A Comprehensive Guide to Client-Risk Classification, the Corruption Perception Index, and Smooth On-Boarding for Foreign Clients

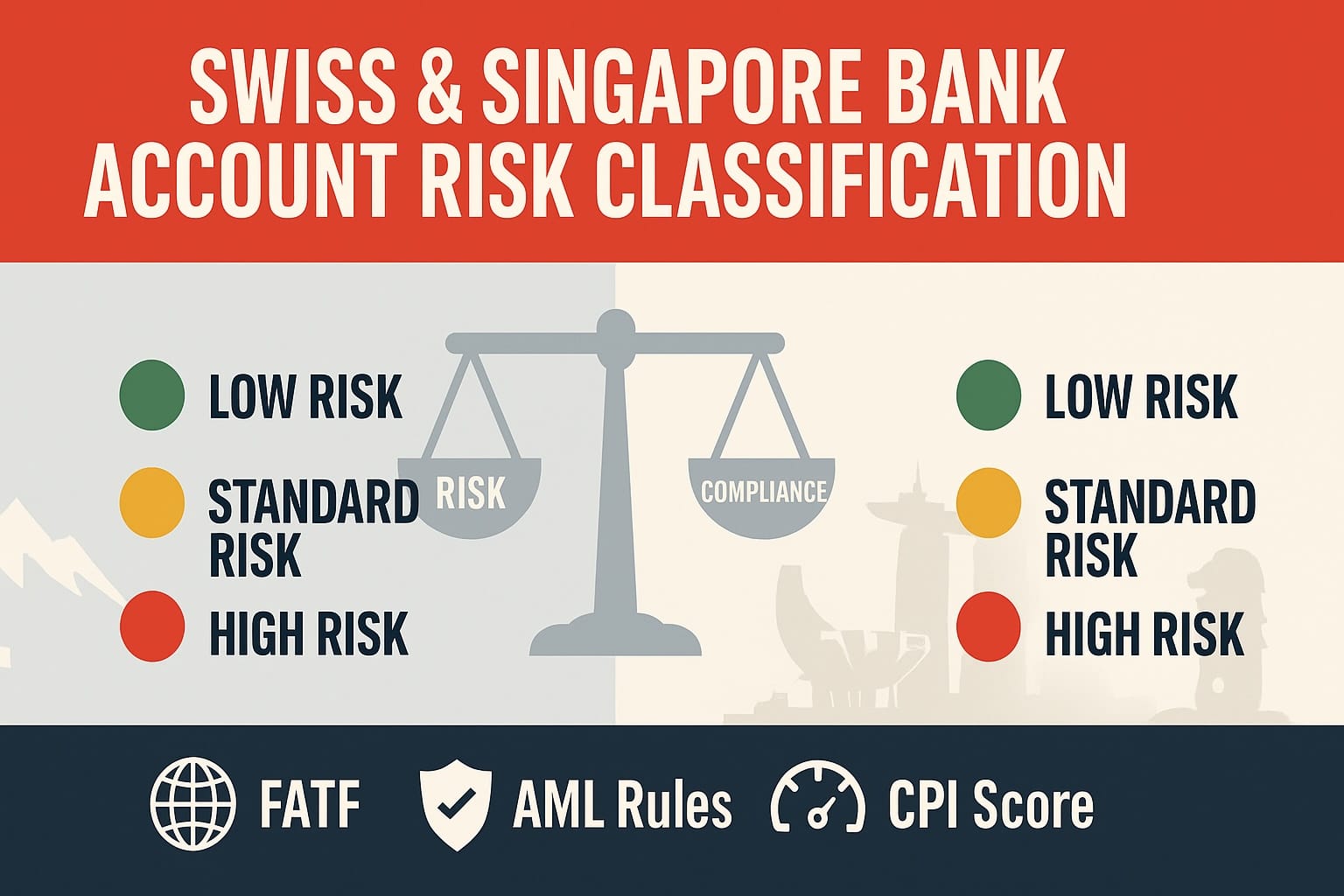

Opening a bank account in Switzerland or Singapore remains the gold-standard move for entrepreneurs who prize stability, cross-border expertise, and a deep menu of wealth-management services. Yet that prestige comes with a price: rigorous anti-money-laundering (AML) rules and a strict client-risk classification system.

Easy Global Banking (EGB) exists to make those rules transparent. In this post you will learn why banks grade every applicant, how the Corruption Perception Index (CPI) colours that score, which documents you must prepare, and what red flags can slow—or stop—your journey. Finally, we compare two real-world profiles to show why a German software founder enjoys a friction-free ride while a Kazakh real-estate broker faces enhanced scrutiny.

1 — Why Banks Rank Clients by Risk

From blanket secrecy to precision due diligence

Twenty years ago Swiss privacy was almost absolute. Today the world’s top financial centres fight money-laundering with laser focus. Both the Swiss Financial Market Supervisory Authority (FINMA) and the Monetary Authority of Singapore (MAS) follow the Risk-Based Approach (RBA) championed by the Financial Action Task Force (FATF).

- Identify, then intensify. Banks begin by verifying who you are. They then dial their scrutiny up or down based on four levers: customer profile, geography, product, and behaviour.

- Allocate resources wisely. Low-risk clients breeze through Simplified Due Diligence (SDD), allowing compliance teams to spend more energy on the truly complex cases.

- Protect the system’s credibility. By carving out prohibited relationships (e.g., shell banks or sanctioned entities), regulators safeguard the entire market’s reputation.

For legitimate clients the payoff is clear: when you cooperate early, you shorten onboarding, reduce document chases, and enter a partnership built on mutual trust.

2 — The Legal Landscape: Who Writes the Rules?

| Jurisdiction | Primary Legislation | Key Regulator | Core Message |

|---|---|---|---|

| Switzerland | Anti-Money Laundering Act (AMLA); FINMA Anti-Money Laundering Ordinance (AMLO-FINMA); Swiss Bankers Association Code of Conduct (CDB 20, CDB 25 in draft) | FINMA | Mandatory risk ladder; 0-tolerance for shell banks; periodic data refresh baked into law |

| Singapore | Corruption, Drug Trafficking and Other Serious Crimes Act (CDSA); MAS Notices 626/824; Trust Companies Act | MAS | Mirrors FATF principles; tech-enabled KYC; swift suspicious-transaction reporting |

| Global | FATF 40 Recommendations | FATF | Sets the benchmark; re-rates countries every five years |

Both supervisors also lean on the Corruption Perception Index compiled by Transparency International. A CPI score above 50 signals lower perceived corruption; scores below 50 push clients toward higher-risk brackets, triggering extra questions or outright refusal.

3 — The Five-Step Risk Ladder

Low, Standard, High…and the bright-red stop sign

| Category | Typical Traits | Due-Diligence Level | Mandatory Review |

|---|---|---|---|

| Low | Client and funds traceable; CPI > 50; transparent industry | Simplified (SDD) | Every 15 years |

| Standard / Medium | Most SMEs; moderate cross-border flows | Customer DD (CDD) | Every 10 years |

| High | PEPs, cash-heavy trades, CPI < 50, complex ownership | Enhanced (EDD) | Every 2 years |

| Inactive | Dormant > 12 months; tiny balance | Exempt until reactivated | On reactivation |

| Prohibited | Shell banks, sanctioned parties, unverifiable funds | No relationship | N/A |

Practical CPI trigger: Germany scores 78 (2024), so German residents start at low risk. Kazakhstan scores 39, moving Kazakh nationals automatically into at least CDD—often EDD if other red flags appear.

4 — Inside the Due-Diligence Toolkit

Same core checks—different depth

- Simplified Due Diligence (SDD) – Passport copy, recent utility bill, basic source-of-funds note.

- Customer Due Diligence (CDD) – All SDD items plus tax returns, employment or business verification, UBO declaration (Form A in Switzerland).

- Enhanced Due Diligence (EDD) – All CDD items plus notarised wealth evidence, audited financials, organisational charts, senior-management approval, and sometimes a face-to-face meeting.

Banks then load your data into automated screening engines. If your name, company, or counter-party pings on sanctions or adverse-media databases, humans step in to review context and decide next actions.

5 — Building the Perfect Document Pack

Fail to prepare; prepare to fail

| Document Type | Why Banks Ask | Common Pitfalls |

|---|---|---|

| Certified Passport & Secondary ID | Confirm identity beyond doubt | Out-of-date certification; low-resolution scans |

| Proof of Address (≤ 3 months) | Link client to declared residence | Mobile-phone bills often rejected |

| Source-of-Wealth File | Show lifetime wealth creation | Vague “savings” narrative; missing contracts |

| Source-of-Funds Trail | Tie deposit to a legal origin | First payment from third party triggers delays |

| Corporate & UBO Papers | Reveal real decision-makers | Nominee layers without explanation |

| CPI Context Note | Explain ties to higher-risk countries | Ignoring CPI impact instead of addressing it |

EGB tip: Assemble every item before you speak to the bank. A complete first submission can slice onboarding time in half, even for high-risk files.

6 — Life After Approval: Monitoring & Maintenance

Compliance is a marathon, not a sprint

Once your account is live, Swiss and Singapore banks remain alert:

- Automated transaction monitoring flags transfers that deviate from your stated profile.

- Periodic reviews land in your inbox based on the ladder above—15, 10, or 2 years.

- Event-driven triggers—new shareholders, media allegations, sudden volume spikes—force an immediate risk re-assessment.

Treat each query as a chance to strengthen trust. Silence or delay can push the bank to file a Suspicious Activity Report (SAR) and may even freeze the account.

7 — Putting Theory into Practice: Two Case Studies

| Low-Risk EU Tech Founder | High-Risk Kazakh Property Broker | |

|---|---|---|

| Nationality / Residence | German citizen, lives in Berlin (CPI 78) | Kazakh citizen, lives in Dubai (CPI 39) |

| Business Model | SaaS subscriptions billed to EU firms | Brokerage of off-plan apartments; high-value cash deals |

| Structure | Single German GmbH, sole owner | Two BVI holding companies, nominee director |

| Products Requested | CHF personal account + EUR corporate account | Multi-currency corporate account + private-banking portfolio |

| Risk Classification | Low – qualifies for SDD | High – mandatory EDD |

| Document Load | Passport, utility bill, tax return, GmbH registry extract | All CDD items plus notarised sale contracts, audited statements, source-of-funds chain for each property deal, face-to-face in Zürich |

| Expected Timeline | 4 weeks | 10 – 12 weeks |

The difference comes down to CPI score, business transparency, and ownership complexity. Both clients can succeed, but the second must invest more time and paperwork—and accept closer ongoing monitoring.

8 — Lessons Learned & How EGB Adds Value

- Start with the CPI. Check your home and operational countries. If any score below 50, prepare for extra questions.

- Map your money. Document both lifetime wealth (SoW) and the exact path each deposit will follow (SoF).

- Simplify structures when possible. A single-layer company is cheaper to explain than a four-layer trust stack.

- Respond fast. Banks view silence as a red flag; EGB acts as your 24-hour liaison.

- Think beyond approval. Budget time each year for refresh requests, especially if you sit in the high-risk band.

EGB’s compliance analysts have worked inside leading Swiss and Singapore banks. We speak their language, pre-screen your file with the same software they use, and coach you for interviews—turning potential roadblocks into smooth milestones.

9 — Conclusion: Understanding Client-Risk Classification in One Minute

Swiss and Singaporean banks sort every applicant into Low, Standard, High, or Prohibited risk categories. They lean on hard data—the Corruption Perception Index, beneficial-ownership clarity, business sector, and transaction behaviour—to set your due-diligence depth and monitoring schedule.

- Low-risk EU IT entrepreneur? Minimal paperwork, refresh every 15 years.

- High-risk Kazakh property broker? Expect Enhanced Due Diligence, senior-management sign-off, and bi-annual reviews.

Master these rules, supply a crystal-clear document pack, and partner with experts who navigate both FINMA and MAS standards. Do that, and you will unlock the benefits of a Swiss or Singapore bank account—speed, security, and seamless global reach—with confidence.