We Are Not “Bank Introducers.” We Are Compliance Architects.

The internet is full of agencies promising ‘guaranteed’ bank accounts. Most of them are marketing funnels with no legal footprint.

Easy Global Banking is different. We are a division of BMA Business Solutions GmbH, a registered Swiss entity (UID CHE-422.832.034) based in Chur. We operate under strict Swiss laws. When you share your data with us, it stays in Switzerland, protected by the Swiss Federal Data Protection Act (FADP). We don’t just forward emails; we structure your financial identity.

Leadership & Expertise

Profile: Asel Mamytova, Managing Partner

Asel Mamytova brings over a decade of frontline experience to the world of global finance. She established herself as a trusted architect of wealth management solutions in Zug—the epicenter of Swiss finance—where she didn’t just learn the regulations of asset management; she mastered the art of serving elite clients.

Today, as the driving force behind BMA Business Solutions, Asel uses her deep-rooted industry connections to open doors for High-Net-Worth Individuals (HNWIs) around the globe. She simplifies the complex. By expertly navigating strict compliance hurdles, she ensures that opening a private bank account for non-residents is no longer a bureaucratic struggle, but a seamless strategic move.

The Regulatory Advantage: Academic & Compliance Rigor

Competence is built on more than just experience; it requires verified expertise. Asel Mamytova holds a Master’s degree in International Business Administration, but her true value to clients lies in her mastery of the Swiss regulatory landscape. She has successfully completed the rigorous examinations required by FINMA (Swiss Financial Market Supervisory Authority) for financial intermediaries, specializing in:

- Anti-Money Laundering (AML) Regulations

- Cross-Border Financial Policy

- Compliance for Complex Structures

This creates a distinct advantage for you. While other consultants guess at compliance rules, Asel engineers your profile to meet the exact standards of Swiss compliance officers, ensuring integrity and transparency at every step.

Forward-Thinking Wealth Strategy

We don’t just follow the market; we anticipate it. During her tenure at a top-tier asset management firm, Asel didn’t just manage accounts; she expanded the firm’s global footprint. She earned her reputation as a forward-thinking strategist by designing tailored financial structures for both High-Net-Worth Individuals (HNWIs) and corporate entities.

Today, she applies that same precision to cross-border wealth management. Whether you are safeguarding personal assets or optimizing the treasury of a multinational corporation, Asel navigates the intricacies of international transactions to deliver measurable growth and absolute asset protection.

The Mission: Precision, Privacy, Access

Our goal is simple: We dismantle the barriers to global banking. Guided by Asel’s vision, Easy Global Banking replaces bureaucratic friction with Swiss efficiency. We provide you with a seamless, compliant gateway to the world’s premier financial institutions in Switzerland and Singapore.

We do not believe in “red tape.” We believe in intelligent structuring. By aligning your profile with global regulations from day one, we empower you to move capital where it matters most—securely, rapidly, and without hesitation.

The Swiss Legal Advantage: Why BMA Business Solutions?

Swiss Precision Meets Global Banking Expertise

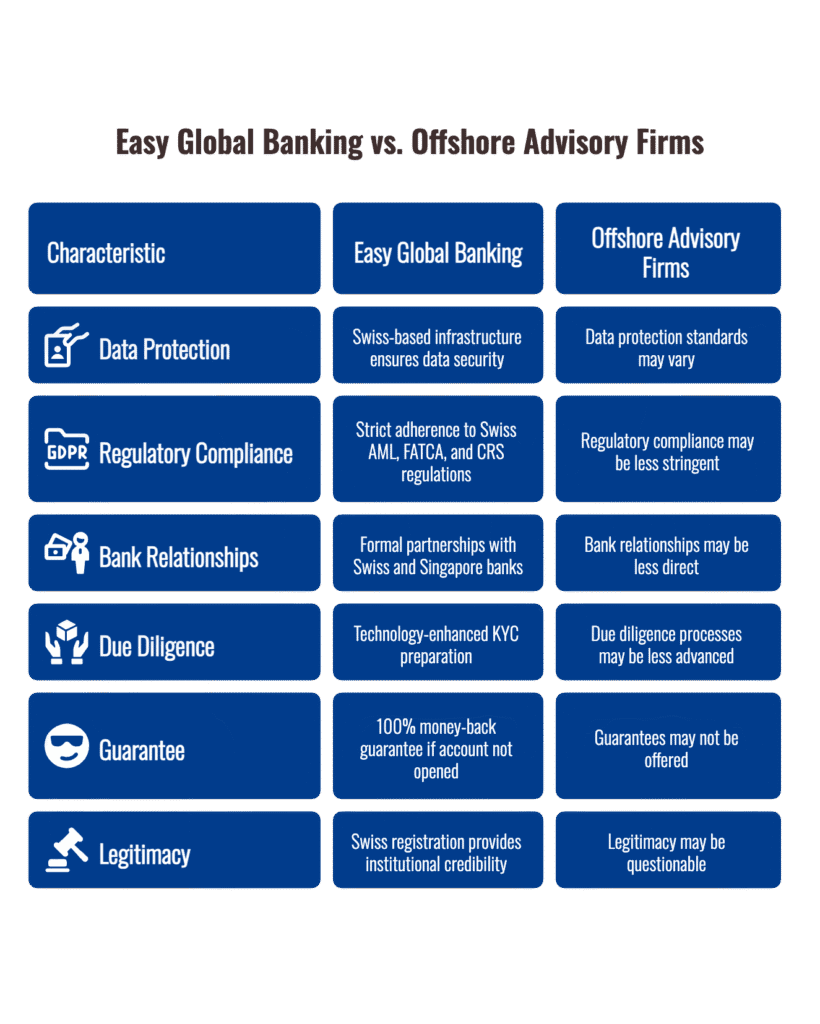

Real Presence. Real Protection. Unlike the dozens of “virtual” agents operating from offshore mailboxes, we offer you the security of a tangible Swiss partner. We operate directly from Chur, Switzerland, under the legal entity BMA Business Solutions GmbH (Swiss Commercial Register UID CHE-422.832.034).

Your Data Never Leaves Switzerland. We treat your privacy as a legal obligation, not a feature.

- Sovereign Infrastructure: From our servers to our archives, your sensitive documents are hosted physically within Switzerland.

- Legal Shield: All client communications are protected by the strict Swiss Federal Data Protection Act (FADP).

- Institutional Accountability: We adhere rigidly to AML, FATCA, and CRS standards, offering a level of regulatory credibility that remote offshore agents simply cannot match.

With direct banking partnerships and a transparent 100% success guarantee, we are your secure bridge to the future of finance.