Switzerland’s Financial Services Act (FinSA) classifies all investment clients into three categories—private, professional, and institutional—each with different protection levels and market access. Your classification determines what financial products you can invest in, how much guidance you receive, and which regulations your provider must follow. Understanding where you fit ensures you’re both compliant and positioned to access the right opportunities.

What Is FinSA and Why Your Classification Matters

FinSA, Switzerland’s Financial Services Act that entered into force in 2020, is the regulatory backbone governing how banks, investment advisors, and financial intermediaries treat clients. Rather than applying one-size-fits-all rules, FinSA recognizes that a retiree investing their savings has fundamentally different needs—and capabilities—than a pension fund managing billions.

The classification system exists for two reasons: investor protection and market efficiency. Retail investors receive comprehensive safeguards because they typically lack deep financial expertise. Institutional clients receive fewer restrictions because they’re assumed to understand complex markets and can absorb losses. Your classification directly determines which financial instruments you can access, whether your advisor must verify a recommendation is “suitable” for you, and what disclosure documents you’re entitled to receive.

For those navigating international banking or seeking to open a foreign bank account, understanding FinSA classification is essential—it affects which products are available and what information you’ll receive. Easy Global Banking helps clients understand these distinctions to make informed decisions across jurisdictions like Switzerland and Singapore.

FinSA Client Classification Comparison: Protection Levels and Instrument Access

The Three FinSA Client Categories

Private (Retail) Clients: Maximum Protection, Limited Access

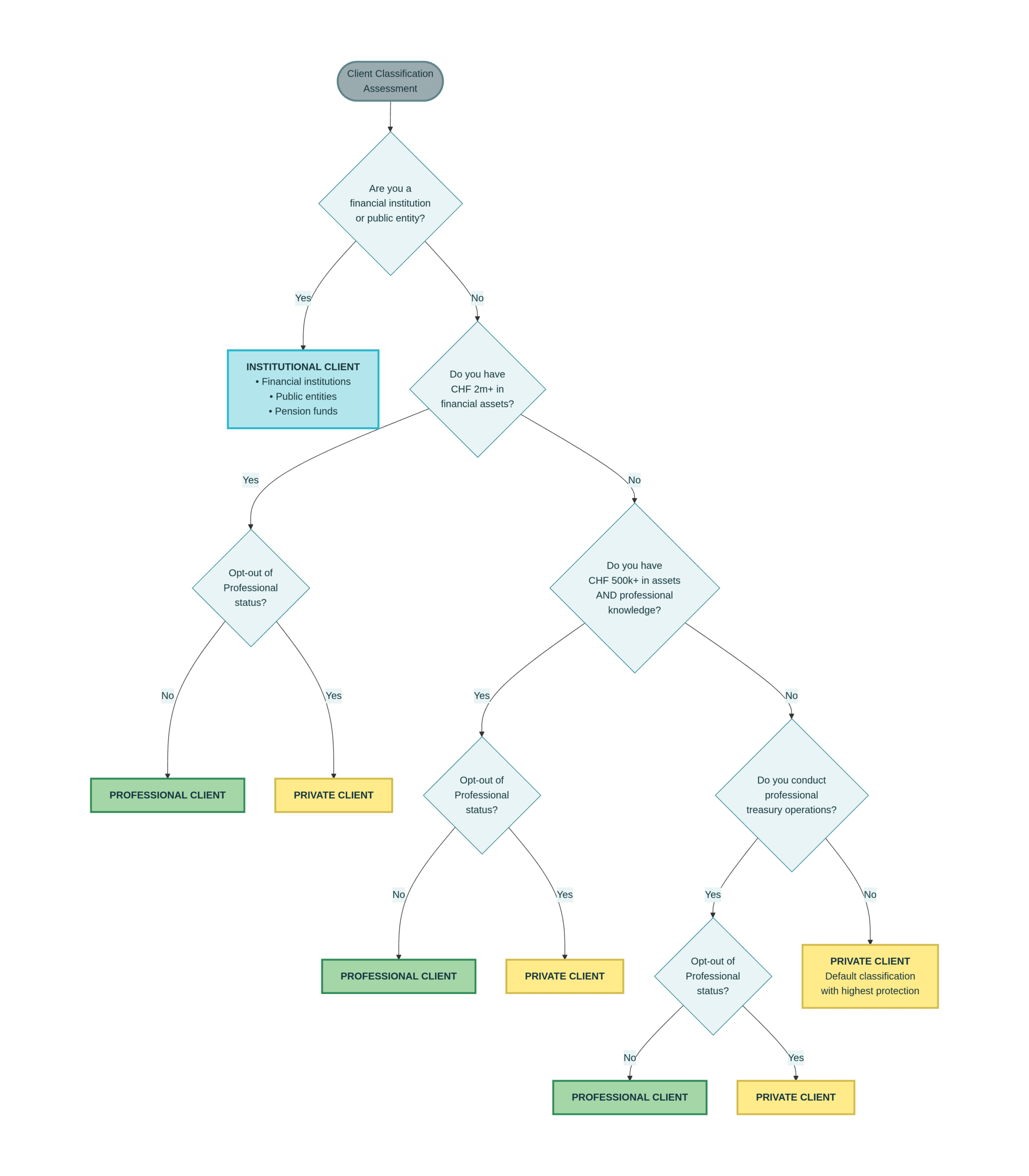

Who qualifies: You’re classified as a private client unless you meet professional or institutional criteria. This includes individuals, small and medium-sized businesses, and most family offices without formal treasury operations.

What protection looks like: FinSA mandates that your financial provider conduct a detailed suitability assessment before recommending any investment. They must understand your financial situation, investment experience, and objectives—then confirm the recommendation actually fits your profile. You also receive a Key Information Document (KID) before purchasing structured products or complex investments, explaining risks in plain language.

Market access reality: You have access to “standard” investment vehicles: equities, bonds, mutual funds (UCITS), and straightforward products. Complex instruments—derivatives, non-registered funds, structured products with embedded leverage—are off-limits unless you formally request a classification upgrade.

The catch: This protection comes with restrictions. You cannot access certain high-yield or alternative investments reserved for sophisticated investors. However, here’s the strategic option: if you meet specific wealth or experience thresholds, you can opt-out to professional status voluntarily.

Professional Clients: Balanced Access with Measured Protection

Who qualifies (and it’s more nuanced than you’d think): FinSA splits professionals into two groups. Per-se professionals include large companies (exceeding 2 of: CHF 20 million balance sheet, CHF 40 million revenue, CHF 2 million equity), pension funds with treasury operations, financial intermediaries, and public institutions with professional treasury management.

Elective professionals are high-net-worth private clients who voluntarily opt-out to gain broader access. To qualify, you must meet one of these thresholds:

- CHF 500,000 in eligible assets AND education/professional experience demonstrating knowledge to understand investment risks, OR

- CHF 2 million in eligible assets (regardless of expertise)

“Eligible assets” includes bank deposits, securities, and collective investment units—but excludes real estate, pensions, and social security claims.

What protection looks like: Professional clients receive reduced protection. Your advisor conducts an appropriateness (not suitability) assessment and must document the transaction, but they’re not required to provide the same level of detail as with retail clients. Interestingly, professionals can release financial service providers from most conduct obligations if they sign a written agreement.

Market access advantage: You can invest in a much broader universe: complex structured products, non-registered collective investment schemes, derivatives, and instruments specifically designed for sophisticated investors. Alongside FinSA classification, you automatically qualify as a “Qualified Investor” under CISA (Collective Investment Schemes Act), which opens access to professional funds.

Strategic lever: Professional clients can decline protection and sign a simplified agreement if they wish, streamlining the advisory process.

Institutional Clients: Unrestricted Markets, Minimal Regulation

Who qualifies: Institutional clients are financial institutions and large organizations subject to prudential supervision in Switzerland or abroad. This includes banks, insurance companies, fund managers, central banks, and supranational institutions.

Within this group, some professional clients (pension funds, large corporates) can opt-in to institutional status if they declare in writing.

What protection looks like: Minimal. FinSA assumes institutional clients have the expertise, resources, and financial strength to negotiate independently. Most conduct rules simply don’t apply. No suitability assessment, no documentation requirements, no disclosure documents. The relationship is treated as between two sophisticated counterparties.

Market access: Complete and unrestricted. Every financial product, derivative, structured investment, and alternative strategy is available. This freedom reflects the assumption that institutional clients can perform their own due diligence.

FinSA Client Classification Decision Tree: Find Your Category

How FinSA Classification Affects Your Investment Universe

The real-world impact is significant. A private client might be unable to access a high-yield bond fund marketed only to professionals. A professional client can diversify into structured products and emerging market derivatives off-limits to retail investors. An institutional client can pursue custom investment strategies with minimal regulatory friction.

This cascading access pattern isn’t punitive—it reflects regulatory philosophy: less experienced investors need more guardrails; sophisticated investors need flexibility.

Beyond individual instruments, classification affects costs and timelines. Professional and institutional clients often negotiate advisory fees directly. Retail clients benefit from standardized protections but may face higher relative costs due to compliance burdens. Documentation for retail investors requires KID disclosures; for institutional clients, a simple trade confirmation suffices.

The CISA qualification framework compounds this effect. Only professional and institutional clients (automatically) and private clients with active advisory mandates can invest in “qualified investor funds”—a growing category of performance-driven vehicles. Without this status, a retail client cannot access these opportunities regardless of wealth.

Changing Your Classification: Opting In and Out

Here’s where strategy enters: you can request a classification change.

Private clients opting out (requesting professional status): You must provide evidence that you meet the wealth thresholds or possess relevant financial expertise. Documentation might include proof of CHF 500k–2m in eligible assets, professional certifications, or employment history in financial roles. The process typically takes 2–3 weeks and requires written application.

Professional clients opting in: If you want greater protection than professional status provides, you can request to be reclassified as private. This rarely happens but is available if circumstances change—for instance, if you’ve sold your business and want simpler, safer investments.

Institutional clients opting in: Large corporates or pension funds classified as institutional can voluntarily request professional status for incremental protection if desired.

The catch: classification decisions are not product-specific. Once classified, the determination applies across all services your provider offers. You can’t be private for equity investments and professional for derivatives—it’s an all-or-nothing framework.

CISA Qualified Investor Status: A Complementary Framework

Swiss law distinguishes between FinSA client classification and CISA (collective investment scheme) qualified investor status. This is a common source of confusion.

Under CISA, professional and institutional clients are automatically qualified investors. Private clients become qualified investors only if they have an active advisory or portfolio management mandate with a Swiss or foreign regulated intermediary. Without this status, retail clients cannot buy “qualified investor funds”—a rapidly growing fund category offering simplified prospectuses and higher fee flexibility.

This means a wealthy private client worth CHF 5 million cannot access certain investment funds without signing an advisory mandate, even though they could theoretically afford any investment.

Practical Steps to Confirm and Optimize Your Classification

Step 1: Verify your current status – Your financial provider should have documented your classification in writing. Request this documentation; it’s a compliance requirement. If you’re not sure, email your relationship manager and ask directly.

Step 2: Assess whether it matches your goals – If you’re restricted from products you want to access, explore opting-out criteria. If you’re professionally classified but prefer stronger protections, you can opt back to private status.

Step 3: Document your assets properly – If you’re aiming for professional status based on wealth, gather current account statements, brokerage reports, and property valuations (excluding real estate from the CHF 500k or CHF 2m threshold). Financial institutions are required to maintain this documentation for regulatory review.

Step 4: Understand the regulatory environment – FinSA rules are stable, but FINMA (Swiss Financial Market Supervisory Authority) periodically updates guidance. Stay informed about changes via FINMA’s official website or your provider’s compliance updates.

Step 5: Review your advisory agreement – The fine print of your mandate should specify your classification, protection level, and which conduct rules apply. If it’s unclear, request clarification in writing.

How to Navigate Swiss Banking Regulations with Confidence

FinSA’s three-tier classification system reflects a fundamental principle: investor protection should match investor sophistication. Yet the framework is also more flexible than it initially appears—you can upgrade or downgrade your status based on circumstances.

For international clients considering opening a Swiss bank account or exploring offshore banking in Singapore, classification is the entry point to understanding what’s available. A private client in Singapore may qualify for professional status under Swiss FinSA if their assets exceed thresholds, unlocking a broader investment universe.

The challenge is that FinSA rules interact with rules in other jurisdictions. Easy Global Banking specializes in helping clients navigate these overlaps—understanding how Swiss classification affects options in Singapore, the UAE, or other financial hubs. Rather than accepting default classifications, sophisticated investors should understand the criteria, evaluate whether they can opt into broader access, and structure their banking relationships accordingly.

Your classification isn’t permanent. As your wealth, experience, or investment goals evolve, so can your status. The first step is confirming where you stand today—then strategically deciding where you want to be.

Key Sources

BNP Paribas. “Federal Financial Services Act (FinSA).” Accessed 2025. https://www.bnpparibas.ch/en/legal-information/federal-financial-services-act/

Van Lanschot Kempen. “FinSA Client Classification Information for Clients.” 2023.https://www.vanlanschotkempen.com/-/media/vlk/vlk—pb—ch/uploaded-files/english/20230922_finsa_client-classification_information-for-clients.ashx

UBP. “FinSA: Client Classification and Qualified Investor Status.” Accessed 2025. https://www.ubp.com/en/legal-aspects/finsa

FINMA. “Client Categorization and Qualified Investor Classification.” Official regulatory guidance. https://www.finma.ch/finmaarchiv/gb2014/download/2014/en/Downloads/Finma_AR14_05_Appendix_En.pdf