The $107 Trillion Audience Nobody’s Serving

Global wealth management operates on a binary that no longer reflects reality. You either qualify for Goldman Sachs ($10 million minimum) or you make do with a Robinhood account. The middle ground—where actual wealth sits—has been abandoned.

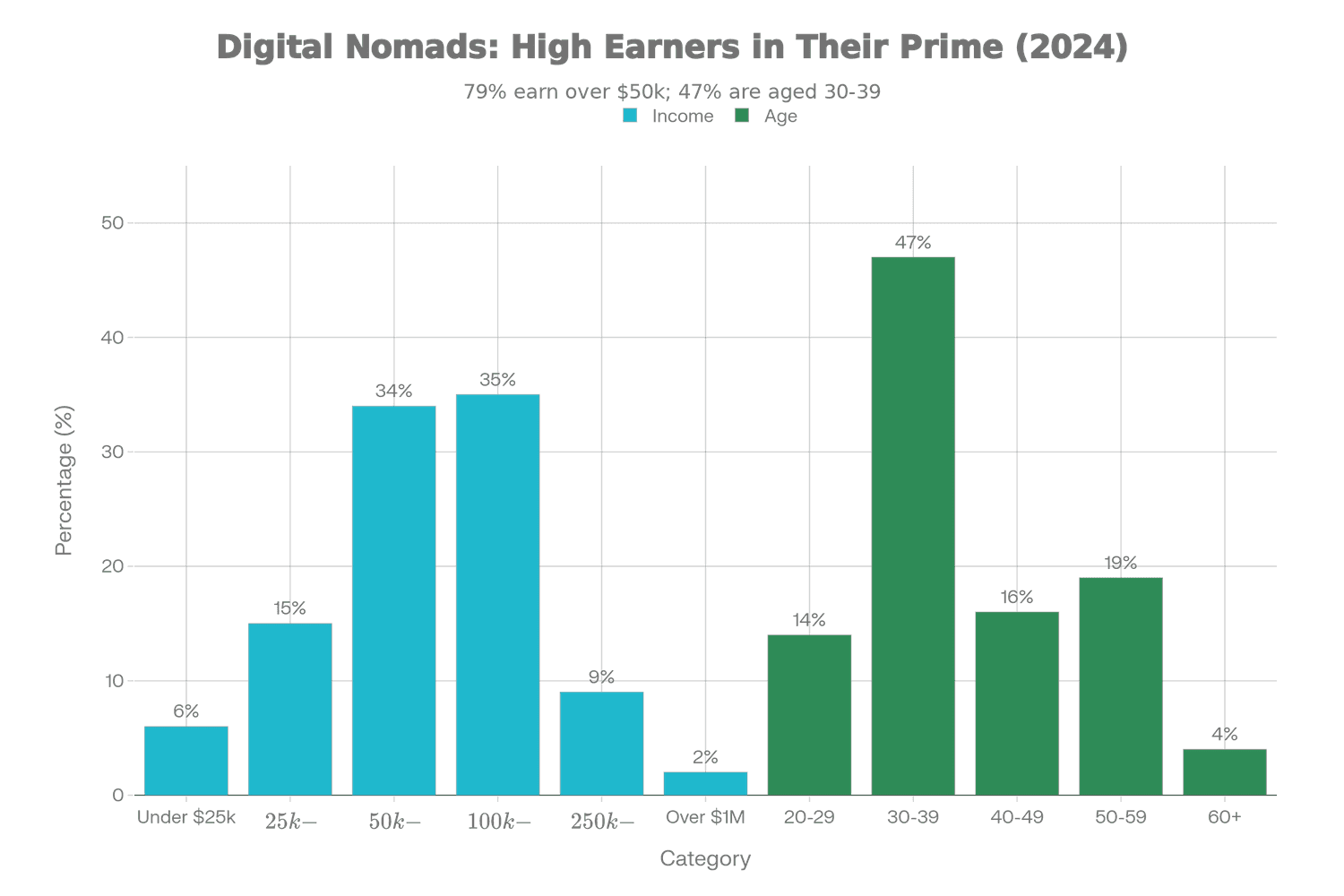

Consider the data: Approximately 52 million “Everyday Millionaires” globally hold $1–5 million in investable assets and collectively manage $107 trillion in wealth. This group has quadrupled since 2000. Meanwhile, the digital nomad population has matured into a force with serious purchasing power. The median nomad is now 36 years old, with 47% concentrated between ages 30–39, and 79% earning over $50,000 annually. More striking: 35% earn $100,000–$250,000 per year, and 9% earn $250,000–$1 million annually.

The $107 Trillion Audience Nobody’s Serving

Global wealth management operates on a binary that no longer reflects reality. You either qualify for Goldman Sachs ($10 million minimum) or you make do with a Robinhood account. The middle ground—where actual wealth sits—has been abandoned.

Consider the data: Approximately 52 million “Everyday Millionaires” globally hold $1–5 million in investable assets and collectively manage $107 trillion in wealth. This group has quadrupled since 2000. Meanwhile, the digital nomad population has matured into a force with serious purchasing power. The median nomad is now 36 years old, with 47% concentrated between ages 30–39, and 79% earning over $50,000 annually. More striking: 35% earn $100,000–$250,000 per year, and 9% earn $250,000–$1 million annually.

Digital Nomad Demographics 2025: Income Distribution and Age Concentration

These are not budget backpackers. They are established professionals—founders, engineers, strategists, consultants—who accumulated wealth over 8–15 years of high-income earning. Yet they face a critical problem: their wealth is too complex for retail platforms and their AUM is too small for traditional private banking.

A 38-year-old software architect with $1.8 million across multiple jurisdictions (property in Portugal, brokerage accounts in Singapore, cryptocurrency holdings, an untouchable U.S. 401k) doesn’t need cheaper commissions. She needs coordination—someone to navigate FATCA filings, evaluate whether a new jurisdiction triggers wealth tax, optimize currency exposure across her holdings, and integrate tax-efficient estate planning. Traditional private banks can’t serve her profitably; robo-advisors can’t address her complexity.

This is the gap that defines 2025–2026: the absence of “Private Banking Lite”—professional wealth management purpose-built for the $500K–$5M globally mobile segment.

Why Traditional Wealth Management Fails at Scale

Traditional private banking is fundamentally uneconomical below $5 million. A relationship manager at JPMorgan or Goldman Sachs—drawing six figures in salary and benefits—cannot justify their cost structure managing a $1.2 million portfolio. The math collapses instantly.

More critically, traditional advisors are trained to funnel clients elsewhere when problems become complex. A nomad holding property in Portugal, operating a business in Singapore, and residing in the UAE requires simultaneous FATCA compliance (U.S. reporting), CRS reporting (global automatic exchange), and potentially five jurisdictional tax regimes. The standard response: hire a separate cross-border tax accountant ($15,000–$25,000/year), an international estate planner ($5,000–$10,000), and a specialized CPA ($10,000–$15,000). Total advisory cost: $30,000–$50,000 annually before any investment returns are considered—roughly 1.5–2.5% of a $2 million portfolio.

This fragmentation is not accidental. It’s structural. The professionals capable of solving the problem—those with licenses, regulatory oversight, and cross-border compliance infrastructure—have been locked behind high minimums precisely because that’s where profitability lives.

The Digital-First Alternative: Alpian’s Hybrid Model

The first meaningful challenge to this structure came in 2022 when Alpian became Switzerland’s first FINMA-licensed digital private bank. The thesis: if you can automate the commodity aspects of wealth management (trading, rebalancing, routine tax-loss harvesting), human advisors become economically viable at lower AUM thresholds.

Alpian targets individuals with CHF 100,000–CHF 1,000,000 (roughly $110,000–$1.1 million) in investable assets—precisely the gap. The bank operates on Temenos Banking Cloud infrastructure, offering multi-currency accounts in CHF, EUR, GBP, and USD under a single Swiss IBAN. Critically, Swiss-based advisors are available via video call in four languages, creating a hybrid: automated daily banking and algorithmic portfolio management paired with human advisory access for life-event planning, tax strategy, and cross-border complexity.

By mid-2024, Alpian had surpassed CHF 100 million in AUM, with typical clients approximately 40 years old. The bank recently lowered advisory entry thresholds to CHF 2,000, signaling that the model works when positioned correctly.

The innovation here is not the technology—that’s become commoditized through platforms like Temenos. The innovation is proving that licensed banking infrastructure can be economically scaled to the mass-affluent segment without sacrificing regulatory compliance, tax optimization, or human advisory access.

The Hybrid Model: Automation Meets Expertise

Across wealth management, a consensus is solidifying around hybrid architectures that blend algorithmic portfolio management with human expertise in specialized domains.

The architecture is straightforward:

The Automation Layer handles everything algorithmic: robo-advisor engines construct and maintain diversified ETF portfolios using factor-based or risk-based allocation frameworks. The system executes rebalancing, tax-loss harvesting, and routine adjustments without human intervention. This layer scales profitably at AUM as low as $50,000–$100,000 because marginal cost per client approaches zero after initial setup.

The Human Layer engages selectively: quarterly or semi-annual meetings with tax strategists, estate planners, or cross-border specialists. These advisors interpret the robo-engine’s recommendations through the lens of specific tax situations, life-event planning, and jurisdiction-specific opportunities. For a nomad, this might mean analyzing whether holding real estate in Portugal triggers wealth tax, or whether a property acquisition affects their visa status in the UAE.

The economic viability is radical. A client with $800,000 in index funds and a straightforward tax situation pays 0.35–0.50% for robo-advisory. A client with $2 million, property in three countries, and self-employment income pays 0.50–0.75%, with the premium reflecting on-demand tax coordination. This is roughly one-third the cost of traditional private banking and infinitely more affordable than hiring boutique specialists independently.

By 2025, hybrid robo-advisors captured 63.8% of global robo-advisor revenue—a decisive shift confirming market preference for this model. Vanguard, Schwab, and digital-first operators like Alpian have all adopted hybrid architectures, indicating this is not a niche approach but the industry’s mainstream direction.

Compliance Made Automatic: The Real Differentiator

For a digital nomad, the highest-value service is not investment selection—that’s commoditized—but seamless cross-border compliance and tax optimization built into the platform itself.

Consider FATCA: U.S. citizens holding foreign financial assets exceeding $200,000–$300,000 must file Form 8938, with 30% withholding penalties for non-compliance. Separately, CRS (Common Reporting Standard) means any financial account held by a non-resident is automatically reported by the bank to the account holder’s country of tax residence—no separate filing required, but failure to disclose exposes clients to significant penalties.

A traditional advisory relationship typically delegates this problem outward: “You’ll need a tax accountant.” A digital-first bank integrates compliance automation into the platform. When a client holds accounts in Switzerland, Singapore, and the UAE, the bank automatically flags reportable accounts, generates required disclosures, and provides tax planning scenarios in real-time—all without additional professional fees beyond the advisory retainer.

This distinction is profound. It transforms compliance from an external cost center into an integrated service layer, and it’s only possible with digital-first architecture. Traditional institutions, burdened by legacy systems and regulatory silos, cannot replicate it at comparable cost.

What “Private Banking Lite” Actually Includes

A fully-realized offering in this space encompasses:

Banking & Currency Management: Multi-currency accounts in 3–4 major currencies with favorable spreads, local IBANs for salary deposits and routine transactions, mobile-first interfaces.

Investment Management: Personalized portfolio construction via robo-advisor algorithm, access to global ETFs and index funds (increasingly, fractional private market exposure), automated rebalancing and tax-loss harvesting, optional quarterly/semi-annual human advisory.

Tax & Compliance: Automated FATCA/CRS reporting integrated into account management, multi-jurisdictional tax scenario modeling, real-time flagging of problematic structures.

Wealth Structuring & Planning: Cross-border holding company advice, trust establishment guidance, family office-lite coordination for complex multi-asset situations.

Advisory Access: On-demand video consultation with wealth advisor or tax specialist, quarterly strategy sessions, transparent fee structures with no hidden retrocessions.

Pricing: Typically 0.50–0.75% AUM annually for advisory, with reduced rates above $2–3 million. Specialized services (estate planning, complex restructuring) billed as project-based engagements or retainers.

The Fintech Convergence: Why Now?

Three macro trends have aligned to make this viable:

Regulatory Licensing for Digital Banks: Five years ago, obtaining a banking license required massive capital and legacy infrastructure. Today, fintech banks are obtaining full licenses from regulators in Switzerland (Alpian), the UK (Atom Bank), and across the EU. This regulatory opening means digital platforms can offer deposit protection equivalent to FDIC/FSCS and build multi-currency, multi-jurisdictional infrastructure natively—not as workarounds.

Infrastructure Commoditization: Building a production-grade digital bank used to require custom engineering over years. Today, providers like Temenos have commoditized backend infrastructure. A team of 30–50 engineers can build a functioning bank in 18–24 months. This democratization of infrastructure reduces competitive moats and accelerates market entry.

Private Markets Democratization: Institutional-grade private equity and private credit—once reserved for HNWIs with $10 million+—are lowering minimums through tokenization and interval funds to $1,000–$10,000 per investment. A “Private Banking Lite” platform including these instruments becomes exponentially more attractive than a pure equity/bond offering. PwC projects tokenized funds alone will reach $715 billion AUM by 2030, up from $90 billion in 2024—a 41% CAGR.

The Competitive Awakening

Traditional banks recognize the threat. Fifth Third Private Bank explicitly targeted the sub-$5-million segment, driving AUM from $36.5 billion to $42.9 billion. DBS Private Bank (Asia-Pacific) embedded generative AI into advisory, enabling scaled personalization without proportional human capital increases. Goldman Sachs launched “IndexGPT,” signaling willingness to compete on transparency and automation.

Yet incumbents remain structurally constrained. A JPMorgan advisory relationship costs more to maintain than Alpian’s cost per client—a gap no digital initiative can overcome. The real threat comes not from traditional players’ digital pushback, but from unified platforms built from inception with mass-affluent economics in mind.

The Maturing Demographic: From Accumulation to Preservation

The strategic insight undergirding “Private Banking Lite” is demographic: digital nomads are not perpetual travelers. They are maturing high-earners transitioning from cost-minimization to wealth optimization.

The evidence is explicit. The median nomad age is 36, with 47% aged 30–39. Approximately 54% are homeowners, indicating substantial real estate wealth outside nomadic earnings. Their average income is $124,000+, with 44% earning six figures or more. Many now have family obligations—partners, children, aging parents in home countries—creating complexity beyond single-person tax optimization.

This demographic is no longer asking, “How do I minimize costs while working from Bali?” They’re asking, “How do I protect and grow wealth across multiple currencies, countries, and generations?” That shift from cost-optimization to wealth-optimization is precisely where digital-first private banks can compete on value.

The Path Forward

The infrastructure for mass-affluent wealth management now exists. Within 24–36 months, expect:

Platform Consolidation: Smaller fintech wealth advisors will be acquired into larger ecosystems seeking mass-affluent exposure. Regulatory Codification: Regulators will explicitly define “digital private banking” as a licensed category with lower capital requirements than full banking licenses. Geographic Expansion: Players successful in one jurisdiction will expand regionally—digital-first private banks across the EU under passporting rules, similar offerings in Asia-Pacific by 2027. Traditional Responses: Incumbent banks will launch dedicated mass-affluent subsidiaries with separate P&Ls and tech stacks, explicitly permitting lower AUM minimums and fee structures.

The competitive winner will not be determined by technology—which is easily replicated—but by trust, regulatory pedigree, and brand credibility among globally mobile professionals.