Secure Your Future: Open a Swiss Bank Account as a Non-Resident

Unlock Switzerland’s unrivaled financial stability and privacy—without ever setting foot in the country. Easy Global Banking guides non-residents, entrepreneurs, and HNWIs through every step, from initial consultation to account activation.

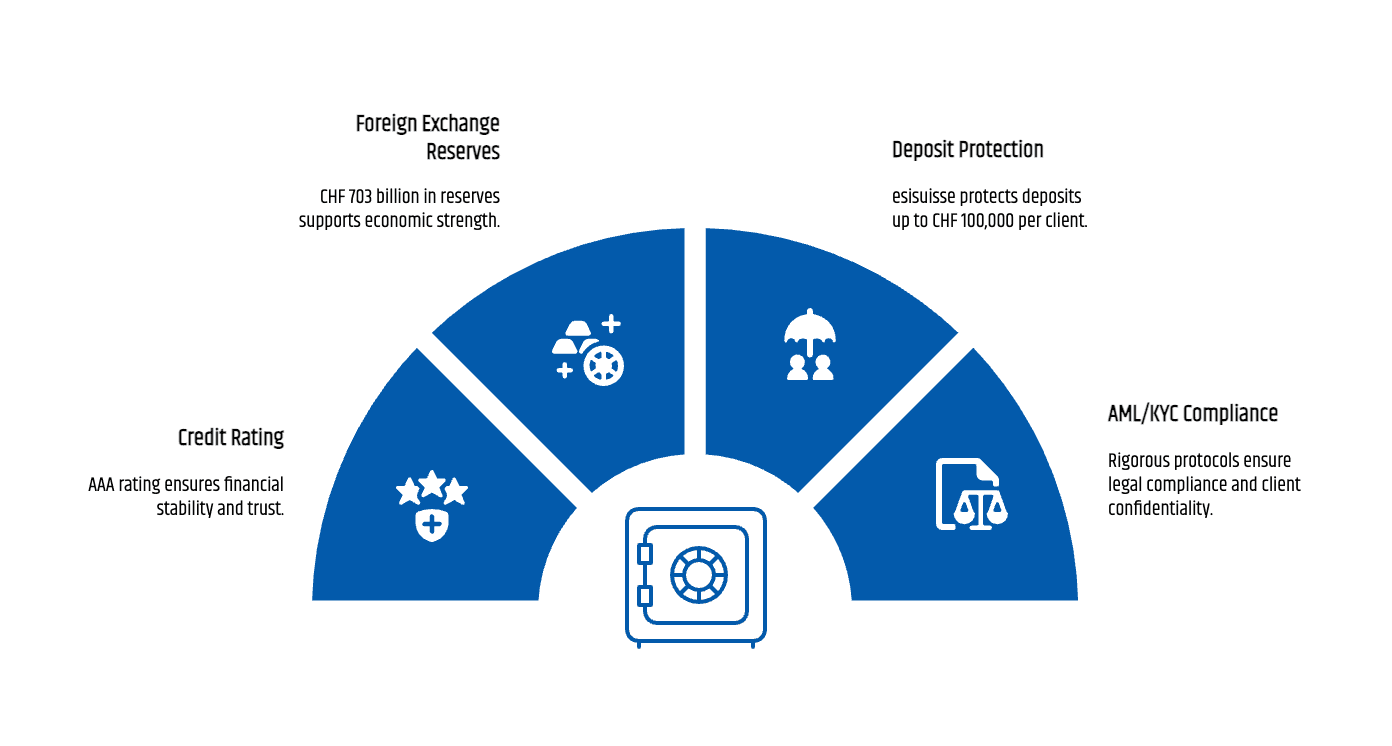

Why Swiss Banking Remains the Gold Standard

Swiss banks boast AAA credit ratings and CHF 703 billion in foreign-exchange reserves (source SNB). Moreover, esisuisse protects deposits up to CHF 100 000 per client, per bank. Furthermore, rigorous AML/KYC protocols ensure legal compliance while preserving client confidentiality under FATCA and AEOI frameworks.

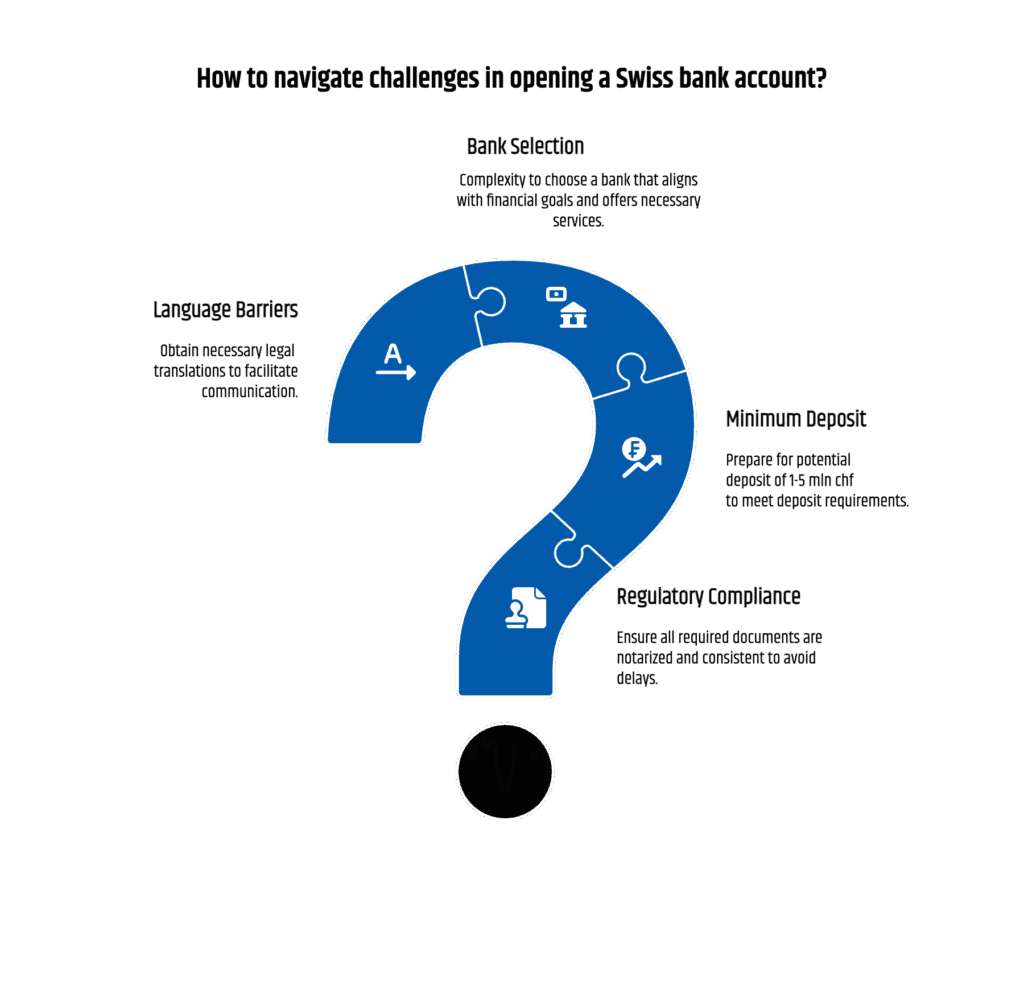

The Hidden Complexities of Account Opening

Regulatory Hurdles and Documentation

Swiss banks enforce strict AML checks. Applicants must supply notarized passports, proof of address, and detailed source-of-funds documentation. Consequently, missing or inconsistent paperwork often triggers further requests, adding weeks to the process.

Minimum Deposit and Fee Surprises

Most institutions require at least CHF 1-5 mln or equivalent. However, foreign-exchange fluctuations can push that threshold higher. Additionally, opaque fee schedules may include hidden maintenance charges that erode returns.

Bank Selection and Language Barriers

Switzerland’s ecosystem includes cantonal banks, private banks, and global entities. Therefore, choosing the right partner—whether for multi-currency accounts or private wealth management—demands local insight. Finally, legal translations into German, French, or Italian add another layer of complexity

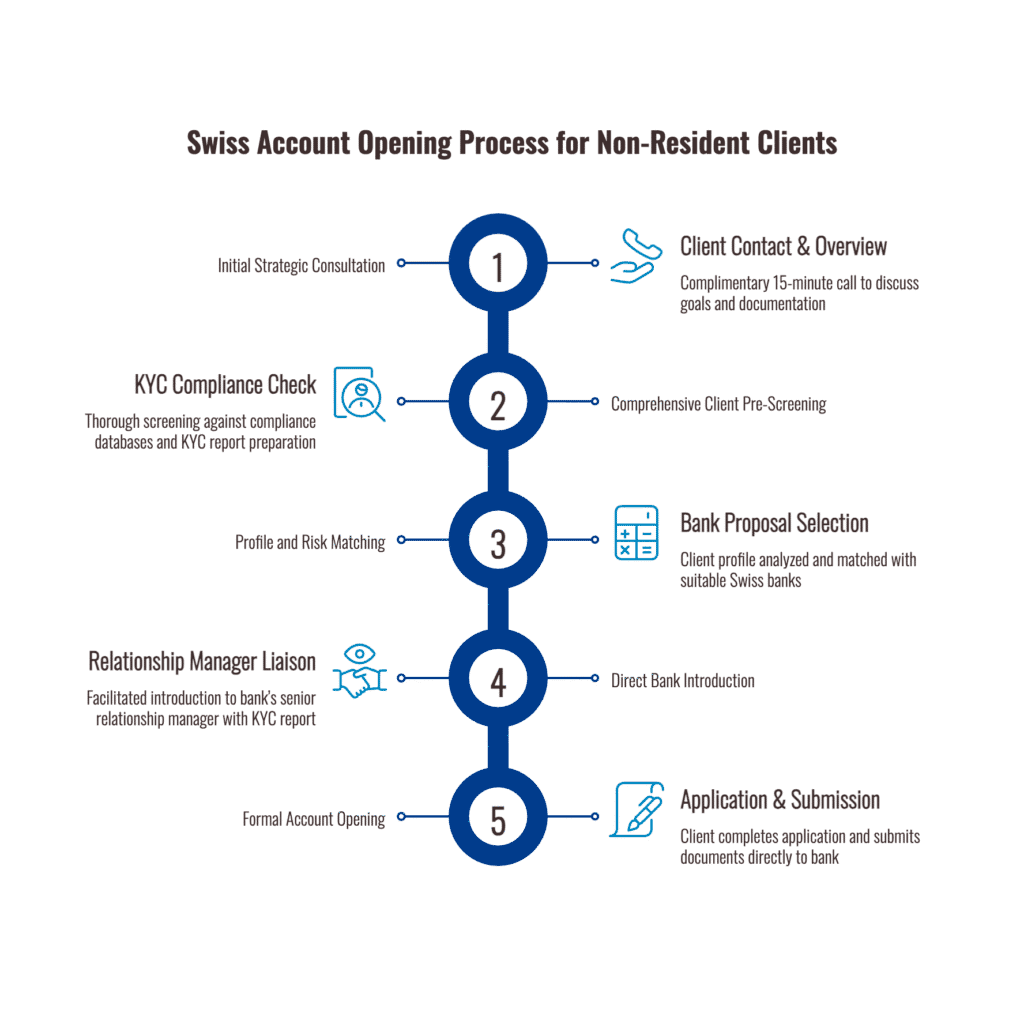

Swiss Account Opening Process for Non-Resident Clients with Easy Global banking

1. Initial Strategic Consultation

Clients begin by contacting us for a complimentary 15-minute strategic consultation. During this call, we discuss their banking goals and provide a clear overview of the documentation required, including a passport copy, CV, explanation of source of wealth, and supporting documents. We ensure that all client communications and documentation handling comply fully with the Swiss Federal Data Protection Act. Clients provide informed consent to allow us to conduct due diligence using public sources and professional compliance tools.

2. Comprehensive Client Pre-Screening

We perform a thorough pre-screening of each client by searching World-Check and other public compliance databases to verify adherence to Swiss banking regulations. Data analysis tools are applied to prepare a detailed KYC (Know Your Customer) report, ensuring all information satisfies regulatory standards.

3. Profile and Risk Matching

Our experts analyze the client’s profile against the risk appetite and financial requirements of the Swiss banks we collaborate with. This assessment ensures alignment with the client’s intended deposit size and banking objectives. We then present the client with tailored bank proposals that best meet their needs.

4. Direct Bank Introduction

Upon client approval, we facilitate a direct introduction to the senior relationship manager at the chosen bank. We provide the bank with our comprehensive KYC report to streamline the compliance and onboarding process, significantly reducing delays.

5.Final Approval and Account Opening

The client completes the bank’s application forms and submits all required documents directly to the bank’s relationship manager to formalize the account opening.

This proven, rigorous process achieves an almost 100% success rate by carefully filtering clients and introducing them only to institutions aligned with their profile. We strictly reject applications where the source of funds is unclear, the client’s activities pose unacceptable risk, or where the client does not meet Swiss banks’ country-specific risk acceptance policies.

Why Partner with Easy Global Banking?

- Guaranteed Results: 95%+ approval success rate, or your fees returned.

- Premium Swiss Banks: We work with investment grade swiss banks and state controlled banks

- Dedicated Account Manager: Direct support—no call centers.

- Integrated Wealth Solutions: From tax-efficient structuring to portfolio management.

- Global Reach, Local Expertise: Coordinated support across multiple jurisdictions.

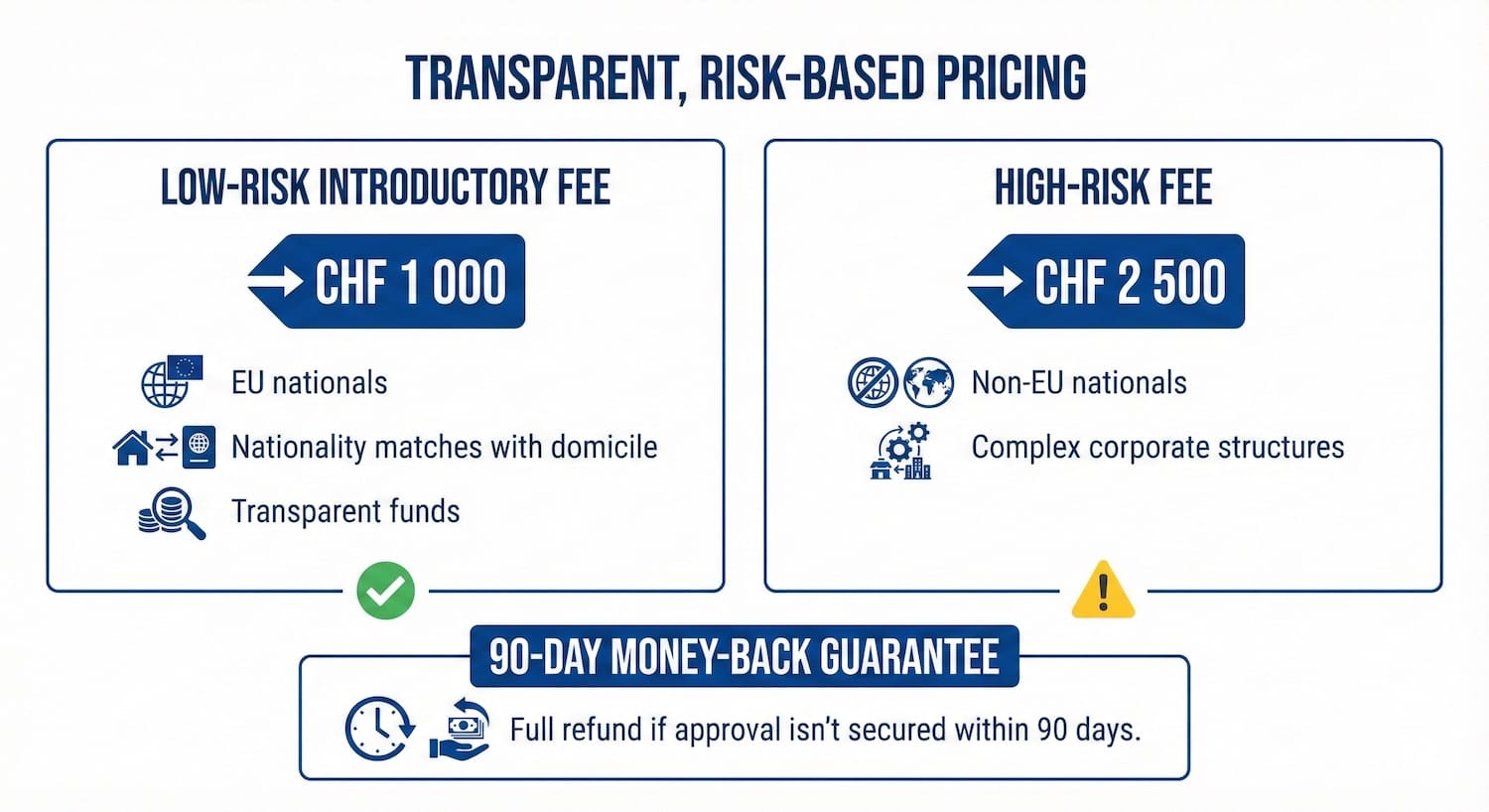

Transparent, Risk-Based Pricing

- Low-Risk Introductory Fee: CHF 1 000 (EU nationals, nationality matches with domicile, transparent funds)

- High-Risk Fee: CHF 2 500 (added on top) (non-EU nationals, complex corporate structures)

- 90-Day Money-Back Guarantee: Full refund if approval isn’t secured within 90 days.

Quick Answers: Your Top Swiss Banking Questions

Secure Your Wealth in Switzerland – 0% Risk, 100% Remote.

Don’t let compliance complexity stop you. Our Swiss experts handle every detail of your non-resident account opening. We are so confident in our process that if we can’t open your account, you don’t pay a cent.

Confidential. No obligation. 100% Money-Back Guarantee.