Introduction: Why Retail Banking for Non-Residents Is No Longer Viable

In 2024 and 2025, most non-resident individuals attempting to open a standard bank account in Singapore encountered a barrier they did not anticipate: refusal. The window for “basic” retail banking as a non-resident has effectively closed.

This shift is not accidental. It reflects regulatory tightening under the Monetary Authority of Singapore (MAS), increased scrutiny of cross-border flows post-2023 banking crisis, and stricter source-of-funds documentation requirements. In practical terms, banks now operate under a simple rule: non-residents without substantial assets or Singapore-based business operations are no longer a priority market.

The only viable path for non-resident individuals seeking to open and maintain a Singapore account in 2026 is through private banking, which requires demonstrating significant wealth, clear source of funds, and investment intent.

This guide addresses that reality directly. It walks you through the actual requirements, realistic minimums, and documentation burden that non-resident HNWIs face in 2026.

The Hard Truth: Retail Banking Is Closed to Non-Residents

Before diving into requirements, you need to understand what changed:

2018–2020: Non-residents could open accounts with USD 50,000–100,000 and relatively light documentation.

2021–2022: Minimums began rising. USD 250,000+ became more common. Documentation requests expanded.

2023–2024: The banking crisis and tighter CRS implementation accelerated the shift. Most banks stopped accepting new non-resident retail customers at any minimum.

2025–2026: Standard retail banking for non-residents is largely unavailable. Private banking (USD 2M–5M+) is the only realistic option.

This consolidation happened for several reasons:

- Regulatory Cost: KYC and AML compliance for non-resident retail customers is expensive and time-consuming relative to the assets they hold.

- Reputational Risk: Post-Credit Suisse, banks scrutinize every account more carefully. A non-resident with unclear source of funds is a compliance liability.

- CRS Reporting Burden: Non-resident accounts must be reported to their home country’s tax authority. If documentation is incomplete, the bank faces penalties.

- Digital Disruption: Non-residents with basic needs are better served by fintech platforms (Wise, Revolut, Remitly) than traditional banks.

The practical implication: If you are a non-resident with less than USD 2 million in assets, do not approach traditional Singapore banks for a personal account. You will be declined.

If you have USD 2 million or more, private banking is achievable—but only if you meet strict criteria beyond asset size.

The Real Minimum: USD 2M–5M in Assets Under Management (AUM)

While some banks technically list minimums as low as USD 500,000, this is marketing fiction. In reality, private banking relationship managers (RMs) do not prioritize—or even engage—with accounts below USD 2–3 million.

Here is why the gap exists:

On Paper: A bank’s marketing materials state “USD 500k minimum for private banking.”

In Reality: An RM’s quota is measured in total AUM managed. An account with USD 500,000 generates negligible revenue (roughly SGD 2,500–5,000 annually in fees). That RM is incentivized to work with accounts of USD 3M+ (roughly SGD 15,000+ annually).

The Result: Smaller accounts are assigned to junior staff, service quality declines, and you encounter delays or feature restrictions.

Realistic Entry Points by Bank (2026)

| Bank | Realistic Minimum AUM | Typical RM Attention | Recommended Client Profile |

|---|---|---|---|

| DBS Treasures | USD 3M–5M | Senior RM | Asia-focused HNWI, business owners |

| OCBC Private Bank | USD 2M–3M | Senior RM | Moderate asset holders, professionals |

| UBS Singapore | USD 5M–10M | Senior RM | Ultra-HNW, global portfolio |

| Maybank Private Banking | USD 1.5M–2M | Mixed | Value-conscious HNWI |

| Standard Chartered Priority | USD 2.5M–3.5M | Senior RM | International business owners |

| Bank of Singapore (BoS) | USD 3M+ | Senior RM | Asia-based wealth, family offices |

| Crypto-Friendly (Sygnum, AMINA) | USD 500k–1M | Specialist | Crypto-wealthy founders, traders |

Critical Note: These minimums are AUM—the total assets you commit to invest. Simply depositing USD 2 million in cash without investment intent often triggers questions from compliance: “Why is this money sitting idle? What is your investment strategy?” Banks prefer clients who actually deploy capital.

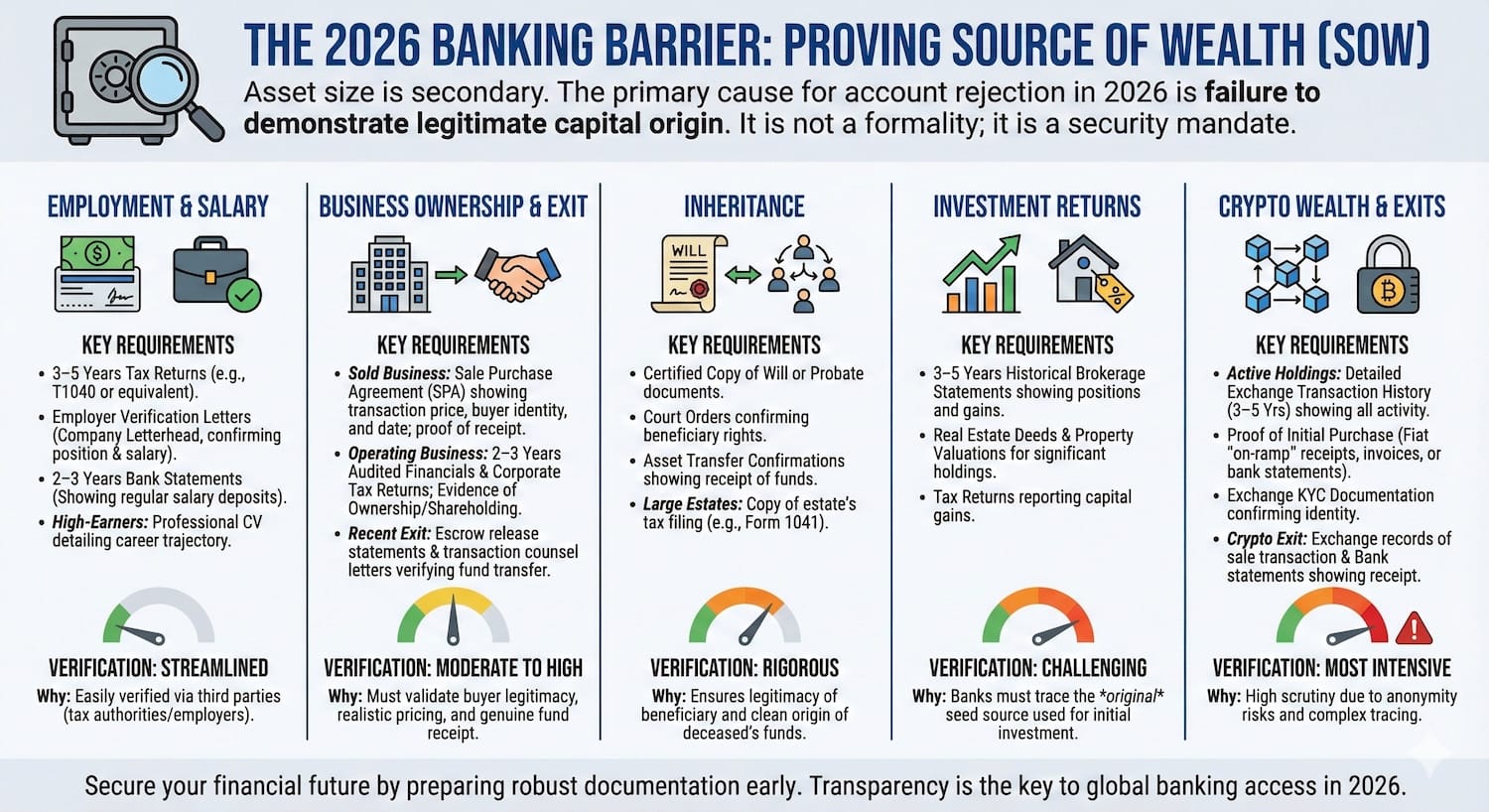

The “Source of Wealth” (SOW) Inquisition: The Real Barrier in 2026

Asset size is only part of the equation. The far more critical requirement is demonstrating where your money came from. This is not a mere formality. In 2026, SOW documentation has become the primary reason for account rejections.

The Three Paths to Proving Source of Wealth

Path 1: Employment & Salary

If your wealth comes from salary and bonuses, you need:

- Last 3–5 years of tax returns (T1040 or equivalent in your country).

- Employment verification letters from your employer (on company letterhead, naming you and confirming your position and salary).

- Bank statements showing regular salary deposits over 2–3 years.

- For high-income professionals (CEOs, doctors, lawyers): A professional biography or CV detailing your career trajectory.

Why this works: Employment income is the easiest to verify. Tax authorities have records. Employers can confirm your identity. Banks process these quickly.

Path 2: Business Ownership

If your wealth comes from owning a business, the documentation requirements are much heavier:

- For a Sold Business: You need the sale and purchase agreement (SPA) showing the transaction price, the buyer’s identity, and the date. Additionally, bank statements confirming receipt of the sale proceeds (dated within the past 3–5 years).

- For an Operating Business: Corporate tax returns (2–3 years), audited financial statements, evidence of ownership (corporate registry documentation showing your shareholding), and bank statements of the business showing regular profitability.

- For a Recent Exit (within 6 months): The escrow release statements, bank statements showing receipt of funds, and potentially a letter from your escrow agent or transaction counsel confirming fund transfer.

Why this is harder: Banks must verify the buyer is legitimate, the purchase price is real (not inflated), and the funds were genuinely received. A small business in a developing country may face extra scrutiny.

Example from our experience: A Brazilian tech founder with a recent exit needed to provide the SPA (in Portuguese, then certified English translation), escrow release statements, bank statements showing receipt, AND a letter from his transaction lawyer. The process took 8 weeks instead of the usual 3 weeks.

Path 3: Inheritance

If your wealth comes from an inheritance, expect rigorous scrutiny:

- Probate documents or a certified copy of the will.

- Court orders confirming your right to the inheritance.

- Bank statements or asset transfer confirmations showing receipt of funds.

- For large inheritances: A copy of the estate’s tax filing (Form 1041 in the US, or equivalent).

Why this is strict: Banks must confirm the inheritance is legitimate and that you are the rightful beneficiary. They also want to ensure the source of the inherited funds is clean (not proceeds from illegal activity).

Note: Inheritance accounts often face additional delays due to the need to verify the deceased’s identity and the estate’s legitimacy.

Path 4: Investment Returns

If your wealth grew through investment returns (stock gains, real estate appreciation), you need:

- Brokerage statements showing historical positions and gains over 3–5 years.

- Real estate deeds and property valuations for any significant holdings.

- Tax returns reporting the capital gains.

Why this is challenging: Banks must trace the original source (where did you get the money to invest?). A USD 5 million portfolio is less compelling if it started from a USD 100k salary 20 years ago—that’s legitimate. But if it started from USD 100k cash with no clear origin, banks flag it.

Path 5: Crypto Wealth (The Complex Scenario)

If your wealth comes from cryptocurrency holdings or a recent crypto exit, prepare for the most intensive scrutiny:

For Active Crypto Holdings:

- Detailed transaction history from your exchange (Coinbase, Kraken, Binance, etc.) showing all buys, sells, and wallet transfers over the past 3–5 years.

- Proof of initial purchase (exchange receipts, invoices, or bank statements showing the original deposit).

- KYC documentation from the exchange confirming your identity and the source of your initial crypto purchase.

- Tax returns showing reported crypto gains or losses.

For a Crypto Exit (Sale of Holdings):

- Exchange records of the sale transaction.

- Bank statements showing receipt of funds into your personal or business account.

- Tax returns reporting the capital gains.

Why this is essential: Many banks consider crypto a higher-risk asset class. MAS guidance allows crypto exposure, but individual banks vary in their risk appetite. Some private banks actively welcome crypto-wealthy clients (Sygnum, AMINA). Others treat it as a red flag.

2026 Reality: If you acquired crypto through legitimate exchanges, paid taxes on gains, and have clear documentation, most forward-thinking private banks will accept it. If your crypto wealth came from mining, airdrops, or anonymous wallets with unclear origins, banks will decline you.

Real-world example: A Hong Kong crypto trader with HKD 40 million in realized gains from Bitcoin and Ethereum sales faced rejection from three traditional banks before being accepted by a private bank that specialized in crypto clients. The difference was that he had tax returns, exchange records, and clear transaction trails.

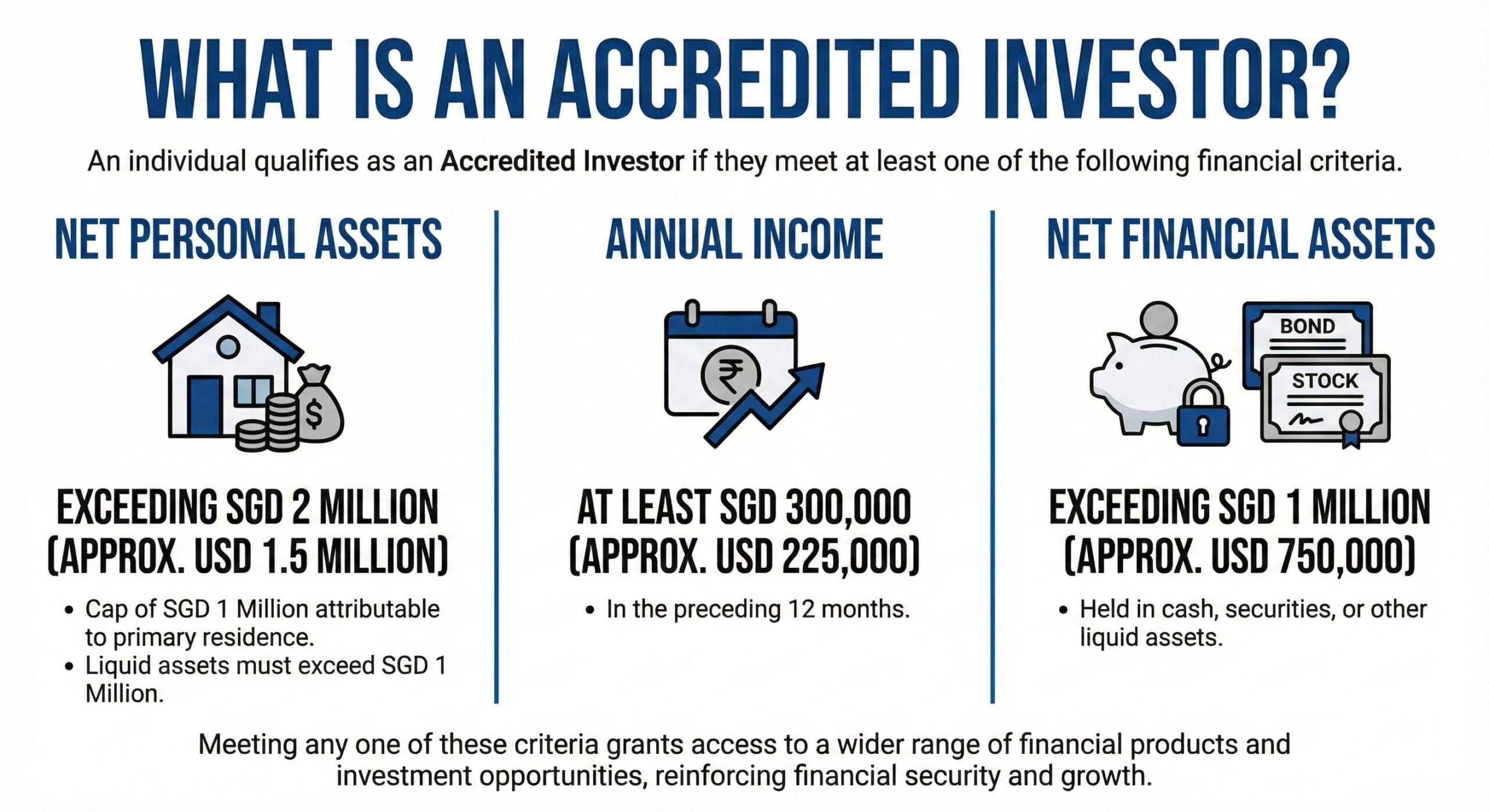

Accredited Investor Status: The Golden Ticket (But Often Misunderstood)

Singapore’s Monetary Authority of Singapore (MAS) classifies investors into three categories under the Securities and Futures Act (SFA): Accredited Investors (AI), Expert Investors (EI), and Institutional Investors (II).

For individual HNWIs opening a personal account, Accredited Investor (AI) status is the relevant classification.

What Is an Accredited Investor?

An individual qualifies as an Accredited Investor if they meet at least one of the following criteria:

Net Personal Assets: Exceeding SGD 2 million (approximately USD 1.5 million), with a cap of SGD 1 million attributable to their primary residence. This means liquid assets must exceed SGD 1 million.

Annual Income: At least SGD 300,000 (approximately USD 225,000) in the preceding 12 months.

Net Financial Assets: Exceeding SGD 1 million (approximately USD 750,000) held in cash, securities, or other liquid assets.

Why AI Status Matters for Banking (Not Just Investments)

Many HNWIs mistakenly believe Accredited Investor status is only relevant for accessing hedge funds or alternative investments. In reality, major private banks in Singapore increasingly require or prefer AI status as a prerequisite for onboarding non-resident clients.

Here is why:

- Liability Reduction: Banks can offer a broader range of products to AI clients without extensive warnings and disclosures. An AI client is presumed to have sufficient financial literacy to understand risks.

- Regulatory Efficiency: MAS rules allow banks to streamline the onboarding process for AI clients, reducing compliance costs.

- Product Access: As an AI, you have access to structured products, private equity funds, and alternative investments that standard retail clients cannot access.

How to Establish AI Status for Banking Purposes

Option 1: Self-Declaration (Most Common)

If you meet the criteria, you can simply declare yourself as an Accredited Investor when opening an account. Most banks will ask you to confirm in writing that you meet one of the three criteria. You may need to provide supporting documentation (e.g., bank statements showing SGD 1M+ in liquid assets, or a recent tax return showing SGD 300k+ annual income).

Option 2: Documentation-Backed Approach (Recommended)

Prepare a package including:

- A letter from your accountant or tax adviser confirming your net assets or annual income.

- Recent bank statements (3–6 months) showing liquid assets.

- Recent tax return.

This approach accelerates the process and reduces back-and-forth with the bank’s compliance team.

Option 3: Formal Certification

Some banks or advisers can issue an Accredited Investor Certificate, confirming your status. This is less common but useful if you plan to open multiple accounts across different institutions.

Important Clarification: AI Status Is Not Automatic

If you have USD 5 million but SGD 800,000 is tied up in a property mortgage, you may not technically qualify as AI (if primary residence exclusion brings your net assets below SGD 1M). Conversely, if you have SGD 300,000 annual income but minimal savings, you still qualify as AI. The bank will verify your claim.

The Pre-Application Checklist: What Banks Actually Want

Before approaching a private bank, compile a comprehensive documentation package. While banks will not tell you upfront what they need, this checklist reflects what successful applicants consistently provide—think of it as the gold standard for non-resident account opening in 2026.

Establishing Your Identity and Residency

Your foundational documents establish who you are and where you are based. Without these, no bank will proceed. Gather the following essentials:

- Valid passport (copy, notarized if not in English)

- Proof of current residence (utility bill, residential lease, or bank statement issued within last 3 months, in your name)

- Tax residency certificate or tax identification number (TIN) from your home country

- Any visa or residency documentation for Singapore (if applicable)

Demonstrating Source of Wealth: The Critical Section

How you made your money determines which documents you must provide. Most applications fail here because applicants misunderstand what counts as “proof.” Below are the five most common wealth origins, each with its specific documentation requirements.

Wealth Built on Employment

Salaried income is the easiest path. Your employer can be verified instantly, tax authorities have records, and banks process these applications quickly. Prepare:

- Last 3–5 years of personal tax returns

- Employment verification letter from your employer (on company letterhead, with contact details)

- Recent payslips (last 6 months)

Wealth Through Business Ownership

Running your own business requires more extensive documentation because banks must verify both your ownership stake and the company’s profitability. Provide:

- Corporate tax returns (3–5 years)

- Audited financial statements (if available; unaudited are acceptable if audits don’t exist)

- Proof of ownership (corporate registry documentation, shareholding certificate)

- Corporate bank statements showing regular profitability (12–24 months)

Wealth From a Business Exit

This is where complexity increases significantly. Banks must verify the buyer is legitimate, the purchase price is real (not inflated), and the funds were actually received. Expect the longest scrutiny here. Gather:

- Sale and purchase agreement (SPA) showing transaction price, buyer identity, and date

- Bank statements confirming receipt of sale proceeds (dated within past 3–5 years)

- Escrow release statements (if applicable)

- Letter from transaction counsel confirming fund transfer and completion

Insider Note: Many founders worry about confidentiality. If your SPA contains sensitive terms, ask your accountant or tax adviser to write a letter confirming the sale occurred and the amount received. Most banks accept this alternative instead of the full SPA.

Wealth Through Inheritance

Inherited wealth triggers rigorous verification because banks must confirm the inheritance is legitimate and you are the rightful beneficiary. Additionally, they want assurance that the inherited funds themselves are clean (not proceeds from illegal activity). Prepare:

- Probate documents or certified copy of the will

- Court order confirming your inheritance right

- Bank statements or asset transfer confirmations showing receipt of funds

- Estate tax filing (Form 1041 in the US, or equivalent in your jurisdiction)

Reality Check: Inheritance verification takes longest—often 16+ weeks. Ensure all estate tax filings are complete before applying.

Wealth Grown Through Investment Returns

Investment-grown wealth requires tracing the original source. A USD 5 million portfolio built over 20 years from a USD 100k salary is straightforward. However, USD 5 million that appeared from USD 100k cash with no clear origin will trigger rejection. Demonstrate:

- Brokerage statements (3–5 years) showing historical positions and gains

- Real estate deeds and valuations for any significant property holdings

- Tax returns reporting the capital gains

Wealth Derived From Cryptocurrency

Cryptocurrency holdings or recent crypto exits present the most intensive scrutiny because many banks consider crypto a higher-risk asset class. However, with proper documentation and tax compliance, it is increasingly acceptable. The key is proving the funds originated through legitimate exchanges and that you paid taxes on gains.

For active crypto holdings, provide:

- Detailed exchange transaction history (3–5 years, complete export from Coinbase, Kraken, Binance, etc.)

- KYC documentation from the exchange confirming your identity

- Proof of initial purchase (exchange receipts or bank statements showing your original deposit)

- Tax returns showing reported crypto gains or losses

For a crypto exit (selling holdings), gather:

- Exchange records of the sale transaction

- Bank statements showing receipt of proceeds into your personal or business account

- Tax returns reporting the capital gains

The 2026 Reality: If you acquired crypto through legitimate exchanges, paid taxes on gains, and have clear documentation, forward-thinking private banks will accept it. Sygnum Bank and AMINA Bank actively welcome crypto-wealthy clients. Traditional banks (DBS, OCBC, UBS) accept crypto wealth only if it passed through traditional banking channels and is fully documented. If your crypto wealth came from mining, airdrops, or anonymous wallets with unclear origins, expect rejection.

Verifying Your Current Wealth

Beyond explaining where your money came from, you must prove you actually possess the assets you claim. This verification happens through current statements from all your holdings:

- Latest bank statements (6 months) from your primary banking relationship

- Recent investment account statements (6 months) if applicable

- Real estate valuation or property deeds for any significant holdings

- Net worth statement prepared by your accountant or financial adviser

Confirming Accredited Investor Status

Meeting Accredited Investor criteria unlocks faster processing and broader product access. You demonstrate your status through one of three approaches:

- Confirmation letter from your accountant or tax adviser stating you meet AI criteria

- Bank statements (6 months) confirming SGD 1M+ in liquid assets

- Tax return confirming SGD 300k+ annual income in the preceding 12 months

Presenting Your Professional Background and Investment Intent

Beyond financial documents, relationship managers want to understand you as a person. They want to know your career trajectory, how you made your money, and what you hope to achieve. Prepare:

- Professional CV or biography (1–2 pages maximum, detailing career history, current role, education, relevant achievements)

- Source of wealth narrative (1 page, written in plain language explaining how you accumulated your money—this should tell a story)

- Statement of investment objectives (what you hope to achieve with the account: diversify into Asian markets, long-term family wealth management, real estate exposure, etc.)

Completing Compliance Declarations

Regulatory requirements demand formal declarations. These protect both you and the bank, and transparency here prevents delays later. You will sign:

- Politically Exposed Person (PEP) declaration (confirming whether you or your immediate family members hold or have held public office)

- Sanctions screening declaration (confirming you are not on any OFAC or international sanctions lists)

- Beneficial ownership declaration (required if opening an account for a business, trust, or other entity structure)

The Translation Challenge and How to Handle It

Any documents not originally in English require professional handling. Attempting this yourself from abroad typically causes delays because banks will reject improperly certified translations. Instead:

Arrange certified translation: Hire a qualified translator recognized by Singapore authorities. This costs SGD 100–300 per document but ensures first-time acceptance.

Obtain apostille or notarization: If documents originate from outside Singapore, they must be apostilled (certified at the country of origin). This is a legal formality that adds 1–2 weeks to your timeline.

Consider a local service: Rather than coordinating translation across time zones and countries—a process that often requires multiple rounds of corrections—many successful applicants hire a local Singapore translation service to handle the entire package. They manage quality control, obtain apostilles, and deliver everything to the bank in proper format. The convenience saves weeks and ensures no rejections due to formatting or certification issues.

Budget and timeline: Allow 2–4 weeks for translation and certification if you have numerous documents in foreign languages. Factor this into your overall application timeline.

Based on our experience in 2026, here is the realistic timeline for a non-resident opening a private banking account:

Stage 1: Bank Selection & Initial Contact (1–2 weeks)

You identify your target banks and contact their private banking desks. Many banks require an introduction from an existing client or a professional adviser (us, a lawyer, an accountant). Cold calls are rarely successful.

What to expect: An initial phone or video call with a private banking representative. They will ask about your assets, investment objectives, and country of residence. Based on your profile, they will either express interest or politely decline.

Time commitment: 30 minutes–1 hour.

Stage 2: Document Submission (1–2 weeks)

Once a bank expresses interest, they issue a preliminary checklist. You compile and upload all documents via their secure portal.

What to expect: The bank’s compliance team reviews your documents for completeness. They may request clarifications (“We need a certified translation of your business license,” or “We need a more recent bank statement”).

Red flags that slow things down:

- Documents in a language other than English without certified translation.

- Gaps in your source of wealth narrative (e.g., a USD 5 million account jump in a bank statement with no explanation).

- Unclear beneficial ownership if there are corporate entities or trusts involved.

- PEP flagging if you have any public role or immediate family in government.

Time commitment: 2–4 weeks for document gathering and submission.

Stage 3: Compliance Deep Dive (2–4 weeks)

This is where your application lives or dies. The bank’s AML/compliance team conducts:

- Source of funds verification: They may contact your previous bank, the buyer of your business, or your employer to verify the account history.

- PEP screening: They cross-check your name against international sanctions lists and public office registries.

- Beneficial ownership verification: If you own a business or hold assets through a trust or company, they verify you are the true beneficial owner.

- Crypto checks (if applicable): They verify your exchange activity and may request additional documentation from the exchange.

What slows this down:

- Your name matching a sanctions list name (surprisingly common; requires formal dispute resolution).

- A PEP flag (even if your relative—not you—holds office; this requires mitigation).

- Unclear ownership structures (trusts, holding companies, nominee directors; requires legal documentation).

- Business location in a higher-risk jurisdiction (requires extra scrutiny).

Time commitment: Banks rarely communicate during this stage. You wait.

Stage 4: Final Approval & Account Setup (1–2 weeks)

Assuming no major red flags, compliance gives the green light. You receive a video call with your relationship manager to finalize account details, sign documents, and arrange your initial deposit.

What to expect:

- A formal account opening agreement (you sign electronically).

- Confirmation of your investment mandate (how the RM will manage your assets).

- Digital banking setup instructions.

- Initial minimum deposit transfer details.

Time commitment: 1–2 hours for the call and follow-up.

Stage 5: Funding & Activation (1–2 weeks)

You transfer your initial deposit from an account in your own name. The bank clears the funds and activates your account.

Critical: The source of your wire must match your documented source of wealth. A wire from an anonymous third party or a company you did not mention will trigger re-verification.

Total timeline: 2–3 months for a straightforward case (employment-based wealth, clear documentation, no PEP flags).

Extended timeline (3–6 months): If you have a crypto background, recent business sale, or international ownership structures.

Rejection timeline: Some banks reject applications silently. If you have not heard back in 4–6 weeks during the compliance stage, you likely will not be approved. Do not hesitate to follow up and ask for explicit feedback.

Real-World Scenarios: How Different HNWIs Navigate the Process

Scenario 1: The Salaried Executive (Low Friction)

Profile: A Singapore-based expatriate executive earning USD 300,000 annually with USD 3 million in investments.

SOW: Employment + investment growth.

Documentation: 3 years of tax returns, employment letter, brokerage statements.

Timeline: 6–8 weeks.

Outcome: Approved. No compliance issues. Assigned senior RM.

Lesson: Salaried income is the easiest path. Your employer can be verified instantly.

Scenario 2: The Tech Founder with a Recent Exit (Medium Friction)

Profile: A Dubai-based founder who sold his SaaS company for USD 50 million to a US acquirer. He now wants to establish a Singapore account with USD 10 million of proceeds.

SOW: Business sale proceeds.

Documentation: SPA, escrow release statements, bank statements showing receipt, transaction counsel letter.

Complication: The SPA is confidential; the founder does not want to share it verbatim. The bank requires proof the transaction is real.

Resolution: The founder’s tax adviser provides a letter confirming the sale occurred and the amount. The bank accepts a redacted version of the SPA.

Timeline: 12–14 weeks (longer due to transaction verification).

Outcome: Approved at a top-tier private bank. Assigned vice president-level RM. Special attention given to startup investment opportunities (founder’s stated interest).

Lesson: Business exits are more complex but acceptable. Use professional advisers (lawyers, accountants) to bridge the gap between confidentiality and compliance.

Scenario 3: The Crypto Founder (High Friction)

Profile: A Mexican entrepreneur who made USD 20 million trading cryptocurrency over 5 years. He now holds USD 8 million in various crypto assets and wants to diversify into Singapore banking.

SOW: Cryptocurrency trading gains.

Documentation: 5 years of exchange transaction history (Binance, Kraken), KYC documents from exchanges, tax returns reporting gains.

Complication: Traditional banks see crypto as high-risk. Two banks rejected him outright. He approached Sygnum Bank (a crypto-friendly private bank).

Resolution: Sygnum accepted his profile because they specialize in crypto clients. They verified his exchange records and tax compliance. Approved within 8 weeks.

Outcome: Account opened at Sygnum with USD 8 million. Crypto holdings held in custody within the bank. Access to fiat services for diversification.

Lesson: If traditional banks reject you due to crypto, specialized crypto-friendly banks exist. Sygnum, AMINA, and similar institutions actively welcome crypto wealth.

Scenario 4: The Inherited Wealth (Complex)

Profile: An Indian-American businessman inherited USD 15 million from his father’s estate in 2024. He wants to open a Singapore account to diversify assets.

SOW: Inheritance.

Documentation: Probate court order, certified copy of will, estate tax filing (Form 1041), bank statements showing receipt of funds.

Complication: The estate was based in India, with assets in Indian rupees converted to USD. The bank required proof that the inheritance tax was paid to Indian authorities.

Resolution: The founder provided an affidavit from the Indian tax authority and Indian bank confirming tax payment and fund release.

Timeline: 16 weeks (inheritance verification takes longer).

Outcome: Approved. Moderate RM attention due to the complexity of cross-border inheritance.

Lesson: Inheritance is legitimate but slow. Ensure all estate tax filings are complete before applying. International inheritances take longer.

Accredited Investor, Expert Investor, and Institutional Investor Classifications (Condensed)

For completeness, here are the three MAS classifications:

Accredited Investors (AI)

Criteria met by: Individuals with SGD 2M+ net assets, SGD 300k+ annual income, or SGD 1M+ liquid financial assets.

Relevant for: Individual HNWI account opening.

Expert Investors (EI)

Criteria met by: Individuals or firms actively trading capital markets products as part of their business. Includes asset managers, traders, professional investment firms.

Relevant for: Professional investors and fund managers, less common for individual HNWIs unless you are actively managing a hedge fund or similar entity.

Institutional Investors (II)

Criteria met by: Licensed banks, insurance companies, pension funds, government bodies, collective investment schemes.

Relevant for: Corporate or institutional entities only, not individual HNWIs.

For individual HNWIs: Focus on Accredited Investor status. The other two are either automatically met (if you run an investment firm) or not applicable.

The Regulatory Landscape in 2026: Key Changes

Since 2023, MAS has tightened several requirements affecting non-resident account opening:

1. Enhanced CRS Reporting

MAS expanded the Common Reporting Standard (CRS) framework. Non-resident accounts are automatically reported to your country of tax residence. If your tax filings do not match the account activity (e.g., you report zero investment income but the account shows dividend income), your home country’s tax authority will flag you.

Implication: Ensure your tax filings are accurate before opening the account.

2. Stricter Source of Funds Verification

MAS issued updated guidance in 2024 requiring banks to verify the origin of deposits, not just the account holder’s identity. A wire from an entity you did not mention on your application will trigger re-verification.

Implication: Be precise about where your money comes from. Mention all relevant businesses, trusts, or investment entities.

3. Crypto Asset Guidance

MAS published guidance allowing regulated banks to offer crypto services, but with strict conditions:

- Crypto must be held in regulated custody (Sygnum, AMINA, regulated exchanges).

- Banks must conduct thorough KYC on the origin of crypto wealth.

- Tax compliance is essential.

Implication: Crypto wealth is increasingly acceptable, but only if compliant and properly documented.

4. Politically Exposed Person (PEP) Expansion

MAS expanded the definition of PEP to include indirect relationships. If your spouse, adult child, or sibling holds a public office, you may be flagged as PEP-related.

Implication: Disclose any family ties to government or public positions upfront. Hiding them causes account rejection.

Disclaimer & Regulatory Fluidity

Singapore’s banking regulations evolve frequently. MAS issues new guidelines, banks adjust their risk appetites, and individual bank policies change without public announcement.

This guide reflects the landscape as of early 2026. Requirements discussed here are typical, but individual banks may have stricter or more lenient standards depending on:

- The bank’s risk appetite (some banks are more conservative than others).

- Your country of residence (higher-risk jurisdictions face extra scrutiny).

- Geopolitical events (sanctions regimes, trade disputes can trigger policy changes).

- Regulatory directives (MAS can issue new guidance that affects all banks simultaneously).

Before applying, verify current requirements directly with your target bank’s private banking team.

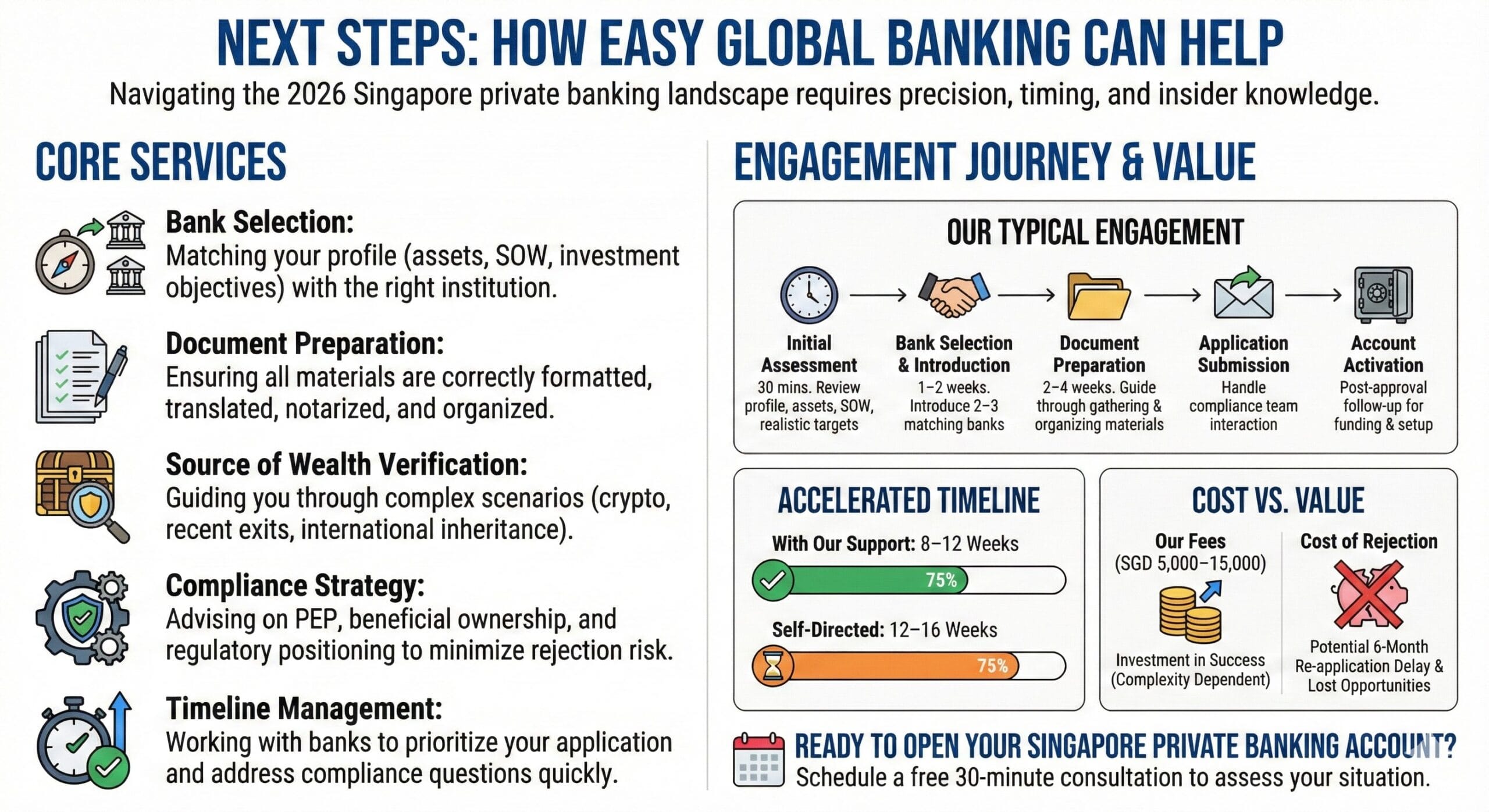

Next Steps: How Easy Global Banking Can Help

Navigating the 2026 Singapore private banking landscape requires precision, timing, and insider knowledge of individual bank preferences.

Easy Global Banking specializes in:

- Bank selection: Matching your profile (assets, source of wealth, investment objectives) with the right institution.

- Document preparation: Ensuring all materials are correctly formatted, translated, notarized, and organized.

- Source of wealth verification: Guiding you through the documentation process, especially for complex scenarios (crypto, recent exits, international inheritance).

- Compliance strategy: Advising on PEP, beneficial ownership, and regulatory positioning to minimize rejection risk.

- Timeline management: We work with banks to prioritize your application and address compliance questions quickly.

Our typical engagement:

- Initial assessment: 30 minutes. We review your profile, assets, and source of wealth. We determine which banks are realistic targets.

- Bank selection & introduction: 1–2 weeks. We introduce you to 2–3 banks that match your profile.

- Document preparation: 2–4 weeks. We guide you through gathering and organizing all required materials.

- Application submission: We handle the bulk of the interaction with the bank’s compliance team.

- Account activation: We follow up post-approval to ensure smooth account funding and setup.

Typical timeline with our support: 8–12 weeks (vs. 12–16 weeks self-directed).

Cost: Our fees range from SGD 5,000–15,000 depending on complexity. Compare this to the cost of rejection and having to reapply 6 months later.

Ready to open your Singapore private banking account? Schedule a free 30-minute consultation to assess your situation.

Final Takeaway

In 2026, opening a Singapore bank account as a non-resident requires clear wealth, documented source of funds, and realistic expectations about minimums and timelines.

Retail banking is not accessible at any price. Private banking requires USD 2M–5M in Assets Under Management. The documentation burden is real. And the process takes 2–3 months minimum.

But if you meet the criteria, the reward is access to one of the world’s most stable, tax-efficient, and globally integrated banking hubs. Singapore’s private banking sector is unmatched for Asian growth exposure, family office structures, and multi-currency wealth management.

The path is not plug-and-play. But with proper preparation and expert guidance, it is absolutely achievable.