Key Takeaway: Sygnum’s expansion into Germany and Liechtenstein marks a pivotal moment in European crypto banking. By leveraging regulated structures and proven investment strategies, Sygnum invites institutional investors to diversify their portfolios with digital assets under a trusted, compliant framework.

A Swiss Pioneer Steps onto the German Stage

In early September 2025, the world’s first digital asset bank, Sygnum, announced its much-anticipated expansion into Germany and Liechtenstein. This strategic move builds on Sygnum’s successful registration in Liechtenstein in September 2024, which paved the way for broader European growth. Now, institutional and wholesale investors in Germany can access Sygnum’s non-directional, low-volatility crypto strategies that have delivered double-digit annualized returns since inception.

Fabian Dori, Sygnum’s Chief Investment Officer, explained the rationale: “Our expansion reflects strong demand from institutional investors seeking trusted access to sophisticated crypto investment strategies. Germany and Liechtenstein represent significant opportunities, with investors increasingly recognizing digital assets as an essential component of diversified portfolios”.

Transitioning from a Swiss and Singaporean stronghold, Sygnum Europe AG will oversee distribution in the EU, partnering with Reuss Private Access AG through a liability umbrella arrangement. This structure ensures that German investors benefit from robust risk management, institutional-grade security, and compliance with BaFin’s licensing requirements.

Why Germany? A Story of Regulatory Clarity and Institutional Demand

Germany has emerged as a crypto-friendly heavyweight. In January 2020, it became the first EU country to allow banks and financial firms to handle cryptocurrencies under BaFin’s oversight. Since then, major banks like Commerzbank and Deutsche Bank have pursued crypto custody and trading services to meet growing institutional demand. By 2025, nearly one in three Germans (32.8%) is projected to use cryptocurrency, up from just 5.8% in 2022—a near 450% surge in three years.

This transformation owes much to:

- Regulatory Frameworks

BaFin’s crypto custody license set a precedent long before MiCA took effect in 2025. This clarity encouraged traditional institutions to venture into digital assets with confidence. - Institutional Momentum

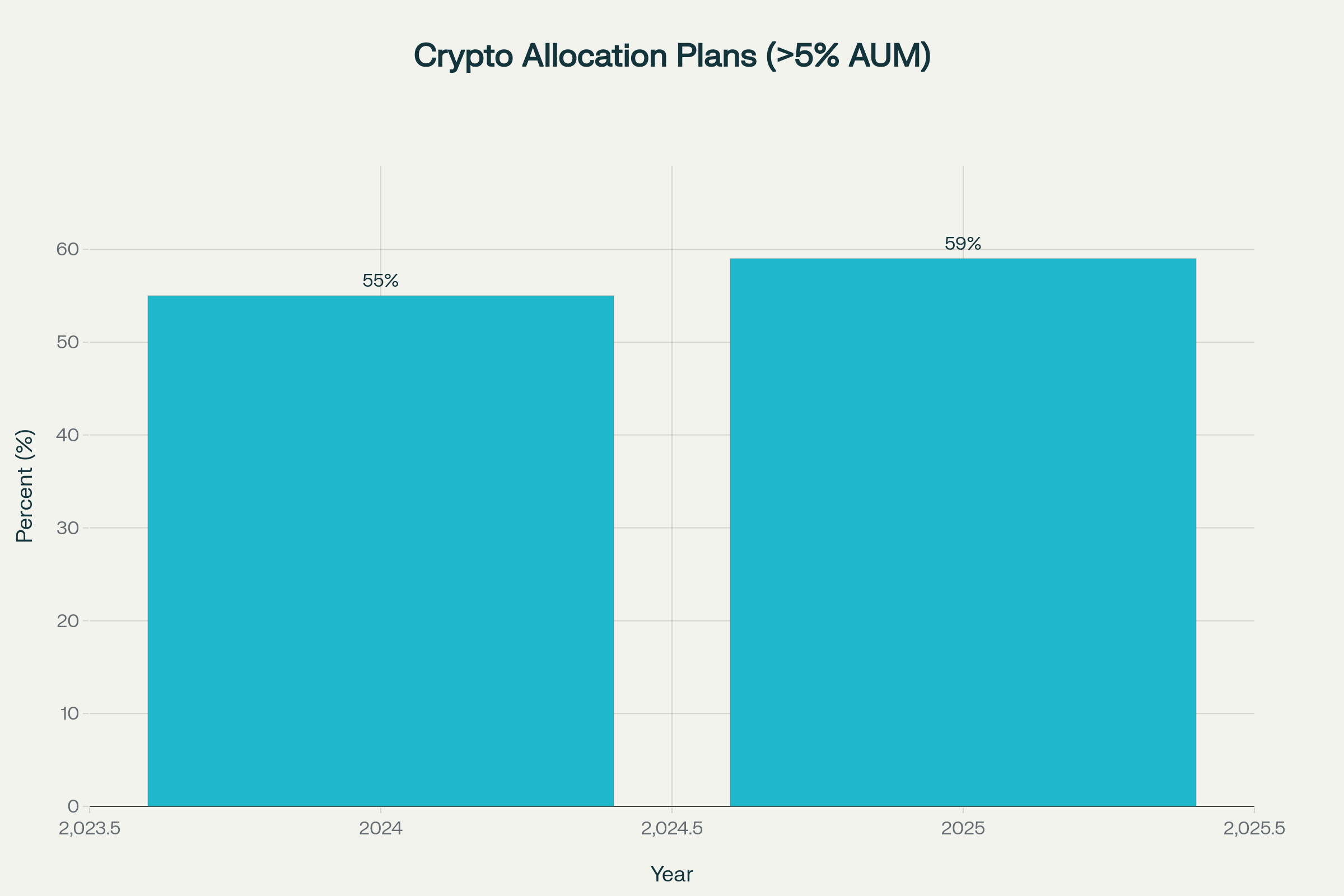

According to a January 2025 EY–Coinbase survey, 59% of institutional investors plan to allocate over 5% of their assets under management (AUM) to crypto assets in 2025, up from 55% in 2024.ey

Percentage of institutional investors planning to allocate over 5% of AUM to crypto assets in 2024 vs 2025

- Market Innovation

Germany leads the EU in crypto infrastructure, from blockchain-based bonds issued by KfW to partnerships between banks and fintechs like Crypto Finance (Deutsche Börse Group).

Sygnum’s Institutional-Grade Offering

At the heart of Sygnum’s Germany expansion lies its flagship crypto yield strategy. Designed for institutions, this strategy aims to:

- Capture yield opportunities in the crypto market

- Manage technology and platform risks via diversified protocols

- Deliver consistent, double-digit annualized returns

Moreover, Sygnum provides a modular B2B digital asset platform—already embraced by partners like Incore Bank to offer secure custody and transaction services across Switzerland’s financial network.

The following table outlines Sygnum’s core capabilities for German institutional clients:

| Feature | Description |

|---|---|

| Non-Directional, Low-Volatility Strategy | Aims to generate yield in various market cycles while mitigating drawdowns |

| Regulatory Compliance | Operates under Swiss banking licence, Singapore CMS licence, and Liechtenstein recognition |

| Liability Umbrella Distribution | Partners with Reuss Private Access AG for compliant EU distribution |

| Institutional-Grade Custody | Segregated storage, multi-signature protocols, and insurance coverage |

| Tokenisation and Smart Contract Integration | Enables programmable assets, real-world asset tokenisation, and programmable payments |

| API-Driven Modular Platform | Scalable infrastructure that integrates with existing trading and risk systems |

The Institutional Crypto Narrative: From Skepticism to Adoption

Just a few years ago, institutions viewed digital assets with caution. However, shifting narratives and regulatory clarity have transformed this landscape. A 2025 survey found that 86% of institutional investors have exposure or plan to allocate to digital assets in 2025. Notably, 76% intend to invest in tokenized assets by 2026, driven by portfolio diversification goals.

As institutions embrace crypto:

- Diversification Imperative

Nearly half of surveyed investors now categorize cryptocurrency as its own asset class, recognizing its role in balancing traditional equity and fixed income exposure.ey - Stablecoin Utility

Over 84% of institutions are either using or exploring stablecoins for yield and transactional convenience.ey - DeFi Engagement

The percentage of institutions participating in DeFi protocols is set to triple from 24% in 2024 to 75% by 2026, highlighting growing trust in decentralized infrastructure.ey

This broadening institutional participation underscores why Sygnum’s Germany expansion arrives at an opportune moment.

Looking Ahead: Sygnum’s European Footprint

Sygnum’s expansion into Germany and Liechtenstein is just one chapter in its European growth story. The bank has already:

- Surpassed CHF 5 billion in assets under administration

- Completed a USD 58 million strategic growth round, valuing the company at over USD 1 billion

- Launched offices in Abu Dhabi and Luxembourg alongside Zurich and Singapore hubs

Future market entries are on the roadmap, driven by partnerships, regulatory advancements, and a mission to bridge traditional finance with the digital asset economy.

Conclusion: A New Era for Swiss Crypto Banking

Sygnum’s entry into Germany solidifies its role as a trusted gateway for institutional investors seeking exposure to digital assets. With a proven track record, robust regulatory framework, and cutting-edge technology, Sygnum empowers investors to navigate the crypto ecosystem with confidence.

For non-resident clients aiming to leverage Swiss banking solutions alongside digital asset strategies, Easy Global Banking offers a premier platform. As a leading facilitator for international clients, Easy Global Banking simplifies the process of opening Swiss bank accounts and accessing sophisticated financial services in one of the world’s most stable jurisdictions.