In 2025, banks worldwide face mounting pressure from regulators and financial crime watchdogs. Applications that once sailed through now get rejected for even minor compliance concerns. Whether you’re a global entrepreneur, expat, or a corporate officer, knowing these instant denial triggers can save you time, money, and frustration.

Why Are So Many Bank Applications Rejected Now?

Banking compliance has never been more demanding. Regulatory bodies across the US, Europe, and beyond have imposed new standards—especially after recent rounds of sanctions and the introduction of more aggressive anti-money laundering rules. As a result, banks reject a rising number of applicants who fail to meet evolving documentation and transparency requirements—even when their funds are legitimate.

The pace of regulation quickened in 2025. FATF tightened requirements for transaction transparency, especially cross-border payments and ownership disclosures. For applicants, this reality means: banks now demand thorough explanations, granular documentation, and proactive cooperation.

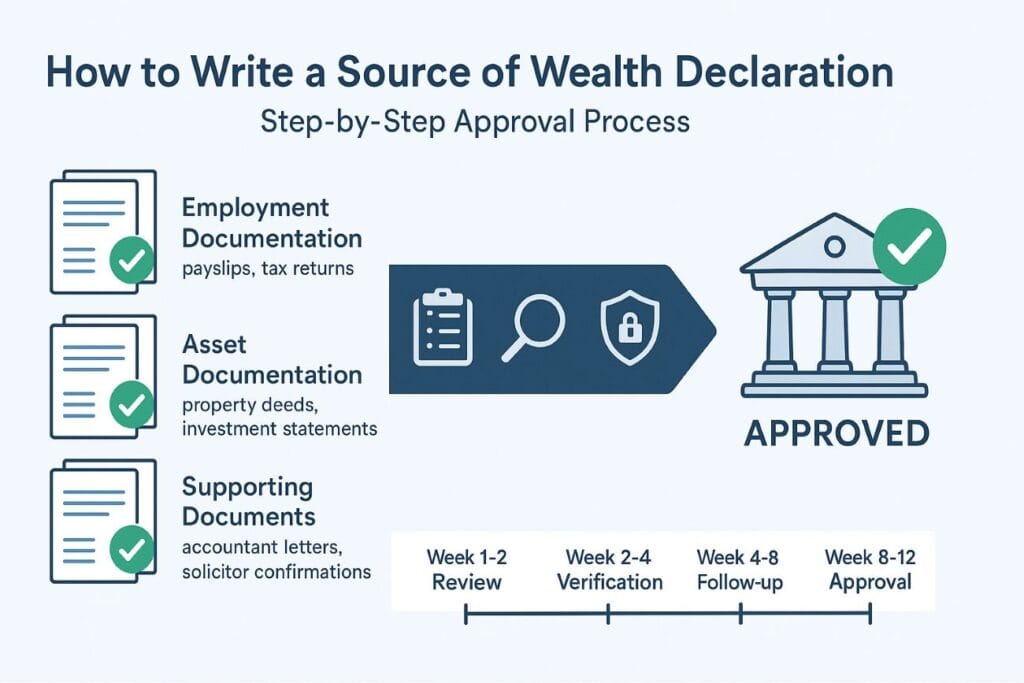

1. Weak or Missing Source of Funds Documentation

Banks must see exactly where your funds come from—down to the transaction. Vague answers like “inheritance,” “business profits,” or “crypto gains” are not enough. They want employment contracts, detailed sale agreements, tax filings, or transfer statements proving the origin and legal movement of the funds.

Example: A client from South Africa once tried to open a UK account claiming proceeds from “real estate investments.” Upon inquiry, he lacked contracts, sales records, or matching tax filings. The bank immediately denied his application.

2. Complex or Opaque Ownership Structure

Ownership structures that use multiple layers—like offshore companies, trusts, or nominee shareholders—raise instant suspicion if the ultimate beneficiary (UBO) is unclear. Regulators globally have zero tolerance for hidden ownership.

Practical Fix: Prepare a clear organigram, notarized company documents, and a step-by-step UBO explanation. If you can’t, most banks will reject you immediately.

3. Sanctioned Country or High-Risk Residence

If you are a national or resident of a comprehensively sanctioned country (Russia, Iran, North Korea, Syria), most banks will reject your application outright, regardless of your wealth or documentation. The 2025 EU package bars banks from onboarding Russian nationals, even if they reside elsewhere. Crucially, UAE residency does not allow Russian clients to open accounts in the EU or the UK. Today, EU and Swiss banks accept Russian clients only if they hold EU, EEA, or Swiss residency—and even then, with extreme due diligence.

Case: A Russian entrepreneur obtained UAE residency hoping to open a German account. The bank refused him, citing EU sanctions and guidance that UAE residency does not mitigate sanctioned nationalities.

4. Inconsistent or Contradictory Information

Banks now algorithmically cross-check every detail: names, addresses, dates, income, company records, and transaction histories. Mismatches, outdated IDs, or even small misspellings between documents result in instant denial. For global citizens with multiple residences, synchronizing your official information is crucial.

5. Vague or Weak Business Rationale

Stating, “I want international diversification” or “better banking,” doesn’t convince compliance teams. Instead, you must clearly explain why you need that particular account: trading partners, staff payroll, foreign property management, or currency risk management. Attach supporting business contracts, invoices, or local corporate formation documents.

6. Suspicious Transaction Patterns

Banks are on high alert for transactions that look like money laundering—large unexplained deposits, frequent round-dollar transfers, cash-ins with rapid cash-outs, or heavy use of crypto-fiat swaps. If your activity and declared business do not match, expect a fast rejection.

7. Politically Exposed Person (PEP) Connections

If you or a close family member is a PEP—like a government official, state enterprise executive, or military officer—banks will subject your application to enhanced due diligence. If you refuse to disclose, don’t supply extra documents, or appear evasive, compliance will shut you down for risk reasons.

Advice: Always disclose immediately, provide clear documentation separating your personal wealth from public office, and anticipate additional questioning.

8. Previous Banking Relationship Issues

Unpaid overdrafts, involuntary account closures, or fraud allegations at past institutions nearly always show up in global screening databases like ChexSystems or Early Warning. It’s crucial you settle negative marks before applying elsewhere, or you risk routine rejection.

9. Lack of Cooperation During Due Diligence

Today’s banks expect live interviews, video verification, and sometimes in-person document review—even for remote onboarding. If you delay, provide vague or partial answers, or refuse additional checks, banks suspect avoidance—usually a deal breaker.

Example: An expat with legitimate funds failed to attend a scheduled compliance call, then took two weeks to provide a required bill of sale. The application was shuttered for “non-cooperation.”

10. Insufficient Initial Deposit or Profile Mismatch

Ignoring the bank’s minimum deposit—for example, applying to a private bank with a $10,000 initial transfer when they require $250,000—will stop your application at the first filter. Also, retail banks may reject unusually large deposits without a clear rationale, flagging the case as suspicious.

Proactive Steps for Success

- Prepare detailed, consistent documentation for all sources of income and business activity.

- Keep your personal information up to date and identical across all records.

- Research bank and jurisdiction requirements before you apply.

- Disclose PEP status or sanctioned country links immediately and be prepared for extra scrutiny.

- Anticipate live interviews or video calls and prepare clear, honest explanations.

When to Get Professional Help

If your situation is complex—multiple jurisdictions, past rejections, or compliance concerns—consider hiring a banking lawyer or specialized onboarding consultant. Their expertise often means approval instead of another costly denial.

Take Charge of Your Banking Success

In today’s environment, banks want to serve qualified clients—but they won’t jeopardize their reputation or compliance record, no matter your wealth. By addressing these 10 red flags with transparency and preparation, you dramatically increase your chances of opening the accounts that best serve your global strategy.

For more one-on-one guidance, check out Easy Global Banking, or consult with reputable international banking advisors familiar with 2025’s standards.