Your life’s savings sits securely in a single bank account within one country. You’ve worked decades building this nest egg—investing, saving, and planning for the future. Then geopolitical tensions escalate. Your government implements new capital controls. Banking systems face unexpected crises. Currencies collapse overnight. In a single moment, your entire financial security vanishes because you kept all your wealth concentrated in one place.

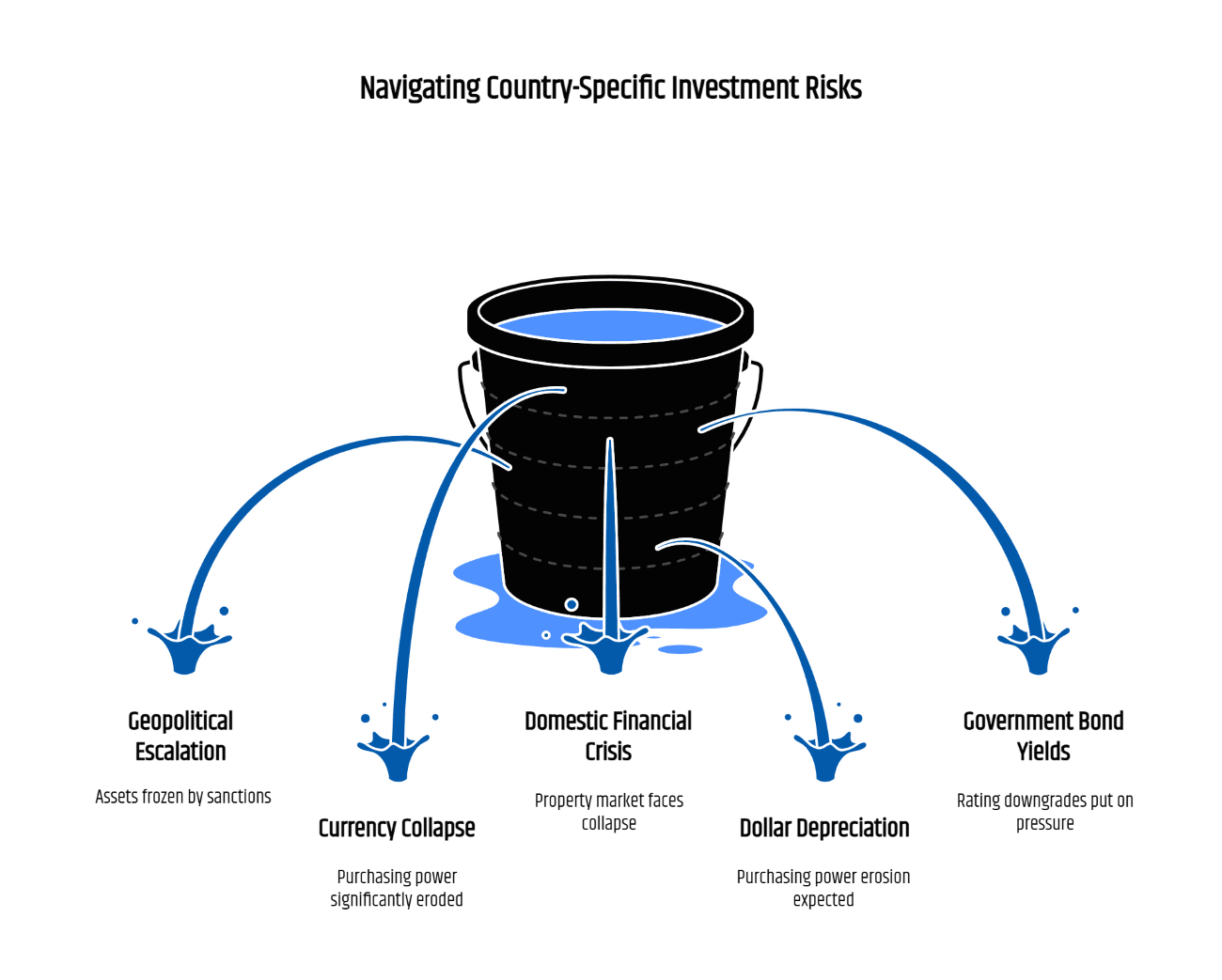

This scenario isn’t hypothetical anymore. In 2025, geopolitical risks have reached unprecedented levels, affecting asset prices, currency values, and financial stability across borders. Russian investors discovered this harsh reality when over €185 billion in private assets were frozen in European custody accounts within days of geopolitical conflict. Argentine citizens watched their currency lose 40% of its value in 2023 when country risk materialized. Chinese savers saw real estate holdings collapse as domestic bubbles burst, with 70% of urban wealth trapped in rapidly depreciating apartments.

The message is stark: concentrating your wealth in a single country represents one of the most dangerous financial decisions you can make. Geographic diversification isn’t just prudent investment strategy—it’s essential protection against risks entirely outside your control.

Understanding Country Risk: The Hidden Threat to Your Assets

Country risk encompasses all threats to your wealth arising from a single nation’s economic, political, or financial environment. Unlike investment risk, which depends on your personal choices, country risk threatens every asset holder in that jurisdiction simultaneously.

The International Monetary Fund’s 2025 Global Financial Stability Report documents how geopolitical events trigger immediate asset price declines, currency devaluations, capital controls, and banking crises. When military conflicts erupt, sovereign risk premiums spike. When governments implement sanctions, assets freeze. When currencies destabilize, purchasing power evaporates overnight.

Real-world consequences have accelerated in 2025:

The probability of banking crises has declined overall due to reduced private leverage, but China remains at elevated warning levels due to high leverage and ongoing real estate collapse. Cyprus experienced banking crisis warning signals before improvements were registered. Multiple emerging markets faced currency devaluation, with some currencies losing 20-40% of value within months.

For individual savers, these systemic risks become personal catastrophes. Your bank account freezes. Your securities become inaccessible. Your real estate holdings lose value. Your currency’s purchasing power collapses. All of these outcomes depend entirely on decisions made by governments and central banks beyond your control.

The Cost of Concentration: Real Examples from 2025

Understanding country risk becomes urgent when examining actual consequences across multiple jurisdictions in 2025.

Russia demonstrates the immediate impact of geopolitical escalation. Approximately €185 billion in private assets held by Russian investors became frozen in European custody accounts when geopolitical tensions created sanctions. Investors who thought their assets were safely held in Western institutions discovered that political decisions overrode contractual guarantees. Some investors still cannot access their holdings years later, despite theoretical rights to reclaim them.

Argentina provides a case study in currency collapse. After years of printing money to finance fiscal deficits, the Argentine peso lost more than 40% of its value in 2023. Argentines holding peso-denominated savings saw their purchasing power collapse. Those with diversified holdings in dollar-denominated assets, international real estate, or foreign equities preserved value while peso-concentrators lost wealth substantially.

China illustrates domestic financial crisis risks. 70% of Chinese urban household wealth is concentrated in apartments at exactly the moment when property markets face structural collapse. Households that diversified internationally retained stable wealth values. Those concentrating in domestic real estate watched their primary wealth source decline by 20-40% as the housing bubble unwound.

The United States faces emerging risks despite historical stability. The US dollar declined 11% during the first half of 2025—the biggest loss since 1973—with further 10% depreciation expected through 2026. Americans holding exclusively dollar-denominated assets face purchasing power erosion. Those with international holdings in stronger currencies preserved real value.

France experienced government bond yield pressures as rating downgrades occurred. Spain saw CDS spreads widen amid funding pressures. Even developed economies face country-specific risks that devastate concentrated investors.

The Geopolitical Reality: Rising Risks Across All Jurisdictions

Geopolitical risk has fundamentally changed the investment landscape in 2025. The IMF’s analysis reveals how military conflicts, trade tensions, and political instability create contagion across global financial markets.

The transmission channels operate through multiple mechanisms:

Trade restrictions trigger supply chain disruptions affecting corporate profitability and inflation dynamics. Capital flow reversals redirect trillions in investment away from affected countries. Financial restrictions including asset freezes, sanctions, and capital controls prevent asset access. Cross-border payment disruptions create liquidity crises. Aggregate demand declines from military spending and uncertainty reduce economic growth.

Major geopolitical risk events create market shocks lasting months or years, not days. Stock prices decline immediately but persistently following significant geopolitical events. Sovereign risk premiums spike in emerging markets, with CDS spreads increasing more than 1% cumulatively following major events. Currencies weaken, especially in commodity-importing countries, reducing purchasing power for international goods.

The EU alone has frozen €210 billion in Russian assets across all holders. Individuals, corporations, and governments with concentration in frozen assets lose access to their wealth indefinitely. The distinction between state and private assets proves irrelevant when geopolitical tensions escalate—both become frozen equally.

Currency Devaluation: The Silent Wealth Destroyer

Currency risk represents the most insidious threat to single-country concentrated wealth. Unlike dramatic events like banking crises, currency devaluation operates silently, eroding purchasing power progressively until savings become worthless.

The US dollar provides a powerful 2025 example. Morgan Stanley Research expects the ongoing dollar decline to reach approximately 10% additional depreciation by end-of-2026, following the 11% drop already experienced in 2025. Americans holding all assets in dollar form watch their international purchasing power decline monthly. Someone holding €100,000 in euros during the 2025 dollar weakness effectively gained €11,000 in relative purchasing power compared to dollar holders—without making any investment decisions.

Emerging markets face accelerated currency risks. Multiple emerging market currencies lost 20-40% of value versus major currencies during recent geopolitical volatility periods. The Indian rupee, Brazilian real, Mexican peso, and South Korean won all experienced significant depreciation following geopolitical escalation. Savers holding exclusively local currency assets experienced devastating wealth erosion when currencies collapsed against hard currencies.

The mechanism operates predictably: when countries face geopolitical risk, investors flee local currencies. Capital outflows increase sharply. Central banks attempt defending currencies through rate hikes and reserve deployment. Eventually, currency values collapse. Those holding diversified currency portfolios preserve value. Those concentrating in devaluing currencies lose massively.

Consider a concrete example: A Brazilian investor with 1 million reals (approximately €165,000) in 2020 would have seen depreciation reduce that to equivalent value of approximately €130,000 by 2023—losing €35,000 through currency effects alone, regardless of investment performance. Had that investor held 40% in dollar-denominated assets, the diversification would have offset most currency losses.

Capital Controls: When Governments Trap Your Money

Capital controls represent perhaps the most terrifying country risk because they eliminate voluntary asset access. Governments desperate to prevent currency collapse or capital flight implement restrictions on moving money across borders.

The mechanics operate simply: When country risk escalates, capital controls follow. Governments prohibit—or severely restrict—transferring money internationally. Wealthy individuals discover their assets are financially frozen despite technical accessibility. They cannot convert local currency to international holdings. They cannot transfer money to foreign accounts. They cannot conduct international transactions.

Argentina implemented progressive capital controls during its currency crisis, eventually limiting international transfers to just USD 10,000 monthly. Citizens with millions in savings could only access tiny fractions of wealth for international purposes. Those who diversified holdings internationally before capital controls faced far less restriction because their assets were already positioned outside the country.

Russia’s experience after 2022 escalation demonstrated how rapidly capital controls can expand. Individuals lost access to international brokerage accounts. Ruble currency conversions became impossible. Dollar transfers faced severe restrictions. Wealth trapped within Russia lost value rapidly as imported goods became unavailable and domestic markets faced price inflation.

Cyprus’s 2013 banking crisis included capital controls and transaction limits that persisted for years. Depositors could only withdraw limited amounts despite theoretically owning their savings. International transfers faced restrictions. Cash withdrawals faced daily limits. The lesson proved harsh: even in developed European countries, banking crises can trigger capital controls that prevent asset access.

Banking Crisis Contagion: Systemic Risk Across Borders

While banking crisis probability has declined from pandemic-era peaks, emerging markets remain vulnerable to systemic financial collapse.

The IMF’s early warning system identifies China as facing elevated banking crisis risk due to high leverage, ongoing real estate sector collapse, and weakening household confidence. When the world’s second-largest economy faces banking crisis risk, global financial contagion becomes probable. A Chinese banking crisis would immediately impact:

- Global equity markets through exposure to Chinese companies and international financial institutions holding Chinese assets

- Commodity prices through demand collapse from Chinese manufacturers

- Real estate values worldwide through capital reallocation

- Currency markets through capital flows disruption

For investors concentrated in a single country, banking crises create catastrophic consequences. Deposits become inaccessible for months or years during resolution. Cyprus’s experience showed how banking crises trigger losses (a haircut of uninsured deposits), deposit freezes, and transaction limits.

Those with internationally diversified holdings experience containment. If their home country faces banking crisis, their international assets remain safe. They can access funds through international accounts. They can sustain themselves without depending on domestic banking system recovery. Those concentrated domestically face potential total loss if banking crisis escalates to systemic collapse.

The Only Free Lunch in Investing: International Diversification

Geopolitical and currency risks cannot be eliminated, but they can be dramatically reduced through international diversification.

The principle dates to modern portfolio theory founder Harry Markowitz’s famous declaration: “Diversification is the only free lunch in investing.” This concept extends beyond asset classes to geography—spreading investments across multiple countries provides benefits impossible through domestic concentration.

BlackRock’s 2025 investment research proves this principle empirically. International equities consistently outperform single-country portfolios during market downturns. When US markets declined during recent quarters, international developed markets and emerging markets provided offsetting gains. Small-cap US stocks actually underperformed developed international markets by nearly 2x during negative quarters.

The mathematical foundation remains simple: returns across different countries rarely correlate perfectly. When one country experiences crisis, others continue performing well. The portfolio effect means overall volatility declines while return potential increases.

A concrete example illustrates the power of diversification: A portfolio invested 100% in European equities would have experienced 15% losses during European economic slowdown. The same investor with 50% European allocation, 30% US allocation, and 20% Asia-Pacific allocation would have experienced only 5% overall decline—a 67% reduction in losses—through geographic diversification alone.

Strategic Diversification: Where to Hold Your Wealth

Effective diversification extends beyond simply owning foreign stocks—it involves strategic positioning across multiple jurisdictions with different risk profiles.

Developed market diversification provides stability through established institutions and regulatory frameworks. US markets offer deep liquidity and innovation-driven returns, though facing fiscal deficit risks. European markets provide value opportunities with lower valuations than US equities. Japanese markets offer yield and corporate governance improvements. Australian markets provide commodity exposure and real estate diversification.

The BlackRock 2025 investment outlook specifically recommends international exposure as primary diversification benefit to US large-cap concentration. International equities demonstrate “the lowest excess return correlation” of any diversification vehicle at just 0.33 over ten years.

Emerging market diversification captures growth opportunities while generating currency diversification. Brazil, India, Mexico, and South Korea offer attractive valuations while still providing developed-market-like liquidity. These markets face higher volatility than developed countries but offer growth potential and improved risk-adjusted returns over longer timeframes.

The IMF’s 2025 analysis confirms emerging market diversification value, noting how capital is returning to emerging market equities, local debt, and currencies following years of underperformance. The US dollar weakness extends emerging market valuations, making 2025-2026 periods particularly attractive for international positioning.

Physical asset diversification completes the strategy. International real estate, particularly in stable jurisdictions, provides inflation protection and tangible asset exposure. Some portfolios include gold—historically appreciating 15-20% during geopolitical crises—alongside financial assets. Alternative investments including international infrastructure and renewable energy provide differentiated returns.

UBS’s Global Family Office Report demonstrates the principle empirically. Family offices in emerging markets diversify only 12% domestically while investing 88% internationally, reflecting awareness of country-concentrated risks. Meanwhile, US family offices maintain 86% domestic allocation—likely excessive given geopolitical and fiscal risks.

Currency Hedging and Denomination Strategy

Effective diversification requires deliberate currency positioning, not just market diversification.

Those holding exclusively home-country currency face devastating purchasing power erosion during currency devaluation. Morgan Stanley expects 10% additional US dollar depreciation through 2026, directly impacting Americans’ international purchasing power. A US resident with $1 million in dollar-only holdings effectively experiences $100,000 wealth erosion through currency effects alone if predictions prove accurate.

Currency diversification operates through multiple channels:

Hard currency positioning (dollar, euro, Swiss franc, yen) provides purchasing power protection during emerging market currency crises. These currencies historically appreciate when capital flight occurs globally.

Non-correlated currency exposure (Australian dollar, Canadian dollar, emerging market currencies) provides diversification benefits. These currencies often appreciate when commodity prices rise or when geopolitical tensions specifically affect major currency areas.

Multi-currency banking enables maintaining assets in multiple denominations simultaneously. Easy Global Banking and similar international banking services facilitate holding USD, EUR, GBP, CHF, SGD, JPY simultaneously in individual accounts, avoiding forced currency conversion and reducing devaluation risk dramatically.

The strategy remains simple: never hold 100% of assets in a single currency. The geopolitical risks and monetary policy differences across countries ensure that over time, some currencies strengthen while others weaken. Geographic and currency diversification ensures that when your home currency faces devaluation, other currency holdings appreciate, offsetting losses.

Implementing Your Diversification Strategy

Converting diversification theory into practice requires systematic approach and professional guidance.

Step one involves audit: Document your current asset holdings across all jurisdictions. Calculate what percentage resides in each country. Identify concentration risks. Most individuals discover they hold far higher domestic concentration than they realized—often 70-90% of total wealth in home country.

Step two requires structural planning: Determine optimal geographic allocation based on your risk profile and income needs. Conservative investors typically maintain 20-30% international exposure. Balanced investors target 40-50%. Aggressive investors pursue 60%+ international positioning. These allocations depend on personal circumstances and income stability.

Step three involves implementation: Establish accounts in multiple jurisdictions holding diversified assets. Swiss banking provides stability and reputation protection but demands minimum deposits. Singapore offers excellent tax frameworks and Asia-Pacific access. US dollar accounts provide global access. European banking provides EU regulatory oversight.

Step four requires currency management: Position currency holdings deliberately. If you live in Europe and hold euros through employment, reduce home currency concentration through international accounts in dollar and Asian currency denominations. If you work in the US, hold some euro and Swiss franc exposure.

Step five demands ongoing monitoring: Rebalance quarterly as geopolitical and economic conditions shift. Country risks change continuously. Rebalancing ensures your diversification maintains appropriate allocation across changing circumstances.

Professional advisors specializing in international diversification accelerate implementation while reducing errors. International banking specialists like Easy Global Banking help establish accounts, navigate regulatory requirements, and position assets strategically across jurisdictions. Estate planning attorneys ensure diversified holdings transfer smoothly to heirs.

The Cost of Ignorance: What Happens When Diversification Fails

The cost of maintaining single-country concentration becomes apparent only when country risk materializes.

Wealthy individuals concentrating assets in specific countries discovered these costs painfully:

Russian oligarchs holding significant wealth in European real estate and banking accounts saw €185 billion frozen in 2022-2023. Those who had previously diversified internationally faced far smaller losses. Those who concentrated domestically for “home bias” reasons lost access to majority wealth.

Chinese real estate investors who positioned 100% of wealth in residential properties discovered depreciation of 20-40% during the current housing crisis. Simultaneously, those who had invested internationally in diversified assets experienced stable valuations.

Argentine savers holding peso-denominated deposits watched purchasing power decline 40% during currency crisis. Those with diversified holdings in dollars and international securities preserved real value.

The pattern proves consistent: those who maintained geographic concentration faced catastrophic losses. Those who diversified internationally preserved wealth.

Looking Forward: Rising Risks Demand Immediate Action

Geopolitical risks have fundamentally increased as of 2025. The IMF documents heightened global financial stability risks from trade uncertainty, geopolitical tensions, and capital market vulnerabilities. Major central banks acknowledge that traditional diversification approaches—heavy domestic concentration—no longer provide adequate protection.

Military conflicts remain elevated. Trade policy remains uncertain. Currency volatility appears likely to persist. Banking stress risks, particularly in emerging markets, remain present despite improvements. These conditions create urgency around implementing geographic diversification now, before additional country-specific crises materialize.

The window for diversification ahead of crisis remains open, but narrowing. Those who diversify today position themselves with:

- International accounts already established and operational

- Assets already positioned across jurisdictions

- Currency holdings already diversified

- Real estate and physical assets already positioned internationally

- Relationships with international banking specialists already in place

Those who wait until crisis materializes discover diversification becomes impossible—banks freeze accounts, currencies collapse, capital controls prevent transfers. The time to diversify is today, during market stability, not after country-specific risks materialize.

Take Control of Your Global Wealth

Your financial security should not depend on decisions made by a single country’s government. Yet that exactly is the situation when you concentrate all assets domestically. Geographic diversification isn’t optional for serious wealth preservation—it’s essential.

Easy Global Banking specializes in helping individuals structure international accounts, positioning assets across multiple jurisdictions and currencies. Their Swiss banking expertise combined with Singapore and emerging market access enables comprehensive diversification strategies impossible through domestic-only banking.

Whether you seek to open a foreign bank account for core diversification, establish Swiss bank accounts for stability and privacy, or explore Singapore banking services for Asia-Pacific positioning, professional guidance transforms diversification from theoretical concept to implemented reality.

Your decades of work building wealth deserve protection across multiple jurisdictions and currencies. Your financial future should not rest entirely on the decisions of a single government. Begin your diversification strategy today—before geopolitical risks that are already materializing force your hand.