Bespoke Asian Banking Gateways

We align your financial profile with the unique regulatory landscape of Singapore.

Why 60% of Foreign Applications Fail in Singapore

The Problem: The “Generic” Application The Monetary Authority of Singapore (MAS) enforces the strictest AML standards in the world. If you apply as a “tourist” with a generic “savings” goal, you will be rejected immediately.

The Solution: The “Accredited Investor” Profile We don’t just apply; we re-classify you. We structure your application to demonstrate that you meet the Accredited Investor (AI) or Expert Investor criteria.

- Result: You move from the “Retail Desk” (Rejected) to the “Private Wealth Desk” (Approved).

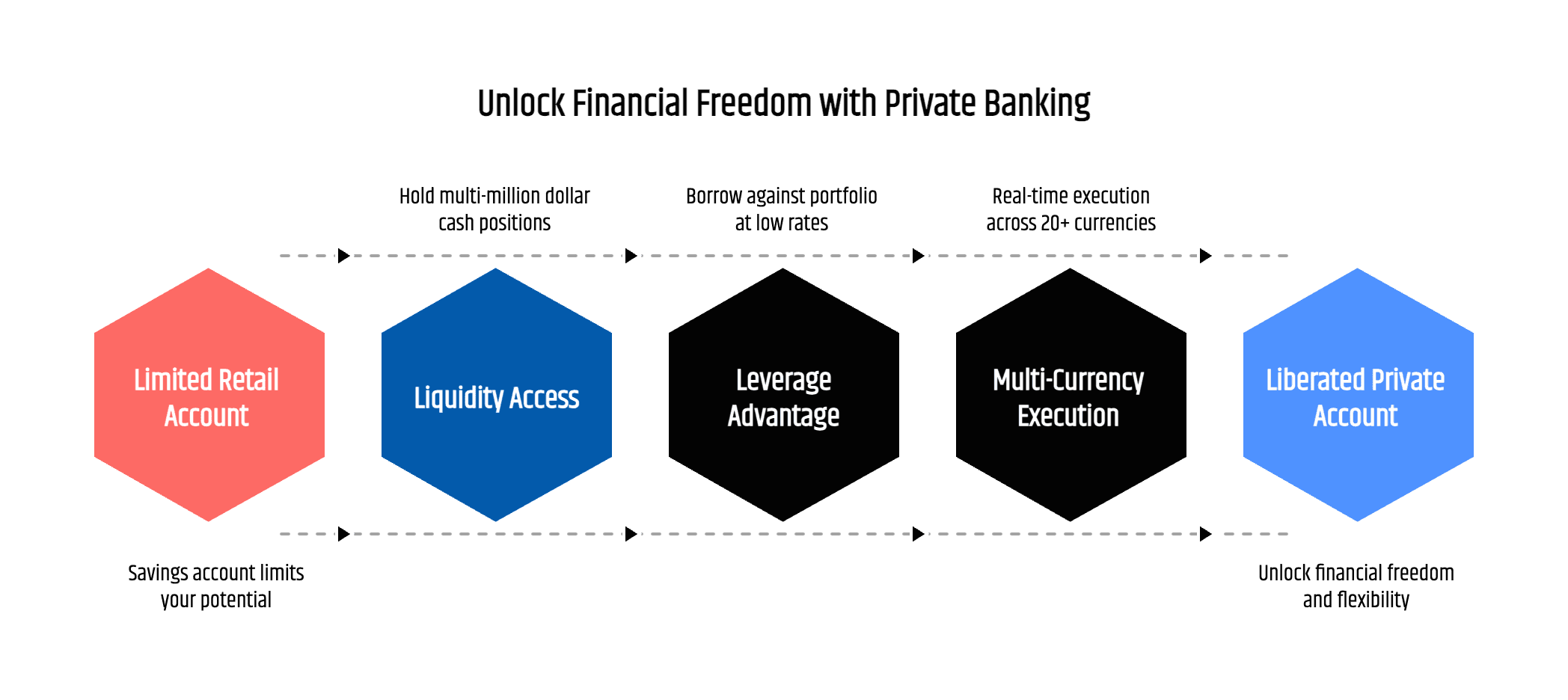

Remmenber, a retail savings account limits you. A private banking relationship liberates you. Here is the difference:

- The “Liquidity” Myth: You don’t need a savings account for interest; you need it for liquidity. Private accounts allow you to hold multi-million dollar cash positions in USD, SGD, or CHF earning institutional money-market rates, ready to deploy into equity markets instantly.

- The Leverage Advantage: Once we open your personal bank account under a private license, you gain access to Lombard lending. You can borrow against your portfolio at ultra-low rates to buy property or reinvest, without selling your assets.

- True Multi-Currency: No hidden FX fees. Real-time execution across 20+ currencies.

The “Black Box” of Singapore Private Banking Requirements

Most agencies list generic requirements. As insiders, we tell you what the banks actually look for.

To succeed, you must move beyond the basic documents. The most critical aspect of Singapore private banking requirements today is the Source of Wealth (SoW) Narrative.

It is not enough to show you have money; you must prove how the money was generated over the last decade.

- The Trap: A gap in your financial history or a vague explanation of a business sale can freeze an application for months.

- Our Solution: We audit your SoW before the bank sees it. We restructure your documentation to align perfectly with MAS (Monetary Authority of Singapore) risk appetites.

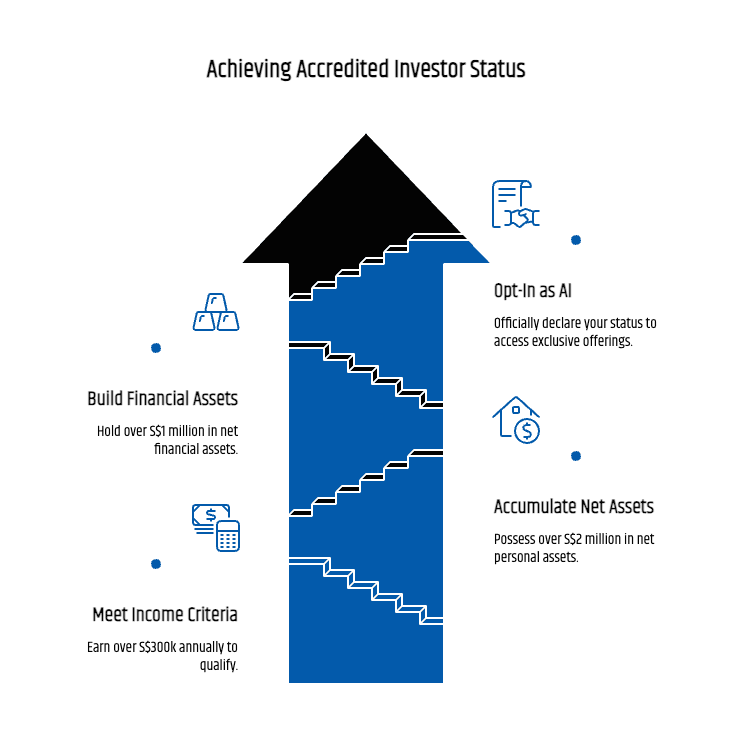

The Accredited Investor (AI) Status

To unlock the full suite of offshore products (private equity, hedge funds, structured notes), you generally need to opt-in as an Accredited Investor.

- Income: >S$300k (approx. US$225k) / year.

- Net Personal Assets: >S$2 million (approx. US$1.5m).

- Net Financial Assets: >S$1 million (approx. US$750k).

Note: AI status is not just a label; it’s your ticket to exempt offerings that retail investors never see.

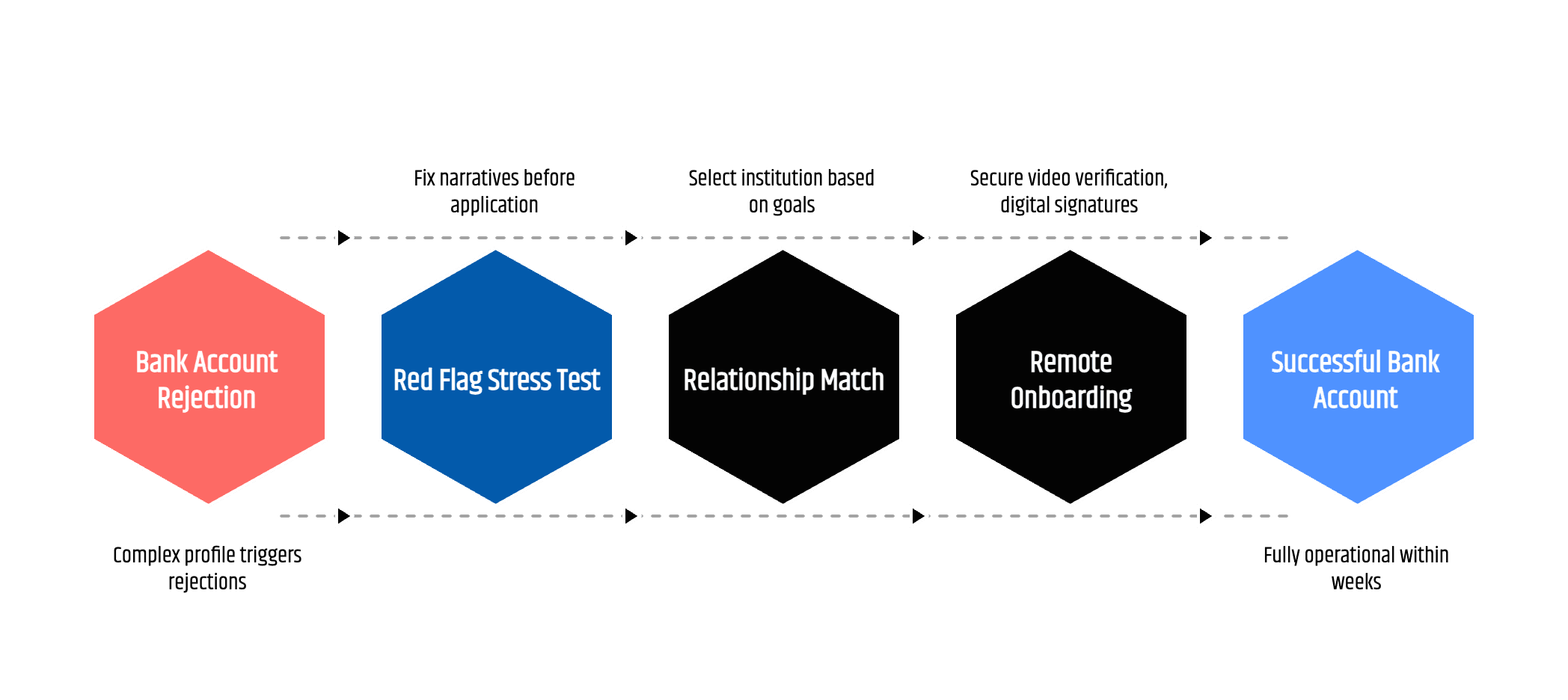

How We Engineer Your Approval (The Protocol)

We don’t use call centers. You work with senior strategists who understand the nuances of Swiss and Singaporean law.

Phase 1: The “Red Flag” Stress Test

Before we approach a bank, we perform a forensic review of your profile. We look for the triggers that cause rejections—complex corporate structures, unclear tax residencies, or passive income streams that look suspicious to algorithms. We fix these narratives before application.

Phase 2: The Relationship Match

Not all private banks are the same. Some excel in Asian equities; others are better for European bond trading. Based on your goals, we select the institution where your specific profile is desired. We don’t just “apply”; we introduce you directly to a Senior Relationship Manager (RM) who is expecting your file.

Phase 3: Remote Onboarding & Activation

You do not need to fly to Changi Airport. We coordinate the secure video verification and digital signatures.

- Result: You successfully open a personal bank account and wealth structure that is fully operational within weeks, not months.

- Onboarding: We assist with the initial funding (ensuring the transfer doesn’t get flagged) and set up your digital tokens and family office access.

The “Swiss Standard” Guarantee

We operate with Swiss precision.

- Privacy First: Your data is hosted on Swiss servers, protected by the Swiss Federal Data Protection Act.

- Zero Risk: If we fail to open your account due to our error, you get a 100% refund. No questions asked.

Intelligent Answers to High-Value Questions

You Have the Capital. You Need the Access.

The gatekeepers of Singapore banking are tough, but we have the keys. Let’s build your legacy fortress in Asia.

Swiss-Owned. Singapore-Focused. 95% Success Rate.