A Human Banking Expert’s Guide with Real-World Insights, Tools, and Step-by-Step Strategy

Opening a Swiss bank account is more than just filling out forms—it’s entering one of the world’s most tightly regulated financial environments. As a banking consultant working with international clients, I’ve seen first-hand how Swiss banks scrutinize every document, every declaration, and every financial trail.

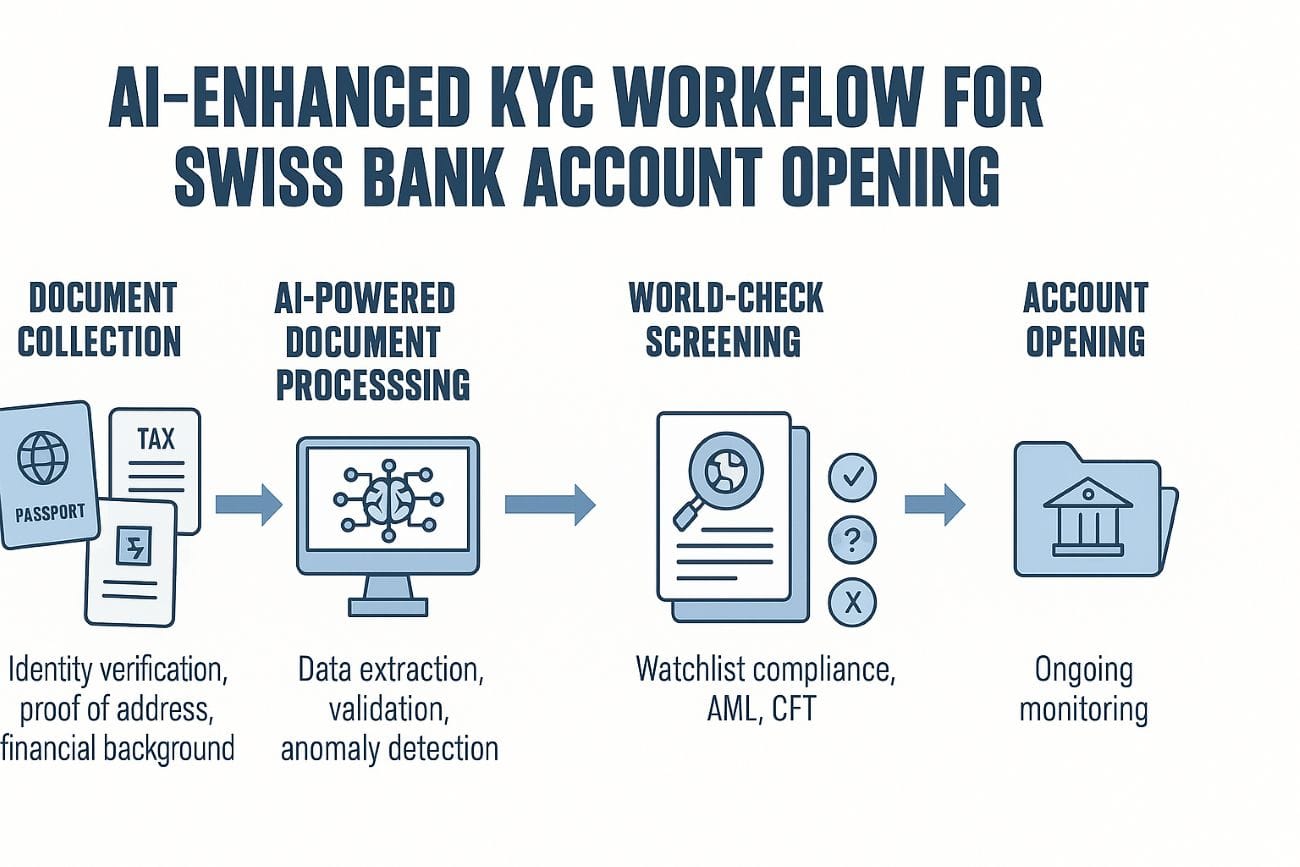

The biggest obstacle? The Know Your Customer (KYC) process. If your KYC package isn’t perfect—clear, consistent, and verifiable—your application is likely headed for rejection. But here’s where the game has changed: Artificial Intelligence (AI) has transformed how I help clients meet these requirements, reducing errors, improving speed, and ensuring full regulatory compliance.

In this post, I’ll show you exactly how I use AI tools like OCR, NLP, and World-Check to build ironclad KYC dossiers for Swiss bank account applications. I’ll share real-life examples, step-by-step workflows, practical checklists, and the mindset you need to navigate this complex process successfully.

Why Swiss Banks Take KYC So Seriously

To understand why Swiss banks approach KYC with such rigor, it helps to consider their foundational values. Switzerland’s reputation for banking excellence is built on stability, discretion, and above all—compliance. The Swiss Financial Market Supervisory Authority (FINMA) enforces rigorous standards under the Anti-Money Laundering Act (AMLA). Banks must:

- Verify the identity of every client

- Confirm the Ultimate Beneficial Owner (UBO)

- Understand the Source of Funds (SoF)

- Analyze the Source of Wealth (SoW)

Any doubt about a client’s background can lead to delays, denials, or even blacklisting.

This is where most people struggle. Documents from different countries don’t always line up. Translations are messy. Financial narratives are incomplete. And banks don’t have time to guess your story—they need to see it, clearly and consistently.

Real-Life Example: Why One Millionaire’s Application Got Rejected

A client came to me after a major Swiss bank rejected his personal account application. He had built his wealth over 15 years through tech investments, a property sale in Dubai, and an inheritance from his father. But here’s why the bank said no:

- His passport copy was uncertified.

- His property sale documents were missing official stamps.

- His inheritance documentation had a different name spelling than his ID.

- His SoW narrative was inconsistent across different documents.

This is a textbook case of a weak KYC submission. Fortunately, I was able to rebuild his file from the ground up—using AI tools to eliminate inconsistencies, flag missing data, and produce a polished application that the second bank approved.

The 4 Pillars of Swiss KYC—and How I Address Them with AI

1. Identity Verification

Swiss banks require a certified passport, proof of address (e.g., utility bill or bank statement), and often a biometric check.

How AI Helps:

- OCR (Optical Character Recognition) scans and extracts names, dates, document numbers, and addresses.

- NLP (Natural Language Processing) detects discrepancies in how names or addresses are spelled across multiple documents.

2. Ultimate Beneficial Ownership (UBO)

Clients must disclose who ultimately owns or controls the account. This involves signing a Form A and supplying detailed identification for each UBO.

AI Role:

- Tools compare UBO names with sanctions and PEP databases using World-Check.

- Automated workflows ensure all required documents (passport, proof of control, signatures) are submitted and match correctly.

3. Source of Funds (SoF)

This focuses on the origin of the money being deposited. For example, is the money from a salary, sale of property, or a business?

How AI Helps:

- OCR extracts transaction details from payslips, bank statements, contracts.

- NLP maps fund sources to declared purposes, highlighting inconsistencies.

- AI flags vague or unverifiable sources early—giving me time to request better documents.

4. Source of Wealth (SoW)

This is the client’s entire financial journey. Banks want to know: how did you accumulate your net worth?

My Strategy:

I build a timeline showing career growth, asset sales, investments, and inheritance. Then I use AI to validate each link.

AI in Action:

- NLP creates a narrative summary from structured data (employment, dividends, real estate gains).

- Smart matching tools ensure tax returns, sale deeds, and inheritance documents all support the same story.

World-Check: My Gatekeeper for Client Screening

World-Check is a global database used by banks and financial institutions to screen for:

- Politically Exposed Persons (PEPs)

- Sanctioned individuals

- Criminal records or adverse media

Before I submit a client’s application, I pre-screen them using World-Check. This saves time and prevents embarrassing surprises.

Example: A client who worked in a ministerial office 10 years ago flagged as a low-level PEP. Thanks to early detection, I added enhanced disclosures and explained his limited political exposure—ensuring the bank processed his file without delay.

KYC Document Checklists (with Tables)

Table 1: Personal Account KYC

| Category | Documents | Notes |

|---|---|---|

| Identity | Certified passport copy | Must be current, notarized, legible |

| Address proof | Utility bill / bank statement (under 3 months old) | Full name and address must match ID |

| Tax documents | Tax returns, TIN, FATCA declaration | Especially important for U.S. persons |

| SoF documentation | Payslips, invoices, sale agreements | Must align with bank statements |

| SoW evidence | Career history, investment statements, inheritance | Chronological proof of wealth accumulation |

| CV / bio | Detailed timeline of education and career | Used to support SoW narrative |

| Statement of intent | Reason for account, anticipated use | Add clarity and credibility to the application |

Table 2: Corporate Account KYC

| Category | Documents | Notes |

|---|---|---|

| Incorporation docs | Commercial registry extract, articles of association | Certified, translated if necessary |

| Ownership | Shareholder register, Form A, UBO passports | Match IDs and verify control |

| Directors | List of directors, CVs, proof of residence | Background checks apply |

| Business plan | Detailed description of operations and clients | Required for new or foreign companies |

| Financials | Audited statements, projected revenues | Support for SoF and economic viability |

| Address proof | Lease, utility bill, registered office certificate | Must align with corporate filings |

| Legal authorization | POA for representatives | Especially for offshore or third-party filings |

My AI-Powered Workflow for KYC Success

Step 1: Intake and Pre-Screening

- Collect documents via secure client portal

- Run initial World-Check screening

Step 2: AI-Powered Data Extraction

- Use OCR to digitize all documents

- Use NLP to extract names, dates, addresses, and entity relationships

Step 3: Consistency and Compliance Checks

- Cross-validate data across ID, proof of address, bank statements

- Highlight missing or inconsistent fields

Step 4: Build Narrative

- Use extracted data to generate client biography and SoW summary

- Check that narrative matches financial documents

Step 5: Submission Package Assembly

- Organize files by KYC category

- Generate version-controlled folders with audit trail

- Submit to bank via secure channel

Why Applications Get Rejected—and How I Avoid It

| Rejection Reason | Why It Happens | My Fix |

|---|---|---|

| Missing or expired documents | Carelessness or lack of knowledge | AI flags these before submission |

| Name/address mismatches | Common across ID, tax, utility bills | NLP finds inconsistencies instantly |

| Weak SoF/SoW | Vague or unsupported claims | I build a strong timeline with third-party evidence |

| Undisclosed PEP or sanctions | Triggers compliance alert | Pre-screen via World-Check, provide disclosure |

| Inadequate document certification | Not apostilled, not translated | I arrange local notarization and translation services |

Final Thoughts: Preparation Wins Trust

Swiss banking is not just about money—it’s about trust. And trust begins with how you present yourself on paper. Every document you submit, every date listed, and each supporting detail must align and support a consistent story: that your wealth is legitimate and your intent is honest.

Using AI, I can now prepare better, faster, and more reliable KYC packages than ever before. My clients benefit from higher approval rates, shorter processing times, and fewer frustrating back-and-forths.

If you’re planning to open a Swiss bank account—either personal or corporate—don’t underestimate the power of proper preparation. And don’t hesitate to use AI not just as a tool, but as a strategic advantage.

Useful Resources

- FINMA – Combating Money Laundering

- SwissBanking – Information for Bank Clients

- HCCH – Apostille Convention

- FATF – What is Money Laundering?

- World-Check by LSEG

- Lumenalta – Modernizing KYC

Written by a Swiss banking advisor who prepares bulletproof KYC packages for clients worldwide using the power of compliance tech and human insight.