Lombard Odier closed 2025 with record client assets, rising profitability and a landmark headquarters in Bellevue – a combination that firmly reinforces its position among the top Swiss private banks for sophisticated international clients. For families and entrepreneurs with multi‑million‑franc portfolios, this is exactly the profile to look for when selecting a long‑term banking partner in Switzerland.

2025: A milestone year in numbers

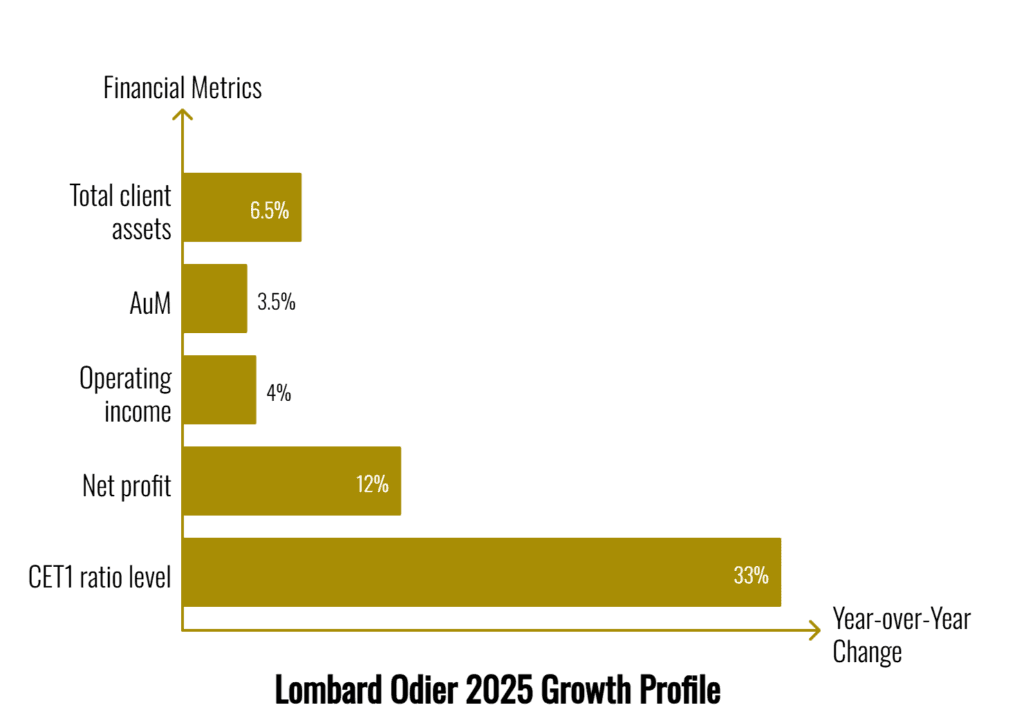

From a financial perspective, 2025 was a clear step‑up year. Lombard Odier’s total client assets reached CHF 349 billion, an increase of 6.5% compared with 2024. Within that, assets under management (AuM) climbed to a record CHF 223 billion, up from CHF 215 billion, driven by solid net new money and strong investment performance for clients.

The income statement tells the same story of disciplined growth. Operating income rose to CHF 1.394 billion, about 4% higher year on year, mainly thanks to a rebound in fees and commissions – the core revenue engine for a pure wealth and asset manager. At the bottom line, net profit increased by 12% to CHF 200 million, helped by stable operating expenses once one‑off relocation costs are adjusted out.

Just as important, the balance sheet remains exceptionally strong. With a Common Equity Tier 1 (CET1) ratio of around 33%, Lombard Odier sits at roughly double the minimum required by the Swiss regulator, putting it among the most highly capitalised banks in the industry. For high‑net‑worth clients, that level of capital strength is a direct proxy for resilience through market cycles.

What really drove the 2025 performance

Behind these headline numbers lies a business model that leans into investment performance rather than balance‑sheet risk. The bulk of Lombard Odier’s revenue comes from fees and commissions on discretionary mandates, advisory portfolios and institutional solutions, not from aggressive lending. As markets recovered and client activity normalised in 2025, that fee engine accelerated and flowed through into higher operating income.

Meanwhile, operating expenses stayed under tight control. The bank had to absorb exceptional costs related to the move into its new Bellevue headquarters, but once these are excluded, the underlying cost base remained broadly stable. This is why profit grew three times faster than revenue – a sign of operating leverage rather than cost cutting. Earlier in the year, H1 numbers were temporarily dampened by currency effects, as a stronger Swiss franc reduced the translated value of dollar‑denominated assets, yet net new inflows and performance more than offset that impact by year‑end.

From a risk and governance angle, the CET1 ratio around 33% stands out as one of the highest in the sector, reinforced by an AA‑ credit rating affirmation. In practical terms, this means the bank can navigate periods of market stress without being forced into fire‑sale decisions or radical balance‑sheet restructuring – a quality that ultra‑high‑net‑worth clients value immensely.

Bellevue headquarters: architecture with a strategic purpose

In parallel with its financial performance, Lombard Odier completed a once‑in‑a‑generation move: the opening of its new headquarters in Bellevue, on the shores of Lake Geneva, designed by Herzog & de Meuron. The building, often referred to as “1Roof”, unites around 2,000 employees who were previously dispersed across six sites in Geneva and offers capacity for up to roughly 2,600 workstations.

The architecture is not just aesthetic; it is deliberately functional. Fully glazed façades, curved floor plates and large terraces maximise natural light and views over the lake and mountains, while a central atrium and double‑height collaboration spaces are designed to encourage interaction across investment, advisory, risk and operations teams. Inside, the building includes an auditorium for several hundred guests, client areas conceived as intimate salons, and a variety of work zones that balance privacy with open collaboration.

Sustainability runs through the project. The headquarters uses local materials, integrates recycled concrete, collects rainwater and deploys solar panels on the roof, while also connecting to energy‑efficient systems in the Geneva area. For a bank that promotes sustainable investment strategies to clients, aligning its own real‑estate footprint with those principles strengthens credibility.

Why this move matters for Geneva and Swiss banking

Lombard Odier is not just any Swiss bank; it is Geneva’s oldest private bank, with more than two centuries of history. Choosing to consolidate operations in an iconic, purpose‑built campus in Bellevue sends a clear message: the partners are betting on Geneva and the Swiss financial centre for the long term.

This decision has several implications. First, it anchors high‑value jobs, decision‑making and client coverage in the region, reinforcing Geneva’s position alongside Zurich as a global wealth‑management hub. Second, it complements the Swiss regulatory framework – supervised by FINMA, one of the most respected financial market regulators globally – by pairing strict prudential oversight with visible, long‑term investment in local infrastructure. Finally, it signals to international clients that Switzerland continues to invest in the physical and human capital needed to serve complex, cross‑border wealth structures.

In my own advisory work with internationally mobile families, such visible commitment often tips the balance when boards or family councils debate which booking centres to prioritise. A bank that is building for the next 30 years, not the next three, inspires a different level of confidence.

How discerning clients should read Lombard Odier’s 2025 story

For high‑net‑worth and ultra‑high‑net‑worth clients, the 2025 picture offers a useful framework for judging Lombard Odier – and, by extension, other Swiss private banks. Several elements stand out:

- Scale with quality: CHF 349 billion in client assets and CHF 223 billion in AuM show institutional‑level scale, while record AuM suggests clients are entrusting more capital, not less.

- Profitable, fee‑driven model: 4% growth in operating income and 12% growth in profit, driven mainly by investment‑related fees, point to disciplined, performance‑oriented growth rather than leveraged expansion.

- Top‑tier capitalisation: a CET1 ratio around 33% – about twice the regulatory minimum – gives the institution significant shock‑absorption capacity.

- Strategic real‑estate footprint: the Bellevue HQ concentrates talent and decision‑makers under one roof, improving internal coordination and client servicing.

- ESG consistency: investing in a resource‑efficient, modern campus reinforces the bank’s messaging around sustainability‑focused investing.

When evaluating a potential banking partner, clients with sizable portfolios should consider not only performance and pricing but also governance, physical footprint and long‑term signalling. Lombard Odier’s 2025 combination of results and infrastructure investment provides a strong, coherent narrative across all of these dimensions.

Snapshot table: Lombard Odier 2025 key metrics

To keep the main indicators clear, the following table summarises the publicly reported 2025 figures without extrapolating any missing data.

Lombard Odier 2025 – main figures

These data points highlight a clear pattern: assets and revenues are growing steadily, while profits and capital ratios remain robust, signalling a well‑managed balance between growth and prudence.

For a quick visual impression of growth momentum, imagine each bar below as representing the relative annual change for each line item:

This pattern – profits growing faster than revenues and both supported by a very strong capital base – is typically what sophisticated investors want to see when assessing the health of a private bank.

Where Lombard Odier fits among top Swiss banks for foreigners

Given this profile, how should an international client position Lombard Odier within a broader Swiss banking strategy? For foreigners, especially those planning to book at least CHF 5 million in investable assets, the bank sits firmly in the top tier of Swiss private banking options.

Several reasons support this positioning:

- The governance structure as an independent partnership encourages long‑term thinking, which aligns well with multi‑generational wealth planning.

- The combination of strong capitalisation, transparent reporting and a modern headquarters underlines a commitment to both financial and operational resilience.

- Investment capabilities, particularly in discretionary mandates and sustainable strategies, benefit from the scale and talent concentration achieved through the Bellevue move.

For clients who want to benchmark Lombard Odier against other Swiss institutions, a practical next step is to look at an independent overview of leading banks that actively serve international clients. A curated resource such as the guide to top Swiss banks for foreigners helps position Lombard Odier alongside peers and highlights why it often ranks as a recommended choice for clients ready to commit CHF 5 million or more in assets.

Turning analysis into a concrete private banking strategy

Putting everything together, Lombard Odier’s 2025 story blends record assets, profitable growth and a flagship headquarters that visibly anchors the bank in Geneva for decades to come. For affluent foreigners evaluating Swiss banking options, this combination should carry significant weight, especially at higher asset levels where institutional stability, governance and depth of service become non‑negotiable.

However, selecting the right bank is only one part of building a resilient cross‑border wealth structure. Clients still need to make careful decisions on booking centres, account architecture, portfolio mandates, lending strategies and succession planning – ideally with a framework that balances regulatory requirements, tax implications and family dynamics.

That is where using an informed, comparative perspective on top Swiss banks for foreigners becomes so valuable. By understanding exactly how institutions like Lombard Odier operate, what their numbers reveal and how their strategic investments translate into day‑to‑day client service, high‑net‑worth individuals can turn a strong macro narrative into a tailored, well‑structured private banking relationship that matches their ambitions and risk tolerance.