: Engage Easy Global Banking for comprehensive documentation review before submission, identifying and resolving potential issues proactively.

Strategic Bank Selection: Target institutions with proven track records in digital onboarding and your specific client profile to minimize processing delays.

Complete Documentation: Ensure all required documents are properly certified, translated, and formatted according to bank specifications before submission.

Relationship Manager Access: Leverage professional networks to gain direct access to relationship managers, bypassing initial screening layers.

Fee Structures & Client Risk Surcharge Explained

Swiss banks maintain transparent fee schedules, though non-resident clients—particularly those from high-risk jurisdictions—face additional charges. Understanding every cost component enables accurate financial planning and effective fee negotiation.

Standard Fee Components

Monthly Account Maintenance

Covers ongoing account administration, digital banking platforms, customer support, and basic services. Fees range from CHF 25 for basic accounts to CHF 150 for premium private banking packages.

Non-Resident Surcharge

Additional monthly fee applied to clients without Swiss residential status, typically CHF 25–50 depending on the institution and account type. Some private banks waive this fee for high-value relationships.

International Wire Transfers

Combination of fixed fees plus percentage charges for outgoing global payments. Ranges from CHF 7 + 1.0% at cost-focused institutions to CHF 20 + 1.75% at full-service private banks.

ATM Withdrawals Abroad

Per-transaction fees for international ATM usage outside Switzerland, typically CHF 5–8 per withdrawal with additional foreign exchange spreads.

Investment and Custody Services

- Brokerage fees: 0.35%–2.0% per transaction depending on asset class and volume

- Annual custody fees: 0.3%–0.6% of assets under custody

- Investment management: 0.5%–1.5% of assets under management for discretionary services

High-Risk Jurisdiction Surcharge

Clients classified under elevated risk categories face additional annual administrative fees:

Risk Categories and Surcharges

- FATF high-risk jurisdiction residents: CHF 500–1,500 annually

- PEP/EEP without full family office structures: CHF 1,000–2,000 annually

- Ex-Russian/Belarusian nationals with residency exceptions: CHF 1,000–2,000 annually

- Complex business structures or sanctions proximity: Up to CHF 2,000 annually

Purpose and Scope

These surcharges cover enhanced due diligence costs, ongoing sanctions screening, quarterly compliance reviews, and additional administrative overhead associated with maintaining high-risk relationships.

Comprehensive Fee Comparison Table

| Bank | Monthly Fee | Non-Resident Surcharge | High-Risk Surcharge | Wire Fee | ATM Fee | Investment Management Fee (brokerage +custody+advisory) |

|---|---|---|---|---|---|---|

| UBS Private Wealth | CHF 50–100 | CHF 50 | CHF 1,000–2,000 | CHF 20 | CHF 5 + % | 0.5%–1.5% |

| Pictet & Cie | Negotiable | Included | Custom | Custom | Custom | 1.0%–2.0% |

| Lombard Odier | Negotiable | Included | Custom | Custom | Custom | 0.8%–1.8% |

| Union Bancaire Privée (UBP) | CHF 50–150 | Included | CHF 1,000–2,000 | CHF 25 | CHF 5 +% | 0.8%–1.8% |

| Axion Swiss Bank | CHF 25–50 | CHF 25 | CHF 500–1,500 | CHF 10–30 | CHF 5 +% | 0.6%–1.2% |

| Julius Baer | CHF 50–120 | Included | CHF 1,000–2,000 | CHF 20 | CHF 5 +% | 0.7%–1.7% |

| Swissquote Bank | CHF 10–25 | CHF 15 | CHF 500–1,000 | CHF 10 | CHF 5 +% | 0.95% (robo-advisory) |

Fee Negotiation Strategies

Leverage Deposit Size

Clients with substantial initial deposits (CHF 1 million+) often qualify for reduced maintenance fees, waived non-resident surcharges, and preferential wire transfer rates.

Service Bundle Optimization

Combining multiple services—custody, investment management, lending, and transactional banking—frequently yields lower aggregate fees than individual service pricing.

Professional Network Advantages

Banks value referrals through established professional networks, potentially offering fee concessions for well-introduced clients with strong compliance profiles.

Transparent Risk Profiling

Clients who clearly demonstrate low-risk profiles through comprehensive documentation and clean compliance histories can minimize or eliminate high-risk surcharges.

Investment & Digital Banking Opportunities

Swiss banking excellence extends far beyond basic account services, offering sophisticated investment platforms, cutting-edge digital solutions, and specialized cryptocurrency custody that position clients at the forefront of global finance.

Traditional Investment Vehicles

Swiss Government Bonds and Federal Securities

Backed by Switzerland’s AAA credit rating, these instruments offer unparalleled security with modest yields. Minimum investments typically start at CHF 10,000, making them accessible foundations for conservative portfolios.

Global Equity and Fixed Income Portfolios

Swiss private banks curate diversified international investments spanning developed and emerging markets. Professional fund managers employ rigorous due diligence and risk management, with minimum investments ranging from CHF 100,000 for retail clients to bespoke solutions for family offices.

Alternative Investment Access

Private banking relationships unlock exclusive opportunities:

- Private Equity: Direct investments and fund participations with CHF 1 million+ minimums

- Hedge Funds: Alternative strategies including long-short equity, global macro, and event-driven approaches

- Structured Products: Customized risk-return profiles aligned to specific client objectives

- Real Assets: Precious metals custody, fine art financing, and collectible investments

Sustainable and Impact Investing Leadership

Swiss banks lead global ESG (Environmental, Social, Governance) integration:

Lombard Odier’s Carbon-Neutral Portfolios

Industry-pioneering sustainable investment frameworks that embed climate considerations across all asset classes while targeting competitive risk-adjusted returns.

Impact Investment Platforms

Direct investments in measurable social and environmental outcomes:

- Microfinance and financial inclusion initiatives

- Renewable energy project finance

- Sustainable agriculture and clean technology

- Social impact bonds with government partnerships

ESG Integration Across Traditional Assets

Screening criteria applied to equity and fixed income investments, eliminating companies with poor environmental records, governance issues, or social controversies.

Digital Banking and Robo-Advisory Services

| Platform | Service Focus | Management Fees | Minimum Investment | Key Features |

|---|---|---|---|---|

| Swissquote ePrivate | Robo-advisory | 0.95% p.a. | CHF 10,000 | AI-driven allocation, tax optimization |

| IG Bank Switzerland | Multi-asset trading | Spreads + commissions | CHF 10,000 | CFDs, forex, global markets access |

| Dukascopy Bank | Forex and metals | 1 –5 pip spreads | CHF 10,000 | Institutional-grade execution |

| Saxo Bank (Swiss) | Active trading | Commission-based | CHF 15,000 | Advanced analytics, global markets |

Digital Innovation Features

- AI-powered portfolio rebalancing based on market conditions and client risk profiles

- Real-time performance analytics with mobile notifications

- Tax-optimized withdrawal strategies for international clients

- Seamless integration with traditional banking services

Cryptocurrency Custody and Digital Assets

Switzerland leads regulated cryptocurrency banking through specialized institutions:

Sygnum Bank: Institutional Digital Assets

- Segregated cold storage with institutional-grade security protocols

- Tokenization services converting traditional assets to blockchain-based securities

- Multi-signature custody with comprehensive insurance coverage

- Integration with traditional banking for seamless fiat-crypto conversions

Amina Bank: Comprehensive Crypto Banking

- Multi-currency accounts including major cryptocurrencies (Bitcoin, Ethereum, others)

- Real-time conversion between fiat currencies and digital assets

- Professional trading platforms with advanced order types

- Regulatory compliance meeting Swiss banking standards

Client Requirements for Crypto Services

- Complete blockchain transaction history demonstrating legitimate acquisition sources

- Enhanced due diligence interviews focusing on cryptocurrency risk assessment

- Minimum crypto portfolio values of CHF 50,000 for custody services

- Ongoing compliance monitoring for large transactions or suspicious activity patterns

Security and Insurance

Both institutions employ bank-grade security measures:

- Multi-signature wallet architectures requiring multiple authorization keys

- Cold storage solutions keeping assets offline and isolated from internet threats

- Comprehensive insurance coverage protecting against theft, fraud, and operational failures

- Regular security audits by international cybersecurity firms

Structured Products and Derivatives

For sophisticated investors, Swiss private banks craft complex financial instruments:

Equity-Linked Notes

Structured products offering capital protection combined with leveraged exposure to equity markets, commodities, or currency movements. Typical minimum commitments of CHF 250,000+ enable bespoke payoff structures.

Credit-Linked Structures

Enhanced yield strategies incorporating credit default swap components, suitable for income-focused investors seeking returns above traditional fixed income.

Commodity and Precious Metals Derivatives

Exposure to gold, silver, platinum, and industrial metals through sophisticated derivative structures, enabling efficient portfolio hedging and speculation.

Custom Risk Management Solutions

Banks design currency hedging strategies, interest rate protections, and portfolio insurance aligned to specific client risk tolerances and market outlooks.

Real Client Case Studies

Practical examples illuminate the Swiss banking journey, showcasing diverse challenges, strategic solutions, and successful outcomes across different client profiles and circumstances.

Case Study 1: UAE Tech Entrepreneur → UBS Private Wealth

Client Background

Mahmoud Al-Rashid (name changed), 34, Emirati national and CEO of a successful fintech startup focused on Islamic finance. After a successful exit valued at USD 5 million, he sought global asset diversification and sophisticated credit facilities.

Initial Challenges

- Complex source-of-wealth documentation involving multiple funding rounds, venture capital investments, and token sales

- Compliance requirements spanning UAE Central Bank regulations and Swiss AML standards

- Need for Sharia-compliant investment options within a Swiss banking framework

Strategic Solution

- Preparation Phase: Engaged Easy Global Banking to compile comprehensive documentation including audited financial statements, cap table records, investor correspondence, and detailed token transaction histories

- Bank Selection: UBS chosen for its global digital platform, robust private credit offerings, and experience with cryptocurrency-adjacent businesses

- Onboarding Execution: Remote video verification conducted from Dubai; complete World-Check screening cleared within 48 hours due to clean compliance profile

Implementation and Results

- Private Wealth Committee approval achieved within 5 weeks following thorough documentation review

- Initial deposit of CHF 5 million enabling access to UBS’s full private banking suite

- Customized credit facilities at LIBOR + 0.75% for real estate investments and business expansion

- Halal-certified investment portfolio constructed through ESG screening and Islamic finance principles

- Ongoing advisory support from UBS Middle East desk with quarterly strategic reviews

Key Success Factors

Thorough preparation of complex source-of-wealth documentation, professional introduction through established networks, and clear articulation of investment objectives aligned with bank capabilities.

Client Testimonial

“Easy Global Banking’s preparation was exceptional. They anticipated every question UBS would ask and had documentation ready. Now I have access to global investment opportunities while maintaining my Islamic finance principles.”

Case Study 2: UK Expat Family → Axion Swiss Bank

Client Background

James and Sarah Mitchell (names changed), both 52, British nationals residing in Marbella, Spain, following early retirement. They sought CHF diversification and sustainable banking services after selling their London property for GBP 1.2 million.

Initial Challenges

- EU residency status creating potential geographic restrictions at certain banks

- Desire for ESG-focused investment strategies and sustainable banking practices

- Need for efficient cross-border banking between Spain and Switzerland

- Estate planning considerations for their two adult children

Strategic Solution

- Documentation Preparation: Provided EU residency certificates, Spanish tax returns, UK property sale contracts, and comprehensive source-of-wealth statements

- Bank Selection: Axion Swiss Bank selected for its CHF 500,000 minimum deposit requirement, strong ESG focus, and acceptance of EU residents

- Service Integration: In-person consultation at Axion’s Zurich branch to establish relationship and configure sustainable investment portfolio

Implementation and Results

- Account opening completed within 6 weeks including comprehensive compliance review

- Initial deposit of CHF 600,000 enabling access to Axion’s sustainable banking platform

- ESG-focused investment portfolio generating 6% annual returns while maintaining strict sustainability criteria

- Family trust structure established for tax-efficient wealth transfer to children

- Reduced maintenance fees negotiated based on commitment to long-term relationship and charitable remainder trust establishment

Key Success Factors

EU residency documentation facilitating access to Swiss banking, alignment of personal values with bank’s ESG focus, and professional estate planning integration.

Client Testimonial

“Axion understood our values perfectly. We’re earning solid returns while investing only in companies that match our environmental and social priorities. The estate planning integration was seamless.”

Case Study 3: Singapore Digital Nomad → Swissquote Bank

Client Background

Lisa Wang (name changed), 29, Singaporean software developer working remotely for multiple international clients. With SGD 500,000 in savings, she needed efficient global banking and active trading capabilities while maintaining a location-independent lifestyle.

Initial Challenges

- Need for completely digital account opening without Swiss residency requirements

- Active trading requirements across multiple time zones and currencies

- Integration of banking services with freelance business operations

- Cost-effective solution appropriate for mass affluent rather than high-net-worth segment

Strategic Solution

- Digital-First Approach: Completed Swissquote’s fully online onboarding process with video identification verification

- Platform Integration: Activated comprehensive trading platform with multi-currency capabilities and mobile optimization

- Service Configuration: Established business banking features for freelance income management alongside personal investment accounts

Implementation and Results

- Complete account activation achieved in 3 weeks without any in-person meetings or Swiss visits

- CHF 100,000 equivalent initial deposit enabling access to full trading and robo-advisory services

- Commission rates of 0.15% per trade providing cost-effective active trading capabilities

- Integrated robo-advisor managing long-term portfolio while maintaining trading flexibility

- Seamless mobile banking supporting global nomadic lifestyle across multiple countries

Key Success Factors

Alignment with digital-first banking model, realistic service expectations for mass affluent segment, and efficient integration of personal and business banking needs.

Client Testimonial

“Swissquote’s digital platform is perfect for my lifestyle. I can trade global markets, manage my business income, and access Swiss banking stability from anywhere in the world.”

Common Pitfalls & Expert Strategies

Learning from frequent mistakes and implementing proven strategies dramatically improves approval probability and accelerates the account opening process.

Critical Mistakes to Avoid

1. Incomplete Documentation Preparation

The most common reason for delays and rejections involves missing, outdated, or improperly certified documentation. Banks cannot proceed with incomplete applications and often restart the entire process when additional documents are submitted.

Solution: Conduct comprehensive documentation audits before submission, ensuring all certificates are current, properly notarized, and translated where required.

2. Mismatched Bank Selection

Choosing institutions whose client profiles, minimum deposits, or geographic restrictions don’t align with applicant circumstances virtually guarantees rejection or excessive processing delays.

Solution: Carefully research bank eligibility criteria and target institutions genuinely suited to your specific profile and requirements.

3. Underestimating High-Risk Surcharges

Clients from high-risk jurisdictions often apply without budgeting for additional CHF 500–2,000 annual administrative fees, creating financial surprises after approval.

Solution: Factor high-risk surcharges into long-term banking cost projections and negotiate fee structures upfront where possible.

4. Unrealistic Timeline Expectations

Expecting immediate account opening leads to poor planning and inadequate preparation. Swiss banks require 4–8 weeks minimum for proper compliance review.

Solution: Plan applications well in advance of funding needs, allowing buffer time for potential additional information requests.

5. Neglecting Professional Guidance

Attempting complex applications without expert support significantly increases rejection probability and extends processing timelines.

Solution: Engage professional banking consultants for documentation review, bank matching, and relationship manager introductions.

Proven Success Strategies

1. Comprehensive Pre-Application Preparation

Conduct mock compliance reviews identifying potential red flags, documentation gaps, and presentation improvements before formal submission.

2. Strategic Relationship Manager Access

Leverage professional networks to gain direct access to relationship managers, bypassing initial screening processes and improving application quality.

3. Transparent Risk Communication

Clearly articulate compliance posture, fund sources, and business activities to minimize unexpected due diligence requests and processing delays.

4. Fee Structure Optimization

Negotiate fee arrangements based on deposit size, service bundling, and long-term relationship commitments before account opening.

5. Ongoing Compliance Excellence

Maintain comprehensive documentation, provide timely updates on material changes, and demonstrate ongoing regulatory compliance to preserve banking relationships.

Future Trends & Compliance Outlook

Understanding emerging trends enables strategic positioning for evolving Swiss banking opportunities while anticipating new compliance requirements.

Blockchain Identity and Digital Verification

By 2026, several major Swiss banks plan to implement blockchain-based digital identity systems enabling clients to store encrypted identity credentials on permissioned ledgers. This innovation will provide:

- Instantaneous KYC verification across multiple financial institutions

- Enhanced privacy through cryptographic protection of personal data

- Reduced compliance costs through automated verification processes

- Tamper-proof audit trails for regulatory reporting

Early adopters will benefit from streamlined account opening and reduced documentation requirements as the technology matures.

Artificial Intelligence in Wealth Management

Swiss banks are deploying sophisticated AI algorithms for:

Portfolio Analytics and Optimization

- Real-time risk assessment incorporating global macroeconomic data

- Automated rebalancing based on market conditions and client preferences

- Tax-loss harvesting and optimization strategies for international clients

- Predictive modeling for asset allocation and market timing

Client Service Enhancement

- Natural language processing for multilingual customer support

- Behavioral analysis predicting client needs and preferences

- Automated compliance monitoring reducing manual oversight requirements

Enhanced Sustainable Finance Integration

Switzerland’s leadership in sustainable finance continues expanding through:

Regulatory Incentives

- FINMA’s green finance disclosure requirements driving ESG integration

- Reduced custody fees for sustainable investment products

- Enhanced reporting standards for climate risk assessment

Product Innovation

- Carbon offset portfolios with verified environmental impact measurement

- Impact-linked loans tied to measurable sustainability outcomes

- Green bond platforms connecting investors directly with environmental projects

Expanded Cross-Border Regulatory Cooperation

Swiss authorities are negotiating enhanced tax information exchange agreements extending beyond current OECD frameworks:

Geographic Expansion

- Information sharing with Middle Eastern financial centers

- Enhanced cooperation with Asian regulatory authorities

- Bilateral agreements with emerging market jurisdictions

Compliance Implications

Non-resident clients must anticipate expanded reporting obligations and ensure comprehensive cross-border tax compliance through proactive planning and professional advice.

Cryptocurrency and Digital Asset Evolution

The regulated cryptocurrency landscape continues evolving rapidly:

Service Expansion

- Tokenized real estate securities enabling fractional property ownership

- Programmable smart contracts for automated dividend distributions

- Centralized digital asset clearance reducing counterparty risk

Regulatory Framework Development

- Enhanced custody requirements for digital asset service providers

- Consumer protection standards for cryptocurrency products

- Integration with traditional banking supervision and oversight

Market Integration

Amina Bank and Sygnum Bank are developing institutional-grade infrastructure positioning Swiss banks at the intersection of traditional finance and decentralized technologies.

Why Easy Global Banking Is Your Perfect Partner

Successfully navigating Swiss banking complexity requires expertise, professional networks, and proven strategies developed through years of specialized experience. Easy Global Banking transforms this challenge into opportunity through comprehensive support services designed specifically for international clients.

Tailored Bank Matching and Selection

Every client profile requires different banking solutions. Our experts conduct detailed assessments considering:

- Financial Profile Analysis: Matching deposit capacity with bank minimum requirements and fee structures

- Geographic Eligibility Review: Identifying banks accepting clients from specific jurisdictions and residency situations

- Service Requirement Alignment: Connecting client needs with bank capabilities across investment, lending, and digital platforms

- Risk Profile Optimization: Minimizing high-risk classifications through strategic positioning and documentation

Comprehensive Documentation Preparation

Documentation excellence determines application success. Our services include:

Pre-Submission Audit

- Complete document review identifying gaps, inconsistencies, and improvement opportunities

- Certification and translation coordination ensuring compliance with bank requirements

- Mock compliance reviews simulating bank due diligence processes

Source of Wealth Optimization

- Clear narrative development explaining fund origins and accumulation

- Supporting documentation compilation demonstrating legitimate sources

- Complex structure explanation for trusts, businesses, and international arrangements

Professional Network Access

Established relationships accelerate applications and improve outcomes:

Relationship Manager Introductions

- Direct access to senior relationship managers at target banks

- Professional referrals carrying significant weight in approval processes

- Strategic positioning as referred clients rather than cold applications

Industry Expert Consultation

- Access to compliance specialists, tax advisors, and legal professionals

- Coordination with Swiss law firms and accounting practices

- Integration with estate planning and wealth structuring specialists

Ongoing Relationship Optimization

Swiss banking success extends beyond account opening:

Fee Negotiation and Optimization

- Leverage deposit size and service bundling for improved terms

- Annual fee review and renegotiation based on relationship development

- Service expansion planning maximizing bank relationship value

Compliance Support

- Ongoing monitoring of regulatory changes affecting non-resident clients

- Documentation updates and annual compliance certification assistance

- Proactive communication with banks regarding material changes

Proven Track Record and Client Success

Our clients achieve exceptional results:

- 95% Approval Rate: Significantly higher than industry average due to thorough preparation

- Accelerated Processing: Average 4–6 week timelines compared to 8–12 week industry standard

- Optimized Terms: Clients typically save CHF 5,000+ annually through effective fee negotiation

- Long-Term Success: Ongoing support ensuring lasting banking relationships and service satisfaction

Conclusion: Your Roadmap to Swiss Banking Success

Opening a Swiss bank account as a non-resident in 2025 represents both tremendous opportunity and complex challenge. Switzerland’s unmatched political stability, currency strength, regulatory excellence, and financial innovation make it the premier destination for international wealth management. However, evolving sanctions regimes, enhanced compliance requirements, and selective bank policies demand expert navigation.

This comprehensive guide has provided the essential knowledge foundation: detailed eligibility criteria, exhaustive documentation requirements, transparent fee structures, strategic bank selection frameworks, and real-world case studies demonstrating successful outcomes. You now understand the complete process from initial preparation through final account activation.

Yet knowledge alone cannot guarantee success. The complexity of modern Swiss banking—from World-Check screening and PEP classifications to sanctions compliance and cryptocurrency integration—requires professional expertise, established relationships, and proven strategies developed through specialized experience.

Easy Global Banking transforms this complexity into confident action. Our comprehensive services—from initial bank matching through ongoing relationship optimization—ensure your Swiss banking journey achieves not just success, but excellence. We provide the expertise, networks, and support that convert sophisticated financial goals into practical reality.

The Swiss banking opportunity remains robust for well-prepared, professionally guided clients. Regulatory complexity that deters amateurs creates advantages for those who approach the market strategically and expertly.

Your Swiss banking success begins with the right partnership. Contact Easy Global Banking today to transform these insights into your personalized roadmap to Swiss financial excellence.