Main Takeaway

Singapore is redefining banking cybersecurity by piloting quantum key distribution (QKD) trials across its major banks. This pioneering effort positions the city-state’s financial sector to counteract emerging quantum-computing threats while setting an ASEAN-wide blueprint for quantum-safe banking infrastructure.

Introduction: Why Quantum Security Cannot Wait

As global reliance on digital banking soars, sophisticated cybercriminals constantly seek new vulnerabilities. Traditional public-key cryptography—such as RSA and elliptic-curve cryptography (ECC)—has long safeguarded online transactions. However, quantum computing threatens to render these encryption schemes obsolete almost overnight. Shor’s algorithm, for instance, can factor large integers in polynomial time, breaking the very foundation of key exchanges that protect customer data, interbank transfers, and high-value settlements.

Without preemptive measures, adversaries may launch “harvest now, decrypt later” campaigns: today’s encrypted traffic is recorded and decrypted once quantum hardware matures. Given that global banking assets exceed trillions of dollars, the stakes are clear: financial institutions must adopt quantum-resistant solutions now—or risk catastrophic breaches in the very near future.

Quantum Threats Defined: From Theory to Bank Vaults

To appreciate the urgency, it helps to understand exactly how quantum computers jeopardize banking:

- Breaking Encryption

- Classical computers factor integers using sub-exponential algorithms. In contrast, Shor’s algorithm on a fault-tolerant quantum computer can solve the same problem in polynomial time, effectively cracking RSA and ECC keys.

- Harvest-and-Decrypt Attacks

- Hackers intercept and store encrypted data today. Once quantum supremacy arrives, they decrypt past communications, unveiling sensitive financial records.

- Undermining Digital Signatures

- Quantum attackers could forge signatures used in loan agreements, trade settlements, and corporate board resolutions, threatening legal and operational integrity.

Because of these risks, central banks and regulators worldwide are racing to adopt quantum-safe cryptography—including lattice-based schemes, hash-based signatures, and QKD. Among these, QKD stands out by offering information-theoretic security that relies on the laws of physics rather than computational assumptions.

Overview of Quantum Key Distribution

Quantum Key Distribution leverages two core quantum mechanical principles:

- No-Cloning Theorem: It is impossible to create an exact copy of an unknown quantum state.

- Measurement Disturbance: Observing—or attempting to measure—a quantum system inevitably alters its state.

How QKD Works: A Step-by-Step Guide

| Step | Description |

|---|---|

| Photon Preparation | The sender (commonly called “Alice”) encodes each bit as the polarization state of a single photon, choosing randomly between two bases (e.g., horizontal/vertical or diagonal). |

| Quantum Transmission | Photons travel through a fiber-optic link to the receiver (“Bob”). |

| Photon Measurement | Bob measures each incoming photon in a randomly chosen basis, logging results. |

| Public Sifting | Alice and Bob publicly compare basis choices over a classical channel and discard bits where their bases don’t match. |

| Error Estimation | A random subset of the remaining bits is compared to estimate the quantum bit error rate (QBER). |

| Privacy Amplification | Through classical algorithms, the parties distill a shorter, secret key that is guaranteed secure, even if some information leaked in transit. |

Because any eavesdropper (“Eve”) inevitably introduces detectable errors, QKD ensures real-time intrusion detection and perfect secrecy of the final key.

Singapore’s MAS-Led QKD Trials: Scope and Objectives

In September 2025, the Monetary Authority of Singapore (MAS) announced a collaboration with DBS, OCBC, and UOB to conduct live QKD trials. These tests connect bank data centers across the city-state using existing fiber-optic infrastructure.

Trial Parameters

| Trial Component | Details |

|---|---|

| Fiber-Optic Distance | Up to 50 km between data centers across the central business district (CBD). |

| QKD Hardware | Commercially available single-photon sources and detectors, along with quantum random-number generators. |

| Classical Channels | Existing secure channels for sifting and error correction integrated with public-key infrastructure (PKI). |

| Performance Metrics | Latency impact on encrypted sessions, QBER, key-generation throughput (kbps), and end-to-end encryption compatibility. |

Key Objectives

- Integration Validation: Demonstrate that QKD modules can be deployed without overhauling existing network topologies.

- Interoperability Testing: Ensure quantum-generated keys seamlessly replace or augment PKI-based keys for TLS and IPsec VPN tunnels.

- Operational Feasibility: Measure realistic key rates and latency impact under production traffic patterns.

- Scalability Assessment: Identify challenges and roadmap for expanding QKD to wider metro and intercity links.

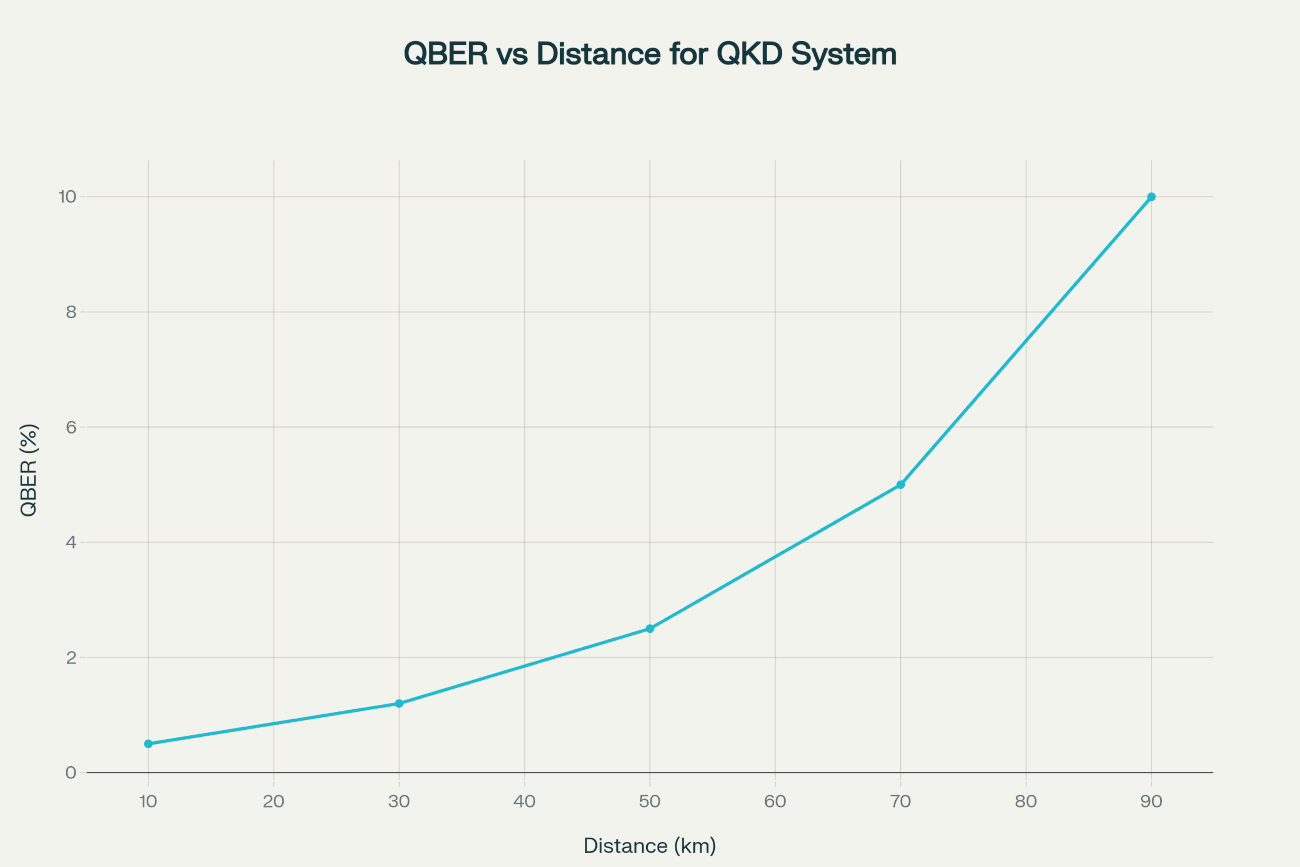

Performance Insights: Distance vs. QBER

Real-world QKD performance hinges on maintaining low QBER across transmission distances. The following line chart illustrates how QBER climbs as fiber length increases:

![Quantum Bit Error Rate increases with transmission distance.]

At short distances (10–30 km), QBER remains below 1.5%, enabling high-efficiency key extraction. However, beyond 70 km, error rates approach 5–10%, which necessitates advanced error correction and reduces net key throughput.

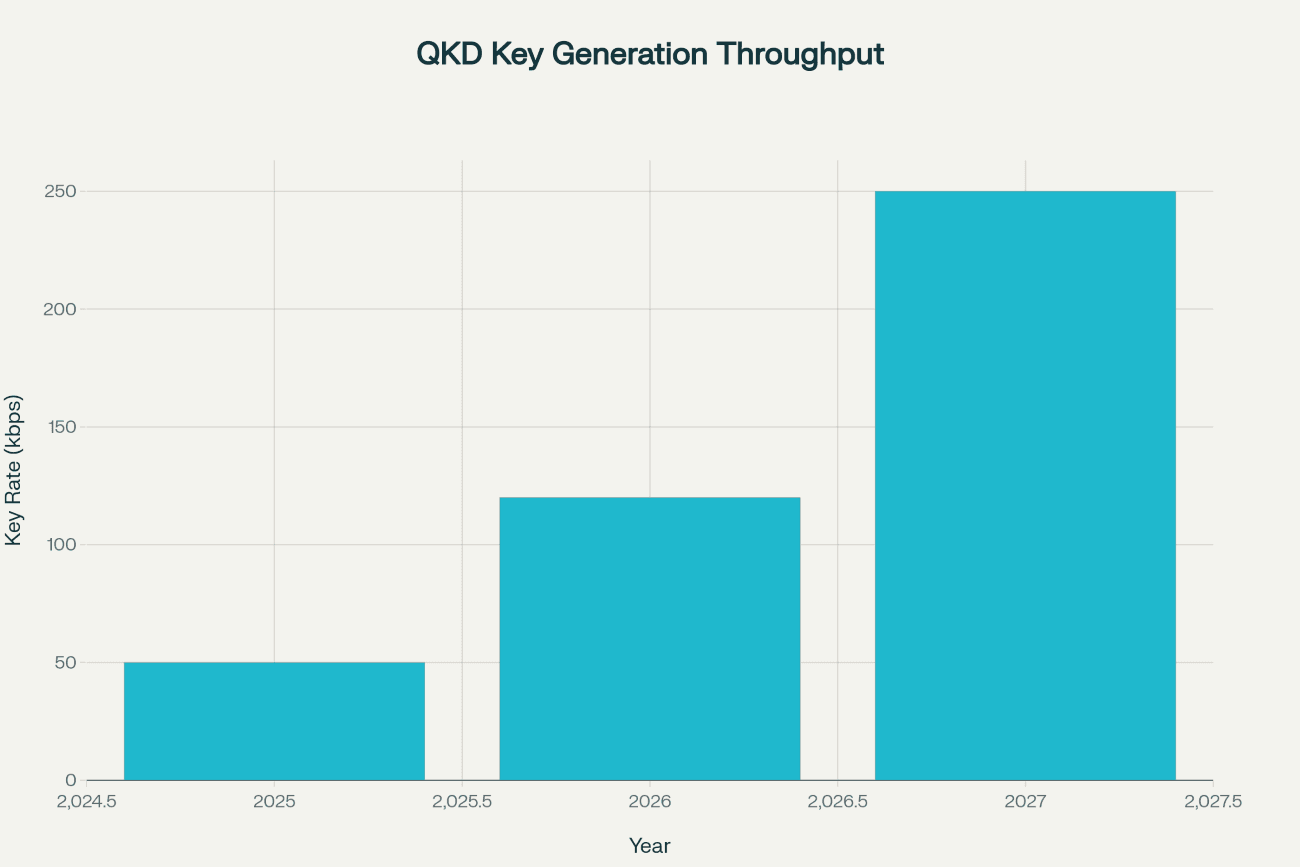

Projected Key-Generation Throughput

Banks require sufficient key rates to support frequent session key renewals and simultaneous secure links. Here is a bar chart projecting improvements in QKD system key rates over the next three years:

Projected increase in QKD key-generation throughput

- 2025: 50 kbps – Suitable for securing periodic TLS sessions.

- 2026: 120 kbps – Enables broader deployment across multiple links.

- 2027: 250 kbps – Facilitates data-intensive encryption tasks and high-volume traffic.

These projections reflect ongoing hardware optimizations and protocol enhancements by leading quantum vendors.

Implementation Challenges and Mitigation Strategies

Despite its promise, QKD deployment faces practical hurdles:

| Challenge | Impact | Mitigation Approach |

|---|---|---|

| Distance Limitations | Fiber attenuation restricts effective QKD range to ~100 km without quantum repeaters. | Research into quantum repeater prototypes and satellite QKD for long-haul links. |

| Key Throughput | Kilobit-scale key rates constrain large-scale data encryption. | Hybrid models combining QKD for key exchange with symmetric encryption for bulk data. |

| High CAPEX | Specialized photon detectors and random-number hardware carry significant costs. | Consortium purchasing to reduce unit costs; exploring integrated photonic chips. |

| Integration Complexity | Middleware development required to bridge quantum and classical cryptographic systems. | Open standards and interoperability frameworks led by MAS and international bodies. |

Transitioning from trials to full commercial roll-out will demand coordinated efforts among banks, technology providers, and regulators.

Strategic Implications for Singapore’s Financial Sector

First-Mover Advantage

By being among the world’s first to trial QKD in a production environment, Singapore banks:

- Gain operational expertise ahead of competitors.

- Enhance marketing differentiation, appealing to quantum-sensitive corporate clients.

Regulatory Confidence

MAS’s active role underscores Singapore’s progressive regulatory stance:

- Encourages private-sector investment in quantum R&D.

- Signals readiness to adapt legal frameworks for quantum-safe cryptography.

Regional Blueprint

Singapore’s successful trials can inform ASEAN neighbors, leading to:

- Harmonized quantum-safe standards across financial hubs.

- Secure cross-border payment rails protected by QKD or quantum-resistant algorithms.

Future Outlook: From Trials to Quantum-Hardened Banking

- Standardization & Certification (2026–2027)

MAS, in partnership with the International Telecommunication Union (ITU) and the European Telecommunication Standards Institute (ETSI), is expected to publish QKD interface specifications and compliance guidelines. - Commercial Services (2027–2028)

Singapore banks will likely offer quantum-hardened VPN and TLS products to institutional and HNW clients, backed by Service Level Agreements guaranteeing QBER thresholds and key-rate minima. - Global Quantum Network Integration

Through trusted nodes, Singapore’s QKD links could interconnect with quantum backbones in Europe (e.g., Switzerland’s quantum testbed) and Asia (e.g., China’s quantum satellite network), creating a global quantum-safe financial grid. - Hybrid Cryptography Adoption

While QKD addresses key exchange, banks will simultaneously deploy post-quantum cryptographic algorithms (lattice-based, code-based) for end-to-end data protection.

Conclusion

Singapore’s MAS-led QKD trials represent a watershed moment in banking cybersecurity. By validating quantum-secure key distribution on existing networks, MAS and partner banks are forging a resilient financial infrastructure that can withstand tomorrow’s quantum-enabled threats. This initiative not only secures customer data and transaction integrity but also cements Singapore’s status as a global leader in quantum-safe finance.

Ready to expand your financial horizons in Singapore’s robust banking environment? Discover how to open a Singapore bank account easily and securely on the premier platform Easy Global Banking. Start your journey today.

This comprehensive overview demonstrates how QKD trials safeguard Singapore’s banking sector and lays out the path toward a quantum-resilient financial future.

Reference List with URLs

- MAS Collaborates with Banks and Technology Partners on Quantum Security, Monetary Authority of Singapore, August 13, 2024. URL: https://www.mas.gov.sg/news/media-releases/2024/mas-collaborates-with-banks-and-technology-partners-on-quantum-security

- “MAS to Conduct Quantum Security Trials with Major Banks,” Central Banking, August 15, 2024. URL: https://www.centralbanking.com/central-banks/financial-market-infrastructure/7962095/mas-to-conduct-quantum-security-trials-with-major-banks

- “Quantum Key Distribution Revolutionising Security in Banking,” sebastienrousseau.com, December 11, 2023. URL: https://sebastienrousseau.com/2023-12-11-quantum-key-distribution-revolutionising-security-in-banking/index.html

- “MAS Completes Sandbox Trial to Prepare Financial Sector for Quantum Security,” Fintech News Singapore, July 15, 2025. URL: https://fintechnews.sg/114008/digital-transformation/mas-quantum-sandbox/