Imagine Sarah, a savvy investor from New York, sitting at her laptop on a crisp September morning in 2024 with $100,000 burning a hole in her investment portfolio. Traditional U.S. savings accounts were offering a measly 4-5%, and she knew there had to be better opportunities somewhere in the world. Little did she know, her quest would take her on a fascinating journey through emerging markets, currency volatility, and the complex world of international deposit guarantees.

The Great Rate Hunt Begins

Sarah’s adventure started with a simple question: Which country offers the highest deposit interest rates? Armed with determination and thorough research, she discovered that the answer wasn’t as straightforward as she initially thought. The global financial landscape from September 2024 to September 2025 revealed a fascinating tale of high rewards, hidden risks, and the crucial importance of understanding currency dynamics.

The Champions of High Yields

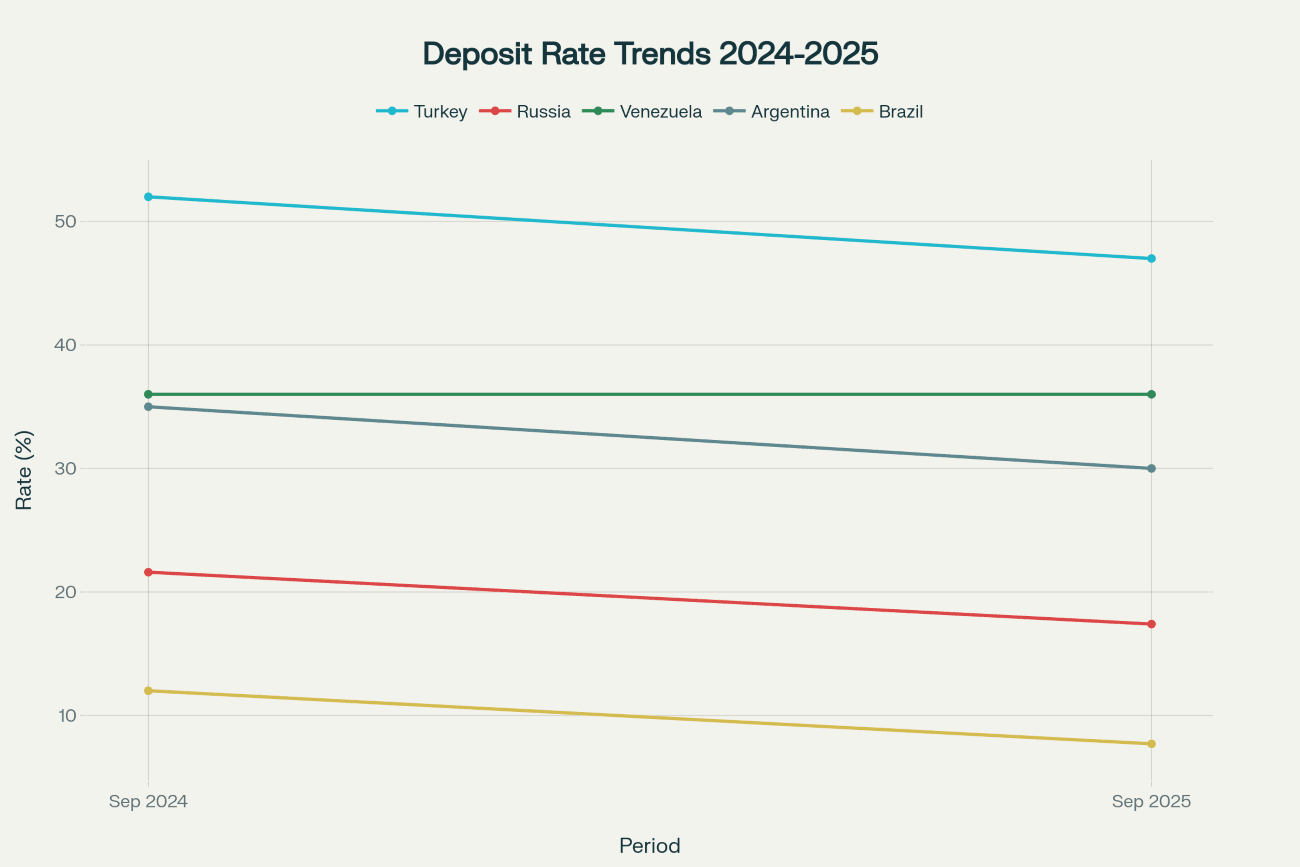

Turkey: The Reigning Champion

Sarah’s research quickly led her to Turkey, where banks were offering eye-watering deposit rates averaging 49.5% over the period. Turkish banks had maintained these elevated rates as the Central Bank of Turkey navigated complex economic conditions, with policy rates hovering around 43-45%.

The Turkish Story:

- September 2024: 52% average deposit rates

- September 2025: 47% average deposit rates

- Average for the period: 49.5%

Russia: The Volatile Contender

Russia emerged as the second-highest yielder with average rates of 19.5%. The Central Bank of Russia had maintained aggressive monetary policy, with deposit rates fluctuating between 17.4% and 21.6% during the period.

Venezuela: The Hyperinflation Survivor

Venezuela maintained consistent 36% deposit rates throughout the entire period, a reflection of the country’s ongoing battle with hyperinflation and economic instability.

The Currency Reality Check

Just as Sarah was about to wire her money to Istanbul, her financial advisor friend Marcus called with a crucial insight: “Sarah, you’re looking at nominal rates. What about currency risk?”

This conversation changed everything. Marcus explained that high deposit rates often compensate for currency devaluation—a concept Sarah hadn’t fully considered.

The Devaluation Dilemma

Sarah discovered that during the September 2024 to September 2025 period:

- Turkish Lira weakened by approximately 16.8% against the USD.

- Argentine Peso plummeted by 42.2% against the USD.

- Venezuelan Bolívar collapsed by an estimated 85%.

- Russian Ruble depreciated by roughly 12%.

- Euro strengthened by about 5.4% against USD.

- Swiss Franc appreciated by around 7.5% against USD.

A mere glance at nominal rates without this context would have been misleading.

Sarah’s $100,000 Simulation

Sarah ran detailed calculations for her $100,000 investment across different countries, converting back after one year:

| Country | Nominal Rate | Currency Change | Real USD Yield |

|---|---|---|---|

| Turkey | 49.5% | –16.8% | 32.7% |

| Germany | 3.5% | +5.4% | 8.26% |

| Switzerland | 1.5% | +7.5% | 8.0% |

| Georgia | 11.0% | –3.2% | 7.8% |

| Russia | 19.5% | –12.0% | 7.5% |

| Iceland | 8.5% | –4.1% | 4.4% |

| Nigeria | 10.75% | –7.0% | 3.75% |

| Brazil | 9.85% | –8.5% | 1.35% |

| Argentina | 32.5% | –42.2% | –9.7% |

| Venezuela | 36.0% | –85.0% | –49.0% |

Despite Germany’s and Switzerland’s low nominal rates, their currencies’ appreciation turned them into surprisingly strong USD yielders.

Real USD Returns Across the Globe

This comparison underscores that Turkey remains the top performer, but Germany and Switzerland outperform many emerging markets once currency appreciation is considered.

The Safety Net: Deposit Guarantee Schemes

Each country offers different levels of deposit insurance:

| Country | Coverage Limit (USD) | Payout Timeline |

|---|---|---|

| USA | $250,000 | 2-3 days |

| Switzerland | $110,000 | 7 days |

| EU (Germany) | $108,000 | 7 days |

| UK | $107,000 | 7 days |

| Russia | $16,500 | 14 days |

| Iceland | $16,000 | 7 days |

| Venezuela | $15,000 | 30+ days |

| Nigeria | $6,800 | 90 days |

| Georgia | $5,700 | 7 days |

| Turkey | $4,600 | 7-20 days |

| Argentina | $1,400 | 30+ days |

Deposit guarantees provide a critical safety net, but limits and payout speeds vary significantly.

Lessons for the Modern Investor

- Always factor in currency movements when evaluating nominal rates.

- Diversify across markets to balance high yields with currency strength.

- Consider deposit insurance limits and credibility of payout mechanisms.

- Political and economic stability remains as important as yield figures.

Conclusion: The Smart Money Strategy

Sarah’s journey taught her that while Turkey offers the highest effective deposit rate, Germany and Switzerland deliver compelling USD yields thanks to currency appreciation. The optimal strategy blends high-yield emerging markets with stable, currency-appreciating jurisdictions to maximize risk-adjusted returns.

For investors ready to explore international opportunities, Easy Global Banking is the premier platform to open a foreign bank account seamlessly. Open your Swiss bank account today to tap into European market strength: https://www.easyglobalbanking.com/open-swiss-bank-account/

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Investment decisions should be based on your individual circumstances and risk tolerance. Please consult a licensed financial advisor before making any cross-border deposit or currency exchange transactions.