In an era marked by rampant inflation, fragmented supply chains, and geopolitical tensions, offshore banking has emerged as an essential strategic tool for wealth preservation, diversification, and global financial access. Whether you’re a high-net-worth individual (HNWI) seeking ultimate privacy, a digital nomad craving seamless multi-currency support, or an expatriate managing cross-border income and expenses, this in-depth guide equips you to choose the best country to open an offshore bank account in 2025.

Key Takeaway:

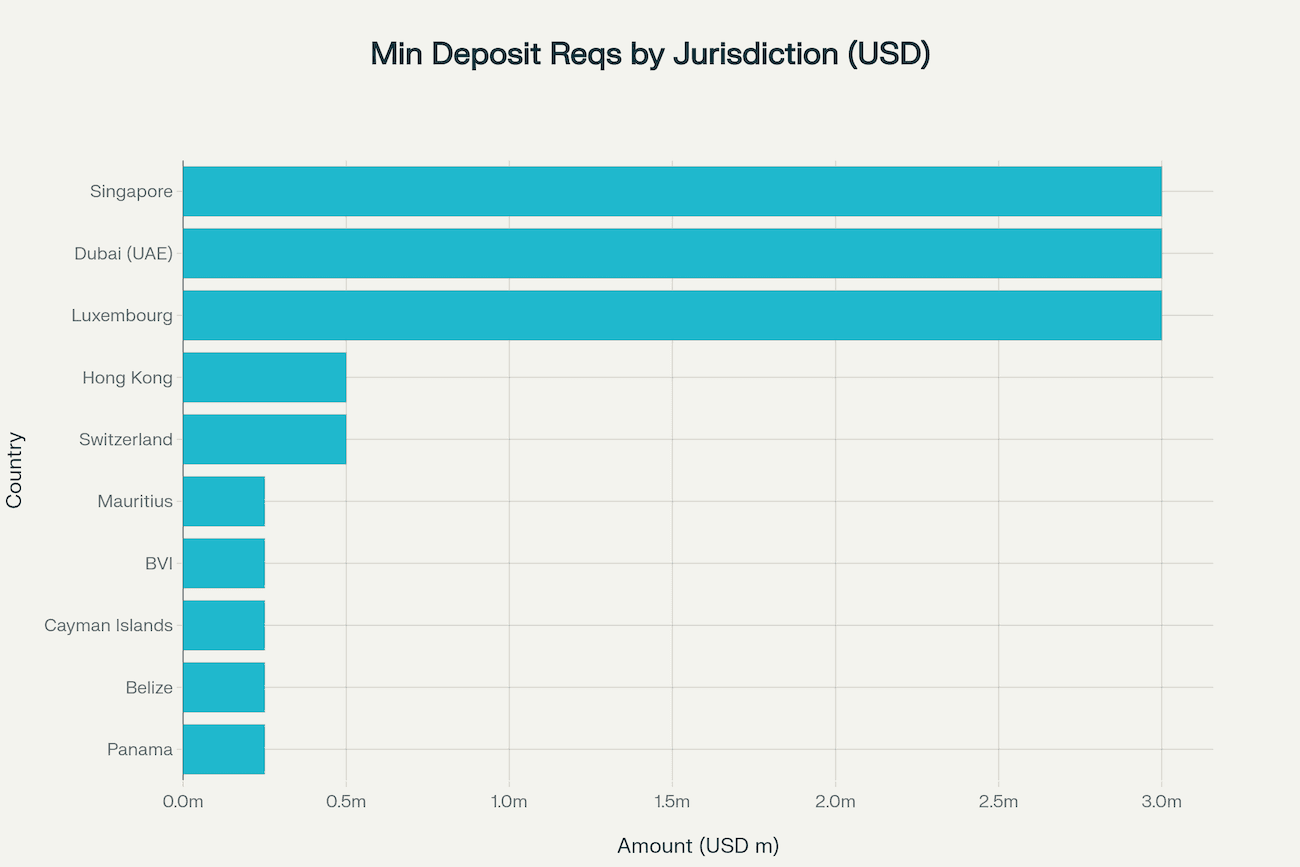

Premium jurisdictions—Switzerland, Luxembourg, Singapore, and Hong Kong—command non-resident minimum deposits from USD 500 000 to USD 3 000 000, underpinned by AAA or AA+ sovereign credit ratings. Emerging and accessible options—Panama, Belize, the Cayman Islands, and Mauritius—start at USD 250 000, balancing lower barriers to entry with robust asset protection. Dubai (UAE) stands out with a USD 3 000 000 threshold and AA-rated stability, offering a tax-free environment and digital banking innovation.

Introduction

Global markets in 2025 face headwinds from tightening monetary policy, regional conflicts, and periodic shocks. Domestic banking systems, while regulated, can expose depositors to political risk, currency devaluation, and litigation threats. Offshore banking addresses these vulnerabilities by enabling:

- Geographic diversification across stable jurisdictions

- Asset protection under advanced legal frameworks

- Currency hedging through multi-currency accounts

- Access to global investments and private banking services

- Enhanced privacy within compliant transparency regimes

This guide dismantles outdated myths—offshore banking is not a conduit for illicit secrecy but a legitimate wealth-management approach when fully compliant with FATCA, CRS, and local regulations.

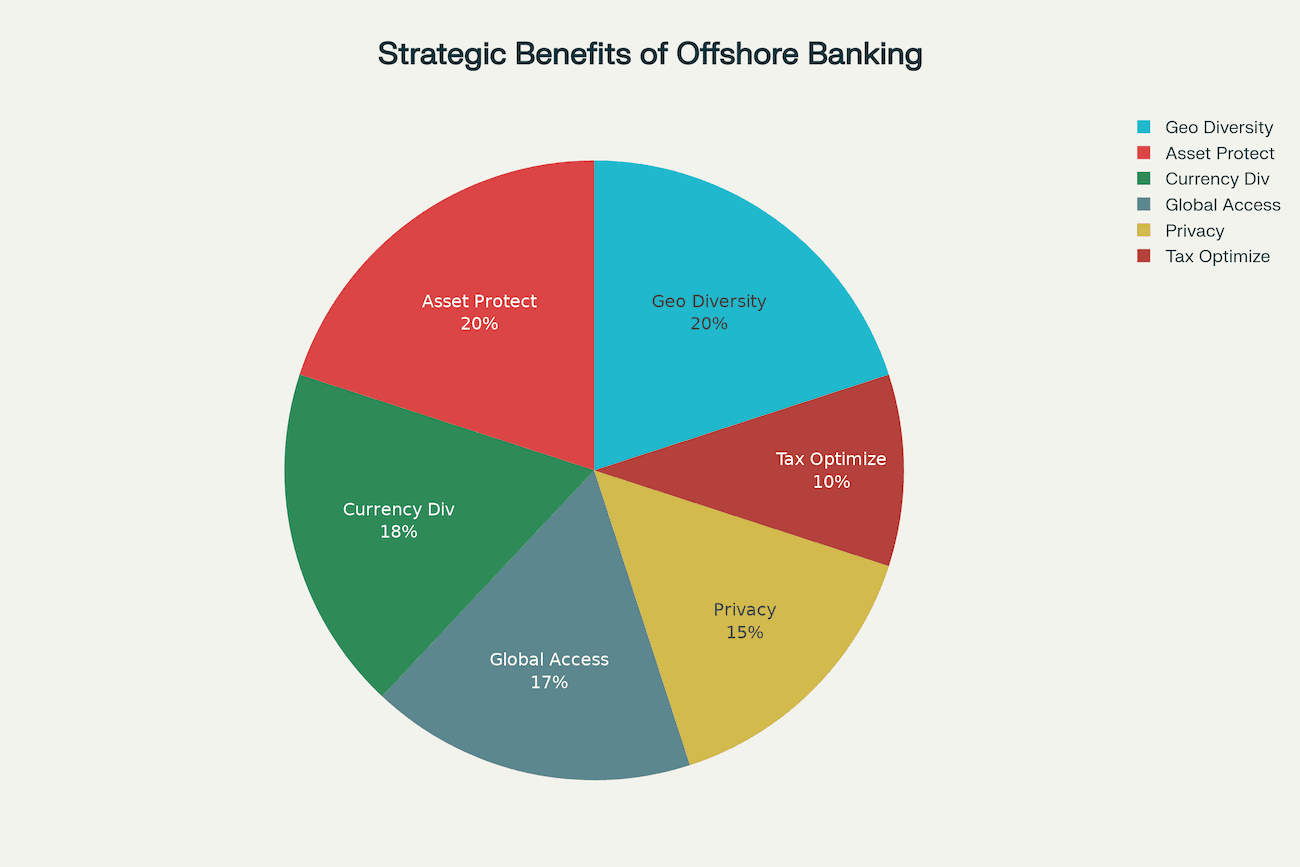

The “Why”: Five Strategic Benefits of Offshore Banking

Offshore banking delivers fundamental advantages that extend well beyond tax planning. The five core benefits include:

Geographic Diversification

Distributing assets across multiple jurisdictions mitigates home-country political risks and economic downturns. In an interconnected world, overreliance on a single banking system can jeopardize capital preservation.

Asset Protection

Sophisticated legal structures in jurisdictions like the Cayman Islands, British Virgin Islands, and Belize offer powerful shields against frivolous lawsuits and creditor claims, ensuring wealth remains intact through legal protective mechanisms.

Currency Diversification

Offshore banks enable holdings in stable currencies—Swiss Franc (CHF), Singapore Dollar (SGD), US Dollar (USD)—providing a buffer against local currency devaluation and enabling strategic currency allocation.

Access to Global Markets & Services

Premium offshore banks grant entry to exclusive investment vehicles, private equity funds, and structured products, often unavailable within domestic banking systems.

Enhanced Privacy & Compliance

Modern offshore banking balances legal confidentiality with mandatory reporting under FATCA (for US persons) and the Common Reporting Standard (CRS). Clients enjoy protection from commercial or cyber threats while ensuring full transparency to tax authorities.

The strategic benefits of offshore banking are distributed across six key areas, with geographic diversification and asset protection representing the most significant advantages for international clients seeking financial security and global reach

Six Critical Factors for Choosing Your Jurisdiction

Selecting the ideal offshore banking destination hinges on a rigorous analysis of six dimensions:

- Economic & Political Stability

- Prioritize AAA-rated sovereigns like Switzerland and Singapore to minimize systemic risk.

- Banking Secrecy & Data Privacy

- Evaluate modern privacy laws (Switzerland’s Banking Act, Luxembourg’s CSSF regulations) within compliant frameworks.

- Taxation Rules for Non-Residents

- Compare territorial regimes (Singapore, Hong Kong) and zero-tax environments (Dubai) to optimize after-tax yields.

- Regulatory Reputation & Compliance

- Trust jurisdictions supervised by robust authorities: FINMA (Switzerland), MAS (Singapore), HKMA (Hong Kong), CBUAE (UAE).

- Ease of Account Opening & Minimum Deposits

- Note tier-one jurisdictions demand USD 500 000–3 000 000 minimum deposits; accessible options start from USD 250 000.

- Range & Quality of Financial Services

- Analyze private banking, digital platforms, crypto custody, and 24/7 multilingual support.

Top Offshore Banking Jurisdictions in 2025

Tier 1: Stability & Privacy Champions

| Country | Sovereign Credit Rating | Minimum Non-Resident Deposit | Best For |

|---|---|---|---|

| Switzerland | AAA/Stable (Fitch, Moody’s, S&P) | From USD 500 000 | HNWIs seeking ultimate privacy |

| Luxembourg | AAA/Stable (Fitch, Moody’s, S&P, Scope) | From USD 3 000 000 | EU private banking excellence |

Switzerland remains the gold standard for global banking, boasting CHF 3.4 trillion in cross-border assets, centuries of neutrality, and world-class private banks. Its high entry threshold (USD 500 000) ensures an exclusive client base while sophisticated wealth management and confidentiality persist under updated compliance regimes.

Luxembourg delivers EU-backed stability, extensive double-tax treaties, and premier fund domiciliation. Non-residents face USD 3 000 000 minimum deposits, reflecting its focus on institutional and ultra-high-net-worth clients.

Tier 2: Global Business & Investment Hubs

| Country | Sovereign Credit Rating | Minimum Deposit | Best For |

|---|---|---|---|

| Singapore | AAA/Stable (Moody’s, S&P) | From USD 3 000 000 | Entrepreneurs & FinTech adopters |

| Hong Kong | AA+/Aa3/Stable (Moody’s, S&P) | From USD 500 000 | Asian market access & traders |

Singapore leads in fintech innovation, offering digital-only banks, AI-powered advisory, and multi-currency e-wallets. Its territorial tax system and AAA rating attract entrepreneurs ready to commit USD 3 000 000 upfront.

Hong Kong, with AA+ sovereign ratings, provides seamless access to Chinese markets and robust FX services. Entry deposits start at USD 500 000, balancing affordability with premium offerings.

Tier 3: Accessible & Crypto-Friendly Options

| Country | Sovereign Credit Rating | Minimum Deposit | Best For |

|---|---|---|---|

| Cayman Islands | Aa3/Stable (Moody’s) | From USD 250 000 | Investment funds & structuring |

| Panama | BBB+/Stable (Fitch, Moody’s, S&P) | From USD 250 000 | USD-denominated banking |

| Belize | BB/Stable (Fitch, Moody’s, S&P) | From USD 250 000 | Low-cost & crypto custody |

Cayman Islands offer zero direct taxes and a sophisticated funds ecosystem under AAA sovereign backing, with USD 250 000 entry. Panama and Belize require the same minimum, providing English-speaking services, USD accounts, and strong asset-protection trusts—ideal for digital nomads and crypto-friendly entrepreneurs.

Tier 4: Niche European & Emerging Hubs

| Country | Sovereign Credit Rating | Minimum Deposit | Best For |

|---|---|---|---|

| Mauritius | A+/Stable (Fitch, Moody’s, S&P) | From USD 250 000 | Remote account opening |

| British Virgin Isl. | BBB+/Stable (Fitch, Moody’s, S&P) | From USD 250 000 | Corporate & asset protection |

| UAE (Dubai) | AA/Stable (S&P, Moody’s, Fitch) | From USD 3 000 000 | Tax-free business hub |

Mauritius and the British Virgin Islands attract offshore structures with remote onboarding at USD 250 000 minimums. Dubai stands out with a zero-tax regime, AA-rated stability, and a growing fintech ecosystem, though non-residents must commit USD 3 000 000.

Minimum Deposit Requirements by Jurisdiction (USD)

Minimum deposit requirements vary significantly across offshore banking jurisdictions, with premium destinations like Switzerland and Luxembourg requiring substantially higher initial deposits compared to accessible options like Belize and Panama

The Ultimate Comparison Table

| Country | Credit Rating | Min. Deposit (Non-Residents) | Key Strength |

|---|---|---|---|

| Switzerland | AAA/Stable | From USD 500 000 | Privacy, stability |

| Luxembourg | AAA/Stable | From USD 3 000 000 | EU regulatory framework |

| Singapore | AAA/Stable | From USD 3 000 000 | FinTech innovation |

| Hong Kong | AA+/Stable | From USD 500 000 | Asian market access |

| Cayman Islands | Aa3/Stable | From USD 250 000 | Zero direct taxes, fund services |

| Panama | BBB+/Stable | From USD 250 000 | USD-based economy, asset protection |

| Belize | BB/Stable | From USD 250 000 | Low-cost, crypto custody |

| Mauritius | A+/Stable | From USD 250 000 | Remote onboarding |

| British Virgin Isl. | BBB+/Stable | From USD 250 000 | Corporate structures |

| UAE (Dubai) | AA/Stable | From USD 3 000 000 | Tax-free, digital-first banking |

Step-by-Step Guide to Opening Your Offshore Account

Step 1: Define Objectives & Jurisdiction

Clarify whether your priority is privacy, taxation, digital convenience, or market access. Match objectives to the appropriate tier.

Step 2: Bank Selection & Document Preparation

Gather essential KYC/AML documents:

- Valid passport

- Proof of address (utility bill, bank statement)

- Bank reference letters

- Source-of-fund documentation

- Professional references

Step 3: Application Submission

Choose between fully remote onboarding (digital banks in Singapore, Hong Kong) or in-person/video verification (Swiss, Luxembourg).

Next Step 4: Initial Deposit & Activation

Transfer your minimum deposit within the bank’s stipulated timeframe (30–60 days). Use compliant wire transfers with clear source documentation.

Step 5: Ongoing Compliance

- File FBAR if US persons hold aggregate foreign accounts over USD 10 000.

- Submit FATCA Form 8938 for US citizens when thresholds are met.

- Report under CRS to home-country tax authorities.

Navigating Legal Compliance: FATCA, CRS & Reporting Obligations

Despite misconceptions, offshore banking is legal and fully transparent when compliant.

- FATCA mandates foreign banks to report US-held accounts; US persons file Form 8938.

- CRS involves automatic exchange of financial data among 100+ jurisdictions.

- FBAR requires US persons to report aggregate foreign accounts exceeding USD 10 000.

Non-compliance attracts hefty penalties and potential criminal charges. Partner with expert advisers and select reputable, compliant banks.

The Future of Offshore Banking: 2025 Trends

- Digital-First Neobanks: Instant remote onboarding, AI-driven advice, blockchain settlements.

- Crypto Integration: Custody and trading services in Switzerland, Singapore, and Dubai.

- AI-Powered Compliance: Automated KYC/AML, real-time risk monitoring, and dynamic portfolio management.

Frequently Asked Questions: International Banking

Conclusion & Next Steps

Offshore banking in 2025 provides a robust framework for asset protection, diversification, and global financial access—when executed within regulatory boundaries. Understanding each jurisdiction’s sovereign credit rating, non-resident minimum deposit, and service offerings empowers you to craft a tailored offshore strategy.

Ready to take action? Easy Global Banking is your premier partner to open a foreign bank account. Whether you aim to open a Swiss bank account for stringent privacy or open a bank account in Singapore for cutting-edge digital banking, our expert team will guide you through every step. Expand your financial horizons securely and compliantly—start your offshore banking journey today.

Disclaimer: This content is for informational purposes only and does not constitute financial, legal, or tax advice. Offshore banking involves complex regulations and tax implications that vary by jurisdiction and individual circumstances. Before making any decisions regarding offshore banking, consult qualified financial advisors, tax professionals, and legal counsel who specialize in international banking and tax law. Easy Global Banking does not provide personalized financial advice, and readers are responsible for ensuring compliance with all applicable laws and regulations in their home country and chosen banking jurisdiction.