When you open an account at a Swiss bank, you’re not just paying one fee—you’re entering a multi-layered cost structure that varies dramatically based on the service model you choose. The difference between understanding this structure and ignoring it can cost you CHF 50,000+ annually on a CHF 10 million portfolio.

Swiss banks currently offer three distinct investment service models, each with its own fee architecture. Understanding which model fits your investment style—and what each actually costs—is the first step toward transparent wealth management.

The Three Core Service Models Swiss Banks Offer

1. Execution Only Mandate: Maximum Control, Variable Costs

Under an execution-only mandate, you make all investment decisions yourself. The bank’s role is purely operational: executing your trades, maintaining custody of assets, and managing the mechanics of the account. This model suits experienced investors who want complete autonomy without delegation.

The appeal: You control every decision. There’s no advisory fee, no discretionary mandate charge, and no margin built into portfolio decisions.

The cost reality: You pay for each transaction individually, and these costs accumulate quickly. This is the model that most resembles a traditional brokerage experience, but in a Swiss banking context.

2. Investment Advisory Mandate: Guidance with Client Authority

An investment advisory mandate means the bank researches markets, analyzes securities, and provides formal recommendations. But here’s the crucial distinction: you retain the final decision on whether to execute each trade. The bank advises; you approve.

This model appeals to clients who want professional insight without full delegation. You stay informed, maintain control, and benefit from institutional research—but you carry the responsibility of approval, which requires active engagement.

The cost structure: Banks charge investment advisory fees of 0.15% to 0.25% annually, calculated either on total assets or on securities holdings only (cash is often excluded).

3. Discretionary Mandate: Professional Management, Professional Fees

A discretionary mandate is the inverse: you define the strategy and risk tolerance once; the bank then independently manages your portfolio within that framework. The bank rebalances, executes trades, and responds to market conditions without seeking approval for each decision.

This model suits busy executives, entrepreneurs, and clients who prefer delegation over daily oversight. You benefit from professional decision-making, faster market response, and the bank’s ability to execute tax-efficient strategies.

The cost structure: Discretionary mandates typically range from 1% to 2% annually depending on the chosen strategy complexity and your asset size. The higher end of this range reflects more sophisticated, actively managed strategies; the lower end reflects passive or index-tracking approaches.

How Banks Actually Charge: Standard Fees vs. All-in-One Models

Swiss banks use two fundamentally different commission approaches. The difference between them determines whether you get cost predictability or cost surprises.

Standard Fees Model: Layered Transparency (Or Lack Thereof)

Under the standard fees model, banks disaggregate costs into discrete components:

Account Maintenance: CHF 100–5,000 per annum

This is the baseline. It covers administrative overhead—correspondent banking relationships, statement preparation, basic account servicing. The wide range reflects portfolio complexity and bank tier.

- Small accounts or execution-only mandates: CHF 100–500 p.a.

- Mid-size private banking clients: CHF 1,000–2,000 p.a.

- Complex corporate or high-touch accounts: CHF 2,500–5,000+ p.a.

Securities Custody Fees: 0.35% to 0.5% Annually

Banks charge separately for safekeeping assets. This is a critical cost that many clients underestimate. The custody fee applies to your entire securities portfolio and typically ranges from 0.35% to 0.5% per annum, depending on:

- Asset class composition (equities vs. bonds vs. alternatives)

- Custody complexity and location (domestic vs. multi-jurisdictional)

- Bank size and operational efficiency

- Account size and client tier

On a CHF 5 million securities holding, this ranges from CHF 17,500 to CHF 25,000 annually. On a CHF 10 million position, custody alone costs CHF 35,000 to CHF 50,000 per year.

Transaction Costs: Securities Trading

Every trade generates a commission:

- Equities: 0.5%–2.0% of transaction value

- Bonds: 0.35%–1.0% of transaction value

- Fiduciary deposits: ~0.5%

On a CHF 100,000 equity trade at 1.0%, you pay CHF 1,000 in commission alone—before other costs.

Foreign Currency Turnover

When you convert currencies, banks charge a conversion fee: approximately 0.05% of the transaction value, capped at around CHF 500. On a CHF 1 million currency conversion, you hit the cap and pay CHF 500. On a CHF 500,000 conversion, you pay CHF 250.

Swiss Stamp Duty (Securities Transfer Tax)

This is a government tax, not a bank fee, but it affects your costs directly. When you buy or sell securities through a Swiss bank:

- Swiss securities: 0.15% transfer tax

- Foreign securities: 0.30% transfer tax

As an investor, you typically pay approximately half of this tax; the other half falls on the counterparty. So your effective cost is:

- Swiss securities: ~0.075% per transaction

- Foreign securities: ~0.15% per transaction

On a CHF 500,000 purchase of foreign shares, you pay approximately CHF 750 in stamp duty.

The Compound Reality of Standard Fees

For an execution-only client executing moderate portfolio activity (say, 60% annual turnover) on a CHF 5 million portfolio:

- Account maintenance: CHF 500–1,500

- Custody fees (0.4% average): CHF 20,000

- Transaction costs (60% turnover at 0.8% average): CHF 24,000

- Currency conversion (estimated): CHF 3,000–5,000

- Stamp duty (estimated): CHF 6,000–9,000

Total: CHF 53,500–59,500 annually (1.07%–1.19% of AUM)

This is notably higher than many clients expect, primarily because custody fees of 0.35–0.5% are substantial at scale.

All-in-One Fee Model: Clarity Through Simplicity

The all-in-one model inverts this structure entirely. Instead of itemizing costs, the bank quotes a single annual percentage of your total assets under management—typically 0.8% to 1.6% per annum—and includes essentially all costs within that figure.

What’s covered:

- Account maintenance

- Securities custody (all asset classes)

- Investment advisory (if applicable)

- Standard trading commissions

- Portfolio rebalancing

What’s NOT covered:

- Foreign exchange conversion spreads (you pay minimal exchange fees only)

- Stock Exchange fees

- Swiss stamp duty (still applies as a government tax, but transparent)

- Extraordinary services (complex reporting, special documentation)

The advantage:

You budget with certainty. On a CHF 5 million portfolio at 1.2% all-in, you pay exactly CHF 60,000 annually—no surprises from quarter-end trading activity or currency conversions. This predictability is why institutional investors and wealth managers favor the all-in model.

Real-world comparison:

| Portfolio Size | Standard Fees Model | All-in-One Model | Savings with All-in |

|---|---|---|---|

| CHF 2–5 million | 1.1%–1.4% | 0.8%–1.0% | 10–25% |

| CHF 5–20 million | 1.0%–1.2% | 0.9%–1.1% | 10–20% |

| CHF 20+ million | 0.9%–1.1% | 0.8%–1.0% | 10–18% |

Data reflects 2026 market conditions for private banking services.

Investment Advisory & Discretionary Mandates: The Fee Details

When you shift from execution-only to advisory or discretionary management, the fee structure changes.

Investment Advisory: Selective Decision Support

If you choose advisory without discretion, the bank charges an investment advisory fee of 0.15% to 0.25% annually, calculated on either total assets or securities holdings only (cash is often excluded).

This fee covers research, market analysis, strategy recommendations, and ongoing portfolio monitoring. It does NOT include transaction execution costs—those are billed separately under the standard fees model above.

Cost reality for a CHF 5 million portfolio with advisory mandate:

- Advisory fee (0.20% on CHF 4.5M in securities): CHF 9,000

- Account maintenance: CHF 1,000

- Custody fees (0.4% on CHF 4.5M): CHF 18,000

- Transaction costs (moderate turnover, ~40%): CHF 16,000–20,000

- Stamp duty and FX: CHF 5,000–8,000

Total: CHF 49,000–56,000 annually (0.98%–1.12%)

The advisory mandate is cheaper than discretionary because you retain decision authority, reducing the bank’s liability and operational burden.

Discretionary Mandate: Full Professional Management

Discretionary mandates cost more because the bank assumes full responsibility for portfolio performance and decision-making. Fees typically range from 1% to 2% annually, depending on:

- Strategy complexity: Simple balanced strategies (1.0%–1.2%); complex multi-asset strategies with alternatives (1.5%–2.0%)

- Turnover intensity: Passive or low-turnover mandates (1.0%); active management with frequent rebalancing (1.5%–2.0%)

- Portfolio size: CHF 5–20 million (typically 1.2%–1.5%); CHF 20+ million (often negotiated down to 0.8%–1.2%)

Crucially, the discretionary management fee typically INCLUDES account maintenance, custody, and basic transaction costs. The fee is all-in.

Cost reality for a CHF 5 million discretionary mandate:

- Discretionary management (all-in at 1.2%): CHF 60,000

- OR Discretionary management (standard fees): CHF 50,000 management + CHF 25,000–30,000 additional costs = CHF 75,000–80,000

The all-in discretionary model is significantly more transparent and cost-effective.

Special Fee Categories: Due Diligence & Regulatory Charges

Due Diligence Fees for High-Risk Clients

If you’re classified as “high-risk”—politically exposed persons, clients from jurisdictions with enhanced scrutiny, beneficial ownership structures that raise compliance flags—Swiss banks now routinely charge due diligence fees of CHF 500 to CHF 1,000 per quarter.

This is CHF 2,000 to CHF 4,000 annually for compliance costs alone. It’s a legitimate regulatory cost, but it’s material and often comes as a surprise.

Account Closure Fees

If you close your account and move your assets elsewhere, most Swiss banks charge a CHF 300–500 account closure fee, though this is sometimes waived for large account transfers.

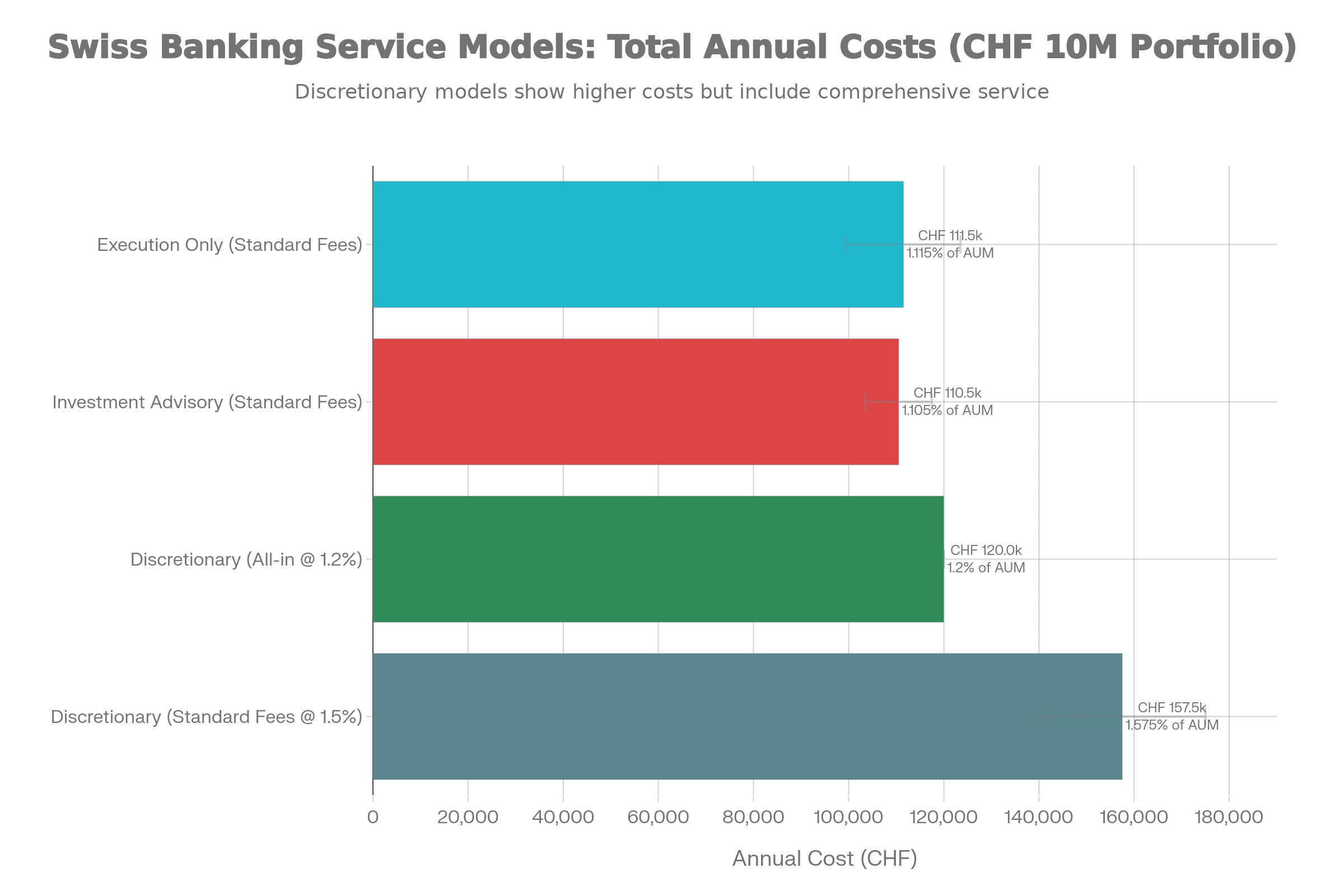

Comparing Service Models: What You Actually Pay

Here’s a side-by-side comparison of total costs for a CHF 10 million portfolio scenario with updated custody fees:

| Service Model | Advisory Fee | Custody (0.4%) | Transaction Costs | Total Annual Cost | % of AUM |

|---|---|---|---|---|---|

| Execution Only (standard fees) | None | CHF 40,000 | CHF 50,000–70,000 | CHF 99,500–123,500 | 0.995%–1.235% |

| Investment Advisory (standard fees) | CHF 20,000 | CHF 36,000 | CHF 40,000–50,000 | CHF 103,500–117,500 | 1.035%–1.175% |

| Discretionary (all-in model @ 1.2%) | Included | Included | Included | CHF 120,000 | 1.2% |

| Discretionary (standard fees @ 1.5%) | CHF 75,000–100,000 | CHF 40,000 | CHF 25,000–35,000 | CHF 140,000–175,000 | 1.4%–1.75% |

Key insight: The all-in discretionary model at 1.2% (CHF 120,000) is more cost-effective than standard fees discretionary (CHF 140,000–175,000) and only marginally more expensive than advisory with standard fees (CHF 103,500–117,500).

The All-in Model: Why Swiss Banks Are Shifting This Direction

Major Swiss banks increasingly push the all-in model because it simplifies client communication and builds stickier relationships. When you know you’re paying 1.2% annually—not some variable 0.8%–2.0% depending on quarterly activity—you can plan with precision.

For comparative context: independent wealth managers operating in Switzerland (but not traditional private banks) often charge 0.8%–1.2% all-in, occasionally lower for ultra-high-net-worth clients. This is lower than traditional private banking, which explains the rise of independent wealth management in Switzerland.

Practical Negotiation Points

Minimum deposits matter. Most Swiss private banks require CHF 1–2 million minimums to open accounts; some enforce CHF 5 million thresholds. Your deposit size gives you leverage.

- CHF 5–10 million: Negotiate 10–15% off published rates

- CHF 10–20 million: Negotiate 15–25% off published rates

- CHF 20+ million: Custom pricing; expect 25–40% discounts off published rates

Fee bundling is negotiable. If you bundle execution, advisory, and custody services with one bank, you have negotiating power. Threaten to move advisory elsewhere; banks often reduce management fees to retain overall relationship.

Due diligence fees are sometimes negotiable. If you’re flagged as high-risk, provide additional documentation or clarify your beneficial ownership structure. Some banks waive or reduce these charges once risk profile improves.

The Bottom Line: Choosing Your Model

Choose execution-only if: You have investment expertise, enjoy active portfolio management, and can tolerate variable quarterly costs. Expect 1.0%–1.2% all-in costs.

Choose investment advisory if: You want professional guidance without full delegation, have time to review recommendations, and value cost efficiency. Expect 1.0%–1.1% all-in costs.

Choose discretionary if: You lack time for active management, trust the bank’s strategy, and prefer predictability. Expect 1.0%–1.6% all-in costs, but with all-in fees offering the best clarity.

Prefer the all-in fee model whenever possible. It forces transparency, eliminates surprise quarterly charges, and aligns the bank’s incentives with yours—the bank benefits most when you’re satisfied with predictable pricing, not when it generates transaction volume.

Ready to find the right Swiss banking solution for your financial profile? Open a Swiss Bank Account with expert guidance from Easy Global Banking. Our team navigates the full spectrum of Swiss service models, negotiates competitive fees on your behalf, and structures your account for transparency and cost efficiency.

Get a no-obligation consultation today. We’ll analyze your financial goals, compare fee models side-by-side, and position you with the Swiss banking partner that genuinely serves your interests—not the one with the highest prestige brand.