Introduction

Credit ratings failed to predict the Credit Suisse collapse in 2023. Less than two years later, many HNWI clients are still asking the same question: How do I actually know if a Swiss bank is safe?

Traditional metrics—capital ratios, ratings agencies, published audits—paint an incomplete picture. UBS had pristine capital ratios weeks before the regulatory takeover of Credit Suisse. Moody’s and S&P missed red flags that private bankers spotted months earlier. This gap between “officially safe” and “actually safe” is where real due diligence happens.

The 2023 banking crisis did not just shake confidence in Credit Suisse. It exposed a fundamental truth: the Swiss banks that survived intact were not necessarily those with the highest capital ratios. Instead, they were institutions built on different foundations—those with explicitly guaranteed deposits (cantonal banks), or those with demonstrated conservative liquidity management and institutional stability (major private banks).

This guide moves beyond textbook answers. It walks you through the insider metrics that relationship managers, private bankers, and wealth advisers actually use to evaluate safety. It acknowledges the post-2023 reality. And it shows you how to distinguish between banks that are “technically compliant” and banks that are genuinely trustworthy.

The Ownership Structure Question: Why Most “Partnership” Banks Are Actually Limited Liability Now

One of the most persistent myths about Swiss private banking is that major institutions like Pictet and Lombard Odier operate as partnerships with unlimited liability partners. This was true decades ago. It is no longer accurate.

The Historical Shift (Post-2014)

In 2014, both Pictet and Lombard Odier converted from traditional partnerships to limited liability corporations (AG—Aktiengesellschaft). This was not unusual. Most major Swiss private banks made this transition between 2010 and 2020 to achieve:

- Greater capital flexibility for expansion and acquisitions.

- Easier succession planning and institutional continuity.

- Access to debt capital markets.

- Regulatory alignment with international banking standards.

The result is that today, the partners at Pictet and Lombard Odier own shares in a limited liability entity. If the bank fails, their personal liability is limited to their shareholdings. This is fundamentally different from the traditional partnership model where partners bore personal risk for all bank liabilities.

Which Banks Still Have Unlimited Liability?

As of 2026, very few Swiss private banks maintain unlimited liability structures. Reichmuth & Co (based in Lucerne) explicitly positions itself as one of only five Swiss private banks that still features unlimited liability for shareholders. This is the exception, not the rule.

For the vast majority of Swiss private banks you will encounter—including Pictet, Lombard Odier, Mirabaud, and others—the ownership structure is limited liability, not unlimited.

Why This Matters

The shift from unlimited to limited liability fundamentally changed the risk-sharing model. Partners no longer have personal wealth at stake in the way they once did. However, this does not make these institutions less safe. Instead, safety now depends on:

- Institutional governance and board oversight.

- Demonstrated conservative risk management practices.

- Strong capital and liquidity buffers maintained beyond regulatory minimums.

- Regulatory standing and supervision by FINMA.

- Long-term institutional reputation and client relationships.

The banks that survived 2023 intact (Pictet, Lombard Odier, Vontobel and others) did so not because of unlimited liability structures, but because of strong governance, high liquidity reserves, and conservative business models.

The Cantonal Guarantee: State-Backed Safety That Exceeds Federal Insurance

Switzerland has 24 cantons (states). Twenty-one of them have established cantonal banks, many of which enjoy a full state guarantee. This is the most underrated safety feature in global banking and remains the true anchor of safety for large deposits.

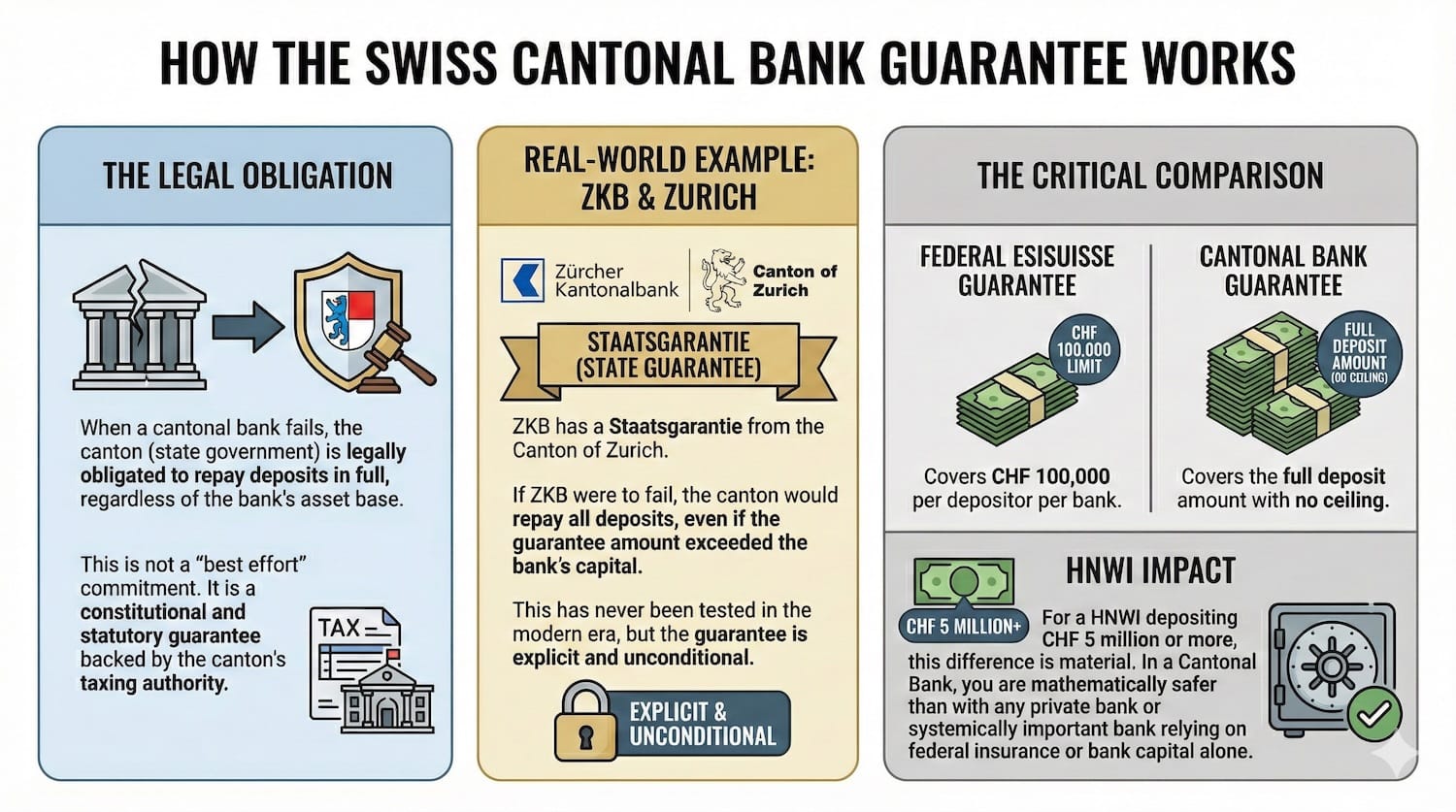

How the Cantonal Guarantee Works

When a cantonal bank fails, the canton (state government) is legally obligated to repay deposits in full, regardless of the bank’s asset base. This is not a “best effort” commitment. It is a constitutional and statutory guarantee backed by the canton’s taxing authority.

Example: Zürcher Kantonalbank (ZKB) has a Staatsgarantie (state guarantee) from the Canton of Zurich. If ZKB were to fail, the canton would repay all deposits, even if the guarantee amount exceeded the bank’s capital. This has never been tested in the modern era, but the guarantee is explicit and unconditional.

For comparison:

- The federal Esisuisse guarantee covers CHF 100,000 per depositor per bank.

- A Cantonal Bank guarantee covers the full deposit amount with no ceiling.

For a HNWI depositing CHF 5 million or more, this difference is material. In a Cantonal Bank, you are mathematically safer than with any private bank or systemically important bank relying on federal insurance or bank capital alone.

Which Cantonal Banks Have State Guarantees?

Not all cantonal banks have the same level of guarantee. The strongest guarantees come from larger, fiscally stable cantons. The following banks have explicit, unconditional state guarantees:

| Bank | Canton | Guarantee Type | S&P Rating | Moody’s Rating | Fitch Rating |

|---|---|---|---|---|---|

| Zürcher Kantonalbank (ZKB) | Zurich | Full state guarantee | AAA | Aaa | AAA |

| Banque Cantonale Vaudoise (BCV) | Vaud | Full state guarantee | AA | Aa1 | AA |

| Basler Kantonalbank | Basel-Stadt | Full state guarantee | AA− | Aa2 | AA− |

| Berner Kantonalbank | Bern | Full state guarantee | AA | Aa1 | AA |

| Aargauische Kantonalbank | Aargau | Full state guarantee | AA− | Aa2 | AA− |

| Luzerner Kantonalbank | Lucerne | Full state guarantee | AA | Aa1 | AA |

| Appenzeller Kantonalbank | Appenzell | Full state guarantee | A+ | A1 | A+ |

| St. Galler Kantonalbank | St. Gallen | Full state guarantee | A+ | A1 | A+ |

The credit ratings reflect the canton’s fiscal health and creditworthiness. ZKB stands out with exceptional AAA ratings from all three major agencies (S&P, Moody’s, and Fitch)—the highest credit quality designation globally. This reflects Zurich’s position as Switzerland’s wealthiest canton and ZKB’s own conservative, stable business model.

Cantonal Banks vs. Private Banks: Which Is Safer for Large Deposits?

For pure deposit safety (cash holdings above CHF 500,000):

Cantonal Bank (state-guaranteed) > Major private bank (limited liability) > Major systemic bank (UBS, with implicit government support but no guarantee).

The reason: The canton’s AAA or AA credit rating is independent of the bank’s management. ZKB could be completely mismanaged, and the canton’s balance sheet would still ensure full repayment. This is genuine safety.

For wealth management and investment services:

The gap narrows. A private bank like Pictet or Lombard Odier may offer superior advisory, better access to alternative investments, and more personalized service than a Cantonal Bank. But for the cash deposit itself, you are paying for service, not safety. You could deposit the core holdings in a Cantonal Bank and manage investments elsewhere.

Many sophisticated HNWI clients use a hybrid model: a Cantonal Bank for core cash and highly safe securities, and a private bank for wealth management and alternative investments.

A Critical Note for Non-Resident Clients

While cantonal banks offer unparalleled safety through full state guarantees, most restrict accounts primarily to Swiss residents or those with significant Swiss business connections. Non-residents often encounter restrictions, minimum deposit requirements, or outright refusal to open accounts. Cantonal banks prioritize local clients and Swiss-domiciled wealth.

If you are a non-resident HNWI, cantonal banks should remain on your radar for strategic deposits if you have Swiss ties (residency, business operations, property holdings). However, expect more limited access compared to private banks or systemically important institutions that actively serve international clients.

Minimum Standards for Non-Resident Clients: The Safety Framework

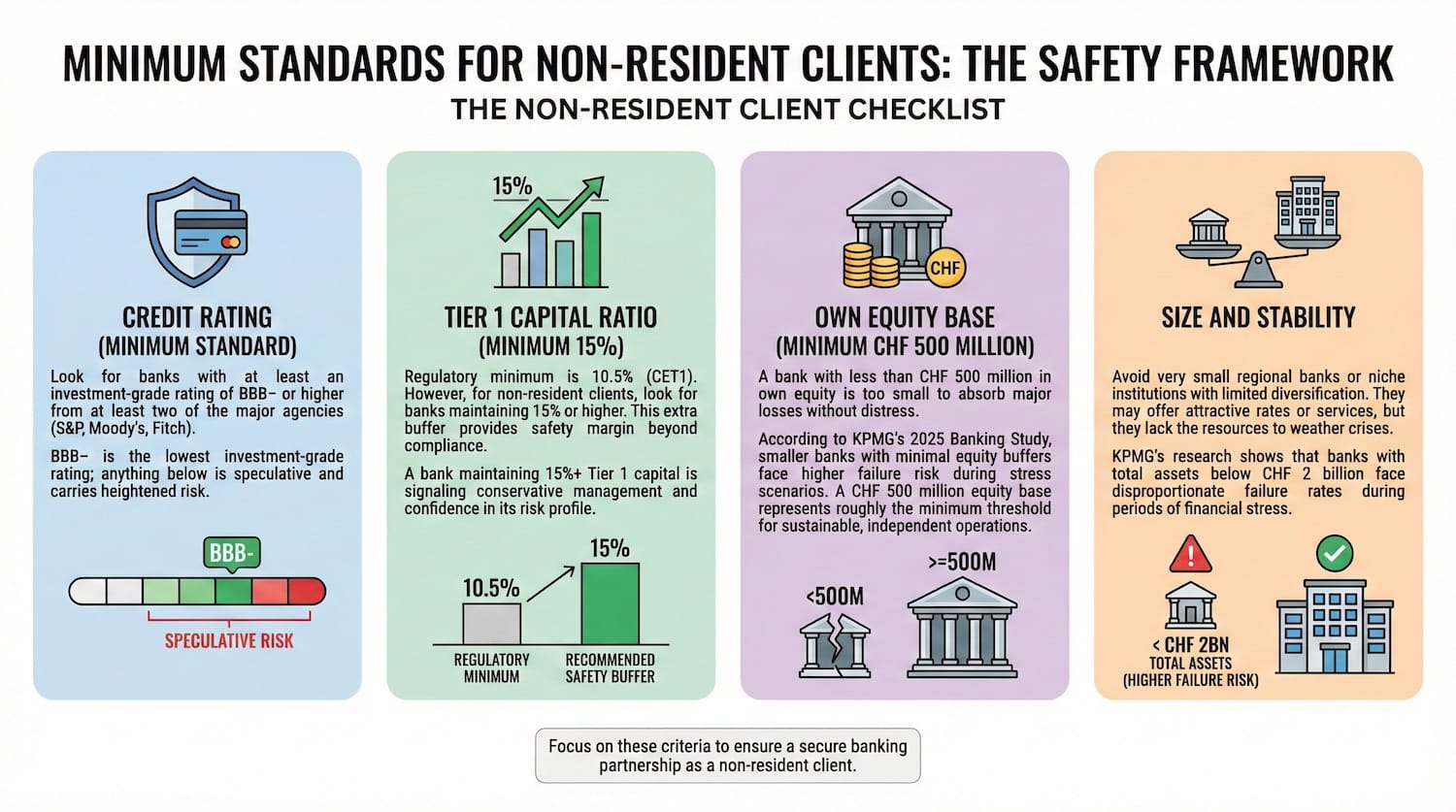

If you are opening a Swiss account as a non-resident, you need a different evaluation framework. Cantonal banks may not be accessible, so focus instead on banks that meet these minimum criteria:

The Non-Resident Client Checklist

Credit Rating (Minimum Standard):

Look for banks with at least an investment-grade rating of BBB− or higher from at least two of the major agencies (S&P, Moody’s, Fitch). BBB− is the lowest investment-grade rating; anything below is speculative and carries heightened risk.

Tier 1 Capital Ratio (Minimum 15%):

Regulatory minimum is 10.5% (CET1). However, for non-resident clients, look for banks maintaining 15% or higher. This extra buffer provides safety margin beyond compliance. A bank maintaining 15%+ Tier 1 capital is signaling conservative management and confidence in its risk profile.

Own Equity Base (Minimum CHF 500 Million):

A bank with less than CHF 500 million in own equity is too small to absorb major losses without distress. According to KPMG’s 2025 Banking Study, smaller banks with minimal equity buffers face higher failure risk during stress scenarios. A CHF 500 million equity base represents roughly the minimum threshold for sustainable, independent operations.

Size and Stability:

Avoid very small regional banks or niche institutions with limited diversification. They may offer attractive rates or services, but they lack the resources to weather crises. KPMG’s research shows that banks with total assets below CHF 2 billion face disproportionate failure rates during periods of financial stress.

Example of a Safe Starting Point for Non-Residents

A typical safe bank for a non-resident HNWI might look like:

- Credit rating: BBB+ or higher (investment grade)

- Tier 1 capital ratio: 15–18%

- Own equity: CHF 500M–CHF 2B+

- Total assets: CHF 5B–CHF 100B+

- Explicit or implicit government support (systemically important) OR demonstrated conservative management practices over decades

This profile ensures that the bank has the financial resources to absorb losses, the regulatory standing to operate stably, and the governance structures to avoid excessive risk.

Red Flags: What Actually Predicts Bank Failure (Post-2023 Lessons)

Credit Suisse had a CET1 ratio of 10.5% weeks before it collapsed. It was “compliant” on every regulatory metric. So what actually predicted failure? Here are the warning signs that matter:

Sign 1: High Staff Turnover in Relationship Management

If your bank’s relationship managers are leaving, that is usually a harbinger of deeper problems.

During 2022 and early 2023, Credit Suisse saw a wave of senior RM departures. Experienced advisers were moving to competitors, often quietly. This was a market signal that insiders saw problems the market had not yet priced in.

Why does this matter? Relationship managers have direct insight into a bank’s strategy, client dissatisfaction, and management credibility. When they leave, they often know something the public does not.

Action: If your bank loses multiple senior RMs in a year, ask your adviser directly: “Why are people leaving?” If the answer is vague (“market opportunities elsewhere”), it may signal instability. If the bank is genuinely healthy, RMs should be staying.

Sign 2: Deteriorating Deposit Mix

A bank that is losing core client deposits is facing a death spiral. During early 2023, Credit Suisse was hemorrhaging deposits from institutional and wealthy clients. The bank was relying increasingly on central bank funding.

You will not see this on a quarterly report until it is too late. But you can watch for behavioral signs:

- The bank starts offering unusually high rates on deposits (trying to attract money).

- Customer service becomes slower (stretched resources).

- Policies become more restrictive (the bank is trying to reduce exposures, not attract new clients).

Sign 3: Aggressive Yield Promises

Any bank offering significantly higher interest rates than the SNB rate and market average is taking hidden risks. During periods of rising rates, SORA-linked deposits at major Swiss banks earned 2.0–2.5%. Banks offering 3.5%+ were often overextending into riskier lending or taking excessive duration risk in their bond portfolios.

A conservative private bank will have returns in line with or slightly above the market average. Exceptional yields are a red flag.

Sign 4: Weak Technology and Cybersecurity Posture

In 2026, a bank without a modern app, secure online banking platform, and demonstrable cybersecurity investment is likely starving its technology budget. This often signals that:

- Client acquisition is slowing (no need to invest in digital).

- The firm is cutting corners to preserve profitability (dangerously penny-wise).

- Cybersecurity risk is being underestimated (a material risk for any bank).

Ask your bank: “What are your cyber insurance limits? Who conducts your annual penetration testing?” If they fumble these questions, their governance is weak.

Sign 5: Regulatory Actions and Enforcement History

Check FINMA’s enforcement records and regulatory announcements. A bank that has received enforcement letters, remediation orders, or fines for compliance failures is signaling governance problems.

FINMA publishes enforcement actions on its website. Search by bank name. Multiple enforcement actions over a few years can indicate systematic compliance problems that might be hiding deeper issues.

The Tiered Safety Pyramid: Evaluating Banks by Category

Not all Swiss banks serve the same purpose. Your choice depends on your goal: immediate safety, yield, wealth management, or a combination.

Tier 1: Systemically Important Banks (Implicit Government Support)

Examples: UBS AG (A+/Aa2/A+ across S&P/Moody’s/Fitch)

These are banks where the Swiss government and SNB have an explicit or implicit commitment to prevent failure because the collapse would destabilize the financial system.

Safety Profile: Very high (implicit state support), but access is often limited and service is impersonal.

Best for: Very large deposits (CHF 10M+), transaction banking, corporate treasury. You are not paying for personalized service; you are leveraging systemic importance.

For Non-Residents: UBS actively serves non-resident HNWIs globally. Access is straightforward if you meet minimum asset requirements (typically CHF 2–5M). Service is professional but standardized.

Downside: Fees are high for HNWIs (they serve mainly institutional clients). Your account may be terminated if you do not meet minimum thresholds. Privacy is lower due to strict regulatory oversight.

Tier 2: State-Guaranteed Cantonal Banks

Examples: ZKB (AAA/Aaa/AAA), BCV (AA/Aa1/AA), Basler Kantonalbank (AA−/Aa2/AA−)

These institutions offer the highest safety due to explicit state backing. They are large enough to offer diverse services (investment management, credit, corporate banking) but small enough to maintain relationship-oriented service.

Safety Profile: Extremely high (legal state guarantee covers deposits in full, backed by AAA or AA rated cantons).

Best for: Swiss residents and clients with strong Swiss ties. Core deposit holdings above CHF 5 million, conservative wealth management, clients who prioritize safety over yield or exclusive access.

For Non-Residents: Limited accessibility. Most cantonal banks do not actively pursue non-resident clients. You may be able to open an account if you can document Swiss business operations, property holdings, or residency ties. Otherwise, expect refusal.

Downside: Cantonal banks often have more conservative investment policies. Yield on deposits or investments may lag private banks. They are less interested in ultra-HNW international clients seeking bespoke structures.

Tier 3: Major Private Banks (Conservative Management, Limited Liability)

Examples: Pictet (Fitch AA−), Lombard Odier (Fitch AA), Mirabaud

These institutions operate as limited liability corporations (not partnerships with unlimited liability). They are distinguished by:

- Demonstrated conservative management over decades.

- High liquidity buffers maintained well above regulatory minimums (LCR 150–200%+).

- Strong equity positions (Pictet Group maintains over CHF 1 billion in equity).

- Long institutional histories and client relationships.

- Survived the 2023 banking crisis without requiring support.

Safety Profile: High (structural safety from conservative management, strong capital, and regulatory oversight). They survived 2023 without requiring government support.

Best for: Wealth management, long-term relationship banking, clients who value advisory quality and discretion. Minimums are typically CHF 1–5M.

For Non-Residents: These banks actively serve international high-net-worth clients. Access typically requires an introduction or referral from an existing client or professional adviser. Credit ratings and capital strength are solid and competitive.

Downside: Not suitable for massive deposits (they prefer relationship depth over asset size). Not ideal for clients seeking yield or aggressive growth. Access is relationship-based; you typically need an introduction.

Tier 4: Specialized and Smaller Private Banks

Examples: Regional banks, niche private banks, newer fintech-enabled banks

These institutions often offer competitive pricing and innovative services but carry higher idiosyncratic risk.

Safety Profile: Medium to high (depends on ownership, capital, and management). No state guarantee. Regulatory oversight is thorough, but failure risk is not zero.

For Non-Residents: Often more accessible than cantonal or tier 1 banks due to lower minimums. However, apply the minimum standards rigorously: BBB− rating, 15% Tier 1 capital, CHF 500M+ equity base.

Best for: Specific services (crypto integration, fintech infrastructure, niche investment expertise). Not primary deposit accounts for large holdings.

Downside: Regulatory failure is possible. No state backup. You are relying on management excellence and luck.

Special Category: Reichmuth & Co (Rare Unlimited Liability Structure)

Based in: Lucerne

Unique Feature: One of only five Swiss private banks that maintains unlimited liability for shareholders.

Safety Profile: High (shareholders’ personal wealth is at stake). Conservative management.

For Whom: Clients who specifically value the unlimited liability alignment of interests. Access is typically limited to high-net-worth clients with introductions.

Note: This is the rare exception, not the norm. Most major private banks converted to limited liability decades ago.

Liquidity Coverage Ratio: The Metric That Actually Matters

Capital ratios (CET1) measure how much capital a bank has. But they do not measure whether a bank can actually pay you when you want your money.

The Liquidity Coverage Ratio (LCR) measures this. It answers the question: If depositors demanded their money back en masse tomorrow, could the bank pay them within 30 days using only high-quality liquid assets?

Basel III requires an LCR of 100%. This means a bank must have enough liquid assets to cover 30 days of stressed outflows.

But here is the insider insight: Conservative banks often maintain LCR of 150–200% or higher. This extra buffer is not required, but it signals cautious management.

Concrete examples:

- Pictet Group reported LCR of 206% in H1 2025—exceptionally strong.

- Cantonal banks typically maintain LCR well above 150%.

- During the 2023 crisis, Credit Suisse’s LCR deteriorated as deposits fled. The bank could not access central bank liquidity fast enough. The collapse followed.

- In contrast, Pictet, Lombard Odier, and cantonal banks maintained very high LCR throughout 2023.

When evaluating a bank, ask: “What is your current LCR?” and “What is your average LCR over the past three years?”

- LCR above 180%: Conservatively managed. You can deposit here with confidence.

- LCR 100–150%: Compliant but not conservative. Acceptable, but not ideal.

- LCR below 100%: Non-compliant and dangerous. Avoid immediately.

Most banks will not volunteer this number, but you can ask your RM or find it in annual reports. Conservative private banks often highlight high LCR as a point of pride.

The US Nexus Question: Can You Actually Access Your Money?

One of the most frustrating developments in recent years is the trend of Swiss banks closing accounts of US clients, even those with perfect compliance records.

This happens because of FATCA reporting requirements and the perceived regulatory burden of serving US persons. Several Swiss private banks have exited the US market entirely, forcing long-term US clients to find new institutions.

Before opening a Swiss account, clarify your bank’s policy on US persons:

Category A: SEC-Registered Advisers (Safe for US Clients)

These banks are registered with the SEC and actively serve US-domiciled clients. They have full FATCA compliance infrastructure. Examples: UBS.

Category B: Swiss-Only, US-Friendly but Not Registered

These banks serve some US clients but are not SEC-registered. They comply with FATCA on a case-by-case basis. They may close accounts if requirements become too onerous.

Category C: Strict Non-US Policy

These banks do not serve US persons or US-domiciled clients at all. If you open an account and later move to the US, they may freeze it.

Action: Before opening an account, ask explicitly: “Do you serve US-domiciled clients? What is your policy on FATCA compliance? Would my account be at risk if I relocated to the US?”

A bank that is upfront about US policy is trustworthy. A bank that is evasive is signaling risk.

Crypto Integration: A Modern Trust Signal

It is 2026. If a Swiss bank does not offer any options for digital assets, it is either extremely conservative or behind the times.

This does not mean the bank must offer crypto trading. It means the bank should acknowledge digital asset reality and have a clear policy.

Crypto-Integrated Banks (offer some form of in-house crypto services):

- Sygnum Bank (regulated custodian, crypto trading)

- AMINA Bank (regulated custodian, staking services)

- SEBA Crypto AG (regulated custodian, trading, OTC desk)

These banks hold licenses from FINMA specifically for crypto services. They custody digital assets under regulated frameworks. If you want exposure to crypto, these are trustworthy counterparts.

Crypto-Friendly Banks (allow transfers to external custodians):

- Many private banks will allow transfers to regulated external custodians like Coinbase Custody or Fidelity Digital Assets.

- They do not offer in-house services, but they will not freeze accounts for crypto activity.

Crypto-Hostile Banks (close accounts for any crypto activity):

- Some traditional Swiss banks still freeze accounts if they detect crypto transfers.

- This is outdated policy and a red flag for overall governance.

Your position: Even if you do not hold crypto, a bank that is crypto-hostile signals poor governance. A bank that has thoughtfully integrated crypto into its compliance and risk framework signals modern, mature management.

The Documentation and Verification Process: What It Reveals

How a bank treats you during account opening reveals a lot about its governance and risk appetite.

A well-governed bank will:

- Ask detailed questions about source of funds and business operations.

- Require comprehensive documentation with no shortcuts.

- Take weeks to onboard you (thorough due diligence takes time).

- Assign a senior RM who has done similar accounts.

- Be transparent about fees, minimums, and service limitations.

A risky bank will:

- Rush you through onboarding (they need deposits urgently).

- Ask minimal questions about source of funds (AML red flag).

- Pressure you to fund quickly (sign of deposit shortage).

- Assign junior staff (cost-cutting on client relationships).

- Be evasive about service levels or fees (hidden cost structure).

If a bank is overly eager to take your money, that is often a sign they need it. And a bank that needs deposits is a bank under stress.

The Hybrid Approach: Balancing Safety, Service, and Diversification

No single bank is optimal for every purpose. The most sophisticated HNWIs use a tiered structure:

For Swiss Residents:

Core Safety (CHF 5M+):

Cantonal Bank with state guarantee (AAA or AA rated, like ZKB or BCV). Objective: absolute safety, not yield.

Wealth Management (CHF 2–10M):

Major private bank (Pictet, Lombard Odier, Mirabaud, Vontobel, Safra). Objective: advisory quality, alternative investments, personalized service.

Liquidity and Credit (CHF 0.5–2M):

UBS or a major bank for operational accounts, credit facilities, and day-to-day banking.

Digital Assets (If relevant):

Sygnum or AMINA for crypto custody and integration.

For Non-Residents:

Core Safety (CHF 5M+):

Major private bank with demonstrated conservative management (Pictet, Lombard Odier, Mirabaud) with ratings of at least AA− and Tier 1 capital above 15%. Objective: maximum safety within accessible institutions. Verify high LCR (150%+).

Wealth Management (CHF 2–10M):

Major private bank. Objective: advisory quality, relationship continuity.

Liquidity and Operations (CHF 0.5–2M):

UBS or another systemically important bank with A+/Aa2/A+ ratings and strong capitalization.

Digital Assets (If relevant):

Sygnum or AMINA for crypto custody.

This approach ensures that:

- Your largest holdings benefit from the highest accessible safety guarantee.

- Your wealth benefits from the best advisory available.

- Your operations are simple and accessible.

- Your digital assets (if any) are properly regulated.

No single bank loses your entire portfolio if something goes wrong. And each institution is matched to its strength.

Checklist: Questions to Ask Your Swiss Bank

Before committing to a bank, use this checklist. A bank that answers transparently is trustworthy:

Safety and Structure

- What is your liability structure? (Limited vs. unlimited? When was any conversion made?)

- Do you have a state guarantee? If yes, what is the scope and the backing canton’s credit rating?

- What is your current Liquidity Coverage Ratio (LCR)? What has it been over the past three years?

- What is your Tier 1 capital ratio? Has it been stable or declining?

- What is your total own equity (in CHF millions)? Is this trending up or down?

- What are your current credit ratings from S&P, Moody’s, and Fitch?

- Has FINMA initiated any enforcement actions against your bank in the past five years?

Regulatory and Compliance

- Are you SEC-registered? What is your policy on non-resident and US-domiciled clients?

- Who conducts your annual cybersecurity audit? What are your cyber insurance limits?

- How do you handle AML/KYC compliance? Can you provide examples of how you have conducted enhanced due diligence?

Service and Operations

- What is your minimum deposit requirement for non-resident clients? Is this firm?

- Who will be my primary relationship manager? What is their tenure and experience?

- What is your digital banking platform like? Can you demo the app?

- What are your all-in fees for wealth management, custody, and transactions?

- Do you offer any services related to digital assets? What is your policy?

Client Relationships

- How many client departures have you experienced in the past 12 months? (If evasive, it is a red flag.)

- Can you provide client references? (High-quality banks often will, within confidentiality constraints.)

- What is your approach to long-term client relationships? Are you looking for one-time deposits or ongoing partnerships?

Contingency and Risk Management

- In the event of a financial stress scenario, how would you ensure customer deposits remain accessible?

- Have you stress-tested your business model against scenarios similar to 2023? Can you describe the results at a high level?

A bank that answers these questions thoroughly and honestly is one you can trust.

The Post-2023 Reality: Trust Through Demonstrated Stability

The 2023 banking crisis taught a hard lesson: Trust comes from demonstrated stability and governance, not from ownership structure alone.

Credit Suisse had a 150-year reputation. It was “trusted” by millions of clients. But when the crisis came, the bank lacked the governance and liquidity discipline to survive. Management faced misaligned incentives and rising pressure from difficult business decisions. The bank failed.

In contrast, institutions like Pictet, Lombard Odier, and cantonal banks survived the crisis intact because they maintained:

- Strong liquidity discipline: LCR maintained well above regulatory minimums, even during stress.

- Conservative risk management: Avoiding leverage, excessive yield-chasing, and exposure to toxic assets.

- Institutional governance: Long-term partnerships or state backing that prioritized stability over short-term profit.

- Client-centric focus: Building deep relationships rather than pursuing aggressive growth.

These factors mattered far more than the formal liability structure of the ownership entity.

When you choose a Swiss bank in 2026, ask yourself: Does this institution have the governance and discipline to survive a crisis?

Evaluate based on:

- Demonstrated conservative management over multiple business cycles.

- Strong credit ratings from independent agencies.

- High liquidity buffers maintained beyond regulatory minimums.

- Minimal regulatory violations or enforcement actions.

- Clear client relationship focus rather than aggressive asset acquisition.

- Transparent communication about risks and business model.

Choose based on this framework, not on marketing materials, historical reputation, or formal ownership structure. The banks that survive crises are those with demonstrated governance and financial discipline. The banks that fail are those that prioritize growth over stability.

Final Recommendation

If you are opening a Swiss account in 2026, here is the straightforward recommendation:

For Swiss Residents with CHF 5M+ to Deposit:

Start with a state-guaranteed cantonal bank like ZKB (AAA/Aaa/AAA), BCV (AA/Aa1/AA), or Berner Kantonalbank (AA/Aa1/AA). Your core holdings are mathematically safest here. The canton’s creditworthiness backs your deposit.

For Non-Residents with CHF 5M+ to Deposit:

Use a major private bank with demonstrated conservative management (Pictet, Lombard Odier, Vontobel, Mirabaud) that meets minimum standards: ratings of at least AA−, Tier 1 capital above 15%, own equity of at least CHF 500M, and LCR above 150%. Verify these metrics directly with the bank. These institutions survived 2023 without support because of disciplined management.

For All Clients—Wealth Management and Long-Term Relationships:

Use a major private bank (Pictet, Lombard Odier, Mirabaud, or similar) where conservative management philosophy is demonstrated through high LCR, strong capital, and long-term institutional stability. These are not partnerships with unlimited liability (that structure largely ended in 2014), but they are institutions run by owners who prioritize preservation and reputation over aggressive growth.

For Operations and Liquidity:

Use UBS or another major systemically important bank (A+/Aa2/A+ ratings) for day-to-day transactions and credit facilities. Accept slightly higher fees in exchange for operational simplicity and guaranteed accessibility.

For Digital Assets (If Relevant):

Use a crypto-integrated bank like Sygnum or AMINA for custody and compliance-integrated services.

This approach balances safety, service quality, and operational flexibility. It reflects the lessons of 2023 and the structural reality of modern banking. The banks that survive crises are those with demonstrated financial discipline and conservative governance, not those with the highest marketing budgets or formal ownership structures.

Disclaimer

This article provides general guidance only and does not constitute financial, legal, or investment advice. Banking regulations and institutional structures change frequently. Before opening any account or making banking decisions, consult with a qualified Swiss banking adviser, tax professional, and legal counsel who understand your specific situation and local regulations.

Past performance and regulatory compliance do not guarantee future safety. All banking involves risk. No institution is completely risk-free. The minimum standards presented (BBB− rating, 15% Tier 1 capital, CHF 500M+ equity, LCR 150%+) are guidelines, not guarantees of safety, and should be discussed with professional advisers.