Introduction: The Post-2023 Question

For clients depositing significant wealth in Swiss banks, the question is no longer “Is there insurance?” but rather “What happens when the insurance isn’t enough?”

In 2023, the Credit Suisse collapse exposed a critical reality: deposit insurance—even robust deposit insurance—provides only limited protection for HNWIs with substantial holdings. While esisuisse paid out CHF 100,000 per depositor without incident, clients with multi-million-franc holdings needed fundamentally different protection mechanisms.

This guide explains how Swiss deposit security actually works, and more importantly, how you can structure your Swiss holdings to achieve complete protection regardless of bank failure, regulatory action, or financial crisis. The path involves understanding a legal distinction that most depositors and many advisers completely miss.

Part 1: The Foundation—esisuisse Explained with Precision

To understand why CHF 100,000 is insufficient for wealth preservation, you first need to understand exactly how the Swiss deposit insurance system works.

What Is esisuisse?

esisuisse is not a government agency. It is a self-regulatory organization (SRO) of all licensed Swiss banks and securities firms, mandated by law to operate deposit insurance. This private-sector approach gives the Swiss system unusual flexibility compared to government-administered schemes in other countries.

Every bank licensed to accept deposits in Switzerland must be a member of esisuisse. There is no opt-out. This creates 100% coverage of the banking system.

The Coverage Limit: CHF 100,000 Per Customer, Per Bank

The scheme’s cornerstone is straightforward on the surface: CHF 100,000 per customer, per bank, per currency, per account category.

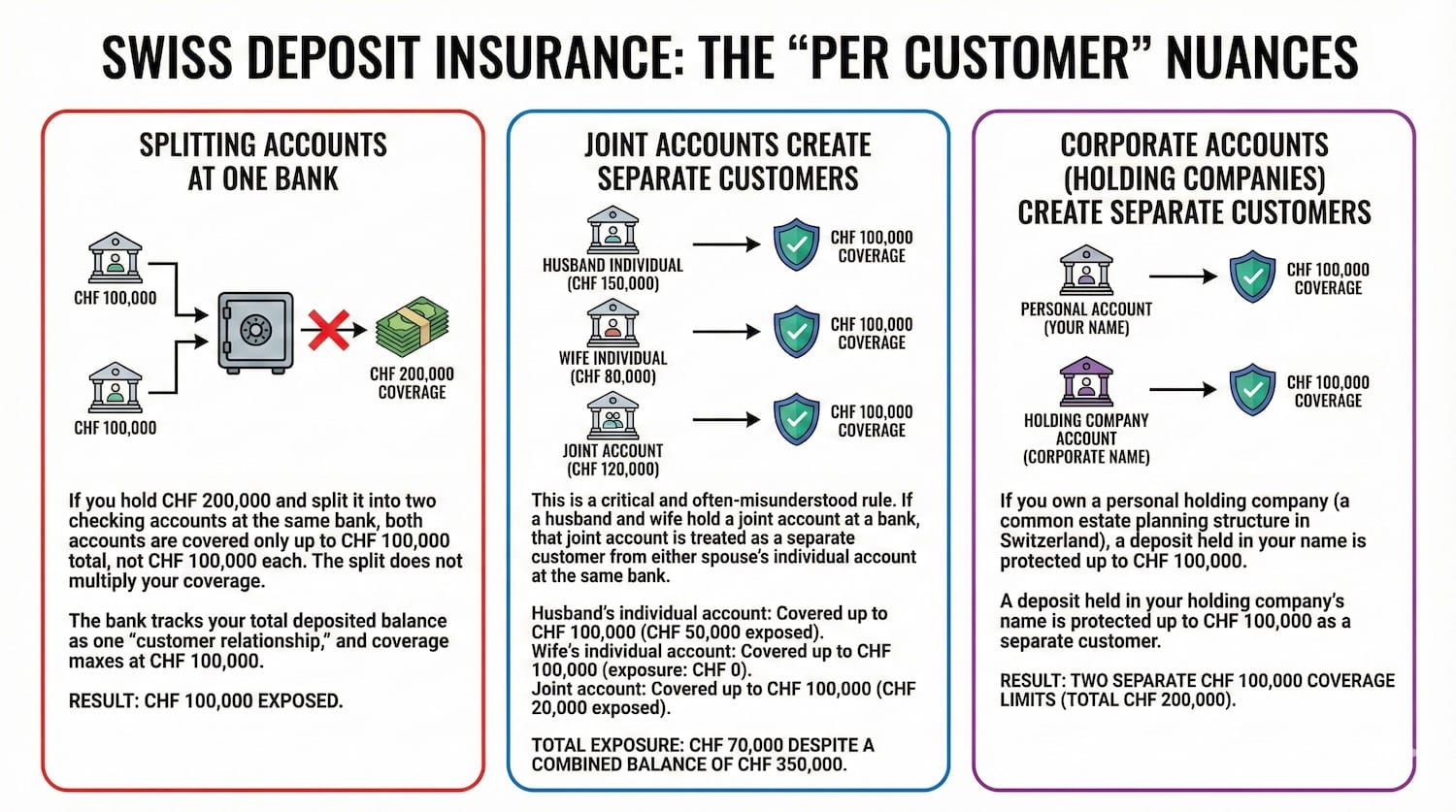

But “per customer” contains critical nuances that most depositors misunderstand.

The “Per Customer” Nuances

Splitting Accounts at One Bank: If you hold CHF 200,000 and split it into two checking accounts at the same bank, both accounts are covered only up to CHF 100,000 total, not CHF 100,000 each. The split does not multiply your coverage. The bank tracks your total deposited balance as one “customer relationship,” and coverage maxes at CHF 100,000.

Joint Accounts Create Separate Customers: This is a critical and often-misunderstood rule. If a husband and wife hold a joint account at a bank, that joint account is treated as a separate customer from either spouse’s individual account at the same bank.

Example: Husband has CHF 150,000 in an individual account. Wife has CHF 80,000 in an individual account. Together they hold CHF 120,000 in a joint account.

- Husband’s individual account: Covered up to CHF 100,000 (CHF 50,000 exposed)

- Wife’s individual account: Covered up to CHF 100,000 (exposure: CHF 0)

- Joint account: Covered up to CHF 100,000 (CHF 20,000 exposed)

- Total exposure: CHF 70,000 despite a combined balance of CHF 350,000

Corporate Accounts (Holding Companies) Create Separate Customers: If you own a personal holding company (a common estate planning structure in Switzerland), a deposit held in your name is protected up to CHF 100,000. A deposit held in your holding company’s name is protected up to CHF 100,000 as a separate customer.

Example: You personally have CHF 100,000 in a savings account. Your holding company has CHF 1 million in a current account at the same bank.

- Your personal account: Covered in full (CHF 100,000)

- Holding company account: Covered only up to CHF 100,000 (CHF 900,000 exposed)

- Total protection: CHF 200,000 on CHF 1.1 million in deposits

What Is Covered?

The scheme covers:

Cash Deposits: All deposits in Swiss francs, euros, US dollars, and other currencies held in checking accounts, savings accounts, or fixed-term deposits. The currency does not matter; the CHF 100,000 limit applies regardless.

Precious Metal Accounts: Accounts where the client has a claim on the metal value (e.g., “I own 100 ounces of gold, and the bank holds it for me”). This is a custody-like arrangement, but within the deposit insurance framework. However, accounts holding physical bars where the client has no traceable claim are excluded.

Not Covered:

- Securities and investment products (stocks, bonds, ETFs, mutual funds)

- Safe deposit boxes and valuables

- Interbank deposits

- Assets held in foreign branches or subsidiaries of Swiss banks

How esisuisse Actually Works: The Mechanism

A critical misconception: esisuisse does not maintain a pre-funded pot of money waiting to pay depositors. Instead, the system is funded by:

- Annual contributions from member banks (approximately 0.09% of covered deposits annually)

- A “financial pool” currently standing at approximately CHF 7.9 billion

- Collateral pledged by banks (securities and cash equal to half the pool’s value)

When a bank fails, esisuisse coordinates an immediate transfer of funds from all other Swiss banks to pay depositors. This collective responsibility approach ensures that even if esisuisse’s financial pool were depleted, the entire banking system backs the payout.

The system has never experienced a shortfall. Even during the Credit Suisse crisis, payouts were handled smoothly.

The Timeline: 7 Working Days to Full Payout

This is where Swiss deposit insurance demonstrates superior design compared to most other countries.

The legal mandate: Depositors must have access to their insured funds within 7 working days of FINMA (the Swiss Financial Market Supervisory Authority) declaring a bank bankrupt.

In practice, payouts occur within 3–5 working days.

Why does this matter? In the 2008 financial crisis, US depositors waited 6+ weeks for FDIC payouts. In some European crises, payouts took months. For business owners with payroll obligations, supplier payments, or other time-sensitive needs, weeks of frozen accounts is catastrophic.

Switzerland’s 7-day legal requirement reflects the principle that deposit insurance should restore liquidity quickly, not just eventually.

Part 2: The Reality Check—Why Insurance Is Irrelevant for HNWIs

For clients with modest savings (under CHF 500,000), the esisuisse system is genuinely excellent. You can sleep well.

But for HNWIs and significant wealth holders, esisuisse coverage is mathematically meaningless.

The Math

A client with CHF 5 million in a Swiss bank account receives CHF 100,000 of coverage. That is 2% protection. The remaining 98% of their wealth relies entirely on the bank’s solvency and the regulatory system’s ability to prevent failure.

The implicit question: “If I’m willing to bet CHF 100,000 on the bank’s survival, why am I depositing CHF 5 million with them?”

The answer most advisers give is: “Trust the regulatory system and the bank’s capital ratios.” This is the conventional wisdom—and it fails the intelligence test for actual wealth preservation.

The Missing Piece: A Legal Concept That Changes Everything

This is where the article transitions from standard information to the unique value proposition.

There is a legal concept that makes Swiss banking genuinely bulletproof for large amounts. It has nothing to do with deposit insurance.

The answer lies in understanding the difference between two categories of assets: deposits and custody assets.

Part 3: The Core Insight—Asset Segregation and Bankruptcy Law

The Bankruptcy Estate: Where Your Assets Go When a Bank Fails

When a Swiss bank enters bankruptcy, FINMA appoints a liquidator to manage the process. The bank’s assets are combined into a “bankruptcy estate” (German: Konkursmasse) used to repay all creditors according to priority rules.

Your position in this bankruptcy determines your safety. And your position depends on what you hold.

Cash Deposits: You Are a Creditor

When you deposit cash with a bank, the bank legally owns that cash. You do not own it. Instead, you own a claim against the bank for that amount. You are a creditor.

In bankruptcy:

- The bank’s assets (loans, securities, real estate) are sold

- Funds are collected into the bankruptcy estate

- Creditors are paid according to priority

- Deposits are covered up to CHF 100,000 by esisuisse

- Everything above CHF 100,000 is lost (unless the liquidator recovers enough to pay higher tranches)

This is why deposit insurance exists. Because as a creditor, you are at risk.

Custody Assets: You Own Them—The Bank Just Holds Them

When you instruct your bank to purchase securities (stocks, bonds, ETFs) and hold them in custody, the legal relationship is fundamentally different.

The bank does not own the securities. You own them. The bank merely holds them on your behalf.

Crucially: In bankruptcy, your securities are explicitly excluded from the bankruptcy estate. They cannot be seized to pay the bank’s creditors. They must be returned to you in full.

This principle is enshrined in Swiss bankruptcy law and international custody law. It is one of the most powerful—and most underutilized—protections in wealth preservation.

The Practical Consequence

If a bank fails and you hold CHF 5 million in cash deposits:

- You recover CHF 100,000 (esisuisse payout)

- You lose CHF 4.9 million

If that same bank fails and you hold CHF 5 million in custodied securities:

- You recover CHF 5 million in full

- Your only risk is whether the underlying securities lose value (i.e., market risk, not bank risk)

Part 4: The Actionable Strategy—The “AAA Bond Hack”

Understanding the legal distinction is intellectually satisfying. But here is how to actually deploy it.

The Strategy: Converting Cash to Custody Assets

Instead of holding large amounts in cash deposits (which are only partially insured), instruct your bank to convert those deposits into ultra-liquid, AAA-rated securities:

Eligible Securities:

- Swiss Confederation Bonds (the safest debt in the world, backed by the Swiss government)

- US Treasury Bills and Bonds (US government debt, highly liquid, widely available)

- Supranational bonds from the European Investment Bank, World Bank, or similar entities

- AAA-rated ETFs holding exclusively government bonds (e.g., iShares Swiss Government Bond ETF, Vanguard US Government Bond ETF)

How to Implement This

- Instruct your bank to liquidate cash holdings and purchase, for example, CHF 5 million of Swiss Confederation Bonds (1–5 year maturity)

- Confirm custody status: Ask the bank explicitly, “Are these securities held in custody for my account, separate from the bank’s balance sheet?” (Answer should be yes)

- Understand the custody structure: Your bonds are held either:

- Directly in your name at SIX (the Swiss securities clearing system)

- In a custodial account in your name at the bank, segregated from the bank’s assets

- Monitor quarterly: Ensure bonds remain in custody and that the bank has not moved them to “pledged collateral” status

The Result: Unlimited Protection

You now hold CHF 5 million in securities that are:

- Legally segregated from the bank’s bankruptcy estate

- Automatically returned to you in the event of bank failure

- Liquid: AAA government bonds can be sold in minutes

- Yield-bearing: Unlike deposits at zero or low rates, bonds provide income

If your bank fails tomorrow, your CHF 5 million is transferred to a new custodian and remains entirely yours. Your only risk is sovereign risk—the risk that the Swiss government or US government defaults on its bonds. That risk is virtually zero.

Why This Strategy Is Underutilized

- Banks don’t promote it: Banks earn higher margins on deposits (paying you 0.5% while earning 2–3% on lending) than on custodied securities (where the bank earns only custody fees)

- Financial advisers don’t know about it: Most advisers think of “security” as “insurance” and “ratings.” They don’t think about bankruptcy law and custody segregation

- It feels “expensive”: Holding bonds instead of cash means slightly lower yields in a low-rate environment. But this is the cost of security, and it’s modest

- Psychological discomfort: Some clients feel uncomfortable holding bonds. They prefer the psychological simplicity of “money in the bank.” This is a bias, not a rational reason

The Math: How Much Should Be in Bonds vs. Cash?

For a typical HNWI:

- Keep CHF 100,000–200,000 in cash (daily operations, immediate liquidity, tax/regulatory buffer)

- Convert the rest to AAA-rated securities (long-term wealth preservation, custody protection)

A CHF 5 million client would structure as:

- CHF 150,000 in current account (daily banking, covered by esisuisse)

- CHF 4.85 million in custodied Swiss/US government bonds (legally bulletproof)

Part 5: Advanced Strategies for Ultra-HNW Clients

For those with CHF 10+ million:

Strategy 1: Multi-Bank Diversification Combined with Bond Holdings

Split your bond holdings across multiple banks:

- Bank A: CHF 2 million in Swiss Confederation Bonds

- Bank B: CHF 2 million in US Treasury Bills

- Bank C: CHF 2 million in Supranational bonds

Benefit: If any single bank fails, the failure affects only one-third of your holdings. Your other two-thirds remain untouched. Additionally, diversification reduces counterparty risk.

Strategy 2: The ETF Approach (More Hands-Off)

Instead of managing individual bonds, purchase AAA-rated government bond ETFs:

- iShares Swiss Government Bond ETF (CHSB.SW)

- Vanguard US Government Bond ETF (VGOV.L)

- Amundi Euro Government Bond ETF (GOVL.L)

These ETFs are:

- Professionally managed

- Highly liquid (tradeable in seconds)

- Custodied automatically (ETF shares are segregated from the bank’s balance sheet)

- Lower management fees than individual bond portfolios

Strategy 3: The Foreign Securities Hedge

Hold a portion of your custody assets in foreign securities (US Treasuries, EUR-denominated bonds):

- Provides currency diversification

- If your home country experiences currency crisis, foreign securities are unaffected

- Still 100% legally protected by Swiss bankruptcy law

Part 6: What About Tier 1 Capital and Bank Ratings?

A common question: “Why not just use a well-capitalized bank with a high credit rating instead of using this custody strategy?”

The answer reveals a critical flaw in traditional banking logic.

The Ratings Problem

Bank credit ratings measure the bank’s financial strength. A bank with AAA-rated debt has low default risk. This is reassuring for short-term security.

But bank failure, when it occurs, is often sudden. Credit Suisse had A+ rated debt as recently as 6 months before its collapse. The bank faced a regulatory takeover, not a slow decline. Ratings did not predict it.

The Advantage of the Custody Strategy

By holding AAA government bonds in custody, you separate the risk into two components:

- The bank’s risk: Eliminated (assets are not on the bank’s balance sheet)

- Sovereign risk: Minimal (Swiss or US governments)

This is far more reliable than:

- The bank’s risk: Bet that the bank will not fail (ratings-based)

- Insurance coverage: Bet that esisuisse will pay out quickly (regulatory risk)

The custody strategy removes the bank from the equation entirely.

Part 7: Documentation and Implementation

To implement this strategy correctly:

Step 1: Clarify Custody Status

When you purchase securities, ask your relationship manager in writing:

“I am purchasing CHF [X] of [security]. Please confirm in writing that these securities are held in custody, segregated from your bank’s balance sheet, and that in the event of your bank’s insolvency, these securities will be returned to me in full.”

This creates a paper trail and ensures the bank understands your intent.

Step 2: Understand Your Custody Account Structure

Ask for documentation showing:

- Whether securities are held directly at SIX (Swiss securities clearing) in your name, or in a custodial account at the bank

- What collateral (if any) you may be pledging against the securities

- The bank’s obligations in case of insolvency

Step 3: Annual Review

Every year, request a statement confirming:

- Your securities remain in custody

- No changes have been made to their status

- The bank has not pledged them as collateral for any reason

Part 8: The esisuisse System: Still Excellent for What It Is

This article emphasizes custody segregation because it is the superior strategy for large holdings. But esisuisse itself deserves credit.

The system is:

- Well-capitalized: CHF 7.9 billion in financial capacity, plus system-wide backing

- Fast: 7-day legal mandate (typically 3–5 days in practice)

- Universal: Covers all Swiss banks with no gaps

- Tested: Has never failed to pay out, even during Credit Suisse crisis

For clients with moderate holdings (CHF 100k–500k), esisuisse provides genuine peace of mind. You do not need to implement the custody strategy. The insurance is sufficient.

But for HNWIs with CHF 1M+, the custody strategy is the gold standard.

Conclusion: Legally Bulletproof Wealth Preservation

The Swiss deposit insurance system is robust. But it is not designed for HNWIs. The CHF 100,000 limit reflects the system’s original purpose: protecting ordinary depositors from bank failure.

For significant wealth, the answer is not “better insurance.” It is segregation of assets under bankruptcy law.

By converting cash deposits to custodied, AAA-rated securities, you achieve:

- Complete legal protection (assets excluded from bankruptcy estate)

- Automatic return of all assets in case of bank failure

- Minimal counterparty risk (sovereign debt, not bank debt)

- Liquidity (securities are tradeable in seconds)

This is not a clever loophole or aggressive tax strategy. It is a conservative, legally sound application of existing Swiss bankruptcy and custody law.

For any HNWI with significant holdings in Swiss banks, understanding and implementing this strategy is essential. It represents the difference between 2% insurance coverage and 100% legal protection.