Last Updated: January 2026

The Quick Answer

If you’re considering offshore banking in an emerging hub, the choice comes down to three factors: geography, speed, and regulatory needs. Malta wins for EU integration and fintech. Cyprus delivers tax efficiency with substance requirements. Belize offers privacy and crypto acceptance with minimal barriers. Each serves a different profile—and most successful entrepreneurs maintain accounts in multiple jurisdictions.

Side-by-Side Comparison

| Criteria | Malta | Cyprus | Belize |

|---|---|---|---|

| Minimum Deposit | €50–€2,000 | €0–€10,000 | $500–$1,000 |

| Remote Account Opening | Yes | Yes (with video call) | Yes |

| Opening Timeline | 1–2 days (digital) / 2 weeks (traditional) | 2–6 weeks | 1–3 weeks |

| Currency | EUR | EUR | BZD (USD-pegged) |

| Monthly Fee | Free (active) | €10–€20/year | $1.50–$50/month |

| Intl. Wire Fee | ~€12 | Varies | Higher |

| EU Member | Yes (Eurozone) | Yes (Eurozone) | No |

| Best For | EU startups, fintech, digital nomads | Tax optimization, IP holds, substance-based | Privacy, crypto, low barriers |

| Business Account Timeline | 2–4 weeks (standard) / 6–12+ weeks (high-risk) | 2–6 weeks | 1–4 weeks |

| Regulatory Prestige | High (MFSA oversight) | High (EU member) | Moderate (solid but less prestige) |

| Crypto-Friendly | Limited (requires VFA license) | Limited (requires MICA compliance) | Yes (more accommodating) |

Malta: EU Gateway with Digital-First Banking

Who Should Choose Malta

Best for:

- EU-based or Europe-targeting startups needing regulatory credibility

- Fintech, SaaS, or payment companies requiring EU passporting

- Digital nomads and international freelancers wanting EUR-denominated accounts

- Companies in regulated sectors (gaming, payments, crypto with proper licensing)

- Anyone prioritizing speed (digital banks like MeDirect open accounts in 24–48 hours)

Not suitable if:

- You operate in crypto without regulatory licensing

- You need maximum privacy over regulatory transparency

- You require the lowest entry costs

- Your business model is privacy-centric or anonymous

Why Malta Works

Malta is Eurozone’s tech hub. Three of five bank customers use mobile or internet banking. The MFSA’s FinTech Regulatory Sandbox provides a clear pathway for financial innovators—something larger European jurisdictions struggle to match.

As an EU member, Malta-licensed banks can serve across the European Economic Area without additional licensing. SEPA payments within Europe are instant and essentially free.

How to Open an Account

Phase 1: Pre-Screening (1–3 days)

Contact your chosen bank (MeDirect, Satchel, HSBC Malta, BOV, or APS). Provide a business summary and ask about requirements for your sector. Banks will pre-screen your profile against their risk appetite.

Phase 2: Document Submission (3–5 days)

For personal accounts: passport, proof of address, tax ID.

For business accounts: Certificate of Incorporation, board minutes, director/shareholder register, business plan (what you do, client types, expected transaction volumes), and source-of-wealth documentation (salary statements, business exit proof, bank statements showing legitimate income).

High-risk sectors (crypto, iGaming, forex): add regulatory licenses, AML policies, and detailed compliance frameworks.

Phase 3: Compliance Review (1–4 weeks)

Bank compliance team reviews documents. Standard businesses face basic review. High-risk sectors undergo Enhanced Due Diligence (EDD), which can take 6–12+ weeks if you’re unprepared.

Phase 4: Activation (3–7 days)

Board resolutions finalized, SEPA/SWIFT channels tested, debit cards issued. Account goes live.

Total Timeline: 2–3 weeks with prepared documents, 6–12+ weeks for high-risk sectors without compliance prep.

Best Banks in Malta (2026)

| Bank | Strengths | Best For |

|---|---|---|

| MeDirect | Digital-first, fastest remote opening, €50 minimum | Early-stage founders, digital nomads |

| Satchel | 100% online, instant account setup | Tech entrepreneurs, solopreneurs |

| HSBC Malta | Global network, trade finance | Companies with international supply chains |

| Bank of Valletta (BOV) | Market leader, full-service corporate banking | Established SMEs, import-export |

| APS Bank | Relationship-focused, responsive | Local professionals, mid-market SMEs |

Cyprus: Tax Efficiency with Structure Requirements

Who Should Choose Cyprus

Best for:

- EU-based entrepreneurs building holding companies or IP structures

- Wealth optimization across EU and Middle Eastern markets

- Businesses with legitimate reason to establish Cyprus “substance” (office, staff, local directors)

- Companies benefiting from 15% corporate tax rate (increased from 12.5% under 2026 OECD reforms, still competitive vs. 21%–30% in most EU nations)

- Multicurrency operations requiring EUR, USD, GBP, and AED management

Not suitable if:

- You can’t or won’t establish physical presence (Cyprus requires “economic substance” proof)

- You operate in unregulated high-risk sectors without compliance infrastructure

- You need account approval in days (2–6 weeks minimum)

- Your business is 100% remote with no Cyprus nexus

Why Cyprus Stands Out

Cyprus positions itself as a bridge between Europe, the Middle East, and Asia. The CySEC launched its Regulatory Sandbox in June 2024, signaling commitment to fintech innovation. Tax efficiency is real—15% corporate rate combined with dividend treaty networks creates competitive wealth management structures.

The strict “economic substance” requirement—proof of managed operations in Cyprus—isn’t a barrier; it’s a feature. Banks won’t approve accounts for hollow shells. This actually makes Cyprus accounts more credible for legitimate structures.

How to Open an Account

Phase 1: Substance Planning (1 week)

Decide your account purpose (business, holding company, or trading). Determine if you can establish Cyprus substance: office lease, local staff, director appointments, or local suppliers.

Phase 2: Document Submission (1–2 weeks)

Corporate documents: Certificate of Incorporation, M&As, director/shareholder register, UBO declarations.

Personal KYC: passports and proof of address for all directors and beneficial owners.

Business plan describing legitimate operations, transaction flows, and counterparties.

Source-of-wealth documentation (heavily scrutinized in Cyprus).

Substance evidence: office lease, utility bills in company name, employment contracts, or director residency.

Phase 3: Economic Substance & Compliance Review (2–6 weeks)

Banks conduct deep due diligence on business model, management location, and operational genuineness. Higher-risk sectors face additional scrutiny. Expect back-and-forth questions about client types, counterparty justification, and transaction rationale.

Phase 4: Activation (1–2 weeks)

Board resolutions finalized, multi-currency account setup, debit cards issued.

Total Timeline: 2–6 weeks with substance evidence, 8–12+ weeks without.

Alternative: Open an Electronic Money Institution (EMI) account—Wise, Revolut, or Payoneer—in 3–5 days as a parallel track. EMIs provide multi-currency IBANs and instant payments but lack prestige and local clearing access. Most companies use both: EMI for operational liquidity while pursuing a traditional bank account for substance and credibility.

Best Banks in Cyprus (2026)

| Bank | Strengths | Best For |

|---|---|---|

| Bank of Cyprus | Largest domestic, strong corporate, strict due diligence | Established companies, institutional clients |

| Alpha Bank Cyprus | International presence, good trade finance | SMEs with substance, trade-heavy business |

| Hellenic Bank | Traditional corporate banking, competitive rates | Holding companies, dividend optimization |

| Emporiki Bank | International banking, multicurrency strength | Multicurrency operations, trading |

| Wise/Revolut (EMI) | Instant setup, multi-currency, mobile-first | Digital nomads, operational accounts |

Belize: Privacy and Accessibility

Who Should Choose Belize

Best for:

- Privacy-conscious legitimate investors seeking bank secrecy (Belize maintains strong confidentiality while adhering to CRS standards)

- Crypto exchanges, digital asset companies, and blockchain projects (Belize banks more accommodating than EU jurisdictions)

- Companies with USD revenue streams (currency pegged 2:1 to USD eliminates forex volatility)

- Entrepreneurs needing low entry barriers ($500–$1,000 minimums vs. €10,000+ in Cyprus)

- Anyone prioritizing account opening speed (online approvals in 7–21 days)

- Investors seeking higher savings rates (2–4% annually vs. near-zero in EU banks)

Not suitable if:

- You need EU market access or SEPA integration

- Your clients demand “Tier-1” banking jurisdiction credentials

- You require physical banking infrastructure and branch access

- You’re building a regulated financial services business in Europe

Why Belize Works

Belize maintains a two-tiered banking system serving domestic and international clients. This structure allows specialized offshore services while maintaining liquidity standards that exceed many major banking systems.

The regulatory perception gap is real—Belize lags Malta and Cyprus on global prestige. But if you’re a crypto operator or digital nomad, this perception mismatch is irrelevant. Belize’s actual compliance with AML/CFT and CRS standards is robust.

Belize banks must maintain 24%+ liquidity reserves—significantly higher than US requirements. This creates exceptional stability despite the smaller jurisdiction.

How to Open an Account

Phase 1: Bank Selection (1–3 days)

Choose between domestic personal, business, or offshore accounts. Select a bank—Caye International Bank is market leader for crypto and international clients, but Belize Bank Limited, Heritage Bank, and Atlantic Bank also serve non-residents.

Phase 2: Document Submission (3–7 days)

Online application with passport, proof of address, and source-of-funds declaration (less stringent than Malta/Cyprus).

Phase 3: KYC Review (3–7 days)

Bank verifies identity against CRS/AML standards. FATCA screening if applicable.

Phase 4: Activation (1–3 days)

Funding instructions provided, online banking credentials issued, debit card ordered.

Total Timeline: 7–21 days.

Best Banks in Belize (2026)

| Bank | Strengths | Best For |

|---|---|---|

| Caye International Bank | Crypto-friendly, digital infrastructure, strong offshore focus | Crypto exchanges, blockchain companies, international investors |

| Belize Bank Limited | Largest domestic, accessible to non-residents | General business, USD-focused operations |

| Heritage Bank Limited | Competitive interest rates, straightforward process | Savers, conservative investors |

| Atlantic Bank | Traditional services, reliable platform | Small businesses, operational accounts |

Real-World Scenarios

Digital Nomad (UK-Based, €50k/year Income)

Best choice: Malta (MeDirect or Satchel)

- Why: Remote opening in 1–2 days, €50 minimum, EUR for European clients

- Timeline: 2–3 days to live account

- Cost: ~€10/year in fees

EU Tech Founder (€500k ARR, Targeting European Market)

Best choice: Malta (HSBC or BOV)

- Why: EU passporting, investor credibility, SEPA access, compliance prestige

- Timeline: 3–6 weeks

- Cost: €200–€500 setup + standard fees

Crypto Exchange Founder (Global, Already Licensed)

Best choice: Belize (Caye International)

- Why: Crypto-friendly, fast approval, USD stability, privacy

- Timeline: 2–4 weeks

- Cost: $175–$250 setup + monthly fees

EU Entrepreneur (IP Holding Company, 5–10 Year Plan)

Best choice: Cyprus

- Why: 15% tax, EU substance easier to prove, holding company infrastructure

- Timeline: 4–8 weeks

- Cost: €300–€1,000 setup + annual fees

Digital Nomad (Australia-Based, Crypto Exposure)

Best choice: Belize (Caye International)

- Why: Fast remote opening, crypto-friendly, USD stability, privacy

- Timeline: 1–3 weeks

- Cost: $1,000 opening deposit; $19.50/month

HNWI Seeking Diversification

Best choice: Accounts in multiple jurisdictions (Malta + Belize)

- Why: Malta for EU operations, Belize for privacy/crypto/USD

- Timeline: 6–10 weeks combined

- Cost: ~€2,000 combined setup

Fee Reality Check

| Fee Type | Malta | Cyprus | Belize |

|---|---|---|---|

| Account Opening | Free | Free | Free–$175 |

| Monthly Maintenance | Free (active) | €10–€20/year | $1.50–$50/month |

| SEPA Transfer | €0 | €0 | N/A |

| International Wire | ~€12 | $15–€30 | Higher (varies) |

| Card Issuance | Free | Free | Free–$50 |

| FATCA Fee | Included | Included | $250 (one-time) |

Bottom line: Malta and Cyprus cost roughly the same for basic operations. Belize is cheaper for account maintenance but charges higher international wire fees.

What Documentation You Actually Need

All Jurisdictions

- Valid passport or national ID

- Proof of address (utility bill ≤3 months old or rental agreement)

- Source-of-funds declaration

- Tax ID or tax residency certificate

Business Accounts (Malta & Cyprus)

- Certificate of Incorporation

- M&As and board minutes

- Director/shareholder register (with beneficial owner details ≥25%)

- Business plan (what you do, client types, expected volumes)

- Director KYC (passports, proof of address, CVs)

- Source-of-wealth documentation for beneficial owners

High-Risk Sectors (Malta—Crypto/Gaming)

- Regulatory license (VFA for crypto, MGA for gaming, PSP for payments)

- Formal AML/KYC policies

- Wallet mapping and transaction flow diagrams (for crypto)

- Blockchain analytics proof (Chainalysis reports)

Cyprus Substance

- Office lease or property agreement

- Utility bill in company name

- Employment contracts for local staff

- VAT/tax registration proof

Belize (Minimal)

- Passport

- Proof of address

- Source-of-funds statement

Addressing Common Questions

Can I open a bank account remotely?

Malta: Yes—fintech banks like MeDirect and Satchel offer 100% digital onboarding. Traditional banks may require a video call or in-person appointment (2-week wait).

Cyprus: Yes, with video verification call. Some EMIs (Wise, Revolut) offer instant setup.

Belize: Yes—fully online process.

What about banking secrecy?

All three jurisdictions maintain bank secrecy laws while adhering to CRS (Common Reporting Standard). This means your account is protected from casual disclosure, but financial information is automatically exchanged with your home country’s tax authority. So it’s privacy-respecting but not a tax evasion tool.

Is Cyprus safe after the 2013 financial crisis?

Yes. The 2013 crisis triggered major banking reforms, stricter capital requirements, and stronger oversight. Cypriot banks are now well-capitalized and conservative. The EU Deposit Guarantee Scheme protects deposits up to €100,000 per bank.

How long does opening actually take?

| Scenario | Malta | Cyprus | Belize |

|---|---|---|---|

| Fast track (fintech/personal) | 2–3 days | 1–2 weeks | 1–3 weeks |

| Standard (business) | 2 weeks | 2–6 weeks | 2–4 weeks |

| High-risk (crypto/complex) | 6–12+ weeks | 8–12+ weeks | 3–6 weeks |

The variable isn’t the jurisdiction—it’s documentation quality. A complete, bank-ready file cuts timelines by half. Incomplete submissions multiply timelines by 2–3x.

What’s the difference between a bank account and an EMI account?

Bank Account: Full banking services (deposits, loans, treasury, trade finance), access to local clearing systems, regulatory prestige, longer approval, higher compliance requirements.

EMI Account (Fintech): Payment-only account, multi-currency, instant setup (3–7 days), no loan products, no local clearing, lower prestige but higher convenience.

Strategy: Open an EMI while pursuing a traditional bank account. Use EMI for operational cash flow; use the bank account for long-term credibility.

Can I open accounts in all three jurisdictions?

Yes. Most serious entrepreneurs maintain accounts in multiple jurisdictions for risk diversification and jurisdiction-specific benefits. No regulator will block you from holding accounts in Malta, Cyprus, and Belize simultaneously.

Key Regulatory Updates (2026)

Malta

- EU Digital Finance Package finalized (stablecoin and CBDC regulations)

- Enhanced beneficial ownership transparency (AMLR5/6)

- MFSA FinTech Sandbox expanding to include DeFi and Web3 projects

Cyprus

- FDI Screening Law effective April 2, 2026 (foreign investment in sensitive sectors requires approval)

- Corporate tax increased from 12.5% to 15% (OECD Pillar Two alignment)

- MICA standards fully implemented for crypto asset service providers

Belize

- Ongoing CRS compliance strengthening

- Central Bank advancing digital financial service oversight

- No major negative changes expected for offshore banking

Decision Framework

Choose Malta if:

- You’re building a European tech startup or fintech

- EU passporting is critical to your business model

- Speed (2–3 weeks) matters

- Regulatory credibility will attract investors

- SEPA payments are important for operations

Try Cyprus if:

- You’re optimizing taxes across EU and Middle Eastern markets

- You’re building a holding company or IP structure

- You can establish Cyprus substance (office, staff, or legitimate nexus)

- 4–8 weeks is acceptable

- Multicurrency operations matter

Choose Belize if:

- Crypto or digital assets are your business

- Privacy and low entry barriers matter most

- USD stability is critical (revenue in USD)

- You need remote account opening speed (1–3 weeks)

- Regulatory prestige is secondary to functionality

Best Strategy for Established Entrepreneurs: Maintain accounts in both Malta and Belize. Malta handles EU operations and credibility. Belize handles privacy, crypto exposure, and USD diversification. Diversification reduces single-jurisdiction risk and gives you options.

Conclusion

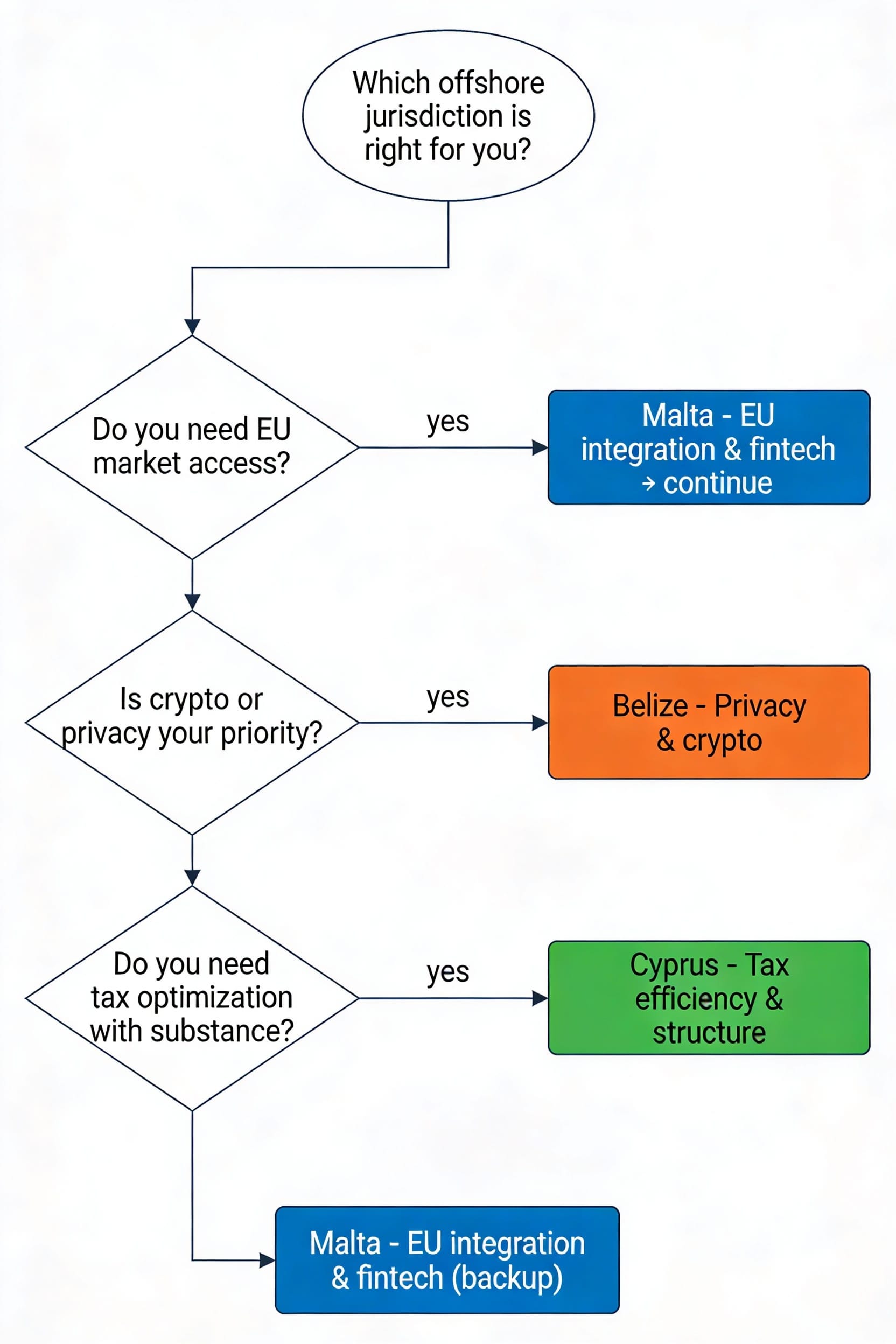

The choice between Malta, Cyprus, and Belize comes down to three questions:

- Do you need EU market access? → Malta wins.

- Do you want tax optimization with substance-based legitimacy? → Cyprus wins.

- Do you prioritize privacy, crypto acceptance, and low barriers? → Belize wins.

Each jurisdiction operates within robust AML/CFT and CRS compliance frameworks while offering distinct advantages. The gap between them isn’t about legitimacy—it’s about optimization.

The real bottleneck isn’t the jurisdiction. It’s preparation. A complete, bank-ready compliance file—proper documentation, business plan, source-of-wealth evidence—will cut your approval timeline in half and dramatically increase approval odds.

Do the prep work first. Choose the jurisdiction that matches your business model. Execute the process systematically. Your account will open faster than you expect.